The great news after a hectic week in the markets is that they’re closed for the next two days. A pause should allow market participants to reassess the current situation and prepare for the Federal Reserve’s rate decision next Wednesday. Or maybe it won’t…we’ll find out on Monday. In the meantime, let’s recap what you missed today. 👀

Today’s issue covers an update on bank stocks, XPeng’s fourth-quarter earnings, and a recap of a crude two weeks for energy stocks. 📰

Check out today’s heat map:

Every sector closed red. Technology (-0.13%) led, and financials (-3.31%) lagged. 🔻

Internationally, French citizens are protesting in the streets after President Emmanuel Macron bypassed lawmakers to raise the retirement age from 62 to 64. Falling energy prices pushed Eurozone inflation down marginally in February, but core prices continued to rise. 🌍

In U.S. economic news, industrial production was flat in February. Meanwhile, the conference board’s leading economic index fell 0.3% in February, bringing its decline over the last six months to -3.6%. And March’s preliminary Michigan consumer sentiment reading fell unexpectedly. However, consumers’ inflation expectations fell to a two-year low. 🔻

In crypto news, FTX’s new management says that the company transferred $2.2 billion to Sam Bankman-Fried-related entities. The Federal Deposit Insurance Corporation (FDIC) denied reports that the buyer of Signature Bank must give up all its crypto business. And Coinbase is reportedly looking to open an offshore exchange to escape U.S. regulatory pressure. ₿

Other symbols active on the streams included: $TRKA (-4.79%), $HUBC (+4.60%), $CRBP (+7.83%), $HSTO (+54.24%), $SRPT (-18.03%), $PXMD (+17.94%), $ENZ (+89.08%), and $BTC.X (+8.37%). 🔥

Here are the closing prices:

| S&P 500 | 3,917 | -1.10% |

| Nasdaq | 11,631 | -0.74% |

| Russell 2000 | 1,726 | -2.56% |

| Dow Jones | 31,862 | -1.19% |

Stocks

Checking In On Bank Stocks

It’s been a wild week for bank stocks, so let’s take stock of where they all stand after today. Though before we get into some charts, let’s recap today’s news stories related to the sector.

First up, SVB Financial Group, the parent company of Silicon Valley Bank, has filed for Chapter 11 bankruptcy protection. The company says this process will allow it to evaluate strategic alternatives for its unaffected businesses and assets, including SVB Capital and SVB Securities, which remain operational. Also, note that Silicon Valley Bank was not included because it was taken over by the Federal Deposit Insurance Corporation (FDIC) last week. ⚖️

SVB Financial Group has roughly $3.3 billion in unsecured debt and $3.7 billion in stock that will likely be eliminated during the bankruptcy process.

Meanwhile, President Biden is calling on Congress to strengthen accountability for executives involved in the bank failures. Some ideas floated to discourage excessive risk-taking include clawing back executive pay, imposing fines, and preventing them from retaking jobs in the banking industry. 📝

And the soundbite that’s going most viral today is one in which Treasury Secretary Janet Yellen confirmed that only banks that pose a systemic risk would receive similar treatment as Silicon Valley Bank. Senator James Lankford used his line of questioning to point out that there are two classes of banks, those that the government will step in to help and those that it will not. 😮

While this was obvious to many market participants already, hearing Yellen say it so candidly sent most of FinTwit and the media into a frenzy. It also sent smaller community and regional bank shares lower as fears that deposits will continue to flee to larger “too big to fail” banks continue to spread. 😬

This is truly incredible.

Here is an exchange with Senator James Lankford & Yellen.

He asks, "Will every community bank … get the same treatment as SVB?"

Yellen: "Banks only get the treatment if … the failure to protected uninsured depositors would create systemic risk." pic.twitter.com/JvAX3Hhb6F

— unusual_whales (@unusual_whales) March 17, 2023

And internationally, Credit Suisse shares tumbled another 7% on news that it’s borrowing up to 50 billion Swiss francs ($54 billion) from the Swiss National Bank. Executives have a long weekend ahead as they discuss scenarios for the bank as it struggles to survive. 🏦

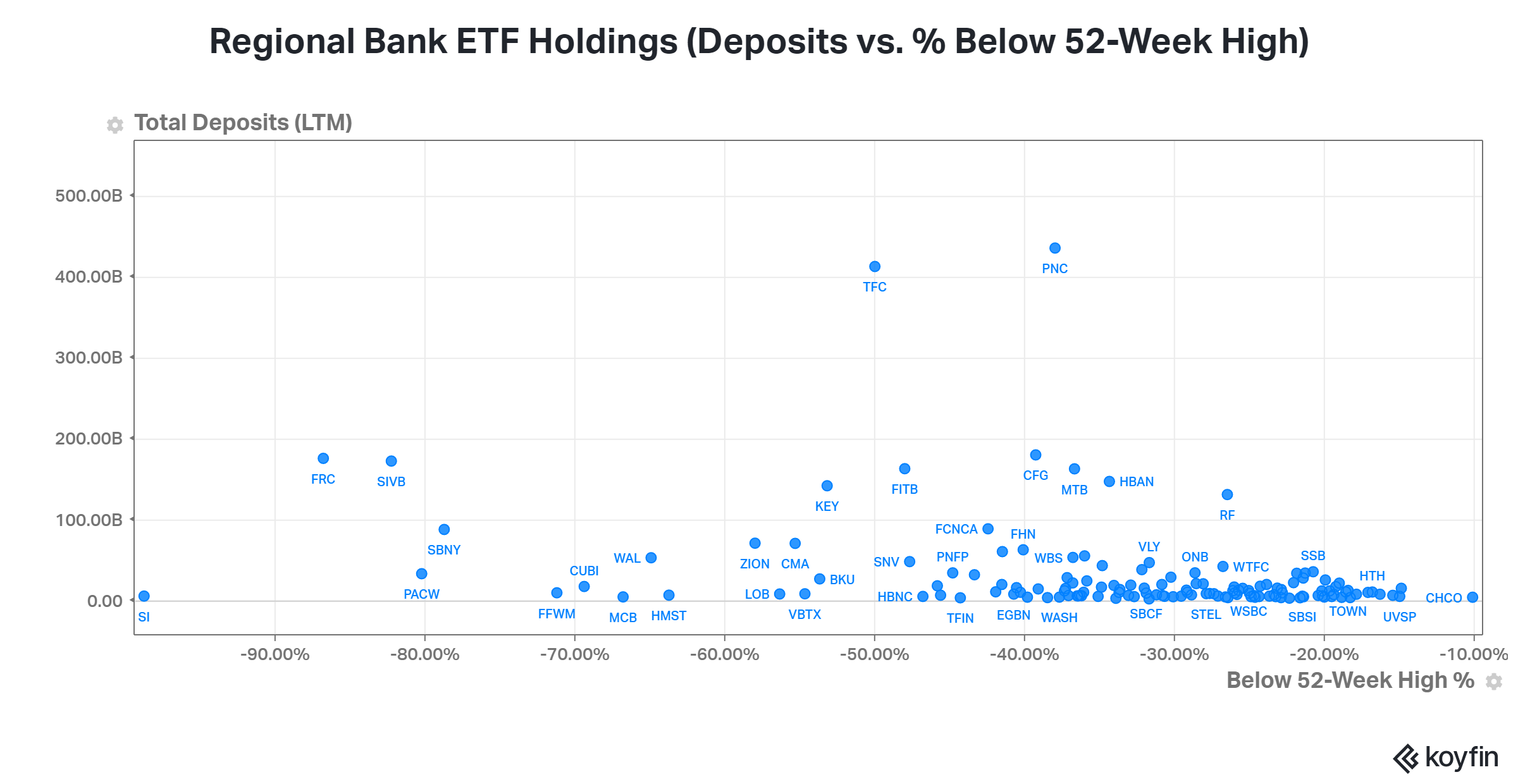

Since regional banks are the big focus these days, below we’re looking at its holdings. In it, we’re plotting their total deposits and how far the stock is below its 52-week highs. This can help provide some context as to the relative size of each of these banks, as well as how much they’ve fallen in price recently. 🤔

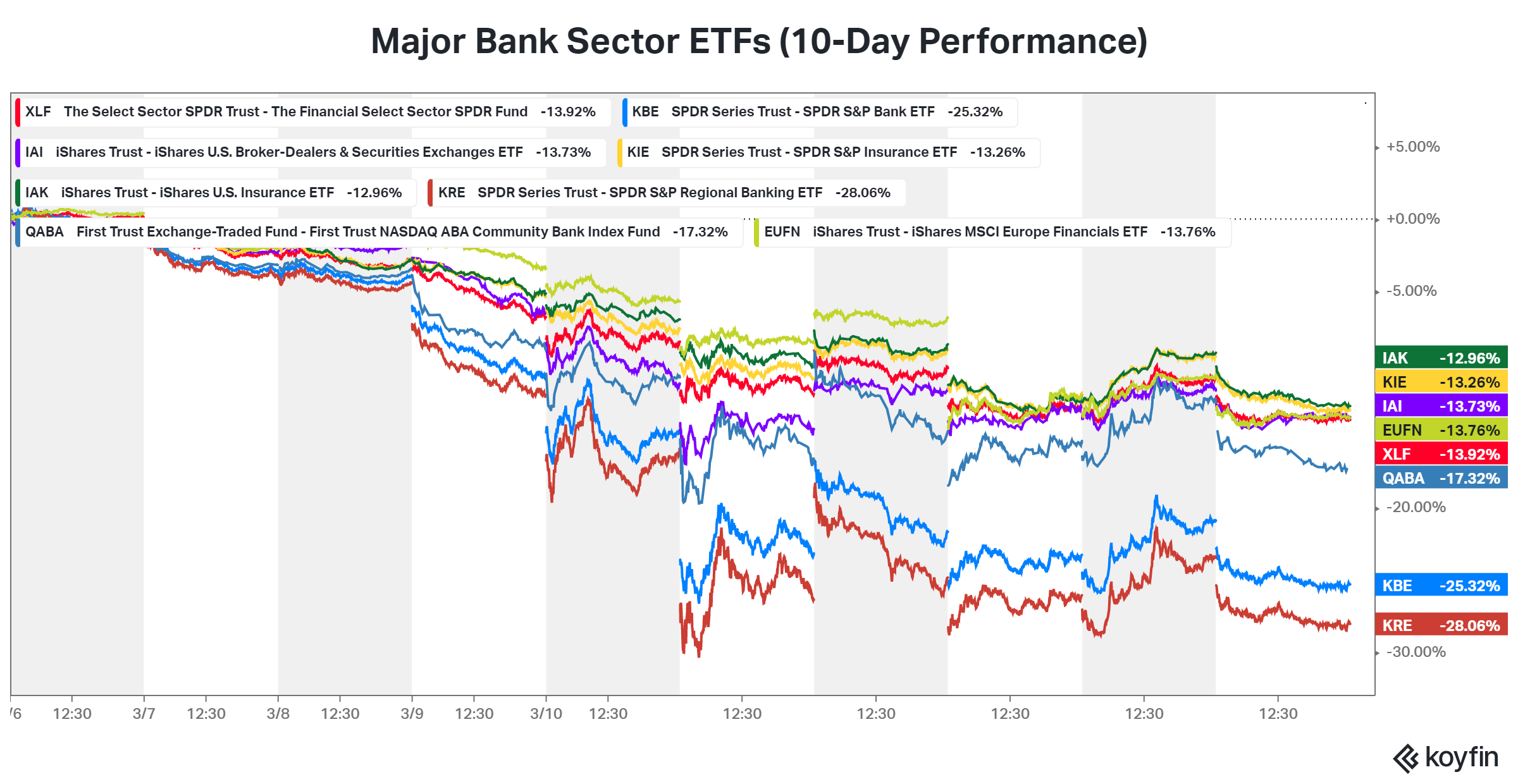

And below is the 10-day performance of various bank sector ETFs. They range from the major banks down to regional and community banks. We’ve even included insurance, capital markets, and other industry ETFs because they’ve all been hit hard.

Needless to say, it’s been a rough two weeks, and the volatility doesn’t seem to be slowing down. As always, we’ll keep on top of it and update you as the situation develops. 🤪

Earnings

XPeng’s Earnings

Chinese electric vehicle maker XPeng Motors is rising today despite weak fourth-quarter earnings.

Its adjusted earnings per share of $0.37 were two cents shy of expectations. And revenues of $750 million were down 40% YoY and $24.4 million short of the consensus view. 🔻

Quarterly vehicle deliveries fell roughly 50% YoY to 22,204, with its vehicle margin falling 590 basis points. China’s electric vehicle pricing war has eaten into its margins, and China’s shutdown impacted production for most of last year. Like other players, the company is refocusing its bets and improving operational efficiency to reduce costs. 🏭

Regarding growth drivers, management noted that smart technologies would play a big role in the industry and that the company intends to lead in the space. They believe the company is well-positioned and can use this advantage to grow market share. Analysts note that’s a longer-term advantage and will unlikely produce short-term results. 🤖

Looking ahead, the company expects to deliver 18,000 to 19,000 vehicles in Q1, with total revenues of $580.4 to $609.4 million. 🚗

Despite the lackluster results and weak guidance, the market responded positively. $XPEV shares rose 6% on the day. 🤷

Commodities

A Crude Two Weeks For Energy

The recent carnage in the energy sector has been lost in the shuffle, so let’s take a quick look.

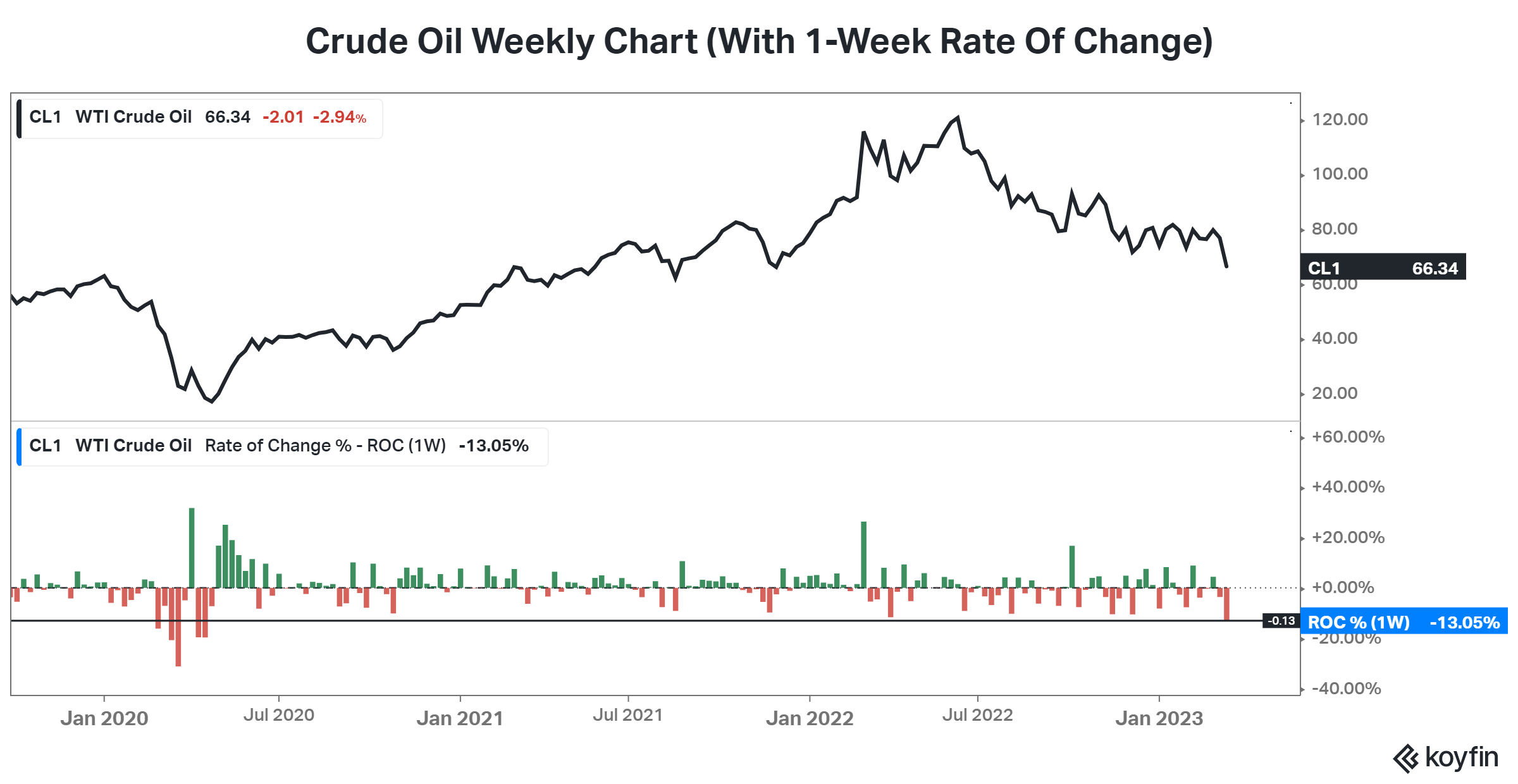

Below is a chart of crude oil’s weekly chart dating back three years. With this week’s decline, prices fell to their lowest level since December 2021. And the one-week rate of change shows this is the largest one-week decline since early 2020. 😬

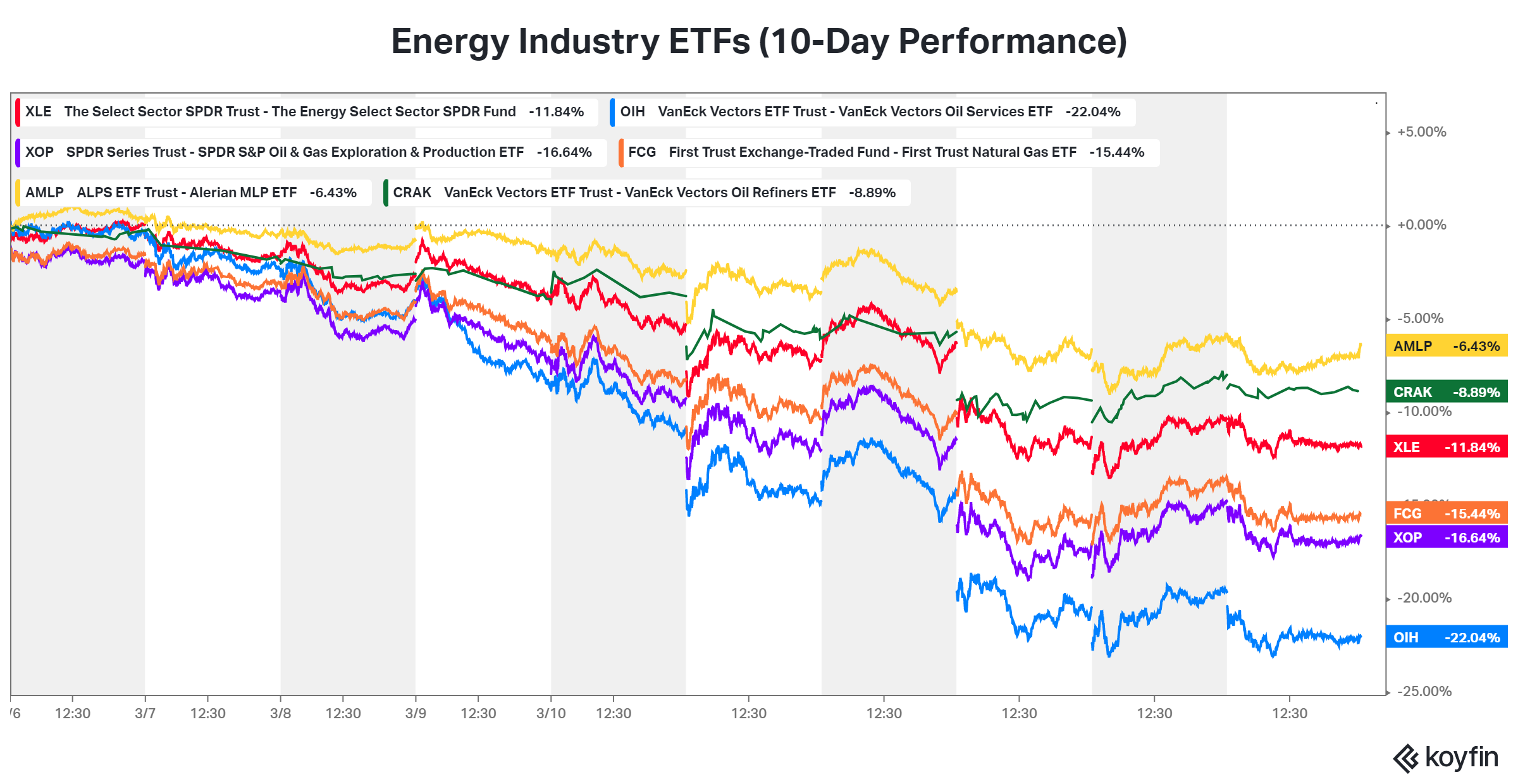

We mention it because the oil price decline is also showing up in energy-related ETFs. Their 10-day performance shows declines ranging from 6% to 22%. 🔻

With the energy sector shifting from last year’s best performer to this year’s worst, many investors are trying to determine whether the downward trend will continue or if this is a potential buying opportunity. For now, we’ll have to wait and see. 👀

Bullets

Bullets From The Day:

🏭 General Motors’ China business is losing ground to competitors. The world’s largest automotive market is becoming a significant challenge for U.S. brands, including General Motors. Including the company’s joint ventures, its total market share in China has fallen from 15% in 2015 to 9.8% in 2022. That’s its first time below 10% since 2004, with earnings from operations also falling about 70% from its 2014 peak. Executives have acknowledged the increased competition and declining progress but have offered little assurance on how they intend to reverse the trend. CNBC has more.

⚽ MLS partners with TikTok to further expand its presence. Major League Soccer (MLS) will bring exclusive content, in-app programming, and more to the app as part of a multi-year partnership. Additionally, a new Club Creator Network will be formed, pairing MLS clubs with TikTok creators who will create regular-season and off-season content. As an official partner of MLS, TikTok will be integrated into every MLS game through the season through various in-stadium branding. It’ll also co-sponsor the eMLS Cup esports tournament. More from TechCrunch.

📱 Google finds vulnerabilities in Samsung modems, which could allow hackers to own people’s phones. Project Zero, Google’s dedicated security research team, says four of the vulnerabilities could give hackers a way into a phone with just its phone number. The team is going public with its findings ninety days after sending its report to Samsung and other vendors, which have not yet patched the issue. In the meantime, vulnerable users can protect themselves by turning off Wi-Fi calling and Voice-over-LTE. The Verge has more.

💉 Sanofi is the latest drugmaker to cap the price of insulin. After Eli Lilly and Novo Nordisk announced they were limiting or cutting the cost of insulin for those with private insurance, Sanofi has finally followed suit. The three insulin makers currently account for 90% of the market in the U.S. They’ve been under political and social pressure to lower costs for years but are likely responding to the Inflation Reduction Act’s capping of out-of-pocket insulin costs for seniors on Medicare at $35 per month. Regardless, this is a welcome sign for the 8.4 million people in the U.S. with diabetes. More from ABC News.

💰 Walmart invests $200 million in the Indian mobile payments giant, PhonePe. The world’s largest retailer and majority owner of PhonePe is investing another $200 million into the startup. The ongoing round values the company at $12 billion pre-money and is expected to raise up to $1 billion. PhonePe dominates transactions on UPI, a network built by a coalition of retail banks in India that processes more than 8 billion transactions a month. Its new valuation makes it India’s most valuable fintech startup as it competes with Google Pay and Paytm. TechCrunch has more.

Links

Links That Don’t Suck:

⏸️ Meta’s metaverse is on the back burner

⌛ The last chance for some retirees to avoid a 25% tax penalty is April 1

🤖 ChatGPT update tricks human into helping it bypass CAPTCHA security

✈️ The FAA proposes lengthening cockpit voice recording time to 25 hours

💊 CMS releases ‘bombshell’ guidance draft of Medicare drug price negotiations

💸 Here’s how far a $100k salary goes in the most – and least – affordable U.S. cities