The stock market indexes opened low and closed near their highs after a volatile, news-filled session. Let’s recap what you missed today as we all await Wednesday’s Fed decision. 👀

Today’s issue covers three days of banking news, why Foot Locker lost its footing, and the continued slowdown in Chinese tech revenue. 📰

Check out today’s heat map:

Every sector closed green. Materials (+1.60%) led, and utilities (+0.03%) lagged. 💚

In crypto news, screenshots posted to Twitter signal Microsoft Edge is testing a built-in Ethereum crypto wallet. The U.S. Supreme Court will hear its first-ever crypto case on Tuesday when Coinbase will attempt to pause a pair of class action lawsuits as it attempts arbitration. And Bitcoin moved to a nine-month high as the broader crypto rally continued. ₿

Other symbols active on the streams included: $TRKA (-5.87%), $HUBC (-11.60%), $MULN (-2.37%), $DWAC (+10.96%), $BIG (-6.01%), $LYLT (+153.78%), $PRU (+2.94%), and $BTC.X (+0.41%). 🔥

Here are the closing prices:

| S&P 500 | 3,952 | +0.89% |

| Nasdaq | 11,676 | +0.39% |

| Russell 2000 | 1,745 | +1.11% |

| Dow Jones | 32,245 | +1.20% |

Company News

A Match Made In Switzerland

It was another wild weekend in banking news, so let’s go through the headlines and summarize what happened. 📰

The biggest story of the day is the shotgun marriage between Switzerland’s two largest banks. Sunday afternoon, it was reported that UBS agreed to buy its embattled rival Credit Suisse for 3 billion Swiss francs (~$3.2 billion). This was up from the initial $1 billion offer made by UBS and will see investors receive 1 UBS share for every 22.48 Credit Suisse shares they own.

However, the deal would not go down without additional government support. The Swiss National Bank is pledging a loan of up to 100 billion Swiss francs to back the takeover. And the Swiss government will also assume losses of up to 9 billion Swiss francs from certain assets to reduce UBS’ risk. 🛡️

Ultimately, neither of these banks is in the best shape. Just take one look at their stock charts over the last two decades. However, the deal is seen as one that helped avoid any immediate systemic crisis. 🤷

As for shareholder reactions, Credit Suisse’s largest shareholder isn’t happy about the deal. The Saudi National Bank confirmed an 80% loss on its recent investment in the Swiss bank. Meanwhile, UBS rose about 3% on the news as investors assess what it means for its longer-term market position. 🕵️

Next up, the U.S. Federal Reserve and central banks from Canada, England, Japan, Europe, and Switzerland unveiled new support over the weekend. Their coordinated action “is designed to enhance the provision of liquidity through the standing U.S. dollar swap line arrangements.” Essentially, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of seven-day maturity operations from weekly to daily. This is another effort to improve the market’s overall liquidity. 💱

Back in the U.S., First Republic Bank fell another 47% to fresh all-time lows. The regional bank’s shares continue to plummet despite last week’s $30 billion deposit from eleven of the U.S.’s largest banks. It’s now reported that JPMorgan is advising the bank on strategic alternatives. Some floated options include a capital raise, a sale of the bank, and more. Nothing is off the table, given outflows from the bank continue amid falling confidence. 🔻

An interesting tweet from The Kobeissi Letter pointed out that First Republic Bank shares were halted 11 times today and over 70 times over the last week. According to a quick search, that may be the most times a single stock has been halted in history—nothing to inspire confidence in depositors and shareholders like a week of erratic trading. 😮

New York Community Bancorp ($NYCB) rose 31% after the Federal Deposit Insurance Corporation (FDIC) agreed to sell NYCB deposits and loans from Signature Bank. Its subsidiary, Flagstar Bank, will assume substantially all of Signature Bank’s deposits, some of its loan portfolios, and all of its 40 former branches. That would leave roughly $60 billion in loans and $4 billion of deposits in the FDIC’s receivership. 💰

Meanwhile, the FDIC continues its search for a buyer of Silicon Valley Bank. It had trouble finding interested suitors last week, so it’s holding two separate auctions: one for its traditional deposits unit and one for its private bank. The more important news is that it will allow bank and non-bank financial firms to bid on the asset portfolios as it looks to broaden its list of potential buyers.

And lastly, Warren Buffett is reportedly in talks with the White House over the current U.S. banking crisis. Buffett and Berkshire Hathaway are often seen as one of the “lenders of last resort,” given their cash piles, but nothing concrete has come out about this yet. 🐐

For now, all eyes are on Wednesday’s Federal Reserve interest rate decision, economic projections, and commentary. As always, we’ll keep you updated as the saga continues. 👀

Earnings

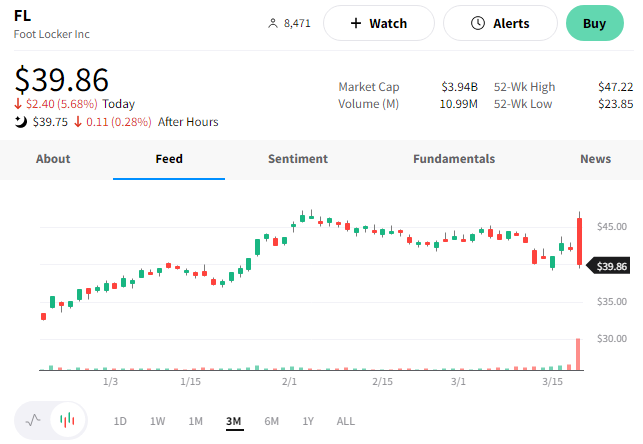

Foot Locker Loses Its Footing

It’s a challenging environment for retailers, especially those of a discretionary nature. And unfortunately, sneaker and athletic apparel retailer Foot Locker is not immune to these challenges.

The company reported a decline in holiday-quarter profits. Its adjusted earnings per share of $0.97 were down from $1.46 the previous year. Meanwhile, revenues of $2.34 billion were also marginally lower than in 2021. 🔻

While Foot Locker faces many of the same challenges as other mall retailers, it also has a supplier concentration problem. In the past, Nike has made up as much as 70% of the company’s overall sales. However, in 2022 Nike began to focus more on its direct-to-consumer sales, shifting away from wholesale channels.

That left Foot Locker in a precarious position. 😬

As a result, when CEO Mary Dillon took the helm in September, she spent “a great deal of time” revitalizing the company’s partnership with Nike. During today’s earnings release, she said the two have “re-established joint planning, as well as data and insight sharing.” As a result, she expects this renewed commitment to one another to show meaningful results in this year’s holiday quarter, with momentum building into 2024. 🤝

On Nike’s end, the supply chain issues faced during the pandemic have largely been resolved. As a result, it now has sufficient inventory to stock its NIKE Direct channel as well as its traditional wholesale channels like Foot Locker. In addition, Nike reiterated the importance of its omnichannel strategy in January, saying that retail partnerships are important because consumers want to try on products and touch/feel them before buying. 👟

In addition to its progress on the Nike partnership front, the retailer continues to adjust its footprint. It’s planning to close about 400 underperforming mall stores and will open roughly 300 new format stores in North America by 2026. 🏬

Executives expect the current fiscal year sales and comparable sales to decline by 3.5% to 5.5%. They also expected adjusted earnings per share between $3.35 and $3.65.

$FL shares initially rallied over 10% on the news. However, they lost their footing throughout the day and closed down 6%. 👎

Earnings

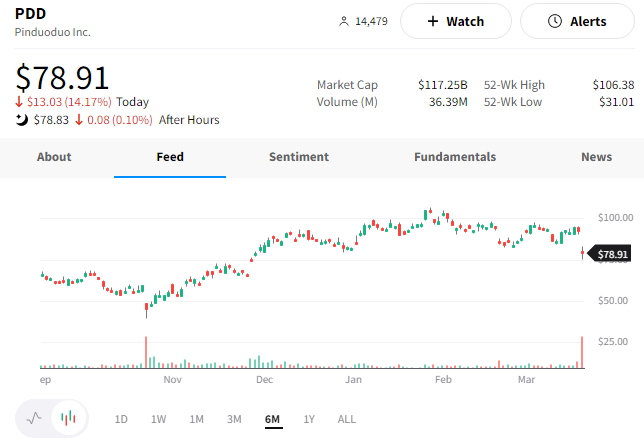

China’s Tech Giant Slowdown

The slowdown in China’s technology sector continues. This time the victim is PDD Holdings, which owns discount e-commerce Pinduoduo and Temu. 🛒

The company’s fourth-quarter revenue of 39.82 billion yuan billion was up 46% YoY but fell short of the 41.01 billion yuan expected by analysts. That’s also down from the 65% revenue growth it reported in the third quarter. However, it’s still above the single-digit revenue growth reported by Alibaba, JD.com, and other competitors during the same period. 📉

While this quarter included only the first couple weeks of China’s reopening, management reported China’s consumption market remains resilient. Given the uptick in inflation, sales of daily essentials showed steady growth. Meanwhile, demand for high-quality merchandise like mobile phones, beauty and cosmetics, and others showed a slight uptick.

With that said, the discount retailer is facing significant pricing competition. Competitors sitting on excess inventory are bringing goods to market at often unsustainably low prices. However, executives say they won’t play that game and instead are focused on longer-term growth opportunities. 📦

Like its peers, it’s looking overseas for its next growth phase. That’s where its Temu platform comes into play. Third-party reports indicate the platform’s gross merchandise value was $192 million in January, up from just $3 million in September. It plans to roll out Temu in Canada, Australia, New Zealand, and the U.K. in 2023.

Despite the progress, investors remained focused on the slowing growth story. Although its revenue growth remains well above some of its larger competitors, it is still slowing. And in this environment, the market continues rewarding companies that focus on profitability rather than revenue growth at any cost. 👎

$PDD shares were down about 14% on the day. 🔻

Bullets

Bullets From The Day:

🚀 Virgin Orbit deal talks continue as bankruptcy looms. The aerospace firm that provides launch services for small satellites has struggled since going public via SPAC in late 2021. Its shares have fallen over 95% from their post-SPAC highs, extending their decline last week after the company announced it had paused its operations and was furloughing almost all its workers. The company has been seeking strategic alternatives for months, but sources say it could file for bankruptcy as soon as this week if it’s not thrown a lifeline. CNBC has more.

✂️ Amazon joins its tech peers in making deeper cuts. Months after the company laid off 18,000 white-collar workers, it’s back announcing another 9,000 layoffs are coming. Those affected will be in its AWS cloud unit, Twitch gaming division, advertising, and PXT (experience and technology solutions) arm. CEO Andy Jassy says the company has not yet completed its full evaluation and that more cuts could be ahead if its due diligence suggests they’re necessary. Analysts wonder whether the layoffs in its AWS cloud unit signal that the company’s recent growth engine is expected to continue slowing. More from TechCrunch.

🧑⚖️ Supreme Court to hear free speech fight that began over a dog toy. A trademark dispute over a poop-themed dog toy shaped like a Jack Daniel’s whiskey bottle could redefine how the judiciary applies constitutional free speech rights to trademark law. The case will likely clarify the line between a parody protected by the U.S. Constitution’s First Amendment and a trademark-infringing ripoff that has repercussions beyond the immediate players. The case will begin on Wednesday, with a ruling due by the end of July. Reuters has more.

🗄️ A landmark copyright lawsuit could impact the “Internet Archive” forever. Book publishers and the Internet Archive are facing off in a hearing that could determine the future of library ebooks, deciding whether they can scan and lend copies of their own tomes or if they’ll need to rely on the digital licenses offered by publishers. The court will consider whether the Open Library violated copyright law by letting users “check out” digitized copies of physical books. This specific case relates to the Internet Archive’s “National Emergency Library,” which removed the “own-to-loan” restriction and let unlimited numbers of people access each ebook with a two-week lending period during the pandemic. More from The Verge.

🪪 Twitter tests a new government ID-based verification system. The company is reportedly testing a new verification process for Twitter Blue subscribers involving submitting a government ID. Code-level insights revealed a method for the commonly-used “know-your-customer” process often used by financial institutions and other businesses that require tighter security. If this is rolled out, it would be a stark contrast to the past system and a significant update to the current system, which requires phone number verification to prove that you’re a human controlling the account. TechCrunch has more.

Links

Links That Don’t Suck:

📺 Age of Easy Money (full documentary) | FRONTLINE

🤑 The 7 fastest-growing STEM jobs that pay over $100,000

💩 Got a question for Twitter’s press team? The answer will be a poop emoji

🚗 Ford, Honda vehicles among 1.9 million cars under recall: Check recalls here

✌️ New Starbucks CEO Laxman Narasimhan takes over nearly two weeks earlier than expected

🪫 EV batteries lack reparability leading some insurers to junk whole cars after even minor collisions