It’s a challenging environment for retailers, especially those of a discretionary nature. And unfortunately, sneaker and athletic apparel retailer Foot Locker is not immune to these challenges.

The company reported a decline in holiday-quarter profits. Its adjusted earnings per share of $0.97 were down from $1.46 the previous year. Meanwhile, revenues of $2.34 billion were also marginally lower than in 2021. 🔻

While Foot Locker faces many of the same challenges as other mall retailers, it also has a supplier concentration problem. In the past, Nike has made up as much as 70% of the company’s overall sales. However, in 2022 Nike began to focus more on its direct-to-consumer sales, shifting away from wholesale channels.

That left Foot Locker in a precarious position. 😬

As a result, when CEO Mary Dillon took the helm in September, she spent “a great deal of time” revitalizing the company’s partnership with Nike. During today’s earnings release, she said the two have “re-established joint planning, as well as data and insight sharing.” As a result, she expects this renewed commitment to one another to show meaningful results in this year’s holiday quarter, with momentum building into 2024. 🤝

On Nike’s end, the supply chain issues faced during the pandemic have largely been resolved. As a result, it now has sufficient inventory to stock its NIKE Direct channel as well as its traditional wholesale channels like Foot Locker. In addition, Nike reiterated the importance of its omnichannel strategy in January, saying that retail partnerships are important because consumers want to try on products and touch/feel them before buying. 👟

In addition to its progress on the Nike partnership front, the retailer continues to adjust its footprint. It’s planning to close about 400 underperforming mall stores and will open roughly 300 new format stores in North America by 2026. 🏬

Executives expect the current fiscal year sales and comparable sales to decline by 3.5% to 5.5%. They also expected adjusted earnings per share between $3.35 and $3.65.

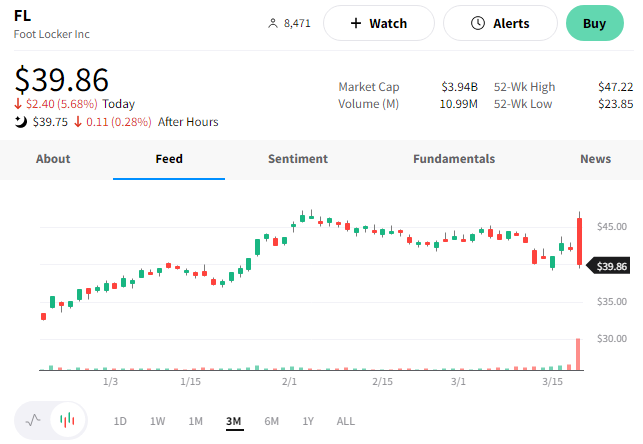

$FL shares initially rallied over 10% on the news. However, they lost their footing throughout the day and closed down 6%. 👎