Stocks and bond yields were up as the market rides a wave of optimism into tomorrow’s highly-anticipated Federal Reserve meeting. It will likely be a volatile rest of the week as investors react to the Fed’s decision, economic forecast, and general commentary. In the meantime, let’s recap what you missed today. 👀

Today’s issue covers why GameStop is soaring after hours, Nike’s volatile post-earnings trading, and a solar stock that shined bright today. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Energy (+3.46%) led, and utilities (-2.01%) lagged. 💚

Going into tomorrow’s meeting, the market is currently pricing an 87% chance of a 25 bp hike and a 13% chance of keeping rates the same. While inflation remains elevated, some market participants believe the recent banking turmoil will cause the Fed to pump the brakes on its tightening efforts. Hence the reason tech stocks and other long-dated assets are performing well recently. 🤷

In U.S. economic news, existing home sales rose 14.5% MoM but were still down 22.6% YoY. The median sales price fell by 0.2% YoY, marking its first decline in a record 131 consecutive months. 😮

Internationally, the European Union drafted a new plan to allow e-fuel combustion engine cars after 2035 if they run only on climate-neutral e-fuels. The European Commission is trying to appease its largest economic power, Germany, which has raised concerns about its previous bill. Meanwhile, Canada’s inflation fell to a thirteen-month low in February, rising just 5.2% YoY. 🔻

First Republic Bank and other regional/community banks got a boost today after Treasury Secretary Janet Yellen said the government could do more to backstop deposits if there’s a risk of contagion. Meanwhile, after the Signature Bank deal with New York Community Bancorp, the Federal Deposit Insurance Corporation (FDIC) is stuck holding $11 billion in bad loans. 🏦

Other symbols active on the streams included: $TRKA (-2.79%), $EDBL (+10.84%), $ALT (-54.67%), $DWAC (-1.73%), $NVOS (+37.08%), $BSFC (+11.53%), $CISO (+67.87%), and $BTC.X (+0.12%). 🔥

P.S. We accidentally wrote Sweden instead of Switzerland in yesterday’s main story about the UBS and Credit Suisse deal. Our writer spent his Sunday at IKEA and must’ve had Sweden on his mind when writing/editing the story. Our bad for the mistake, and thank you to everyone who laughed with us about it on social and via email. 😜

Here are the closing prices:

| S&P 500 | 4,003 | +1.30% |

| Nasdaq | 11,860 | +1.58% |

| Russell 2000 | 1,778 | +1.88% |

| Dow Jones | 32,561 | +0.98% |

GameStop shares were tossed aside for AMC, Bed Bath & Beyond, and other more volatile “meme stocks” over the last year. However, while those stocks were moving, it seems GameStop executives were busy making progress on the business. 🤔

Let’s take a look at how it fared during the fourth quarter.

Net sales dropped from $2.25 billion to $2.23 billion. However, the company reported its first net profit in two years. Earnings of $0.16 per share improved from its $0.49 per share loss a year earlier. 😮

The company’s turnaround plan has been in place for about six quarters and is finally showing results. It’s obvious to most analysts that its NFT marketplace, partnership with FTX, and other “digital” bets haven’t panned out as expected. That said, its full-year fiscal-2022 sales held up better than most expected. Net sales were down just over 1% YoY to $5.93 billion. 🛒

Executives have aggressively cut costs, closed underperforming stores, and improved the online shopping experience. That’s helped buoy sales and increase profitability by reducing selling, general, and administration (SG&A) expenses from 23.9% of sales to 20.4% of sales in 2022. 🔺

Investors were concerned about inventory levels, which ballooned to $915 million in 2021. However, the company made progress there, too, bringing that figure down to $682.9 million at the end of last quarter. Its also been working to bolster its cash position, which is roughly $1.39 billion. 💰

Overall, its turnaround plan appears to be going better than many expected. A return to profitability, improving margins, and essentially flat sales are all positive signs that its business is stabilizing. That said, executives continued their pandemic-era trend of not guiding for the coming quarter or fiscal year.

The market doesn’t seem to mind, though. $GME shares are up nearly 50% after hours. 📈

Earnings

Nike Beats, But Concerns Remain

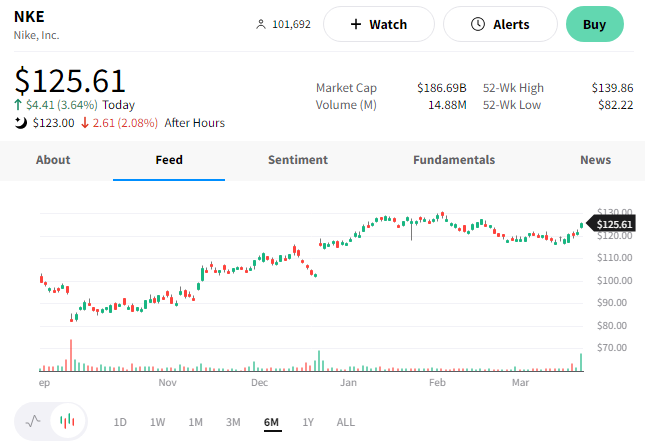

Nike shares popped, then dropped in extended hours after reporting a mixed holiday quarter.

The retailer’s adjusted earnings per share of $0.79 and revenues of $12.39 billion beat the expected $0.55 and $11.47 billion. 👍

As we discussed yesterday after Foot Locker’s earnings, Nike has made a strong push in its direct-to-consumer business. Last quarter, Nike Direct and Nike digital sales were up 17% and 20%, respectively. However, selling and administrative expenses were also up 15%, with wage-related expenses and Nike Direct costs rising. 🔺

Additionally, supply chain disruptions and changing consumer preferences left the company with a glut of inventory. As a result, it needed to discount heavily to offload some of that excess, which weighed on margins. Gross margins fell 3.3% to 43.3% in the quarter, though Nike CEO John Donahoe said the company is now past its inventory peak. 📦

The 16% YoY increase in inventories reported this quarter was primarily due to higher product input costs and freight expenses.

In January, Nike’s leadership discussed the importance of an omnichannel approach. Its renewed partnership with Foot Locker and other wholesalers will continue to play a vital role in its sales and customer experience. Sales in that channel were down 7% QoQ to 12% but played an important role in the company liquidating some of its inventory. 🏬

Overall, investors remain concerned about the rising costs of its direct business and the slowdown in China’s market. Sales in that region missed the $2.09 billion expected by analysts, coming in at $1.99 billion. The weaker macroeconomic conditions and a slowdown in consumer spending here in the U.S. and internationally will remain a headwind for the retailer and its competitors.

The mixed messaging had $NKE shares flailing after hours. They’re currently down about 2%. 👎

Earnings

Canadian Solar Shines After Earnings

Shares of Canadian Solar are shining after the company reported better-than-expected fourth-quarter earnings. 🌞

Its adjusted earnings per share of $1.11 on revenues of $1.97 billion topped the $0.70 and $1.92 billion expected. Revenues were up 29% YoY, and earnings rose 185% YoY.

Additionally, its shipments of solar modules jumped 68% YoY to 6.4 gigawatts, above the company’s outlook of 6.1 gigawatts. With that said, the company forecasted full-year revenue of $8.5 to $9.5 billion, shy of the $9.6 billion expected by analysts. 🔮

Investors appeared to ignore the weak guidance, as $CSIQ shares were up 15% on the news. However, they are still trading in a wide one-year trading range. 🤷

Bullets

Bullets From The Day:

✂️ Vanguard is entirely exiting China after beginning its retreat in 2021. The U.S. fund giant is shutting its main Shanghai office and exiting from a joint venture with Ant Group, ending its six-year presence in the world’s second-largest economy. Vanguard currently owns a 49% stake in the Ant-controlled JV, which executives says is operating as usual along with its fund advisory service. The exit plan comes as rivals BlackRock, Fidelity, and others expand into China. CNBC has more.

💻 Adobe announces its push into AI with a new enterprise tier. The software giant has launched the enterprise tier of its creative application Adobe Express at its Adobe Summit event. The enterprise subscription will grant organizations access to Adobe Firefly, its newly launched suite of generative AI tools. The offering is designed to help businesses build anything from brand content to social media posts without needing expert design skills. It also offers a range of collaboration tools, which could help get non-designers into the creative processes of companies all around the globe. More from TechCrunch.

🤖 Nvidia looks to capitalize on the AI boom with its new service. The company plans to make the supercomputers used to develop AI technologies available for rent to nearly any business. Access will start at 37,000 a month, providing eight of Nvidia’s flagship A100 or H100 chips strung together. Nvidia’s Chief Executive Jensen Huang said that “the iPhone moment of AI has started” and that its partnership with Microsoft and Alphabet to distribute access to its technology could further accelerate the industry’s boom. Reuters has more.

⚡ Ford pushes deeper into the European market with its new Explorer EV. The U.S. automaker unveiled its first all-new electric vehicle exclusively for the European market. The Explorer EV will start at less than 45,000 euros when sales launch later this year, though the company did not disclose its expected range or other performance statistics. The company hopes to leverage the Explorer brand name to help it gain traction in Europe, though some analysts are concerned that the crossover may be the wrong fit for European consumers. More from CNBC.

🚫 Google suspends a popular Chinese shopping app over security concerns. The Chinese budget shopping app is temporarily suspended from the Play Store after Google further investigates the malware it found in some app versions. Executives from Pinduoduo say several other apps have also been suspended, and they’re working closely with Google to rectify the issues. The news comes a day after the company reported weaker-than-expected revenue growth, and its shares fell by about 15%. CNN Business has more.

Links

Links That Don’t Suck:

🏘️ Gen Z is coming for the housing market

🍰 Researchers 3D printed this cheesecake

💨 Tesla’s self-driving ambitions are further and further away

🤏 New 1- bedroom apartments get smaller, now under 900 feet

⛽ Last Dodge Challenger makes 1,025 hp, has optional parachute attachments

⚖️ JP Morgan, Deutsche can be sued for Epstein’s sex-trafficking ring, judge rules