Welcome to the Stocktwits Top 25 Newsletter for Week 25 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 25:

P.S. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

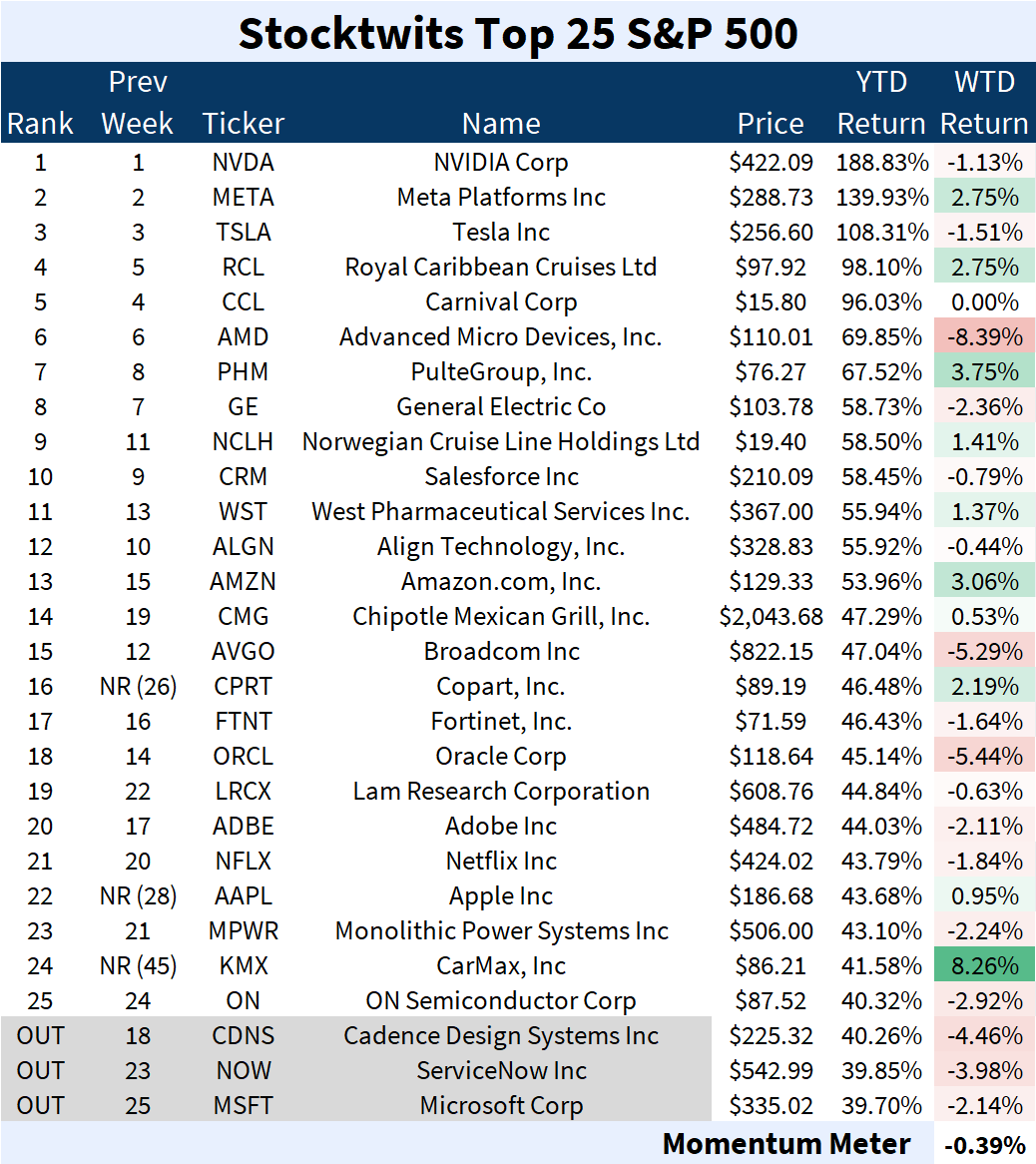

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (-0.39%) outperformed the S&P 500 index (-1.39%).

There were three major changes to the list this week.

Joining: Copart, Inc. (+2.19%), Apple (+0.95%), and CarMax (+8.26%).

Leaving: Cadence Design Systems (-4.46%), ServiceNow (-3.98%), and Microsoft (-2.14%).

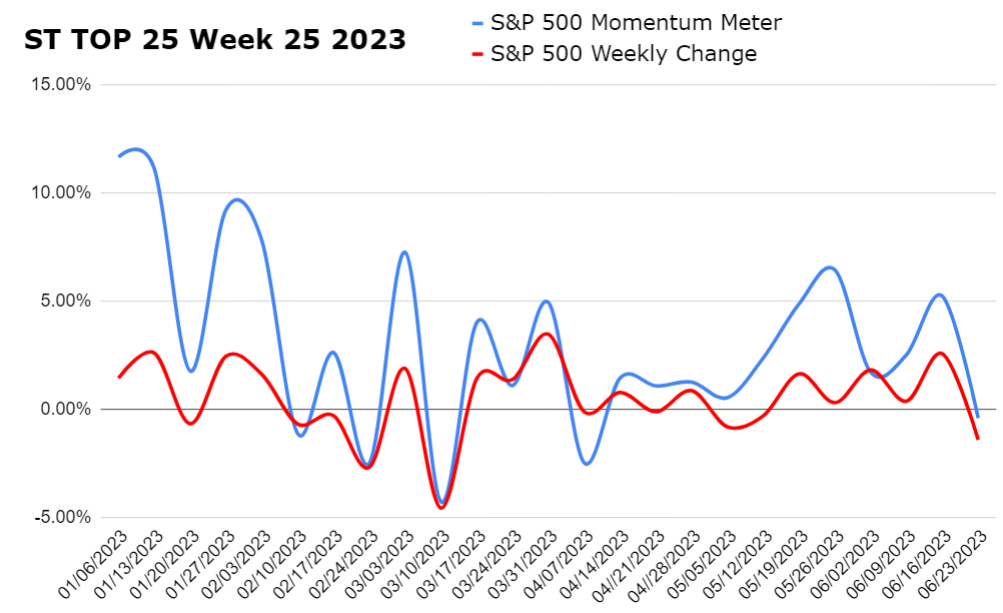

Check out how the momentum meter has performed vs. the S&P 500 index this year:

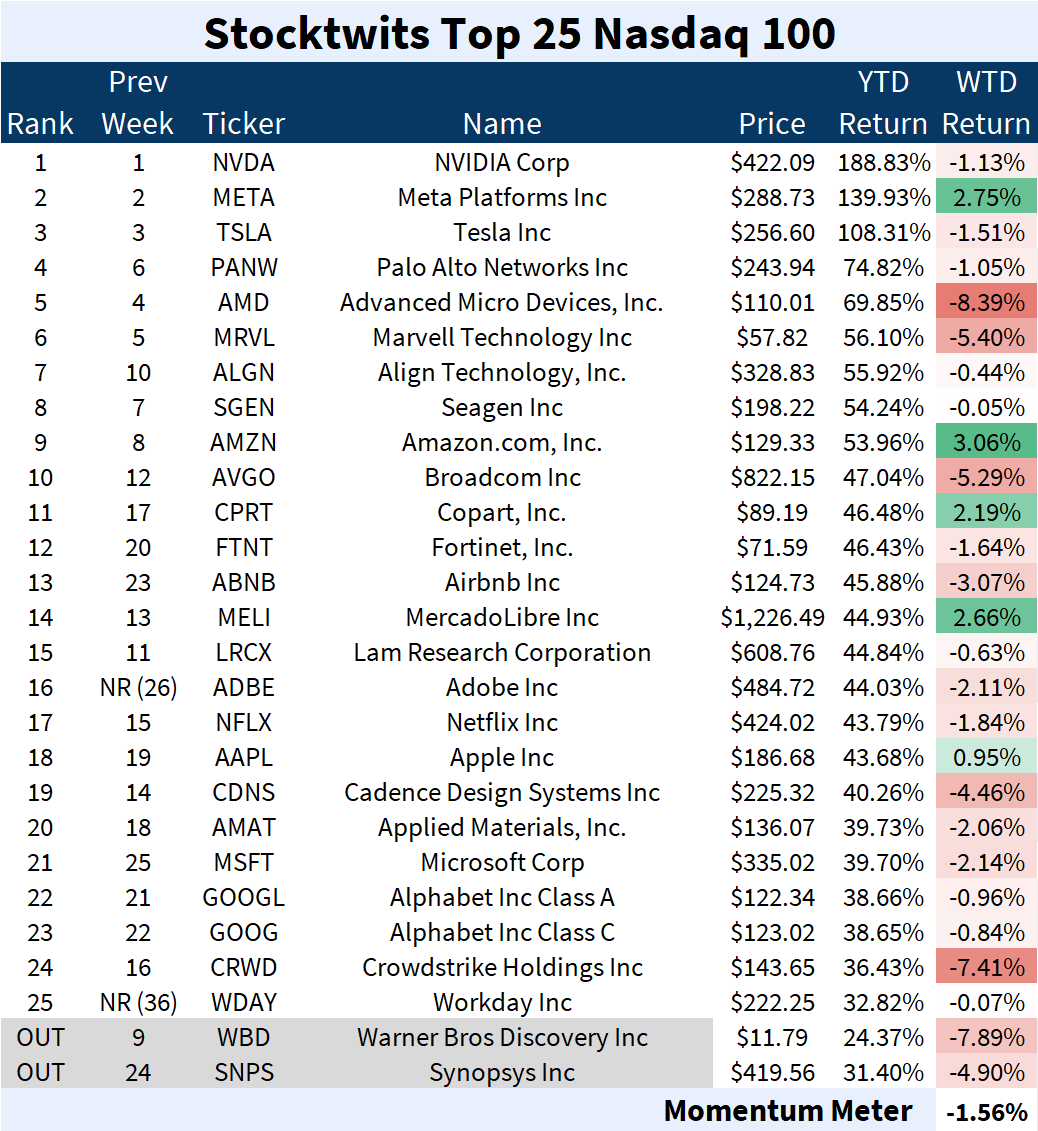

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (-1.56%) underperformed the Nasdaq 100 index (-1.28%).

There were two major changes to the list this week.

Joining: Adobe (-2.11%) and Workday (-0.07%).

Leaving: Warner Bros Discovery (-7.89%) and Synopsys (-4.90%).

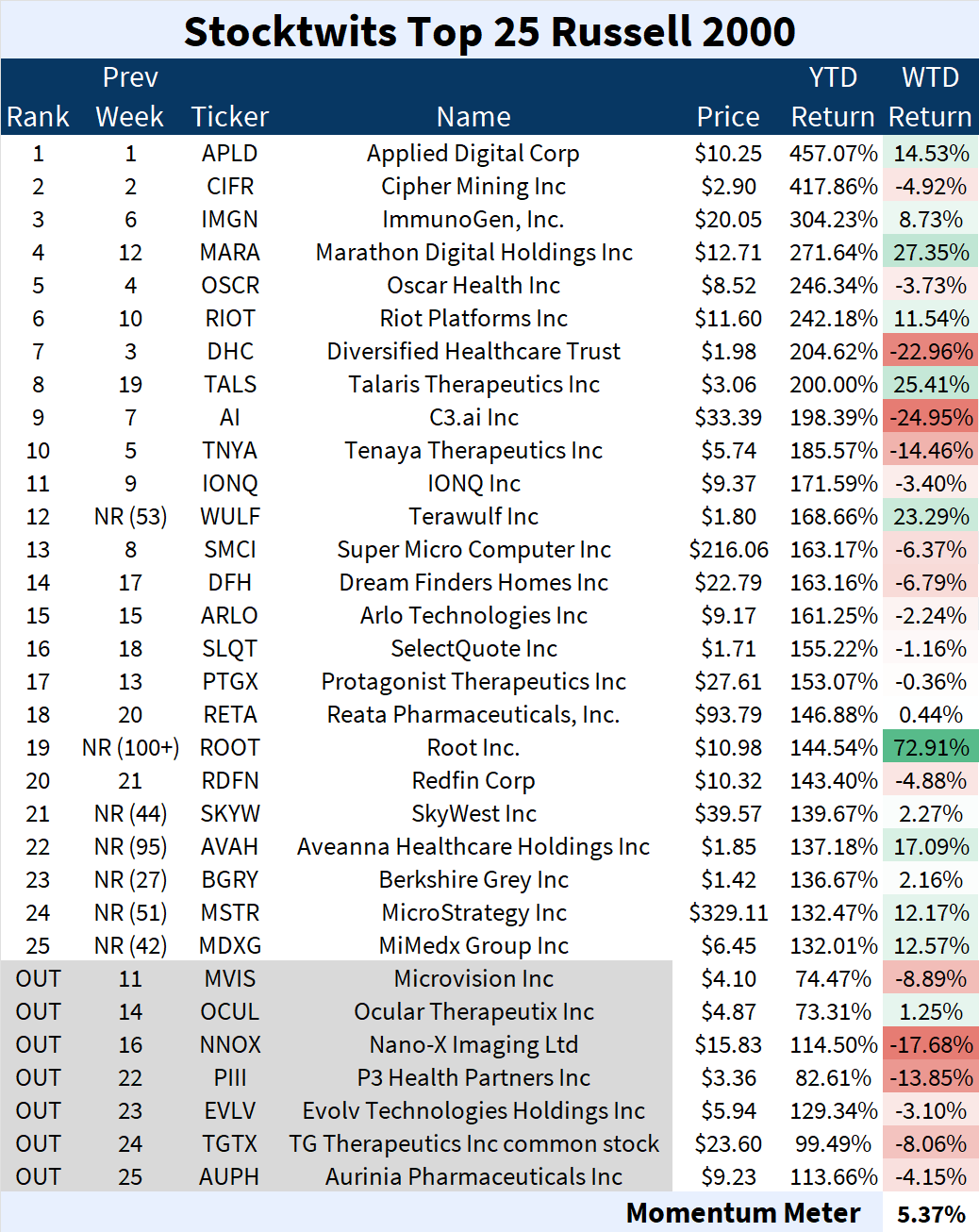

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+5.37%) outperformed the Russell 2000 index (-2.87%).

There were seven major changes to the list this week.

Joining: Terawulf Inc. (+23.29%), Root Inc. (+72.91%), SkyWest Inc (+2.27%), Aveanna Healthcare Holdings (+17.09%), Berkshire Grey (+2.16%), MicroStrategy (+12.17%), and MiMedx Group (+12.57%).

Leaving: Microvision Inc (-8.89%), Ocular Therapetuix (-1.25%), Nano-X Imaging (-17.68%), P3 Health Partners (-13.85%), Evolv Technologies Holdings (-3.10%), TG Therapeutics (-8.06%), and Aurinia Pharmaceuticals (-4.15%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

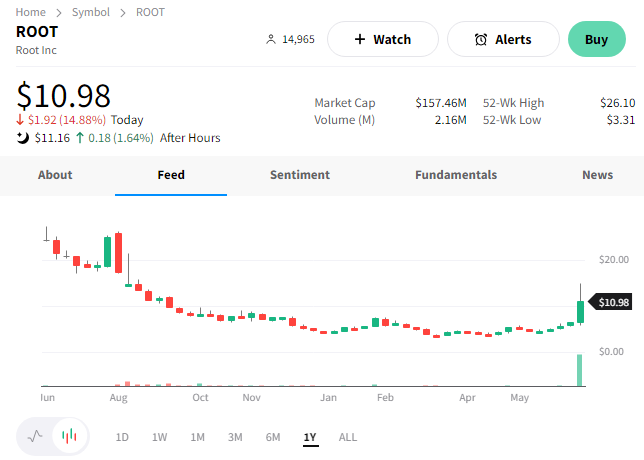

The Top 25 lists’ Top Dawg was Root Inc., which rallied 72.91%. 📈

The formerly mid-cap, now micro-cap car insurance fintech firm soared on reports that it’s received an acquisition offer of $19.34 per share from Embedded Insurance. 💰

With the stock’s value down about 99% from its peak of $7.5 billion, it’s unclear whether or not the board will accept this offer. That’s why shares did not immediately shoot up to the offer price. The board says they’re currently “evaluating how best to deliver shareholder value in accordance with their fiduciary duties.” 🤔

$ROOT is up 144.54% YTD.

See Y’all Next Week 🤙