The decline in stocks accelerated today across the globe as investors took profits following two months of strong gains. Let’s see what you missed. 👀

Today’s issue covers the massive plunge in Siemens Energy, CarMax cruising higher on earnings, and why some traders are eyeing natural gas. 📰

Check out today’s heat map:

Every sector closed red. Communication services (-0.22%) led, and utilities (-1.47%) lagged. 🟥

S&P global manufacturing PMI fell to 46.3 and services PMI dipped to 54.1, leading to a composite value of 53. The overall rate of U.S. business activity expansion continued in June, but manufacturing activity remains weak as higher costs of capital and high inventories weigh on demand. 🏭

Artificial intelligence (AI) stocks took a hit after Deutsche Bank reiterated its sell rating on C3.ai following its investor day. Analysts say they need more clarity about the technology’s merits and overall business impact. 🤖

In crypto news, the first-ever leveraged Bitcoin futures ETF began trading today after being approved by the U.S. Securities and Exchange Commission. Bitcoin continued its rally, topping 31,000 as Ethereum approaches 2,000 and Litecoin approaches 100. And Belgium’s markets regulator ordered Binance to stop offering crypto services within the country. ₿

Other symbols active on the streams included: $MULN (-4.83%), $SPCE (-18.42%), $FSR (-2.86%), $SOFI (-2.47%), $AGLE (-12.30%), $CISS (-28.92%), $NVVE (+12.01%), and $PIK (+93.72%). 🔥

Here are the closing prices:

| S&P 500 | 4,348 | -0.77% |

| Nasdaq | 13,493 | -1.01% |

| Russell 2000 | 1,822 | -1.44% |

| Dow Jones | 33,727 | -0.65% |

Earnings

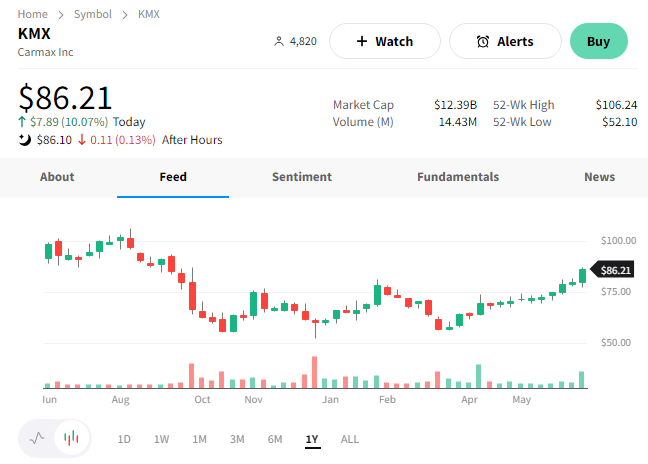

CarMax Cruises On Earnings

CarMax shares are breaking out today following better-than-anticipated first-quarter results. 📈

The last time we talked about the auto retailer was in April, when its results also topped expectations. Back then, the company had seen some of its cost-cutting efforts begin to pay off, raising its profit per vehicle. That helped offset falling transaction volumes and used-car prices.

This time around, continuing cost savings and improving sales declines boosted results. Its adjusted earnings per share of $1.16 on revenues of $7.68 billion exceeded the $0.79 and $7.49 billion Wall Street consensus. 💪

Comparable-store used-unit sales fell 11.4% YoY, compared with 14.1% and 22.4% declines in its last two quarters. Retail used sales units fell 9.6%, while wholesale units fell 13.6% YoY. The company bought 343,000 vehicles during the quarter, down 5.2% YoY but up 31.1% QoQ.

As for costs, selling, general, and administrative (SG&A) expenses dropped 14.8% YoY ($96.9 million). Although, excluding a favorable legal settlement, they fell 5.7% ($37.6 million). Wholesale and retail margins were in line with last year’s first quarter. 🔻

Regarding CarMax Auto Finance (CAF), revenues fell 32.8% YoY to $137.4 million. A compression in its net interest margin percentage and a higher provision for loan losses weighed on results, though improving operations around receivables partially offset those factors. 💵

Overall, CEO William Nash said that the used car market remains depressed but is slowly getting back to normal. As a result, the company is focused on what it can control, reducing staffing levels, cutting ad spending, and improving operational efficiency wherever possible.

$KMX shares rose 10% to a nine-month high on the news. 👍

Company News

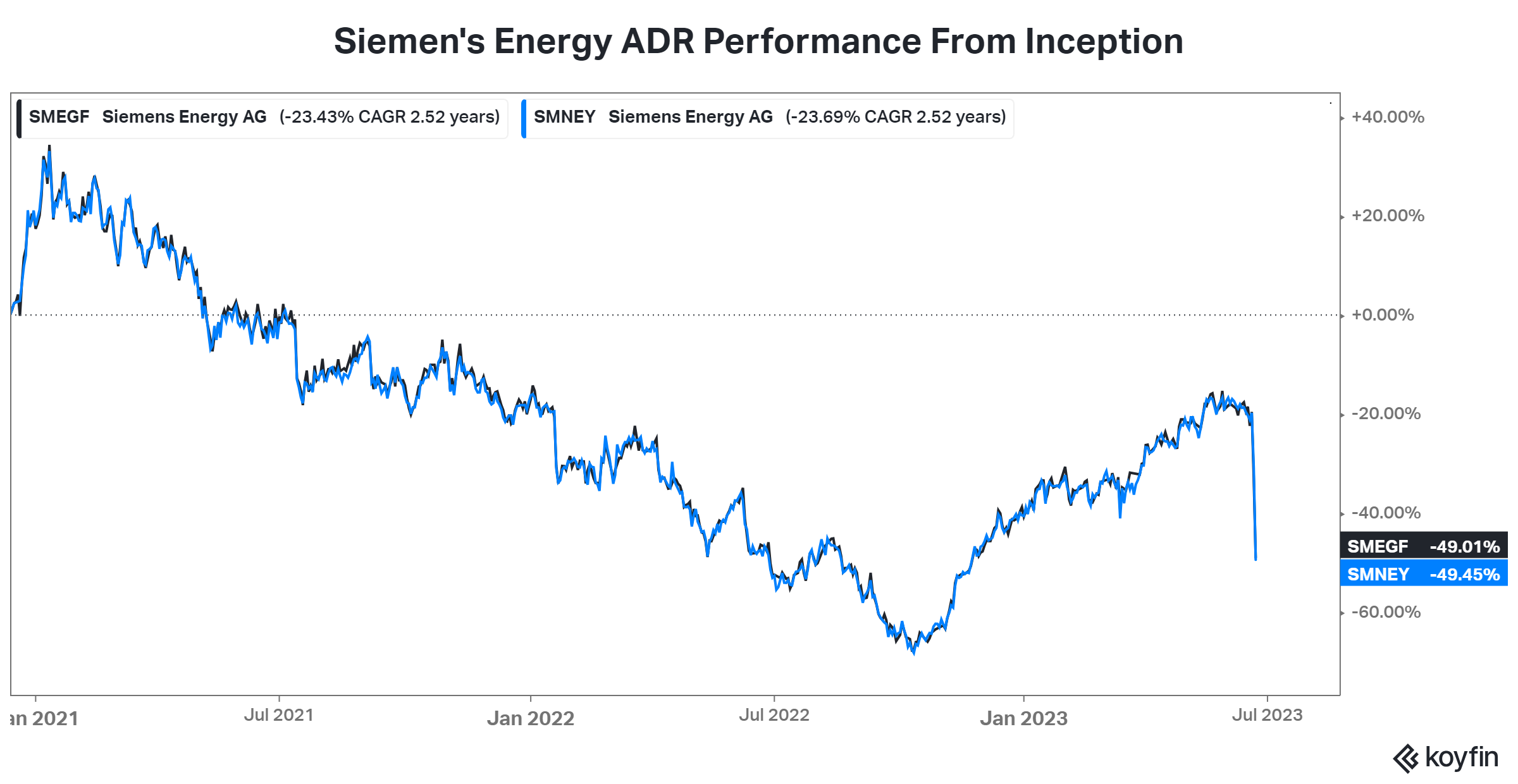

Siemens Energy Plunges

After the company’s announcement that problems at its wind turbine unit could last for years, Siemens Energy shares are gone with the wind. 😱

For background, Siemens Energy was created as a spinoff of German conglomerate Siemens AG’s former gas and power division. And it’s traded separately on exchanges abroad and in the U.S. as an American Depository Receipt (ADR) under ticker symbols $SMEGF and $SMNEY, which combined represent one Siemens ordinary share.

This week it announced that a review of issues as its Siemens Gamesa subsidiary uncovered a “substantial increase in failure rates of wind turbine components.” That news comes about a year after Siemens Energy acquired the remaining stake in this wind turbine unit, which was also publicly listed, for roughly 4 billion euros. While some issues existed at the time, its thesis was that it would be able to better address the renewable energy unit’s operational issues as a 100% owner vs. continuing to operate as a majority owner. 💰

Clearly, that has not panned out as anticipated, with cultural differences plaguing the two companies’ combination. ⚔️

With the additional skeletons being discovered this week, many shareholders question management’s leadership. How can investors rely on the company’s forecasts now if management doesn’t have a clear handle on the situation? Did they not adequately understand the risks before approving last year’s buyout? Many questions remain.

And with executives expecting the new quality issues could impact up to 30% of Siemens Gamesa’s installed onshore fleet, things are unlikely to improve soon. For now, Siemens Gamesa’s board of directors initiated an extended technical review to improve product quality. It’s expected to raise costs by more than 1 billion euros, though the true impact is unlikely to be uncovered for some time. ❤️🩹

Ultimately, the scale of these operational problems shocked the market. Siemens Energy shares are down about 37% over the last two days on the news. Meanwhile, Siemens AG, which still owns about 35% of the company, was down just 4% and is sitting just below all-time highs. 🔻

Ultimately, it’s a very messy situation that management needs to get a handle on before their next report in August. We’ll see if the stock’s drop this week is enough to price in the potential longer-term damage or if investors feel the price should be even lower than it is today. 🤷

Commodities

Natural Gas Is Moving Fast

Okay, maybe not fast. But it certainly is moving differently than it has been. After falling about 80% from its highs from August to March, natural gas futures have been taking the first step to reverse their trend…stop going down. ⏸️

Below is a daily chart of natural gas futures trading in a $2.00 to $2.65 range for the last five months. But this week, traders are putting it back on their radar due to its strength relative to the rest of the energy commodity complex. With crude oil, gasoline, and heating oil all falling several percent this week, natural gas’s nearly 5% gain certainly stands out. 🤔

And from a long-term perspective, some investors and traders see the current area as an interesting one. The daily chart below shows prices stabilized above the $2.00 level that’s acted as an important support and resistance level over the last few years. For the non-technical analysts in the room, that simply means an area where there’s been a significant shift in supply and demand. 🧭

Earlier in the year, there was a lot of activity in natural gas on the short side. Inverse and leveraged ETFs were regularly trending on our streams as traders played the trend to the downside. But so far…there hasn’t been much activity as prices have started to move higher. 🔈

That lack of interest is catching traders’ attention, who believe this week’s rally is the beginning of a new uptrend. Time will tell, as always. But we figured we’d point it out as an interesting, under-the-radar development in the volatile natural gas market. 👀

Bullets

Bullets From The Day:

🛢️ Oil and gas consolidation continues with a $4.9 billion deal. The Italian oil major Eni will buy London-based oil and gas company Neptune Energy for cash from several private equity firms. It’s the largest all-cash European energy merger in years as Europe races to achieve two trends that appear to be at odds: replacing lost Russian imports and reducing carbon emissions. Record profits over the last few years have left oil and gas companies with a lot of cash on hand, many putting it to work via M&A. Axios has more.

😬 Things are getting bad at India’s ed-tech giant, Byju. India’s corporate affairs ministry ordered an investigation into the firm, the same week it lost its auditor and three board members. The most valuable Indian startup’s corporate governance lapses have attracted the government’s attention, notably since it hasn’t filed audited financials for last year. The company is also cutting about 1,000 jobs as it pushes to improve its finances following its valuation being cut by two-thirds to $8.4 billion in March. More from TechCrunch.

🤝 Investors’ nerves soothed as GSK settles first Zantac cancer lawsuit. The company says it has settled a lawsuit alleging its discontinued heartburn drug Zantac caused cancer, preventing the first case of its type from going to trial next month. It instead reached a confidential settlement with a Californian resident who says he developed bladder cancer from the drug. However, it did not admit any liability or wrongdoing. Most of the remaining Zantac U.S. litigation involves 75,000 cases in the state court in Delaware, which will likely be heard in January. Yahoo Finance has more.

⚔️ Microsoft’s opening salvo vs. the FTC focused on competitor Sony. The tech giant’s lawyer Beth Wilkinson unveiled a bombshell email from Sony’s PlayStation chief Jim Ryan, revealing that he thought his company would be okay because Call of Duty would unlikely go exclusive. That email set the tone for the rest of the day, as the Federal Trade Commission’s (FTC) primary opposition to the Activision Blizzard acquisition was concerns about Microsoft making the company’s games exclusive to Xbox. Time will tell how this heated debate develops. More from The Verge.

💵 3M reaches record settlement over water systems contamination. The chemical manufacturer will pay at least $10.3 billion to settle lawsuits over the contamination of many U.S. public drinking water systems with potentially harmful compounds. These “forever chemicals” don’t degrade naturally in the environment and have been linked to various health issues like immune-system damage and cancer. The funds will cover the costs of testing and filtering out PFOA and PFOS from water systems as the company builds on its 2020 decision to phase them out. NPR has more.

Links

Links That Don’t Suck:

🧑⚖️ Supreme Court rules in favor of Coinbase

🏘️ Gen Z is snatching up houses in regional cities

🥤 Automakers have a cupholder problem, J.D. Power reports

🏦 VC giant Andreessen Horowitz expands into wealth management

🌬️ The US’s first commercial offshore wind farm just got its first foundation

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.