The Federal Reserve raised rates for the eleventh time this cycle via a unanimous decision, leaving the door open for another this year. Stocks were mixed, but the Dow managed to eke out its thirteenth straight day of gains. Let’s see what else you missed. 👀

Today’s issue covers rates hitting 22-year highs, Meta’s better-than-expected earnings, and Chipotle’s mixed quarterly results. 📰

Check out today’s heat map:

7 of 11 sectors closed green. Communication services (+1.56%) led, and technology (-1.34%) lagged. 💚

Chinese electric vehicle (EV) maker Xpeng soared 27% after announcing it will jointly develop two new VW-brand EVs for the Chinese market. Volkswagen is also investing $700 million in Xpeng for a 5% stake in the company. ⚡

Stellantis shares rose 4% after earnings. The automaker says Tesla is entering its area of expertise, where tight pricing, cost competitiveness, and operational issues pose significant challenges. 🔋

Shares of Dish Networks popped nearly 10% before fading into the red on news that it will begin selling mobile service on Amazon this week. Its first postpaid mobile service looks to compete with the three major carriers, starting at $25 monthly. 📱

Teladoc shares continued to squeeze after strength in its mental health business boosted second-quarter revenue above Wall Street expectations. Short squeezes continue in many beaten-down tech stocks as better-than-anticipated results continue to roll in. 🖥️

Wells Fargo jumped 2% after the bank announced a $30 billion share buyback program, joining its dividend increase of $0.05. The move comes despite analyst concerns that regulators will likely set higher bank capital requirements in response to the recent regional banking crisis. 🏦

And commercial real estate information, analytics, and news giant CoStar Group fell 8% after reporting weaker-than-expected revenues and issuing soft guidance for the current quarter. 🏢

Other symbols active on the streams included: $MSFT (-3.76%), $GOOGL (+5.78%), $SNAP (-14.23%), $ENVX (+3.05%), $WRNT (-21.16%), $ELWS (-6.94%), $SIMO (+25.19%), and $DOGE.X (-2.52%). 🔥

Here are the closing prices:

| S&P 500 | 4,567 | -0.02% |

| Nasdaq | 14,127 | -0.12% |

| Russell 2000 | 1,980 | +0.72% |

| Dow Jones | 35,520 | +0.23% |

Economy

Economy Stays On The Rails

As expected, the Federal Reserve followed through with its eleventh rate hike of the cycle, raising rates by 25 bps to a target range of 5.25%-5.50%. That’s the highest level in over 22 years, and Powell has left the door open for at least one more. ☝️

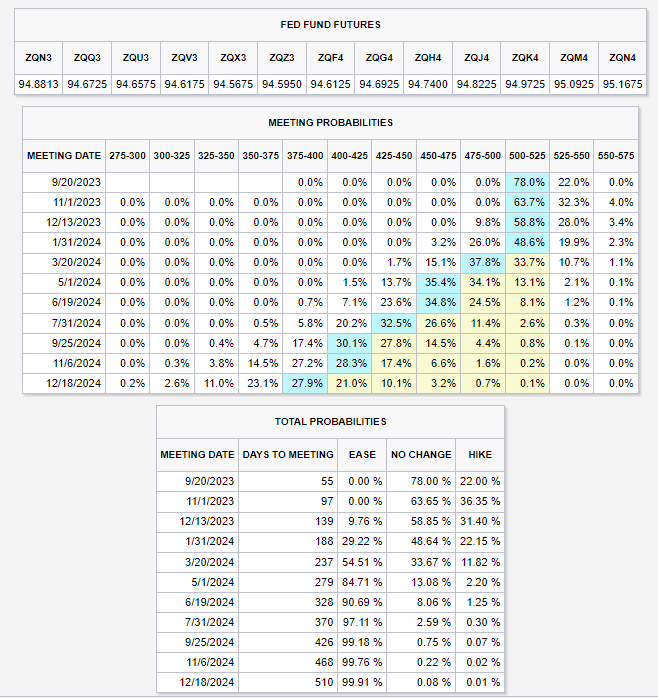

In its last update, the Fed said policymakers expect two more rate hikes this year, but the markets have been anticipating just one more hike this year. Today, Chairman Jerome Powell said that inflation has moderated, but there’s still a long way to go before hitting the 2% target.

More specifically, he said, “I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted. And I would also say it’s possible that we would choose to hold steady and we’re going to be making careful assessments, as I said, meeting by meeting.” 🔬

Given the mixed environment where inflation remains elevated, and the labor market is historically tight, the Fed doesn’t want to commit in either direction. Since the data is mixed, investors will be closely watching it until the Fed’s next meeting in September.

Currently, the bond market is pricing in about an 80% chance of keeping rates where they are and a 20% chance of raising another 25 bps. Overall, the market believes the Fed is behind the curve on inflation again and will not need to hike again by the end of the year. The majority of the Fed’s officials seem to think otherwise. 🤔

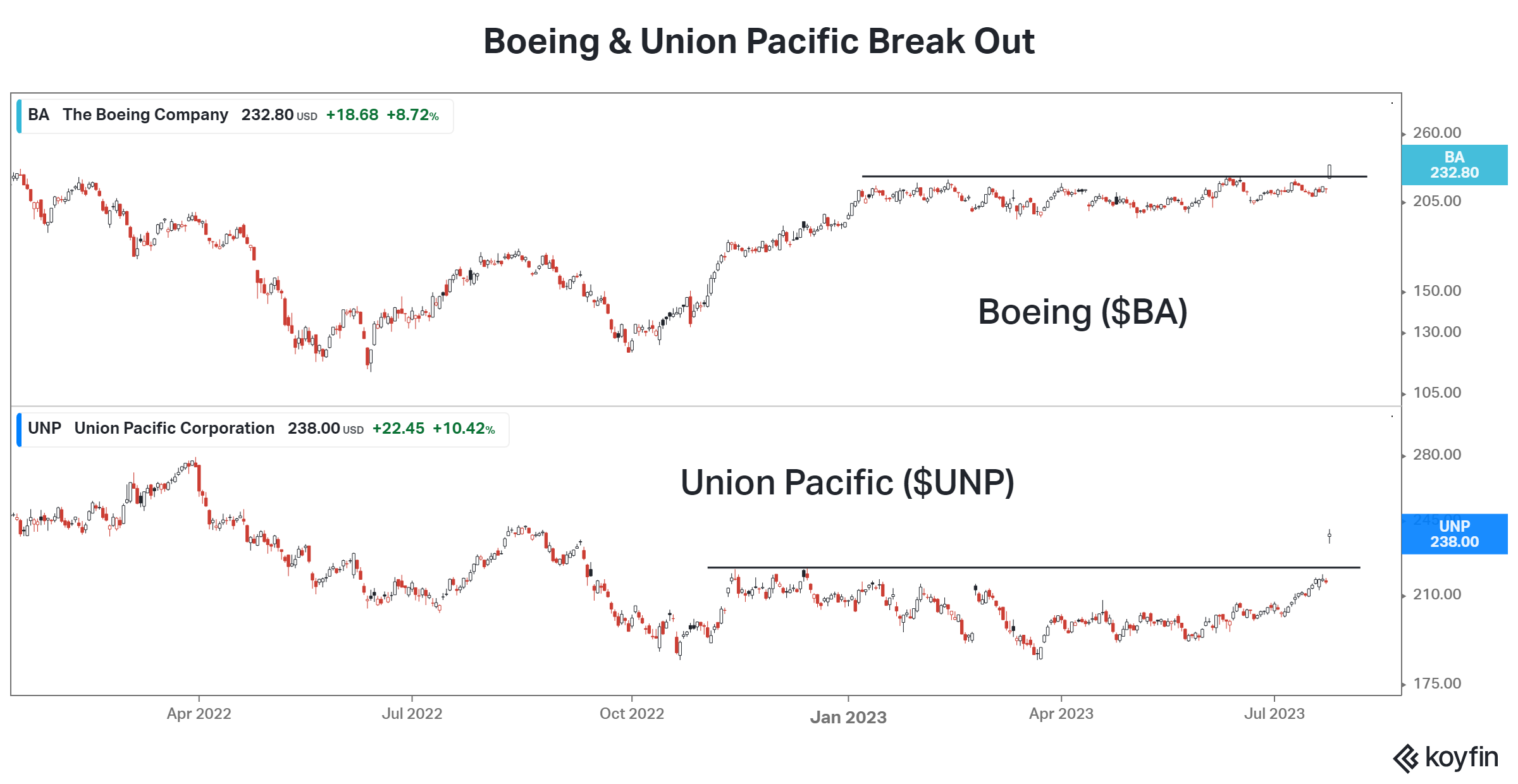

In the meantime, stocks continue to price in a “soft landing” where the economy continues to grow at a moderate pace and inflation comes down over time. We recently talked about the large-cap industrial sector ETF $XLI hitting new all-time highs. 📈

Well, the breakouts continued today, with Boeing and Union Pacific gapping higher following earnings. Bulls are taking to the rails and the skies to express their bullish thesis. They certainly wouldn’t be doing so if they believed the economy was going to collapse.

Overall, optimism continues to reign supreme despite the Fed’s best efforts to calm the markets and economy down. Until a big enough risk comes along to throw the bulls off track, the party looks like it will continue. Who’s next for limbo??? 🤷

Earnings

Meta’s Money Moves Continue

Meta shares are making new recovery highs after reporting better-than-expected results. CNBC has a breakdown: 👇

Investors are celebrating the first quarter of double-digit YoY revenue growth since the end of 2021. Its 11% growth is a stark turnaround from the three periods of revenue declines experienced last year. And looking ahead, the company expects revenues of $32 to $34.5 billion in the third quarter. The low end of that range represents 15% YoY growth. 💪

CEO Mark Zuckerberg touted the company’s exciting product pipeline, including Llama 2, Threads, Reels, Quest 3, and new AI products.

But big investments don’t come without a cost. Expenses rose 10% YoY to $22.61 billion. While the company has aggressively cut costs during its “year of efficiency,” headcount costs remain elevated. Total headcount fell 14% YoY, but only half of the 2023 layoffs are reflected in that number. And payroll expenses are expected to remain elevated as its workforce shifts toward higher-cost technical roles. 🤑

As for its Reality Labs unit, sales of $276 million paled in comparison to its $3.7 billion loss. Much of the company’s 2023 capital expenditures of $27 to $30 billion come from this unit, which is expected to remain a cost center through 2024 as Meta makes its vision a “reality.”

Investors are happy to see the digital advertising environment rebound more than anticipated. Clearly, Meta is positioned well to take advantage of this shift, with $META shares up another 6% after hours. Eventually, the “straight-line” ascent that began last October will end. But today was not that day. 📈

Earnings

Holy Guac Chipotle Shares Socked

Chipotle investors feel like they’ve received a bowl of guac without the chips to eat it with. That’s because its quarterly earnings beat expectations, but sales missed. That starkly contrasts the stock’s post-earnings gap that sent shares to all-time highs in May. 😬

Today the fast-casual restaurant chain reported $12.65 in adjusted earnings per share on $2.51 billion in revenues. Analysts had expected $12.31 and $2.53 billion in revenues. With that said, same-store sales of 7.4% were 0.1 percentage points shy of expectations. 🔻

As for restaurant-level operating margins rose from 25.2% one year ago to 27.5%. Lower avocado prices helped, but the company is still experiencing higher prices for other key ingredients. The company also said last quarter that it’s done raising prices, so margin expansion must come from cost reduction. 🔺

However, CEO Brian Niccol walked back those comments today, saying, “As we get closer to the fourth quarter, we’ll make a decision exactly on what we want to do on the pricing front.”

Executives say they’re focused on improving restaurant efficiency through training and equipment upgrades. Its goal is to serve more customers during peak times. Meanwhile, digital sales continue growing, accounting for 38% of the company’s food and beverage revenue. 📲

Looking ahead, Chipotle reiterated its full-year forecast for same-store sales growth in the mid-to-high-single-digit range. It does expect low-to-mid-single digits in the third quarter, though.

Expectations were high, with prices trading just below all-time highs ahead of the release. Unfortunately for investors, the revenue and same-store sales miss was enough to cause a selloff. $CMG shares are currently down 9% to three-month lows. 👎

Bullets

Bullets From The Day:

🤔 Can the Barbie turnaround mastermind help retailer Gap reinvent itself? Retailer Gap has tapped the Mattel executive who led the Barbie franchise revival as its new CEO following a one-year search. Richard Dickinson will be tasked with leveraging Gap’s portfolio of iconic brands and evolving the company for a new era. Whether or not he can successfully right-size the business and regain market share remains to be seen, but $GPS shares rose 8% on the day. CNBC has more.

📝 U.S. SEC adopts new cybersecurity rules. The Securities and Exchange Commission (SEC) adopted new rules that require publicly traded companies to disclose hacking incidents. In a 3-2 vote, the new law passed and will require companies to disclose a cyber breach within four days after determining it is serious enough to be material to investors. They’ll also be required to periodically describe their efforts to identify and manage threats in cyberspace. More from Reuters.

💰 CrowdStrike is reportedly close to acquiring Bionic.AI. According to sources, the cybersecurity company is in advanced negotiations to purchase cloud services’ security posture management platform. The startup has raised $82 million and will likely be acquired for roughly $200 to $300 million. The acquisition would give Bionic an advanced level of observability to complement its focus on endpoint security. TechCrunch has more.

🔌 Several U.S. automakers team up to create an EV charging network. General Motors, BMW, Honda, Hyundai, Kia, Mercedes, and Stellantis will invest several million dollars to build “high power” charging stations with at least 30,000 plugs by 2030. While many have already adopted Tesla’s NACS charging standard, this move is intended to speed up the adoption of electric vehicles, especially for long-distance travel. Investments have yet to be disclosed, but the first of its U.S. chargers will be ready by next summer. More from AP News.

🔺 Several factors are pushing up commodity prices. Prices of gasoline have slowly been creeping higher, with the national average for a gallon rising to a three-month high of $3.69 this week. Additionally, the war in Ukraine and heat waves in the U.S. are placing upward pressure across the commodity complex, particularly in agriculture. While the market has all but declared inflation finished, a resurgence in commodity prices would be a headwind for the Fed to get inflation down to its 2% target. CNN Business has more.

Links

Links That Don’t Suck:

💳 You can now use Venmo to pay for new Xbox games

🚫 Senate imposes new rules on outbound investments into China

🎫 When is Mega Millions’ next drawing? Lottery jackpot approaching $1 billion

⚠️ The risks are rising for Western firms in Russia. So why are so many staying put?

😮 Elon Musk and company take @x handle from its original user. He got zero dollars for it.