Welcome to the Stocktwits Top 25 Newsletter for Week 30 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 30:

P.S. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

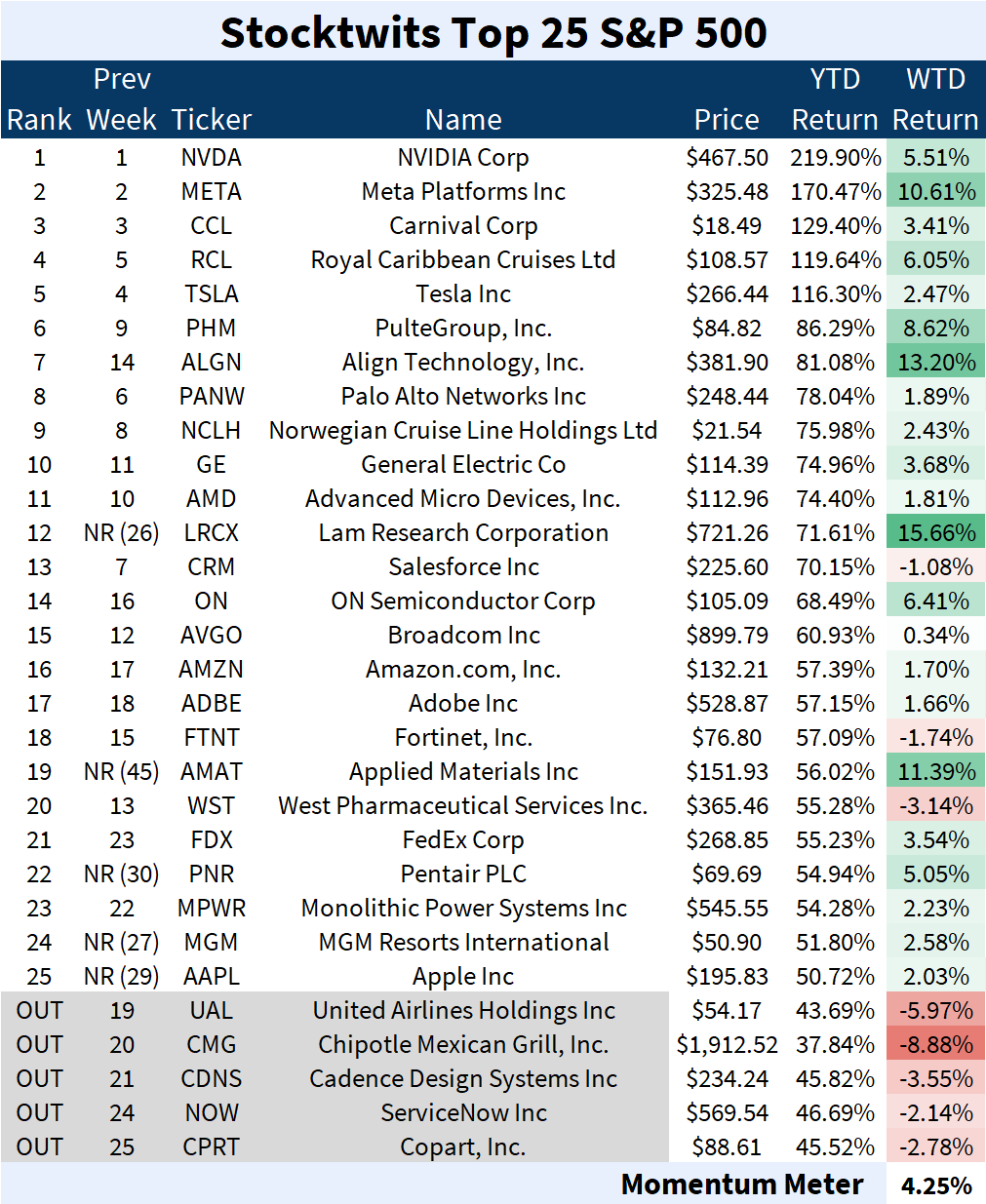

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+4.25%) outperformed the S&P 500 index (+1.01%).

There were five major changes to the list this week.

Joining: Lam Research (+15.66%), Applied Materials (+11.39%), Pentair PLC (+5.05%), MGM Resorts (+2.58%), and Apple (+2.03%).

Leaving: United Airlines (-5.97%), Chipotle Mexican Grill (-8.88%), Cadence Design Systems (-3.55%), ServiceNow (-2.14%), and Copart, Inc. (-2.78%).

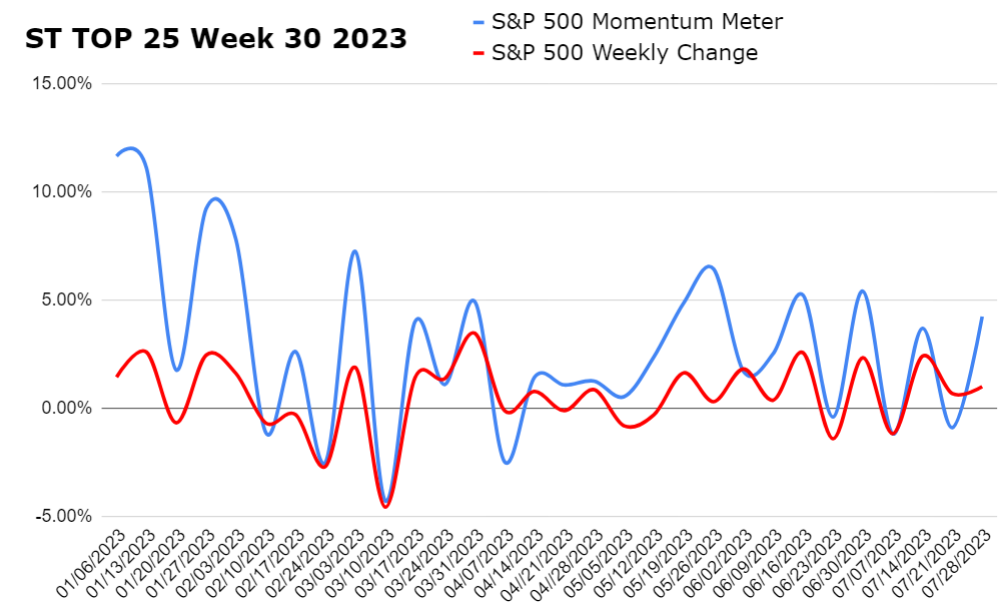

Check out how the momentum meter has performed vs. the S&P 500 index this year:

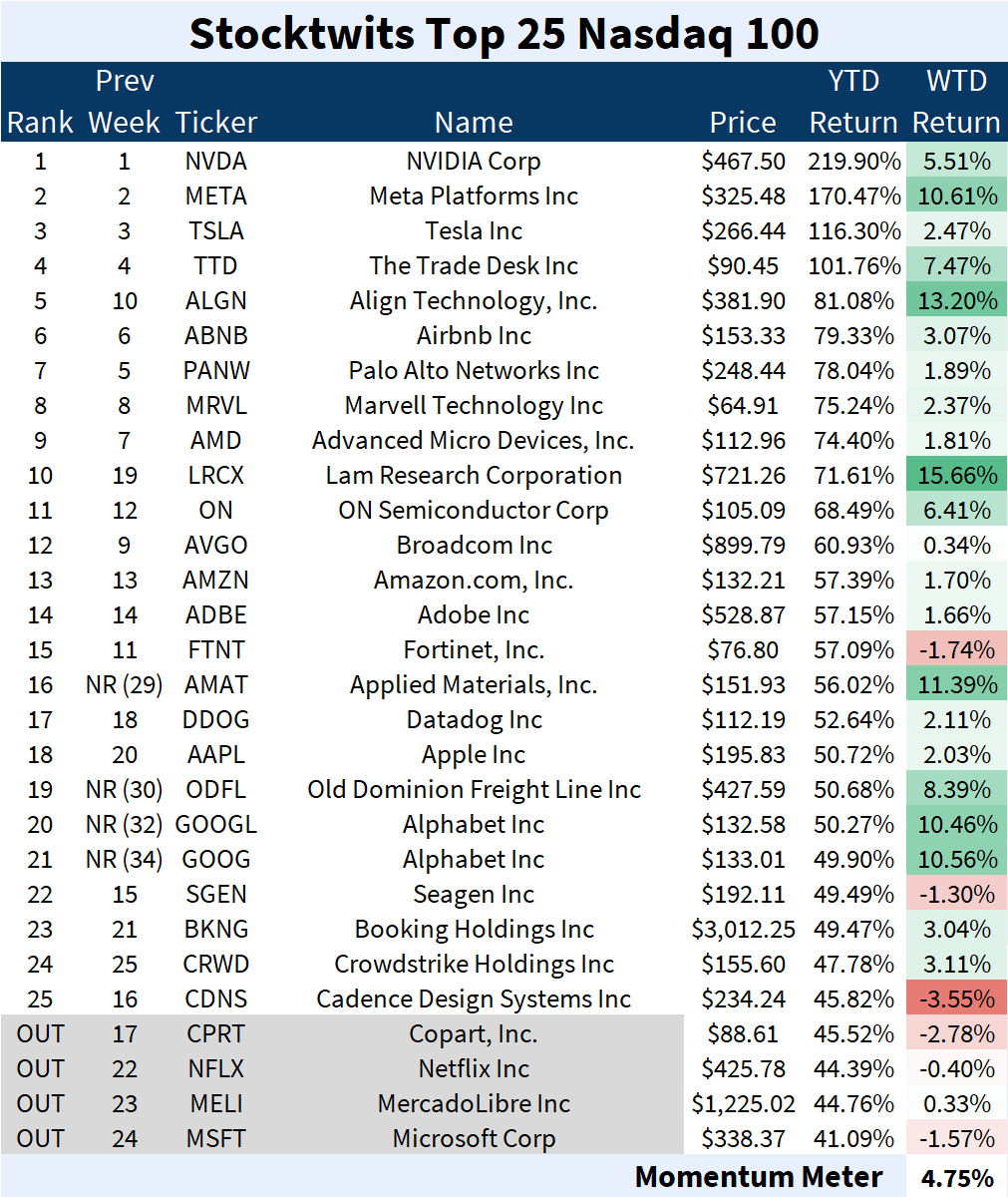

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+4.75%) outperformed the Nasdaq 100 index (+2.11%).

There were four major changes to the list this week.

Joining: Applied Materials (+11.39%), Old Dominion Freight Line (+8.39%), and Alphabet Class A & C Shares (+10.46%).

Leaving: Copart, Inc. (-2.78%), Netflix (-0.40%), MercadoLibre (+0.33%), and Microsoft (-1.57%).

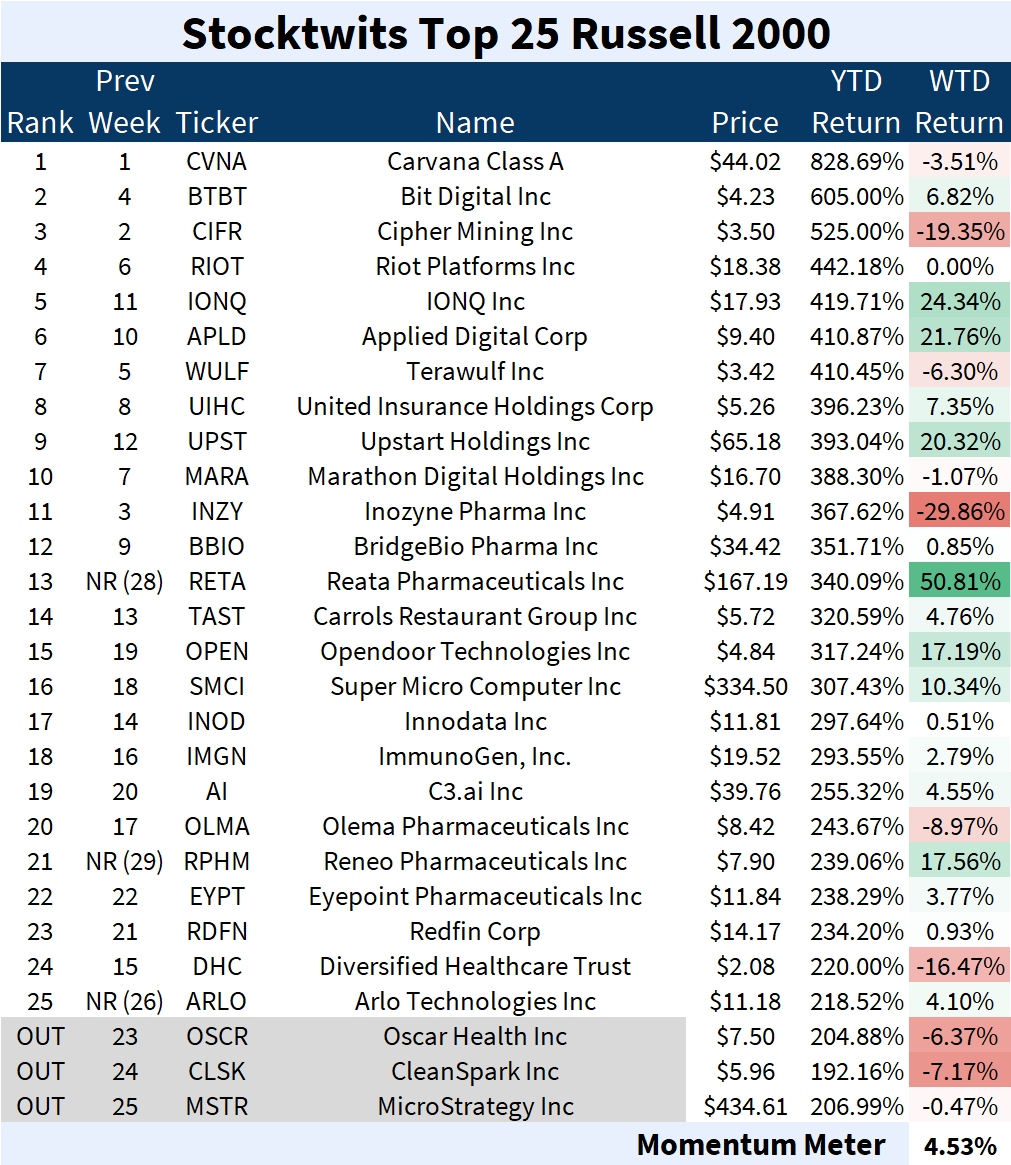

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+4.53%) outperformed the Russell 2000 index (+1.09%).

There were three major changes to the list this week.

Joining: Reata Pharmaceuticals (+50.81%), Reneo Pharmaceuticals (+17.56%), and Arlo Technologies (+4.10%).

Leaving: Oscar Health (-6.37%), CleanSpark (-7.17%), and MicroStrategy (-0.47%).

🐶🐶🐶

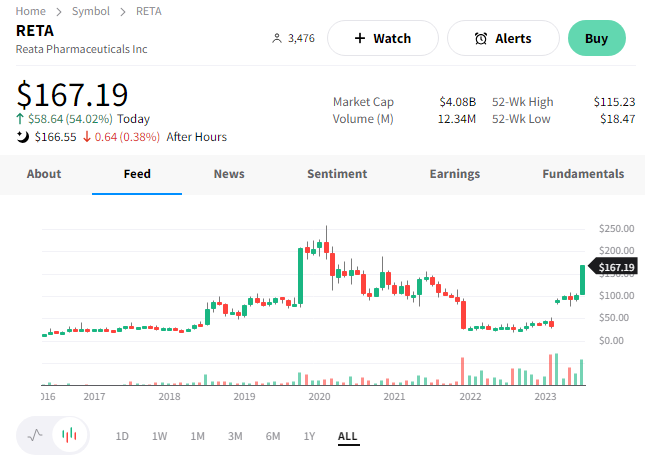

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Reata Pharmaceuticals, which rallied 50.81%. 📈

The rare disease drugmaker soared this week after receiving a $6.5 billion acquisition offer from Biogen, who is banking on the launch of a new Alzheimer’s drug Leqembi to drive growth. Biogen’s infrastructure should speed up the launch and help drive annual sales to $1.3 billion by ’29. 💉

The deal is for $172.50 per share in cash, but including debt, values Reata at ~$7.3 billion. 🔺

$RETA is up 340.09% YTD.

See Y’all Next Week 🤙