It was another mixed day in the market, with retail stocks coming under pressure after rising shrinkage (aka theft) weighed on quarterly results. Let’s see what else you missed. 👀

Today’s issue covers retailer earnings wreckage, Charles Schwab’s restructuring plans, and a mixed day for several retail investor favorites. 📰

Check out today’s heat map:

4 of 11 sectors closed green. Real estate (+0.31%) led, and financials (-0.93%) lagged. 💚

U.S. existing home sales fell 2.2% in July to a six-month low, but low inventory pushed prices of the median home sold up 1.9% YoY to $406,700. Mortgage rates and inventory availability are the key factors driving housing market activity. 🏘️

Richmond Fed manufacturing activity stayed in negative territory for the sixteenth consecutive month in August. Overall manufacturing activity is off its recent lows but remains near historically weak levels. Meanwhile, the Fed continues to mull the idea of changing its inflation target to adapt to a new environment. 🏭

Microsoft submitted a newer version of its Activision bid in an attempt to win U.K. regulator approval, sending the video game maker’s shares marginally higher. 📝

Shares of Novavax continued to rebound after the drugmaker said its new Covid vaccine is effective against the most recent Eris variant. 💉

Icahn Enterprises shares printed a new 52-week closing low as the activist investment firm continues to address short-seller concerns. 📉

Other symbols active on the streams: $LOW (+3.75%), $BJ (-5.13%), $BIDU (+2.75%), $NVOS (+7.49%), $SOS (-31.06%), $TTOO (-8.64%), $MULN (-23.36%), $HKD (+27.40%), & $FULC (+38.52%). 🔥

Here are the closing prices:

| S&P 500 | 4,388 | -0.28% |

| Nasdaq | 13,506 | +0.06% |

| Russell 2000 | 1,851 | -0.28% |

| Dow Jones | 34,289 | -0.51% |

Earnings

This Week’s Retailer Wreck

It was a rough day for shares of several popular retailers, including Dick’s Sporting Goods and Macy’s. Let’s take a look at why. 👇

Starting with Dick’s Sporting Goods, the company reported adjusted earnings per share of $2.82 on revenues of $3.22 billion. Both figures were below the $3.81 and $3.24 billion expected. Gross margins of 34% were also below the 36% consensus estimate.

The company blamed its first earnings miss in three years on an uptick in retail theft (shrinkage) and significant discounts in its outdoor category as it looks to reduce inventory. And unfortunately, executives believe their shrink problem will worsen before it gets better. ⚠️

CEO Lauren Hobart told analysts, “Organized retail crime and theft in general is an increasingly serious issue impacting many retailers. Based on the results from our most recent physical inventory cycle, the impact of theft on our shrink was meaningful to both our Q2 results and our go forward expectations for the balance of the year…”

As a result, they now expect earnings per share of $11.33 to $12.13, down from previous guidance of $12.90 to $13.80. $DKS shares fell nearly 25% to fresh year-to-date lows on the news. 📉

Traditional department-store chain Macy’s also came under pressure today after its second-quarter results disappointed. 👎

Sales of $5.13 billion were down 8% YoY but topped estimates. Its same-store sales fell 8.2%, although a 10% decline in digital sales surprised investors. And adjusted earnings per share of $0.26 topped estimates of $0.14 as the company rationalizes costs. 🔺

Overall, executives remain cautious about the consumer due to an uncertain economic environment and discretionary spending on services over goods. Also, the higher-end consumer continues to hold up better than the low-to-middle-income one. That’s evidenced by a smaller revenue decline at Bloomingdale’s compared to its flagship Macy’s brand. 🛒

It remains an expectations game for the company, which is why it reaffirmed the same guidance it reduced earlier this summer.

For now, investors are still cautious about the stock, with $M shares falling 14% to 2.5-year lows. 🔻

Meanwhile, shares of Nike posted their ninth straight day of losses, marking their longest losing streak ever. It remains a rough environment for many retailers and related industries despite overall U.S. consumer spending holding up better than many expected. Time will tell if these stocks can stage a turnaround. 🤷

Company News

Schwab Raises Debt To Restructure

Financial services company Charles Schwab is back under pressure today after announcing a significant restructuring. Like other stocks caught up in the “regional banking crisis” earlier this year, it has not fully recovered its decline and is now resuming lower. 📉

Yesterday it announced plans to shutter or downsize some real estate holdings and cut employee headcount to save at least $500 million annually. It’s also issuing 11-year debt at roughly 2% above Treasuries for “general corporate purposes,” as it’s estimating $400 to $500 million in restructuring costs in the year ahead.

Investors remain concerned that competition from higher-yielding products is stealing deposits from Schwab and its competitors. Additionally, the firm reported lower net flows of client money as it integrated TD Ameritrade into its business. 💸

It’s not the only financial services giant to issue debt recently, as Bank of America, Goldman Sachs, Huntington Bancshares, and others have tapped the bond market recently. The entire sector remains under pressure for a variety of reasons. For example, today, S&P Global joined Moody’s in cutting several regional lenders’ credit ratings due to high commercial real estate (CRE) exposure. 🔻

$SCHW shares fell another 5% and are down about 20% over the past month as investors reassess the company’s overall financial health. 🕵️♂️

Company News

Retail Favorites’ Mixed Day

It was a mixed day for several of retail investors’ favorite stocks. Let’s see what’s moving. 👀

First up is Canadian Solar, which reported mixed second-quarter results and reaffirmed its full-year 2023 outlook. However, its third-quarter revenue forecast of $1.9 to $2.1 billion lagged the $2.5 billion consensus estimate. $CSIQ shares fell 13% as the solar industry remains under pressure. 🌩️

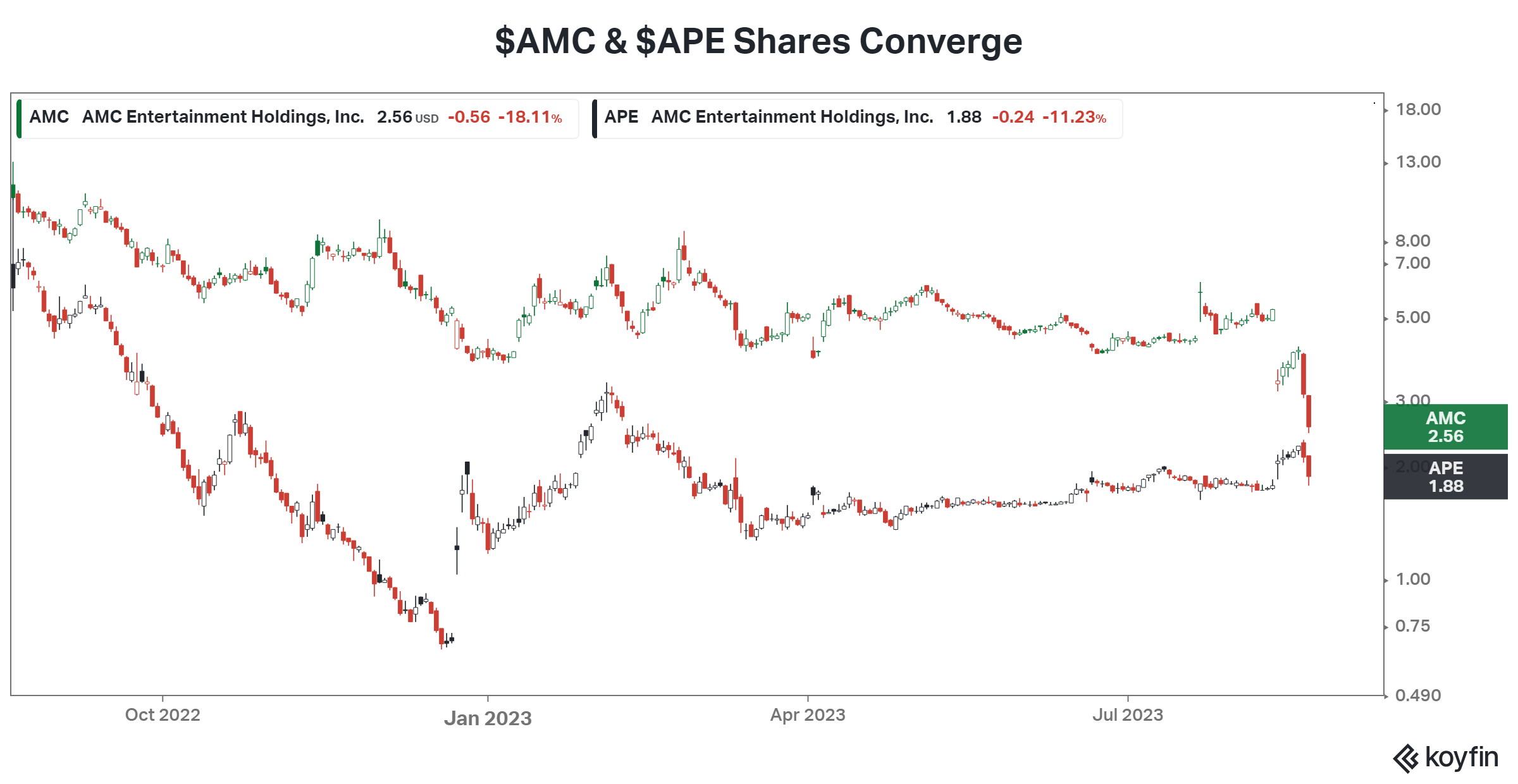

$AMC and $APE shares continued to fall ahead of this week’s corporate events.

On Thursday, AMC common shares will undergo a 10-for-1 reverse stock split, and on Friday, the company’s APE units will be converted to common shares. Many investors had anticipated the gap in share price would’ve closed by APE units rising, but instead, AMC shares are falling to reflect the impact of their coming dilution. 📊

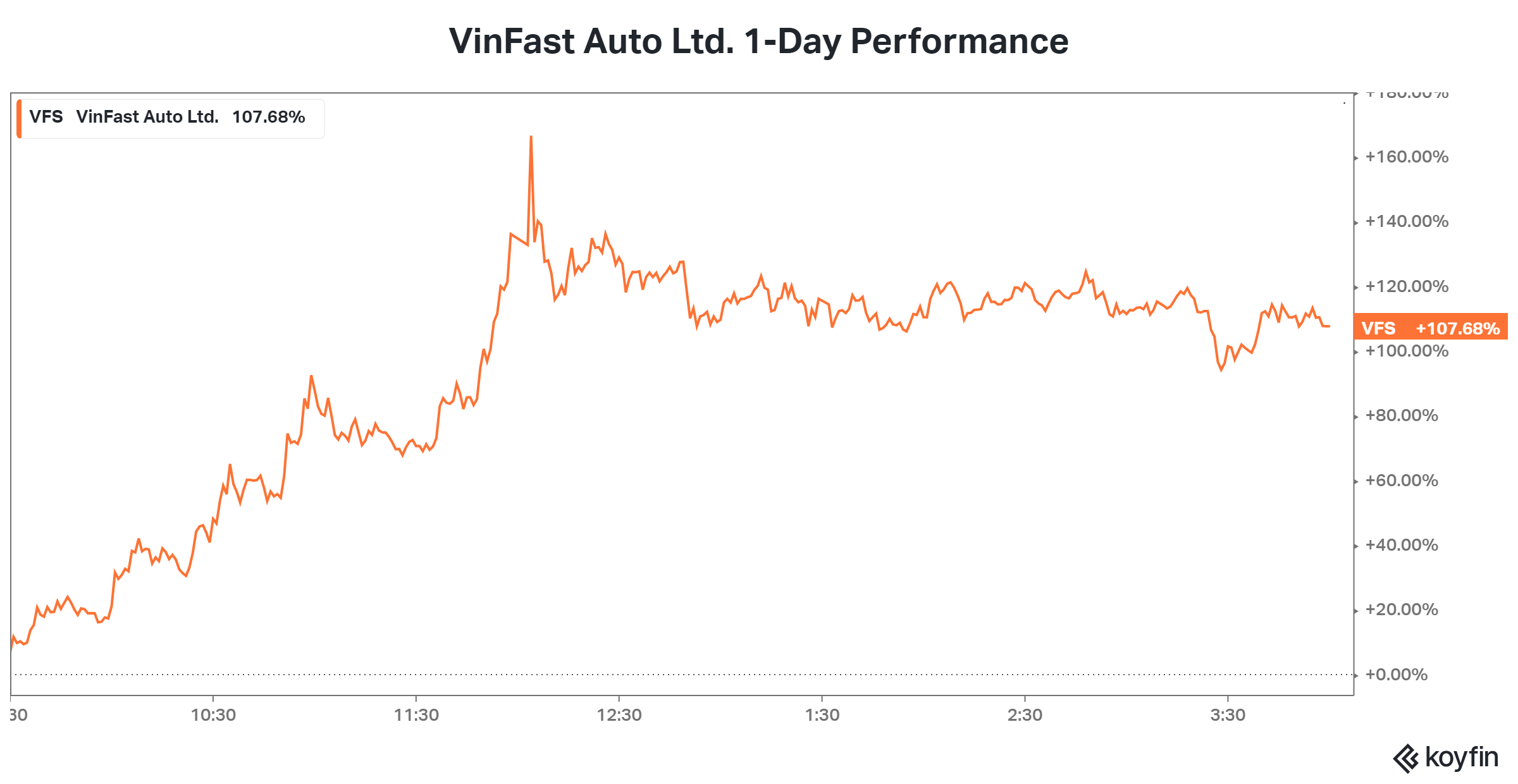

And lastly, Vietnamese electric vehicle maker VinFast’s wild ride continues, with the stock rising more than 100% today. The surge in price brings its market cap back above $84 billion, making it larger than General Motors, Ford, and China’s BYD.

Time will tell if the company’s underlying fundamentals can grow into that valuation, but for now, the stock remains volatile as the “price discovery” process continues. 🤷

Bullets

Bullets From The Day:

🪙 Coinbase takes stake in stablecoin firm Circle. The U.S. cryptocurrency exchange acquired a stake in the issuer of the USDC stablecoin, Circle. The two companies will shutter their joint venture, Centre Consortium, a private governance organization for USDC, as there’s far more regulatory clarity today than when it started in 2018. In addition to this news, Circle plans to launch USDC on six new blockchains between September and October, bringing its total to 15. CNBC has more.

⚔️ What role the labor union plays in the U.S. Steel bidding war? U.S. Steel has recently been back in the limelight, with several suitors looking to acquire the company. However, the company will have to satisfy the steelworkers union as it explores strategic options because, under its current contract, the United Steelworkers (USW) union has a right to bid for the company if it’s up for sale. But instead, it transferred its rights to Cleveland-Cliffs, whose workers are also represented by USW. More from Axios.

😮 Could a payroll revision cause half a million U.S. jobs to vanish? Despite estimates that Wednesday’s government preliminary benchmark revision will impact 500,000 jobs from growth through March 2023, average job growth would still be strong at 300,000 per month. Last year’s government’s employment reports consistently surprised economists to the upside. New samples and data now suggest those numbers were overstated but not enough to diminish the strength of the overall labor market. Yahoo Finance has more.

📊 Finance’s favorite tool is getting an upgrade soon. Microsoft announced the public preview of Python in Excel, allowing advanced spreadsheet users to combine scripts in the popular coding language and their usual Excel formulas in the same workbook. No setup or installation is required, with Excel’s built-in connectors and Power Query allowing users to bring external data into Python using the software. The feature was developed with the data science platform Anaconda and is currently being rolled out to beta users. More from TechCrunch.

🖥️ Meta’s Threads app rolls out web functionality. The company’s X competitor is slowly releasing a web version of the platform, where users can post, interact with others’ posts, and look at their feeds. It comes as the company looks to quickly add users’ most-requested features, if even in a bare-bones manner. With Threads usage plunging from its post-release highs, Meta hopes this additional functionality can help lure users back to the platform. The Verge has more.

Links

Links That Don’t Suck:

📈 Find top stocks using a 3-step system—book a free 30-minute showcase with MarketSmith by IBD!*

📰 X tests removing headlines from links to news articles

🥪 Subway nears $9.6 bln sale to Arby’s owner Roark – WSJ

🦺 US FAA holding runway safety meetings after close call incidents

🤖 Clerical workers most likely to suffer job losses from generative AI: study

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.