Between cramming five days of work into four and the stock market having another red week, the weekend is a welcome sight for investors. Let’s see what you missed. 👀

Today’s issue covers sellers hooking a certain retailer again, a sizeable dent in $RENT shares, and another chip off Block’s share price. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Energy (+0.97%) led, and real estate (-0.62%) lagged. 💚

U.S. wholesale inventories fell in July, and sales jumped, bringing the inventories-to-sales ratio to its lowest level since February. Meanwhile, consumer credit increased at a seasonally adjusted annual rate of 2.5%. 🔺

European gas prices rose sharply as workers prepared to strike at the Gorgon and Wheatstone projects in Western Australia, as talks between Chevron and the unions broke down. ⛽

Automakers rebounded on hopes that a United Auto Workers (UAW) strike could be avoided, with Ford, Stellantis, and GM putting forth new offers ahead of next Thursday’s midnight deadline. 📝

Other symbols active on the streams: $TTOO (-11.49%), $MULN (-1.29%), $AXLA (+70.67%), $EZGO (+23.76%), $NVOS (-5.81%), $GNS (+14.29%), $SWIN (-19.24%), and $MARA (-11.73%). 🔥

Here are the closing prices:

| S&P 500 | 4,457 | +0.14% |

| Nasdaq | 13,762 | +0.09% |

| Russell 2000 | 1,852 | -0.23% |

| Dow Jones | 34,577 | +0.22% |

Company News

Another Chip Off The Ol’ Block

Last month, we discussed pain in payments land with Dutch payments processor Adyen NV and U.S.-based PayPal treading water. 💳

Today, the focus was on Jack Dorsey’s Block, previously known as Square, after its Square and Cash App services were reportedly down throughout Thursday. Its news sent shares of $SQ lower by about 5% as they continue to trade at a key technical level. 📉

Technical analysts have highlighted the 50-60 price level as a major area of demand over the last six years, which is why it’s on investors’ and traders’ radars. Either the stock will find some support here and turn itself around. Or it breaks to fresh lows and continues its downtrend. 👀

Time will tell where it ends up, but the selling pressure on these stocks continues for now.

Earnings

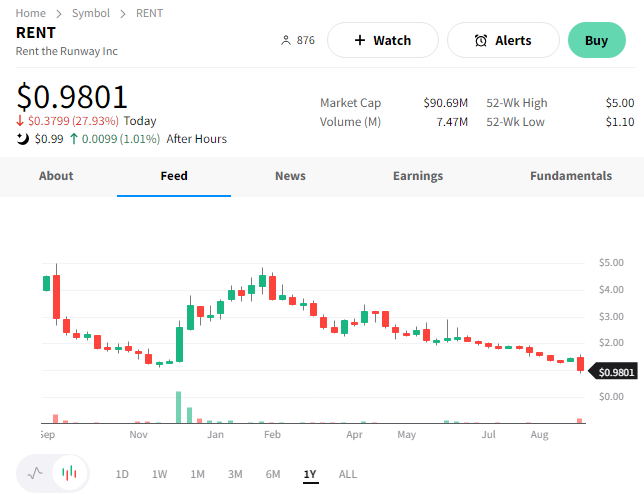

$RENT Gets Another Dent

Investors in subscription fashion service Rent The Runway probably wish they rented shares instead of buying them. That’s because shares fell to fresh all-time lows after another weak quarter. 🙃

Its second-quarter loss per share of $0.40 matched analysts expectations. Meanwhile, a 1% YoY revenue decline to $75.7 million missed the $78.1 million expected.

Ending active subscribers jumped 11% YoY to 137,566, total subscribers rose 6% YoY to 184,400, and gross margin improved by 150 bps YoY to 43.9%. 🔺

With demand remaining weak, the company continues to focus on operating efficiencies, inventory control, and improving its site and onboarding experience.

As a result, executives expect fiscal 2023 revenues to be flat YoY at $296.4 million, adjusted EBITDA margin of 7% to 8%, and free cash flow of negative $50 to $53 million. 🔮

$RENT shares fell 28% to their lowest level as a public company. 👎

Earnings

Sellers Hooked This Retailer Again

Home furnishing retailers across the spectrum have struggled in the current environment. We’ve heard from Big Lots at the low end and RH at the high end, both experiencing weakness due to inflation and housing market activity grinding to a halt. 🐌

Today sellers got their hooks into another retailer, Hooker Furnishings Corp., which reported weak second-quarter results.

The company’s adjusted earnings per share of $0.07 on revenues of $97.8 million fell short of the $0.18 and $127.2 million expected by analysts. That represents a 36% Yoy revenue decline, which executives don’t see improving much. ⚠️

CEO Jeremy Hoff said, “We believe the softer demand seen currently industry-wide is driven by retailers continuing to sell through over-inventoried positions and a short-term glut of heavily discounted home furnishings in the market…”

An inventory glut and weak demand mean a lot of discounting to attract customers, weighing on revenues and margins. Even if the industry clears its excess inventory, demand is expected to remain tepid due to inflation-strapped consumers cutting spending and stagnant housing activity.

$HOFT shares fell 17%, marking their worst one-day decline since June 2019. 📉

Bullets

Bullets From The Day:

✂️ Walmart begins cutting pay for certain new hires as pandemic-era hiring frenzy cools. Economists and analysts look at the nation’s largest private employer for clues about labor market conditions. After a hiring spree and raising wages throughout the pandemic to keep up with demand, the company is now cutting starting pay for new hires who prepare online orders and stock shelves. It’s a sign of both cooling demand and a gradual slowdown in the labor market. We’ll see if its competitors follow suit. CNBC has more.

💊 Kroger settles opioid lawsuits, eyes store divestment to close Albertsons deal. The grocer took a roughly $1.4 billion charge in its recent quarter, accounting for $1.2 billion in opioid case settlements and another $200 million in legal fees. Now, the company is looking to sell more than 400 grocery stores to C&S Wholesale Grocers to satisfy regulators’ anti-trust concerns over its nearly $25 billion takeover of rival Albertsons. As for its recent quarter, same-store sales continue to wane as consumers focus on essentials. More from Reuters.

🕵️ Modern cars have “unmatched power” to spy on you. While many Americans view their car as a safe haven, a new report from the Mozilla Foundation highlights new cars are essentially computers on wheels. As a result, they have an unmatched power to watch, listen, and collect information on what you do and where you go. With today’s vehicles generating about 25 GB of data per hour, consumers’ privacy and billions of dollars worth of information is at stake. Axios has more.

👨💼 Big shakeup at Flexport as founder retakes the helm. Ryan Peterson has returned to run the logistics company he founded, replacing Dave Clark, his handpicked CEO, after just a year in the role. He’s quickly making changes, rescinding offset letters of prospective employees days before they were slated to begin and looking to lease out unused office space across the U.S. as he “gets the company’s house in order.” Needless to say, the very public breakup and criticism have drawn a lot of attention from stakeholders and onlookers alike. More from CNBC.

🔍 SEC probes Ryan Cohen’s Bed Bath & Beyond trading activity. The U.S. Securities and Exchange Commission (SEC) is looking into the billionaire’s ownership and surprise sale of his Bed Bath & Beyond shares at the height of its hope-fueled rally. The regulator has requested information about his trades and communications with officers or directors at the home goods retailer. It raises questions about Cohen’s motives in the stocks he purchases, especially as he serves as the current chairman of another “meme stock,” GameStop. Reuters has more.

Links

Links That Don’t Suck:

📈 Start your FREE trial of Benzinga Pro today for fast news before major stock price spikes!*

🏢 Norway’s $1.4 trillion investment fund is shutting its China office

😮 Grindr loses half its workforce over 2-day return-to-office mandate

🏦 Senate confirms Federal Reserve’s first Latina governor in its 109-year history

💰 Former FTX exec Salame to forfeit $1.5 billion, pleads guilty to two criminal counts

🤔 South Korea’s Hynix is looking into how its chips got into Huawei’s controversial smartphone

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.