Global payments is a very competitive space that boomed during the pandemic but has cooled off significantly since. 🥶

Today’s victim is Dutch payments processor Adyen NV, which fell nearly 40%, erasing roughly $15 billion off its market capitalization. Driving the move was a first-half earnings miss after it experienced weaker-than-expected sales growth and higher costs. With today’s plunge, shares are down about 70% from their 2021 peak. 📉

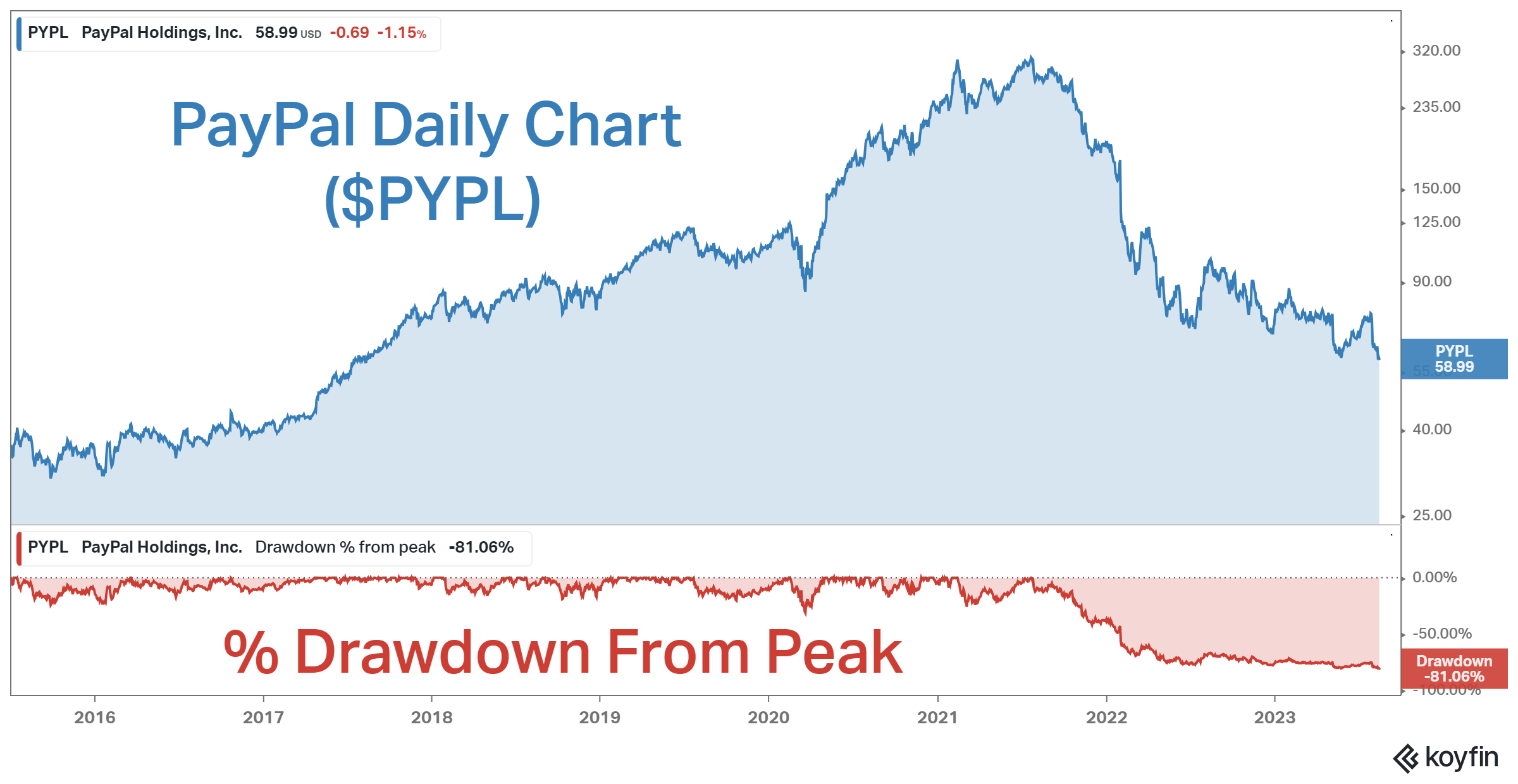

Growth stocks are fun to own when they’re still growing but not so much when their progress slows. Just ask PayPal, which is currently sitting in an 80% drawdown and hitting fresh lows daily. 😬

While some stocks in the sector, like Fiserv, have managed to hold up well in the current environment, most have not. Fears of the global economy slowing down or reaching “peak optimism” and unclear high-margin growth strategies have investors looking for opportunities outside the payments space. 🕵️♂️

It’s unclear what it will take for investors to dip their toes back into the beaten-down sector. But as of today, the tide continues to roll outward in these stocks. As always, we’ll watch in the months ahead to see if that changes and be sure to follow up on this trend. 💳