Strength in Tesla, Amazon, Meta, and several other tech giants helped move the major indexes from a mixed start to a strong close. Let’s see what else you missed. 👀

Today’s issue covers artificial intelligence (AI) driving Tesla gains, Disney and Charter bringing football back, and more from the day. 📰

Before continuing, we want to take a moment to honor the victims, heroes, and all those impacted by the tragic events of September 11, 2001. We will never forget. 🇺🇸

Here’s today’s heat map:

10 of 11 sectors closed green. Consumer discretionary (+2.70%) led, and energy (-1.25%) lagged. 💚

JPMorgan Chase CEO Jamie Dimon remains cautious about the U.S. economy, saying that although it is doing well, it would be a “huge mistake” to believe that it will last for years, given current risks. He acknowledges the consumer remains strong, but it’s not enough to keep the economy booming. ⚠️

It’s a busy week for initial public offerings (IPO), with chip designer Arm and grocery delivery firm Instacart pricing their shares and set to test investors’ appetite. Despite the recent public market rebound, valuations remain well below their private market peaks. 💰

Raytheon plummeted 8% on news it will take a $3 billion pretax hit to its quarterly earnings due to the Pratt & Whitney engine problem it disclosed in July. Meanwhile, Boeing could not gain altitude despite announcing an $8 billion 737 MAX deal with Vietnam Air. 🛬

It was a big day for mergers and acquisitions, with J.M. Smucker agreeing to buy Twinkies maker Hostess Brands for $5.6 billion. Meanwhile, Spirit Airlines rose 12% on news that JetBlue will divest some assets to overcome antitrust concerns and close its deal to buy the company. 🤝

Oracle shares fell 5% after its earnings beat, but revenue fell short of analyst expectations. Its cloud license and on-premises license segment drove the weakness, but the company touted AI’s potential to juice future results. 🌦️

And shares of BlackBerry soared 15% after launching an ‘intrinsically safe’ certified solution for hazardous materials carriers. ☣️

Other symbols active on the streams: $TTOO (-14.11%), $MULN (+5.77%), $SLE (+89.84%), $CRNX (+63.31%), $NVOS (+36.82%), $CGC (+81.73%), $ACB (+72.17%), and $SGMA (-47.70%). 🔥

Here are the closing prices:

| S&P 500 | 4,487 | +0.67% |

| Nasdaq | 13,918 | +1.14% |

| Russell 2000 | 1,855 | +0.19% |

| Dow Jones | 34,664 | +0.25% |

Company News

AI Adds To Tesla’s Gains

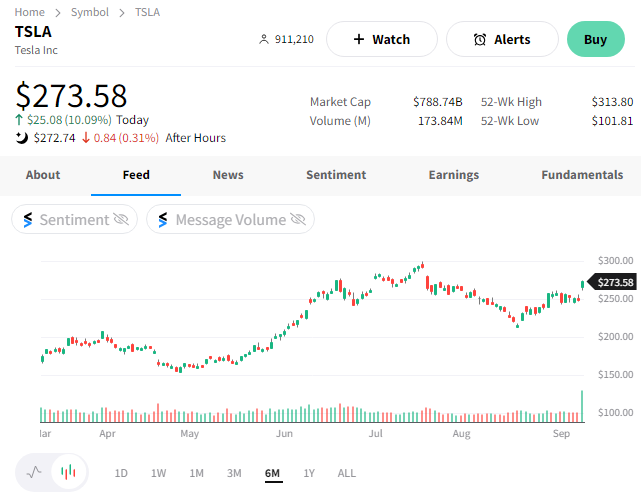

Technology stocks, specifically those in the consumer discretionary sector, drove the market higher today. And leading the pack was electric vehicle maker Tesla.

The world’s most valuable automaker received a boost after Morgan Stanley’s Adam Jonas said the company’s Dojo supercomputer could drive $600 billion in market cap gains. 🤑

So, what is Dojo? It’s the supercomputer Tesla began producing in July to train artificial intelligence (AI) models for self-driving cars, and plans to invest over $1 billion per year into it.

Along with the note, Morgan Stanley upgraded the stock from equal-weight to overweight and raised its 12-18-month price target by 60% to $400, making it the highest on Wall Street.

The overall thesis is that this technology can help speed up Tesla’s push into robotaxis and software services, where most analysts expect its high-margin growth to come from eventually. However, these estimates from Morgan Stanley would require Dojo to do a lot of heavy lifting… 🏋️

For example, Adam Jonas raised his revenue estimate for Tesla’s network services business from $157 billion to $335 billion by 2040. That’s a 113% jump based primarily on the success of one project with about $1 billion in current funding. 😮

Many skeptics highlighted the leap of faith this forecast requires. They also pointed to Morgan Stanley’s lackluster coverage of Tesla in the past, with its analyst team seemingly behind the curve at every major inflection point.

However, $TSLA shares rode the optimism higher, rising 10% on the day and dragging the market higher with it. ⚡

Company News

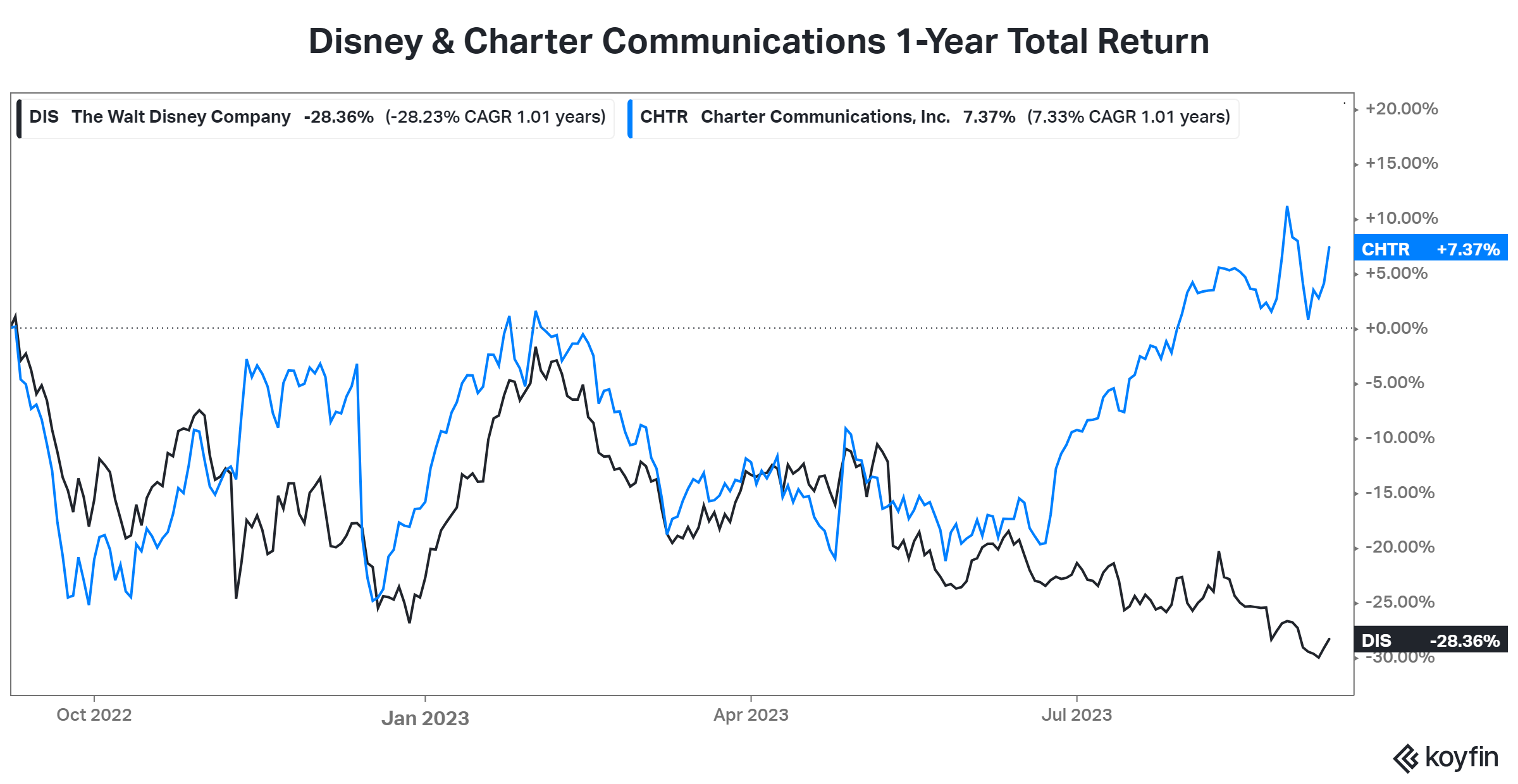

Disney & Charter Come Back Online

After a roughly ten-day cable blackout, Charter Communications and Disney put aside their differences to bring football back to fifteen million households nationwide. 🏈

The deal’s terms can be summarized as:

- Charter will pay Disney higher rates to carry its TV channels

- Ad-supported Disney+ will be available to Spectrum TV select subscribers

- Ad-supported ESPN+ will be available to Spectrum pay-TV subscribers

- Charter pay-TV subscribers will also receive Disney’s direct-co-consumer (DTC) ESPN version

The central sticking point was around the streaming services, which Charter wanted to be included and Disney did not. This appears to be a happy medium as the available ad-supported versions will still allow Disney to monetize the new “free users” acquired from Charter. 🤝

However, based on comments from both companies, it appears Charter got the better end of the deal. 🤔

Charter CEO Chris Winfrey said, “The deal sets the framework for what should be developed throughout the entire industry…” and “Disney’s willingness to meet Charter halfway gives the entertainment giant an opportunity to transform the video business model.”

Meanwhile, Disney Entertainment’s co-chairman Dana Walden said, “We are prepared to make trade-offs to focus on those priorities…” when referring to the new price terms for its TV channels and a boost in distribution for its streaming services.

And the market seems to agree with that sentiment for now. Although both stocks were up on the day, $CHTR shares gained about 3x more than $DIS, which continues to sit near nine-year lows. 📊

For now, it looks like Disney and other media players who paid up for NFL and other sports rights don’t have as much leverage over the traditional cable providers as they thought. At least not yet. 🤷

Bullets

Bullets From The Day:

🤑 KKR invests in Reliance Retail at a whopping $100 billion valuation. The U.S. private equity giant is increasing its stake in India’s largest retail chain, following its initial investment of $755 million at a $62 billion valuation in 2020. If it were a public company, this valuation would make Reliance Retail the 139th largest company in the world, just behind Uber. The investment will support its expansion into new categories as it considers a public listing. TechCrunch has more.

❌ Chevron makes an unconventional bet to avoid Australia’s LNG strike. The U.S. oil and gas giant no longer expects to reach a deal with unions to avoid a costly strike that would impact 5% of global LNG supplies. Instead, it’s pursuing an untested legal strategy that will be a landmark test of new laws introduced in June, empowering the umpire to force parties into an agreement they could not make themselves. While it’s unlikely to happen in time to prevent a strike, it could force an agreement and limit the strike’s impact if successful. More from Reuters.

🚗 BMW will continue to make the Mini in Oxford, but not without a cost. The German automaker will invest $750 million in two new electric versions of the Mini in the United Kingdom. With other carmakers exploring cheaper areas to build and assemble cars, BMW’s commitment secures the future of Mini production in Oxford, where the original classic version of the small car was born 64 years ago. With that said, government incentives likely played a significant role in keeping production in the U.K., which currently lacks the proper infrastructure to scale within its borders. CNN Business has more.

🛰️ U.K. satellite sustainability startup raises $50 million. The role of satellites will only grow in the future, making them a critical piece of global infrastructure. However, the amount of space debris is becoming an issue, given how many rockets and satellites go beyond Earth’s atmosphere. Startup Open Cosmos has just raised money to help address that issue, building a “sustainable” low-earth orbit satellite and an end-to-end system for managing their data. More from TechCrunch.

📝 FASB finally writes accounting rules for crypto. The Financial Accounting Standards Board (FASB), which is responsible for setting accounting standards for U.S. public and private companies, voted on a new rule that would go into effect in 2025. Previously, companies could classify Bitcoin and other crypto as intangibles, but the new rules would require businesses to recognize losses and gains immediately, reducing their ability to use their crypto holdings for ‘earnings management.’ Axios has more.

Links

Links That Don’t Suck:

🥤 McDonald’s is making a big change to its drink stations

🌎 India to explore foreign exchanges listing for local firms

☕ ‘Coffee cup test’ bosses use to judge candidates during interviews revealed

✈️ Boeing’s execs refuse to relocate, instead taking private jets to work: private

💳 Fears over access to credit hit highest level in more than a decade, New York Fed survey says