Stocks fell for the second straight week, with the S&P 500 officially entering “correction” territory by closing 10% below its July highs. Let’s see what else you missed. 👀

Today’s issue covers Exxon and Chevron earnings results, industrial company Barnes Group’s big break, and Deckers Outdoor continuing its trek higher. 📰

Here’s today’s heat map:

2 of 11 sectors closed green. Consumer discretionary (+1.05%) led, & energy (-2.40%) lagged. 💚

The fed’s preferred inflation metric, core personal consumption expenditures (PCE), rose 0.3% MoM and 3.7% YoY. This aligned with expectations, while personal income and spending rose more than expected, at 0.3% and 0.7%, respectively. Michigan consumer sentiment fell for the third straight month, driven by higher-income consumers and those with sizable equity market holdings. 🔻

The Federal Reserve is expected to hold interest rates at current levels next week but keep a hawkish tone as inflation continues its slow, volatile descent. Meanwhile, Russia’s central bank raised rates higher than anticipated, to 15%, as the country’s budget remains strained by its war in Ukraine. ⏯️

Alcohol makers continue to struggle in the current environment, with cognac maker Remy Cointreau cutting its 2024 sales forecast. It’s now projecting a 15%-20% decline in organic sales during the year, well below previous guidance of flat growth. 🍸

French company Sanofi saw shares shed 19% after surprising investors by reducing its profit forecast for next year. That overshadowed its plans to spin off its consumer health division, following its peers like GSK, Novartis, Pfizer, and Johnson & Johnson. ✂️

Automakers continue to tumble after earnings. Ford says it reached a tentative deal with the United Auto Workers (UAW) union, while GM and Stellantis said they’re nearing a tentative agreement. 🚗

Other symbols active on the streams: $SAVE (-8.24%), $SAVA (-3.31%), $OSTK (-9.54%), $XBI (-3.11%), $AMZN (+6.83%), $ICU (+28.79%), $BETS (-30.68%), and $APLM (+51.76%). 🔥

Here are the closing prices:

| S&P 500 | 4,117 | -0.48% |

| Nasdaq | 12,643 | +0.38% |

| Russell 2000 | 1,637 | -1.21% |

| Dow Jones | 32,418 | -1.12% |

Earnings

Checking In On Energy

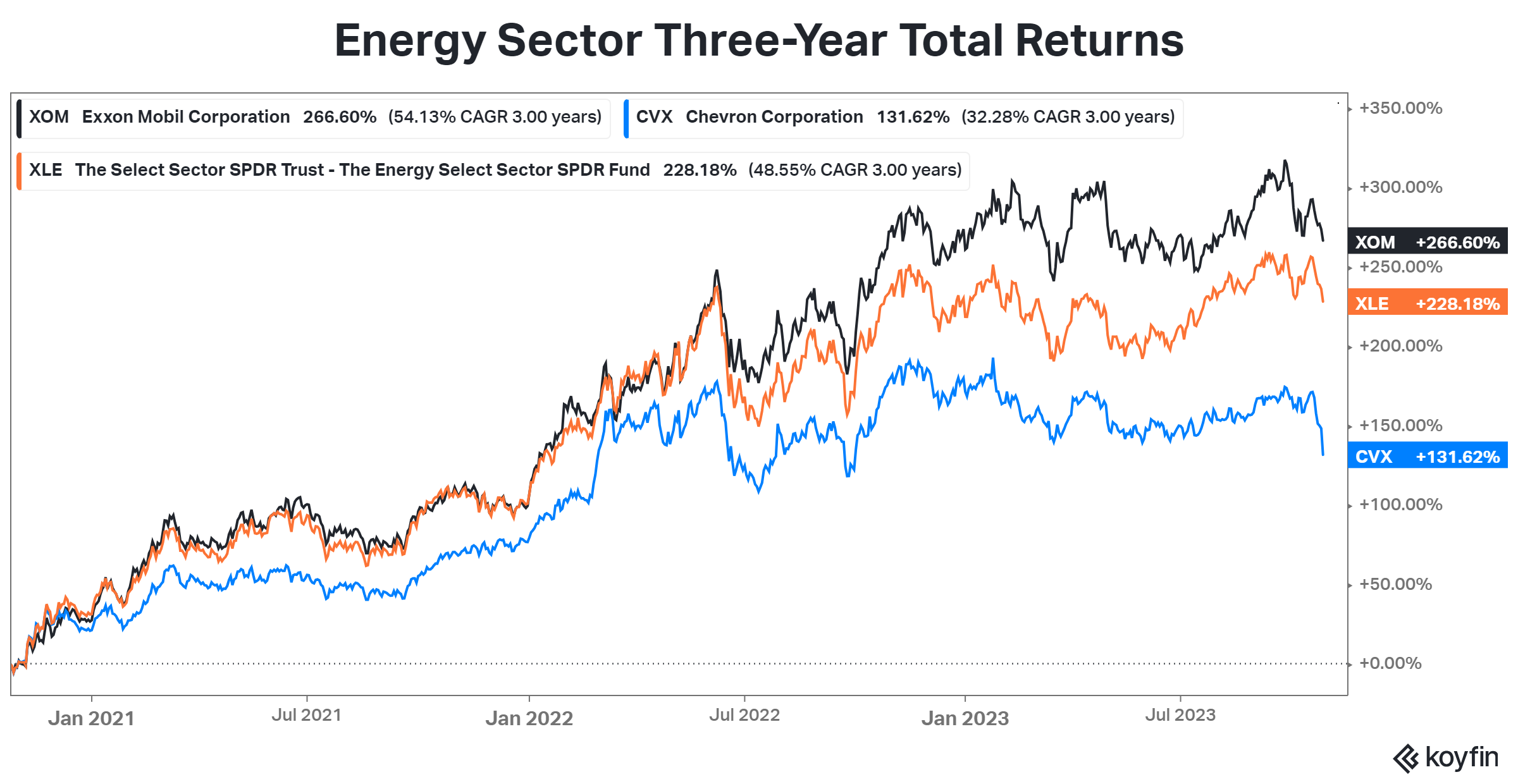

Investors got an update on the energy sector today from oil and gas giants Exxon and Chevron, which both reported results. 🛢️

Exxon Mobil reported adjusted earnings per share of $2.27 on revenues of $90.8 billion. Both were below expectations of $2.37 and $93.4 billion, with weakness in its refining and chemicals segments driving the miss. 🔻

The company also expects to spend more on capital projects than analysts anticipated, saying it’ll come in at the top of its $23 to $25 billion range this year. However, to entice investors, the company is putting more of its cash to work by increasing its quarterly dividend from $0.91 to $0.95. That represents a 3.6% yield at current levels. 💸

Meanwhile, Chevron’s $3.05 per share in earnings on revenues of $51.9 billion were mixed vs. the $3.70 and $51.4 billion expected. Weaker refining margins and natural gas prices weighed on the company’s results this quarter. Unlike Exxon, the company did not boost its dividend this quarter but told shareholders they could expect higher dividends as its free cash flow grows. ⛽

Both companies will also experience some earnings drag initially from their recent acquisitions. Exxon paid $59.5 billion to buy Pioneer Natural Resources and expand its presence in the Permian Basin. Meanwhile, Chevron purchased Hess for $53 billion to expand its production in oil-rich Guyana. But, they’re expected to be accretive to revenue and earnings long-term.

With U.S. oil producers trading at a major premium to their European peers, they’ll need a bit more than “higher oil prices” to go right for them to continue their strong runs from the last few years. So far, stock prices in the sector have been flat for the last year as fundamentals look to catch up to the massive gains experienced in 2021 and 2022. 📊

Earnings

DECK Continues Its Trek Higher

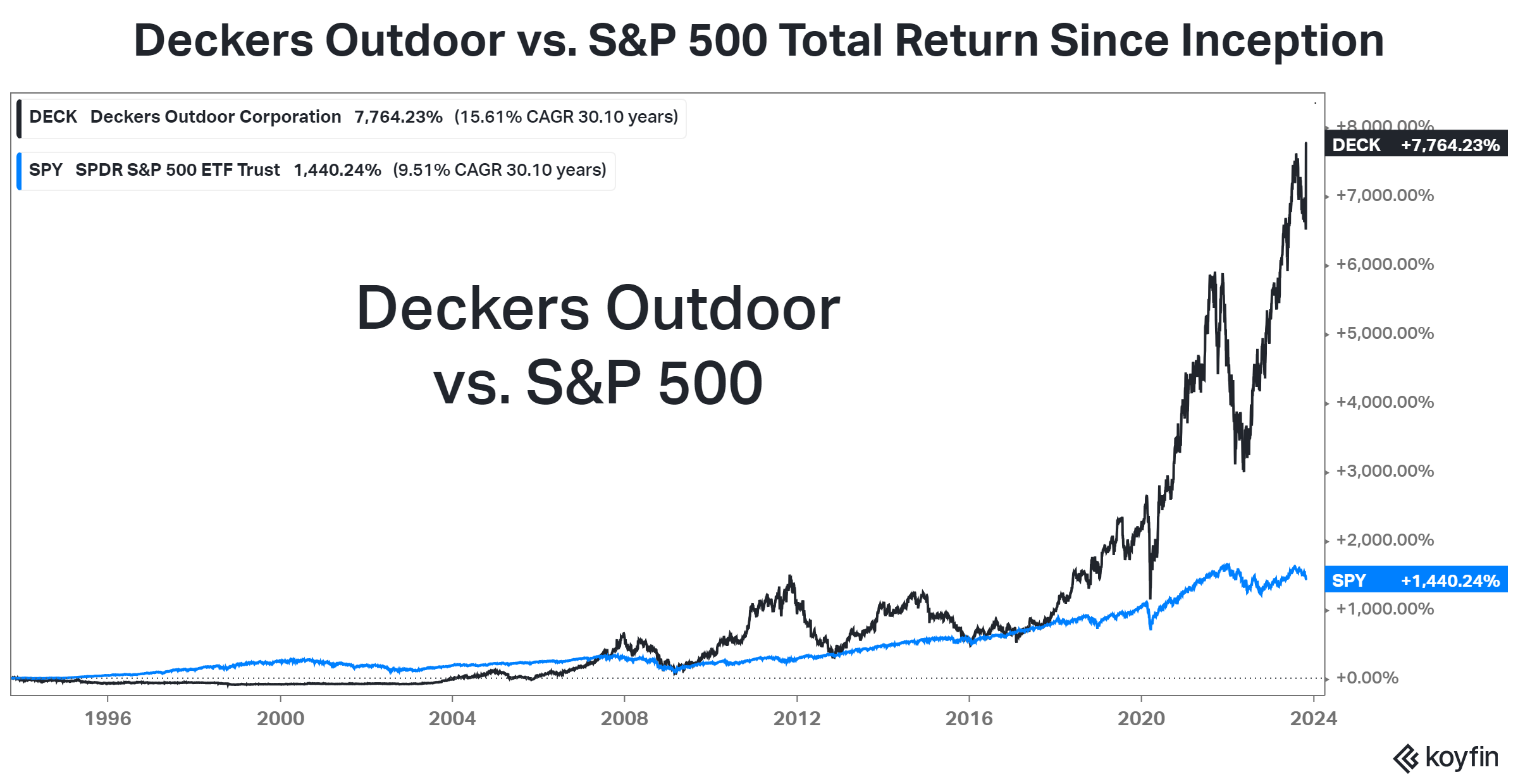

The retailer behind popular footwear brands like UGG and HOKA, Deckers Outdoor, continues to delight investors. 👍

It reported adjusted earnings per share of $6.82, topping the $4.43 expected by analysts. Revenues of $1.09 billion also topped the $960.5 anticipated. That represents 25% YoY revenue growth and a 79% YoY increase in earnings. 📈

Driving the record results was strong consumer demand for its HOKA and UGG brands. Analysts say the company’s inventory management and product mix were positioned well, while engaging marketing campaigns helped differentiate its brands in a competitive space.

Gross margins expanded from 48.2% to 53.4%, with direct-to-consumer (DTC) net sales rising 36.8% YoY vs. 19.4% YoY for its wholesale channels. SG&A expenses did rise due to additional marketing spend, but it’s helping the company drive additional market share gains. 🛒

Here’s how it’s individual brand sales fared on a YoY basis:

- UGG +28.1% to $610.5 million

- HOKA +27.3% to $424 million

- Teva +28.4% to $21.5 million

- Sanuk +28.5% to $5.4 million

- Others (primarily Koolaburra) +7.2% YoY to $30.6 million

Additionally, the company’s cash and cash equivalents essentially doubled YoY to $823.1 million, with inventories falling about 20% to $726.3 million. 💰

Executives expect the strength to continue through the holiday season, raising their fiscal 2024 revenue forecast from $3.98 to $4.03 billion and earnings estimates to $22.90-$23.25 per share.

$DECK shares rose 19% today to fresh all-time highs, with its total return since inception climbing to nearly 7,800%. 🤩

Earnings

Barnes Group’s Big Break

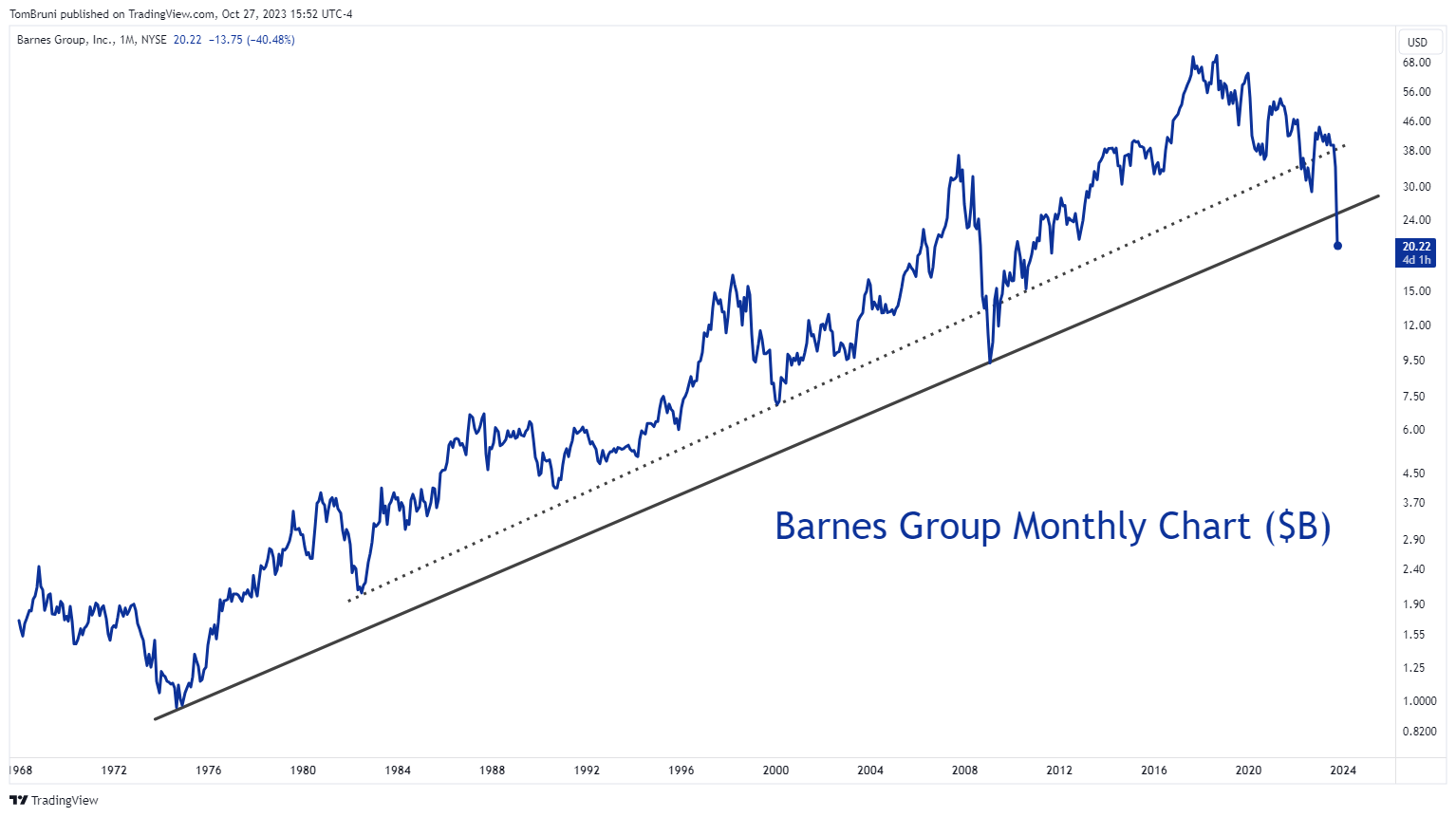

It’s been a rough month for Barnes Group, which is down over 40% in October. Most of those losses came today after it reported weaker-than-expected quarterly results. 📉

The engineered products, industrial technologies, and solutions provider generated adjusted earnings per share of $0.19, well below the $0.48 expected. Revenues jumped 15% YoY to $361 million, while analysts anticipated $364.2 million. 🔻

Executives lowered their 2023 outlook, forecasting organic sales growth of 5%-6% and adjusted earnings per share of $1.57-$1.67. Previous guidance was for 7%-9% and $2.15 to $2.30. They cited the financial impacts of its MB Aerospace acquisition and a reduced industrial forecast.

$B shares plunged 33% today, with investors saying its long-term chart has now clearly broken its uptrend that’s been intact for decades. The market is waiting for a clear catalyst that’s going to stem the stock’s decline. But so far, there hasn’t been anything notable to entice buyers. 🤷

Bullets

Bullets From The Day:

📱 Huawei grew faster than Apple in China due to its 5G smartphone surprise. Launching its Mate 60 Pro phone in the face of U.S. sanctions helped Huawei’s smartphone sales in China surge 37% YoY. Meanwhile, sales of Honor, the largest smartphone maker by market share, rose just 3% YoY. Other significant players in the space, including Vivo, Oppo, and Apple, all saw double-digit declines. The new phone propelled Huawei’s market share to 12.9% from 9.1% a year ago. CNBC has more.

📰 X is looking to take on newswire services. While Instagram Threads and other social media giants lean away from the news, an internal all-hands meeting at X shows Elon Musk’s company is looking to double down on the space with a new wire service called XWire. The product would rival existing press-release services, like Cison’s PR Newswire, though other details about the service or its timeline were not revealed. More from TechCrunch.

🏦 Elon Musk says X will replace banks in 2024. Another one of the “everything app’s” ambitions is to be at the center of users’ financial world, handling anything in their lives that deals with money. He told X employees during their all-hands call that he expects those features to launch by the end of 2024. He reiterated that doesn’t just mean payments; he’s referring to anything that involves money, at one point saying, “…I’m talking about, like, you won’t need a bank account.” The Verge has more.

💾 Western Digital shares plunge after talks with Kioxia break down. Hopes for the two companies to combine their flash memory businesses are fading after discussions between them have ended (for now), according to people familiar with the situation. It comes after remarks from SK Hynix Inc., the world’s second-largest memory chipmaker and indirect shareholder in Kioxia, said that it wouldn’t support the merger because it undervalues its stake. It appears a higher valuation would be needed to draw broad shareholder support. Yahoo Finance has more.

⌚ Apple watches could face an import ban. The U.S. International Trade Commission determined that Apple infringed on a patent held by the medical technology company Masimo. In 2021, Masimo filed a complaint with the Commission, alleging Apple copied its blood-oxygen measurement technology in their pulse oximeter on most Apple Watch models. With the ruling, the Biden administration has 60 days to decide whether to veto the import ban before it takes effect. Meanwhile, Apple can either modify its software to clear the issue or negotiate a civil settlement. Gizmodo has more.

Links

Links That Don’t Suck:

⚠️ The U.S. consumer is ‘walking towards a cliff,’ strategist warns

🏎️ Japan’s automakers are keeping sports cars alive in the EV era

🛑 GM halting driverless car service nationwide after California ban

📊 The last resort of bankruptcy is rising among Main Street businesses across America

🤑 JPMorgan Chase stock slips after bank says CEO Jamie Dimon is selling 1 million shares

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.