Stocks and bonds continued to rebound after the Fed left rates unchanged and Jerome Powell struck a hawkish, but not too hawkish, tone. Let’s see what else you missed. 👀

Today’s issue covers the Fed leaving rates unchanged, the market souring further on China, and the pulse of semiconductor and payment companies. 📰

Here’s today’s heat map:

9 of 11 sectors closed green. Technology (+1.93%) led, & energy (-0.23%) lagged. 💚

Software company Trimble tumbled 13% after missing third-quarter revenue estimates and lowering its full-year revenue and earnings guidance. Meanwhile, Garmin jumped 11% after its revenue topped expectations, and the company raised its full-year revenue guidance. 🧑💻

Online furniture retailer Wayfair dropped 12% before rebounding to close up 4%, with its third-quarter revenue miss overshadowing its narrower-than-expected loss. Consumers’ discretionary spending on goods remains tepid, creating a challenging environment for Wayfair and its peers. 🛋️

Dating services company Match Group fell 15% after its fourth-quarter revenue guidance came in about 4% below analyst estimates. Management continued to point to the weaker macroeconomic environment as the reason for the company’s lackluster results. 📱

CVS shares slumped after its third-quarter earnings and revenue topped estimates, with strength in its health services segment. The company expects to remain challenged as it executes its broader transformation and cost-cutting plans. ✂️

Toyota Motors jumped 6% after its quarterly profit more than doubled, driven by solid demand for hybrids and a weak Japanese Yen. The company’s bet on hybrids over purely electric vehicles has benefited it recently as automakers struggle with an EV market slowdown. However, some analysts remain concerned it’ll leave Toyota behind competitors long-term. ⚡

And Netflix shares popped 2% after providing investors the first update on its ad-supported tier since May. Total global monthly active users have tripled over the last six months to 15 million. 📺

Other symbols active on the streams: $SEDG (-23.51%), $AMD (+9.69%), $CRSP (+12.38%), $SMCI (+8.91%), $TGTX (+30.92%), $CLLS (+172.16%), $AVTX (+19.25%), and $SOL.X (+16.40%). 🔥

Here are the closing prices:

| S&P 500 | 4,238 | +1.05% |

| Nasdaq | 13,061 | +1.64% |

| Russell 2000 | 1,670 | +0.45% |

| Dow Jones | 33,275 | +0.67% |

Earnings

Market Sours On China

Earlier this year, the talk of the town was China’s “reopening,” where the country did away with its COVID-19 lockdown measures and set its eye on growth. That optimism lasted through April, but as more data has emerged, the market has turned increasingly sour toward the country. 😝

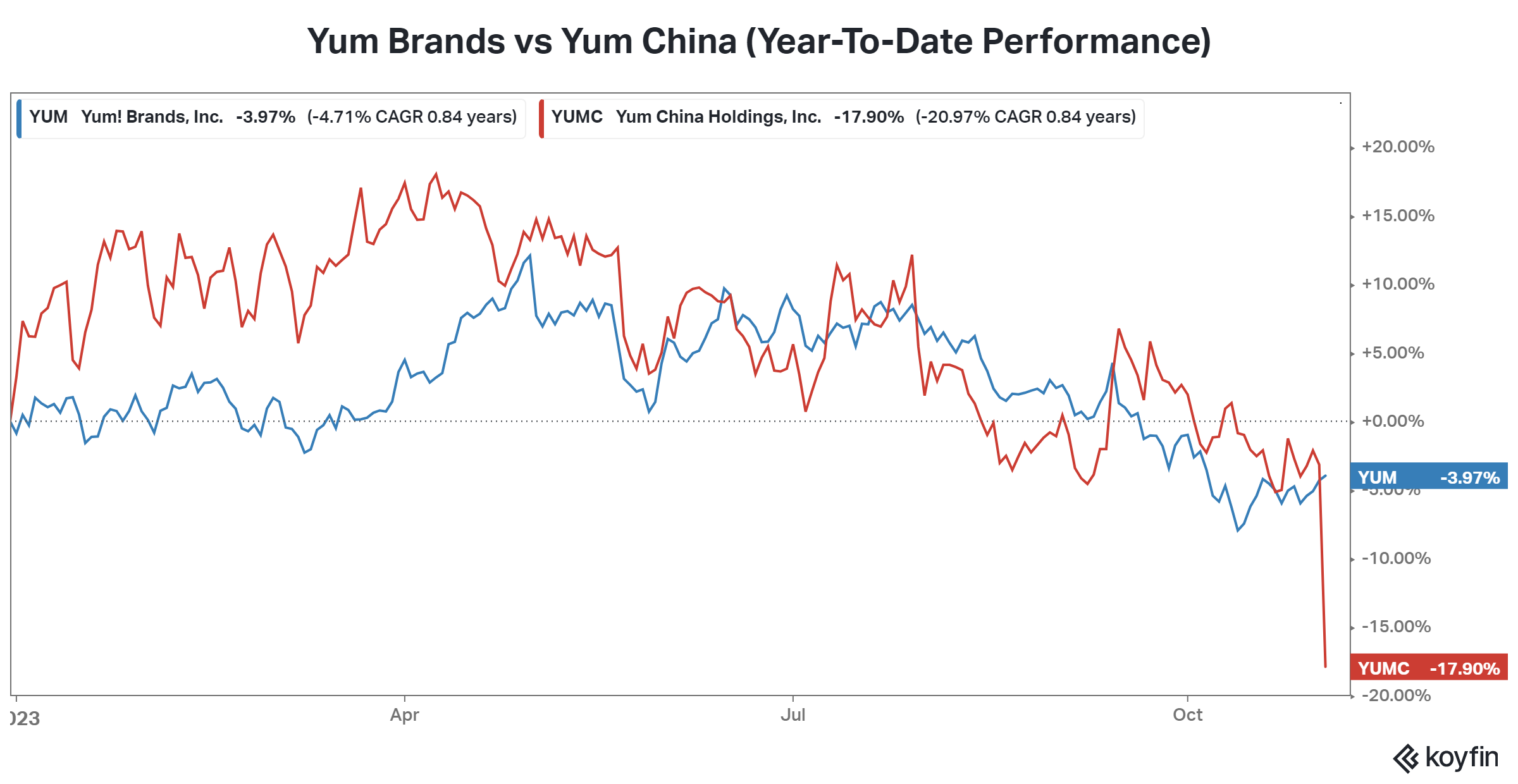

A prime example of this in practice is Yum Brands vs. Yum China, which operates its Chinese restaurants. The chart below shows the Chinese-based company outperforming early in the year but turning south as we headed into the summer. That underperformance escalated today after both companies reported earnings results.

Yum China’s core message: macroeconomic headwinds and softening consumer demand. Both its third-quarter earnings and revenue came in below analyst estimates, with the company saying a slowdown in recent weeks is casting doubt about current-quarter results. That sent shares plummeting 15% today, widening the gap between the U.S.-focused and Chinese-focused parts of the business. 📉

Investors are adding Yum to the growing list of companies seeing a lackluster performance in China. For example, here are two more from today. 📝

Cosmetics giant Estee Lauder crashed to six-year lows after its second-quarter and full-year profit outlook came in well below expectations. It cited incremental external headwinds, specifically slower growth in Asia travel retail and mainland China. It also cited risks of business disruption due to the ongoing Israel-Hamas and Russia-Ukraine wars.

Luxury parka retailer Canada Goose cut its full-year earnings outlook, also citing macroeconomic pressure. In the past, the company had pointed to weakening appetite in North America, but now it’s blaming supposed “growth driver” China for the miss.

Overall, these are unlikely to be the last headlines we see this earnings season about China’s slow growth. With the market turning sour on the country, investors will look elsewhere for growth potential until signs emerge that the country’s efforts to stimulate growth are beginning to work.

Economy

Economic Updates & The Fed

It was a busy day on the economic front, so let’s recap what you missed. 👇

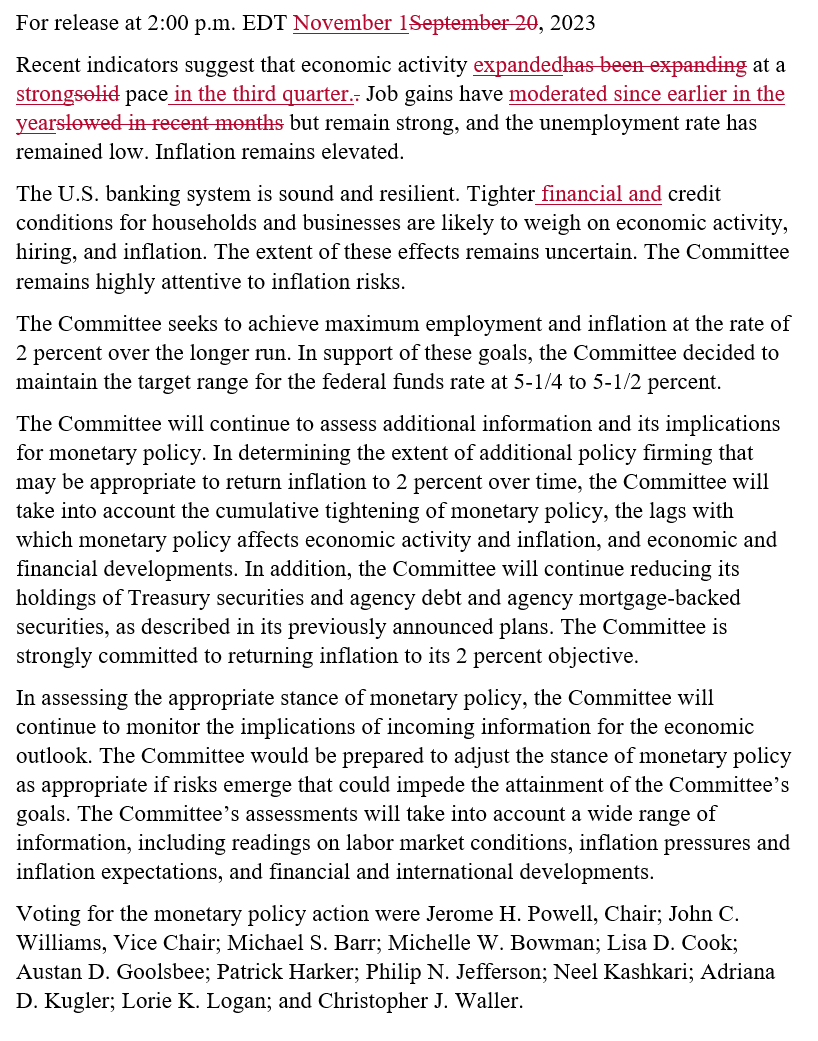

First, we’ll start with the Federal Reserve’s interest rate decision. The central bank left rates unchanged after pausing at its September meeting, largely as expected.

Its red-lined statement showed little change, noting that economic activity remains strong and job gains continue to moderate. Financial and credit conditions are tightening and weighing on economic activity, as it hoped it would. 📝

Following the lackluster statement release, attention turned to Jerome Powell’s press conference. Unfortunately for investors, that didn’t provide much more color either. 📝

Powell acknowledged the recent progress but kept further rate hikes on the table, saying monetary policy might not be restrictive enough for inflation to return to 2%. The supply side of inflation has corrected sharply, but to reach “full price stability,” monetary restraint will have to play a significant role.

Although the decision to keep rates steady at this meeting was unanimous, Powell noted that the Fed’s projections could become stale in the three months between forecasts. As a result, he reiterated the committee will make its December decision based on where the data is at the time. They’ll also provide updated projections (AKA the “dot plot”) at that meeting, which will be heavily scrutinized by investors.

His overall tone was similar to other meetings, giving the committee flexibility by not leaning too strongly in one direction or another. There was an undertone, however, that the risks of “doing too much” and “doing too little” are becoming more balanced. Previously, the primary concern was about not doing enough to tame inflation, especially since the Fed was behind the curve in adjusting rates initially. ⚖️

Moving onto the economic data, the October ADP employment report showed that 113,000 jobs were created, below the estimated 130,000. Wages were up 5.7% YoY, marking their smallest increase since October 2021. And almost all of the job gains continue to come from the services industry. 🧑💼

Helping alleviate that wage pressure is a continued slowdown in the ratio of job openings per available worker. The September JOLTs report showed job openings were flat at 9.55 million, leaving the ratio of job openings to unemployed persons unchanged at 1.5. Levels for quits and hires were also little changed, with layoffs decreasing slightly. 📊

The manufacturing sector readings remained mixed in October. The ISM Manufacturing PMI plunged to 46.7, leaving it in contraction territory for the twelfth consecutive month. Meanwhile, the S&P Global U.S. Manufacturing PMI rose to 50, as the measure looks to stabilize in expansion territory. Albeit volatile, the consensus is that these measures are trying to bottom out and should push back into positive territory by mid-next year. 🏭

It’s also worth noting that many are concerned with the U.S. Federal Government’s debt load, given that higher interest rates will raise the cost of debt servicing going forward. Stanley Druckenmiller said in an interview that the government has been spending like ‘drunken sailors’ and needs to cut entitlements immediately. ⚠️

And lastly, the Swiss National Bank’s chairman said that its intervention with Credit Suisse was needed to avoid a financial crisis. Clearly, governments around the world want to protect systematically important institutions to avoid a repeat of past global financial crises. 🏦

Earnings

The Chips & Payments Pulse

Semiconductor and payment companies are both in focus this earnings season, so let’s check in on what Qualcomm and PayPal are saying.

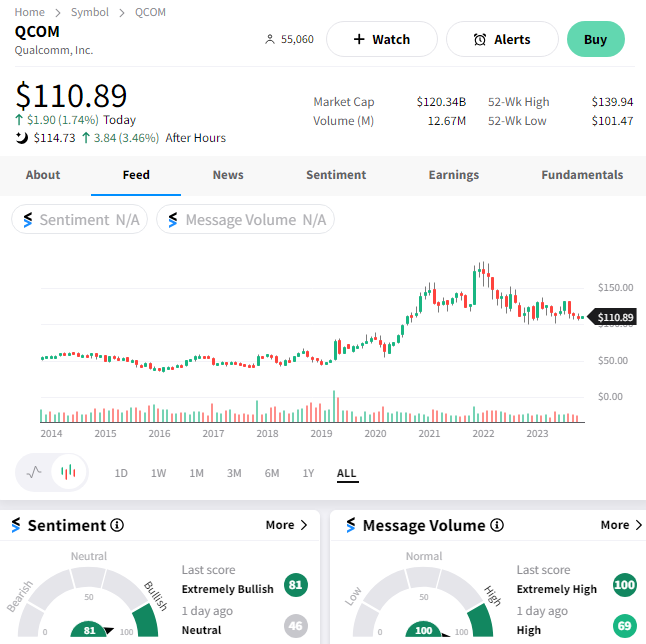

First, we’ll start with Qualcomm, whose fortunes are tied directly to the smartphone industry. Like other consumer electronics and goods, the industry has been dealing with a two-year hangover following rapid pandemic-era growth. As a result, it’s been watched closely by investors.

The chipmaker reported $2.02 in adjusted earnings per share on $8.67 billion in revenues, topping estimates of $1.91 and $8.51 billion. Looking ahead, it raised its current-quarter earnings and revenue expectations, leading many to speculate that the bottom may be near (or in).

Qualcomm’s CFO Akash Palkhiwala said the company is seeing early signs of stabilization in demand for global 3G, 4G, and 5G handsets. As a result, he expects total shipments to decline mid to high single digits YoY in 2023, improving since the company’s last forecast.

Its automotive business was a bright spot, as was its “Internet of Things” and licensing business. And while the company wants investors to see it as an artificial intelligence (AI) play, most investors are just happy to see that its core business is beginning to stabilize.

As a result, $QCOM shares saw a 4% pop after hours, continuing to stabilize above the $100 level in the long(er) term.

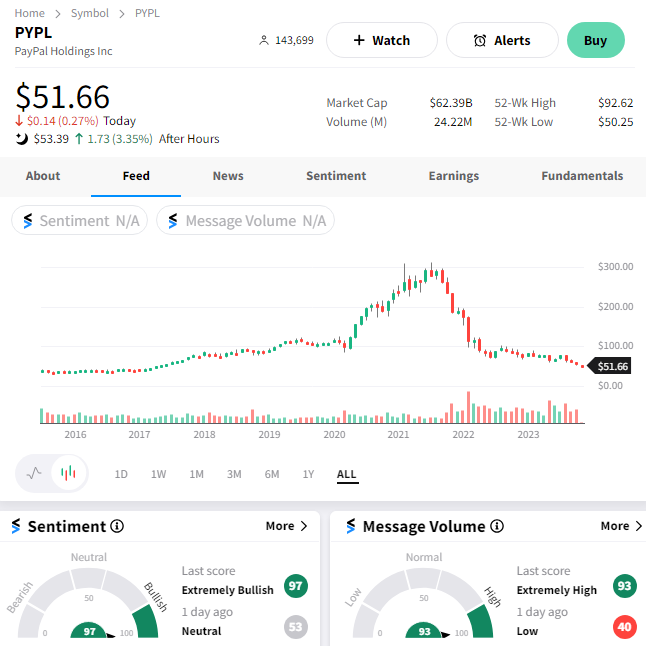

Meanwhile, there was a lot of anxiety about PayPal’s report, given that Paycom plummeted 38% after reporting after the bell yesterday. 💳

The online payments giant reported earnings per share of $1.30 on revenues of $7.4 billion. Earnings beat estimates by $0.07, while revenues were essentially in line. 📊

Chief Executive Officer Alex Chriss had this to say, “My first 30 days leading PayPal have confirmed my belief in the company’s strong assets and market position. Now, we must harness these strengths and put the weight of the organization behind our most important priorities. In the process, we will become more efficient, so we can innovate and execute with higher velocity.”

The new CEO threw some shade at prior management, essentially saying it was execution issues driving the company’s weakness. We’ll have to see if a change at the helm can truly get the company back on track, though. 🧑💼

For now, PayPal said it expects 75 bps of operating-margin expansion, down from its prior targets of 100 bps and 150 bps. Its fourth-quarter forecast for $1.36 per share in earnings on revenues of $7.81 to $7.89 billion was also slightly below consensus expectations. 🔻

$PYPL shares rose about 3% after the bell, with investors assessing whether the company’s turnaround story is a buyable one at current levels. 🤔

Bullets

Bullets From The Day:

🤖 LinkedIn passes 1 billion members as it launches a new AI chatbot. The business and employment-focused social media platform declared the milestone as it debuted an artificial intelligence (AI) chatbot billed as a “job seeker coach.” Since the beginning of the year, the company has been rolling out several AI tools focused on automated recruiter messages and job descriptions. Meanwhile, it’s also cutting jobs in its engineering department as it tries to reaccelerate revenue growth after eight straight quarters of deceleration. CNBC has more.

🧑⚖️ Nokia is suing two tech giants for infringing on its video streaming patent. The Finnish telecom company is suing Amazon and HP Inc. in Delaware federal court, saying they’ve infringed on several of its patents related to video streaming. It claims Amazon’s Prime Video and Twitch streaming services, and HP’s computers, violate patents around streaming video compression, delivery, and other technology. Nokia is looking to force both companies to license the software from them, as well as collect money damages. More from Reuters.

🖥️ Companies can now rent Nvidia GPUs through AWS’ new service. With more companies looking to run large language models, the demand for GPUs continues to climb, especially those made by Nvidia. However, renting a long-term instance from a cloud provider can be uneconomical if only needed for a single job. To address that issue for smaller companies and those with limited resources, AWS launched a new service enabling customers to buy GPU access for a defined period needed to complete their projects. TechCrunch has more.

📰 Another major media player announces a significant restructuring. The media ain’t behind Vogue, The New Yorker, Wired, and Vanity Fair announced changes it’s making to adapt to a “rapidly changing” media environment. A memo sent to employees said the company would cut 5% of its 5,000-person workforce, close open job postings, rethink its long-term projects, and reduce its real estate footprint. Although the broader company’s e-commerce and digital subscriptions have pushed it to a third straight year of revenue growth, it’s looking to further prepare for a leaner future ahead. More from The Hollywood Reporter.

🥦 More businesses are making small bets to test their customers’ appetite for cannabis. While Marijuana remains illegal at the federal level, roughly half of the U.S. states have legalized it for adult medical and recreational use. With the majority of consumers’ opinion of cannabis relatively liberal, the improving regulatory environment has sparked a growing interest from businesses that are looking to capture a share of the new market. Magnolia Bakery is the latest company to test a line of THC-infused edibles to see if the market’s appetite justifies further expansion into the new space. CNN Business has more.

Links

Links That Don’t Suck:

👿 The people who ruined the internet

😊 Instagram spotted developing a customizable ‘AI friend’

⏰ Why efforts to make daylight saving time permanent are stalled

📻 U.S. media veterans back new trading firm with financial news arm

💵 IRS announces 2024 retirement account contribution limits for 2024

⚠️ DoorDash now warns you that your food might get cold if you don’t tip