Semiconductor and payment companies are both in focus this earnings season, so let’s check in on what Qualcomm and PayPal are saying.

First, we’ll start with Qualcomm, whose fortunes are tied directly to the smartphone industry. Like other consumer electronics and goods, the industry has been dealing with a two-year hangover following rapid pandemic-era growth. As a result, it’s been watched closely by investors.

The chipmaker reported $2.02 in adjusted earnings per share on $8.67 billion in revenues, topping estimates of $1.91 and $8.51 billion. Looking ahead, it raised its current-quarter earnings and revenue expectations, leading many to speculate that the bottom may be near (or in).

Qualcomm’s CFO Akash Palkhiwala said the company is seeing early signs of stabilization in demand for global 3G, 4G, and 5G handsets. As a result, he expects total shipments to decline mid to high single digits YoY in 2023, improving since the company’s last forecast.

Its automotive business was a bright spot, as was its “Internet of Things” and licensing business. And while the company wants investors to see it as an artificial intelligence (AI) play, most investors are just happy to see that its core business is beginning to stabilize.

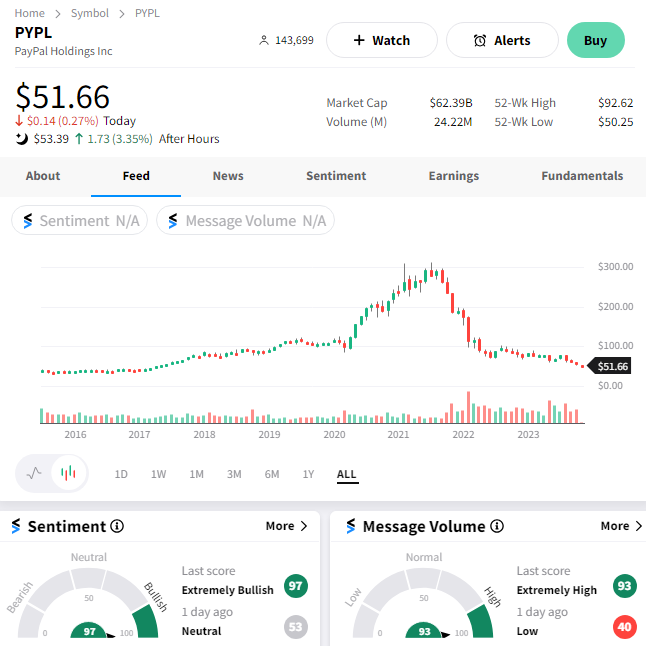

As a result, $QCOM shares saw a 4% pop after hours, continuing to stabilize above the $100 level in the long(er) term.

Meanwhile, there was a lot of anxiety about PayPal’s report, given that Paycom plummeted 38% after reporting after the bell yesterday. 💳

The online payments giant reported earnings per share of $1.30 on revenues of $7.4 billion. Earnings beat estimates by $0.07, while revenues were essentially in line. 📊

Chief Executive Officer Alex Chriss had this to say, “My first 30 days leading PayPal have confirmed my belief in the company’s strong assets and market position. Now, we must harness these strengths and put the weight of the organization behind our most important priorities. In the process, we will become more efficient, so we can innovate and execute with higher velocity.”

The new CEO threw some shade at prior management, essentially saying it was execution issues driving the company’s weakness. We’ll have to see if a change at the helm can truly get the company back on track, though. 🧑💼

For now, PayPal said it expects 75 bps of operating-margin expansion, down from its prior targets of 100 bps and 150 bps. Its fourth-quarter forecast for $1.36 per share in earnings on revenues of $7.81 to $7.89 billion was also slightly below consensus expectations. 🔻

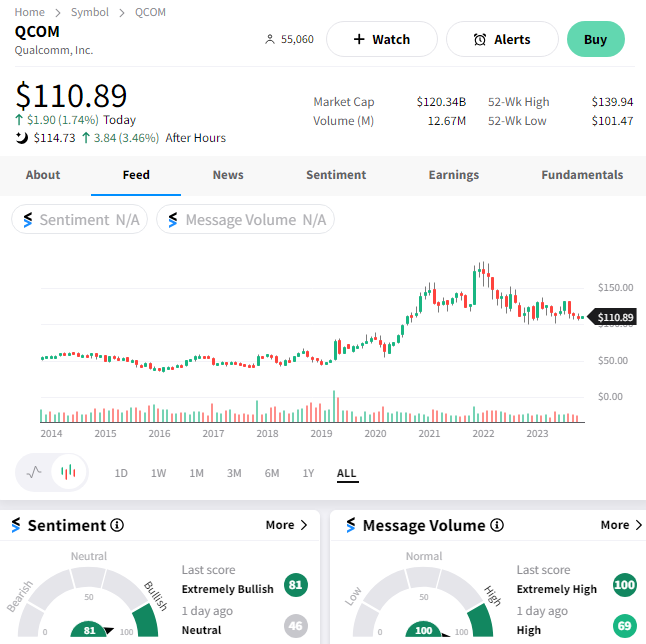

$PYPL shares rose about 3% after the bell, with investors assessing whether the company’s turnaround story is a buyable one at current levels. 🤔