Despite some weakness in several big-cap technology names, three of the four major stock market indexes made new 2023 highs. Let’s see what you missed. 👀

Today’s issue covers a Monday M&A mashup, a check-in with Oracle, and more from the day. 📰

Here’s today’s heat map:

10 of 11 sectors closed green. Consumer staples (+0.96%) led, & communications (-0.77%) lagged. 💚

Natural gas futures continued to slide today on higher-than-anticipated storage numbers and fears that this winter will be warmer than normal. 🥵

Several Nasdaq 100 stocks were on the move as news broke that they’ll be added or removed from the index. Joining are Splunk, MongoDB, Roper Technologies, CDW Corp., and Coca-Cola Europacific Partners. They’ll replace Align Technology, eBay, Enphase Energy, JD.com, and Lucid Group as of the market opening on Monday, December 18. 🔀

Chipmaker Broadcom jumped 9% to new all-time highs after Citi resumed coverage of the stock with a $1,100 price target. The analyst says strength from its VMware acquisition and AI will offset the weakness in its semiconductor business. 👍

Shake Shack shares soared 10% after the company announced that CEO Randy Garutti will retire in 2024, ending a 24-year tenure with the company. The board is still identifying his successor. 🍔

Other symbols active on the streams: $ALT (-19.75%), $FSR (-7.93%), $SHOT (-5.24%), $MULN (-13.51%), $BLUE (+7.34%), $AITX (-2.63%), $MARA (-12.69%), & $DOGE.X (-7.50%). 🔥

Here are the closing prices:

| S&P 500 | 4,622 | +0.39% |

| Nasdaq | 14,432 | +0.20% |

| Russell 2000 | 1,884 | +0.15% |

| Dow Jones | 36,405 | +0.43% |

Earnings

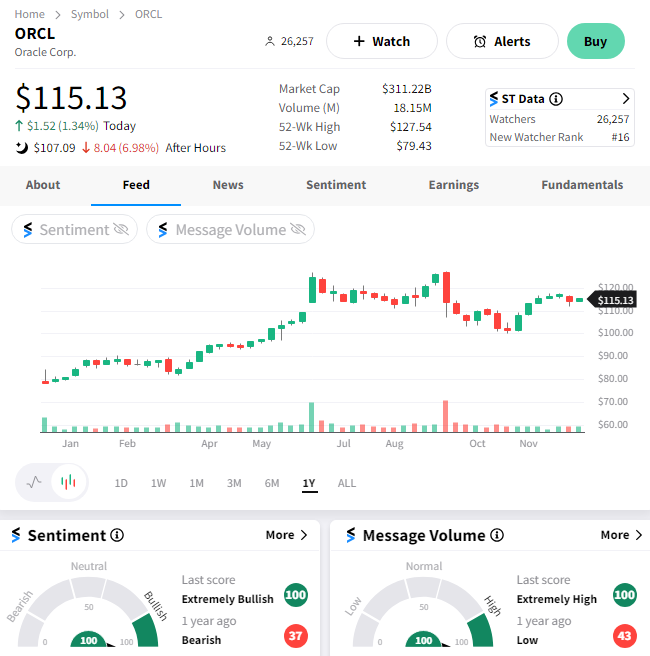

Checking In With Oracle

The world’s largest database management company was in the news today as investors eyed its second-quarter results. 👀

Oracle’s adjusted earnings per share of $1.34 topped the expected $1.32. However, revenues grew just 5% YoY to $12.94 billion, falling short of estimates by about 1%. 🔺

Here’s how segment revenues broke down vs. estimates:

- Cloud services and license support +12% YoY to $9.64 billion vs. $9.71 billion

- Cloud and on-premises licenses -18% YoY to $1.18 billion vs. $1.21 billion

- Services revenue of $1.37 billion vs. $1.40 billion

- Cloud infrastructure revenue +52% YoY to $1.6 billion

Despite picking up cloud business from larger rival Microsoft and announcing its database software will be available on Microsoft’s Azure public cloud, revenues still couldn’t keep pace with Wall Street’s estimates. With Oracle more than doubling the S&P 500’s return year-to-date, the slight miss was enough for some investors to sell.

For the coming quarter, CEO Safra Catz said revenue should grow between 6% and 8%, including Cerner, or 8% to 10% excluding it. She also expects earnings per share of $1.35 to $1.39, with both numbers roughly in line with estimates. 🔮

$ORCL shares are down about 7% on the news. 📉

M&A

An M&A Mashup

It was another busy Monday of M&A and fundraising news, so let’s quickly recap. 👇

First up is Macy’s, which saw shares soar 20% on reports that the 165-year-old retailer is considering a buyout offer from Arkhouse Management and Brigade Capital Management. It’s unclear how the company’s board feels about the offer, but clearly, these firms have value in Macy’s real estate. Analysts speculate that the investor group may sell off real estate and spin off its e-commerce business to deliver short-term gains. However, that would come at the expense of the core retail business people know and love it for. 🏬

Occidental Petroleum is looking to expand its Permian Basin production by purchasing privately held energy producer CrownRock for $12 billion. Additionally, it raised its quarterly dividend from 18 to 22 cents per share. The company is developing a 100,000-acre position in the Midland Basin, which produced 15% of U.S. crude in 2020. Overall, the transaction will add about 170,000 barrels of oil equivalent per day to Occidental’s production, with 1,700 more undeveloped locations. 🛢️

U.S. health insurer Cigna said it had ended its attempt to acquire rival Humana after the pair failed to agree on a price. The company instead plans to use its $10 billion for a buyback program, sending Cigna shares jumping 17% on the day. ❌

ByteDance’s TikTok has found a way to reestablish itself in Indonesia’s online shopping market after new regulations forced it to retreat from the country. It’s investing $1.5 billion to become a controlling shareholder of an e-commerce unit of Indonesia’s GoTo Gojek Tokopedia. That’ll help it get around Indonesia’s ban on online shopping via social media platforms, which it says is needed to protect smaller merchants and users’ data. 🛒

The French are getting involved in the artificial intelligence (AI) race, with a Paris-based OpenAI rival closing $415 million in funding. Mistral AI is now valued at $2 billion and opened up its commercial platform today, just six months after raising a $112 million seed round. However, for now, the company’s best model is only accessible via an API, as it looks to make money from its foundational models. 🤖

A rival to Jack Dorsey’s Block has defied the slump in fintech funding by raising $307 million. The British startup SumUp, known for its small card readers, is now valued at more than $8.6 billion due to this latest funding round, with it focused on further geographical expansion. It last raised funding in the summer of 2022, when it raised $635 million at a $8.6 billion valuation. 💳

Lastly, there are two smaller deals to note. Professional services firm PwC has acquired Surfaceink, a company that got its start as Apple’s key hardware engineering partner after the return of Steve Jobs as CEO. And New York has joined IBM and Micron to invest a combined $10 billion in a semiconductor research facility near the University of Albany as more states vie for the industry to build within their borders. 🗞️

Bullets

Bullets From The Day:

📺 The streaming shuffle continues as Showtime adopts the Paramount+ name. It’s over for Showtime as a standalone brand, with Paramount Global rebranding the linear Showtime cable network as Paramount+ With Showtime. It’s the same name as the company’s top-tier streaming package, but some subscribers of the linear Showtime channel will not have access to the new streaming plan given that Paramount Global does not have agreements with some large pay-TV providers. Needless to say, there’s been a lot of confusion around the switch. Variety has more.

✈️ The real motive behind Alaska Airlines’ acquisition of Hawaiian. The 270% premium that Alaska is paying raised some eyebrows last week, given most acquisitions of public companies take place at a premium of about 30%. However, given Alaska is paying just 0.7 times its annual revenue, well below the industry average, it likely felt the knockout punch of a big bid would prevent anyone from rejecting it or trying to top it. Much of Hawaiian’s recent share decline came from short-term issues, so Alaska likely wanted to snap it up on the cheap while it could. More from Axios.

🤑 TikTok reaches a consumer spending milestone. The social app has become the first non-game app to reach $10 billion in consumer spending, with a small group of other apps achieving this feat in the gaming space. TikTok came into 2023 with more than $6.2 billion in consumer spending, growing 61% from the year’s start to add another $3.8 billion throughout the year. The spending comes from its in-app purchases of “coins,” its virtual currency that users can spend on gifts for its creators. TechCrunch has more.

📹 X looks to expand its live audio conversation feature, Spaces, with video. Elon Musk has announced a new feature is coming to the app, aiming to improve its live audio conversation feature by adding video. The feature is said to be simple, where users can quickly turn the video on or off. Like Google Meet and other video conferencing platforms, the app will display the current speaker when there are multiple ones. It hopes this new feature will help its power users further engage their audience without using third-party platforms. More from TechCrunch.

👀 Tucker Carlson launches new subscription streaming service, but not on X. The former Fox News host announced today he is launching a new service, months after parting ways with the conservative network and setting up shop on X. The Tucker Carlson Network will charge $9 per month, or $72 annually, and bring users hours of exclusive content. People were surprised he didn’t launch on X. Apparently, he considered it, and the platform could not build out the technology to support his venture in time. Axios has more.

Links

Links That Don’t Suck:

📈 Find top stocks using a 3-step system—book a free 30-minute showcase with MarketSmith by IBD!*

🌐 The quiet plan to make the internet feel faster

📰 A financial news site uses AI to copy competitors — wholesale

💊 Patients regain weight after stopping Eli Lilly’s Zepbound, study says

🧳 This holiday season is expected to be the busiest on record at airports, AAA says

💸 Bernie Madoff victims get $159 million from Ponzi recovery fund in latest recovery

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.