The world’s largest database management company was in the news today as investors eyed its second-quarter results. 👀

Oracle’s adjusted earnings per share of $1.34 topped the expected $1.32. However, revenues grew just 5% YoY to $12.94 billion, falling short of estimates by about 1%. 🔺

Here’s how segment revenues broke down vs. estimates:

- Cloud services and license support +12% YoY to $9.64 billion vs. $9.71 billion

- Cloud and on-premises licenses -18% YoY to $1.18 billion vs. $1.21 billion

- Services revenue of $1.37 billion vs. $1.40 billion

- Cloud infrastructure revenue +52% YoY to $1.6 billion

Despite picking up cloud business from larger rival Microsoft and announcing its database software will be available on Microsoft’s Azure public cloud, revenues still couldn’t keep pace with Wall Street’s estimates. With Oracle more than doubling the S&P 500’s return year-to-date, the slight miss was enough for some investors to sell.

For the coming quarter, CEO Safra Catz said revenue should grow between 6% and 8%, including Cerner, or 8% to 10% excluding it. She also expects earnings per share of $1.35 to $1.39, with both numbers roughly in line with estimates. 🔮

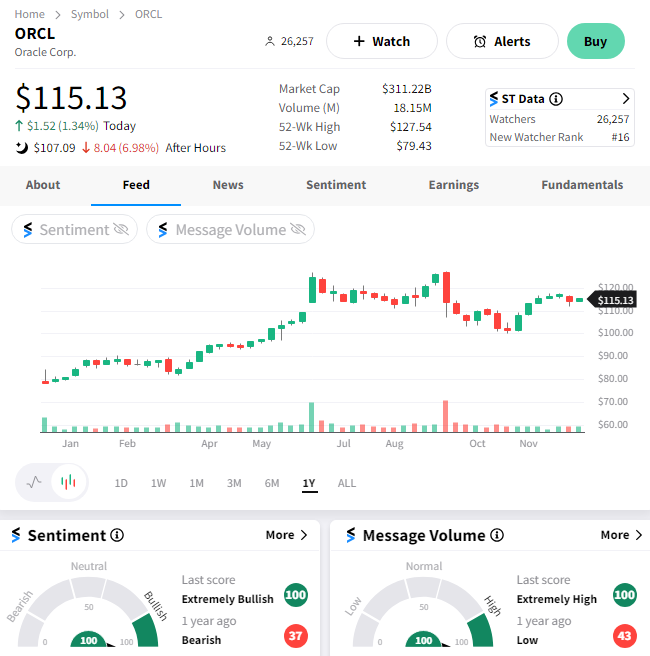

$ORCL shares are down about 7% on the news. 📉