Another measured inflation print gave the U.S. stock market more fuel to push to new 2023 highs while the volatility index hit fresh lows. Let’s see what else you missed. 👀

Today’s issue covers inflation ahead of tomorrow’s Fed decision, Epic’s “victory royale” against Google, and Johnson controls losing control after earnings. 📰

Here’s today’s heat map:

8 of 11 sectors closed green. Financials (+0.74%) led, & energy (-1.35%) lagged. 💚

Paramount Global shares continued their two-day decline on news that it’s considering more than 1,000 layoffs. It comes as Shari Redstone holds talks to sell a controlling interest in National Amusements, which owns a controlling stake in Paramount Global. ✂️

Hasbro shares fell 1% on news it’ll lay off 1,100 workers. Management says weak toy sales have persisted into the holiday season after coming off historic, pandemic-driven levels. 🧸

Managed care stock Centene Corporation jumped 3% after raising its fiscal 2024 earnings guidance and authorized a $4 billion increase to its stock repurchase program. 🔺

Electric vehicle maker Lucid Group fell 8% after announcing that its chief financial officer, Sherry House, is stepping down, effective immediately. ⚡

Other symbols active on the streams: $CAVA (+19.64%), $SAVA (+5.96%), $RBLX (+3.83%), $ICVX (+49.48%), $AMC (-5.49%), $ORCL (-12.44%), $CCCC (+98.31%), & $INVZ (+13.04%). 🔥

Here are the closing prices:

| S&P 500 | 4,644 | +0.46% |

| Nasdaq | 14,533 | +0.70% |

| Russell 2000 | 1,881 | -0.13% |

| Dow Jones | 36,578 | +0.48% |

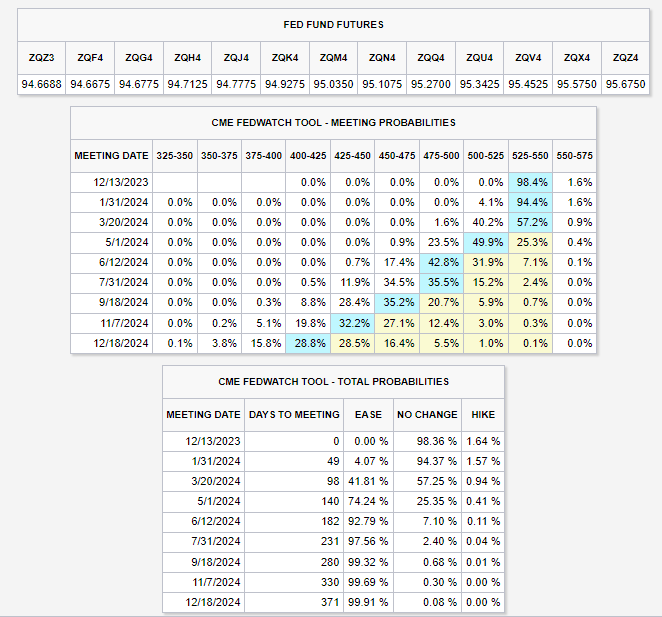

Tomorrow, the Federal Reserve will make its last interest rate decision for 2023 and update its economic projections. With the market increasing its probability of rate cuts throughout the last few months, it will be a closely watched and discussed event. 👀

We’ll get producer prices tomorrow morning, but today’s focus was on the consumer price index.

Headline CPI rose 0.1% MoM and 3.1% YoY, essentially in line with expectations. Additionally, the core index, which excludes food and energy prices, rose 0.3% MoM and 4% YoY. Those were also in line with estimates. 🔺

While continued disinflation is good news, the rate of change continues to slow. Shelter prices, which account for a third of the CPI weighting, rose 0.4% MoM and 6.5% YoY. That said, analysts still say the lagging impact from its calculation is the primary driver for it staying elevated. 🏘️

Overall, though, services inflation remains a sticky component and highlights the work the Fed still needs to do to achieve its 2% inflation target. Analysts say today’s report should temper the market’s expectations for rate cuts a bit, which it did.

However, looking into next year, the Fed Fund Futures market still shows the market expecting a rate cut as early as May of 2024, with several more to follow. That could be too aggressive and cause the stock and bond market to give back some of its recent gains. ◀️

As for the stock market, the bullish sentiment is alive and well. Not only did the S&P 500, Nasdaq 100, and Dow Jones Industrial Average hit new 2023 highs today. But the S&P 500 Volatility Index (VIX), commonly called the market’s fear gauge, hit new lows. 🐂

It’s unclear what the Fed will do and say tomorrow. But what is clear is that the bulls are betting on a supportive stance, given that the last two months have seen prices rally across the board. 🤷

Stocktwits’ Trading Competition lets you compete with traders from across the country. Watch as you rise in the ranks towards the top spot on the leaderboard! Do you have what it takes to be #1?

Earnings

Johnson Loses Control

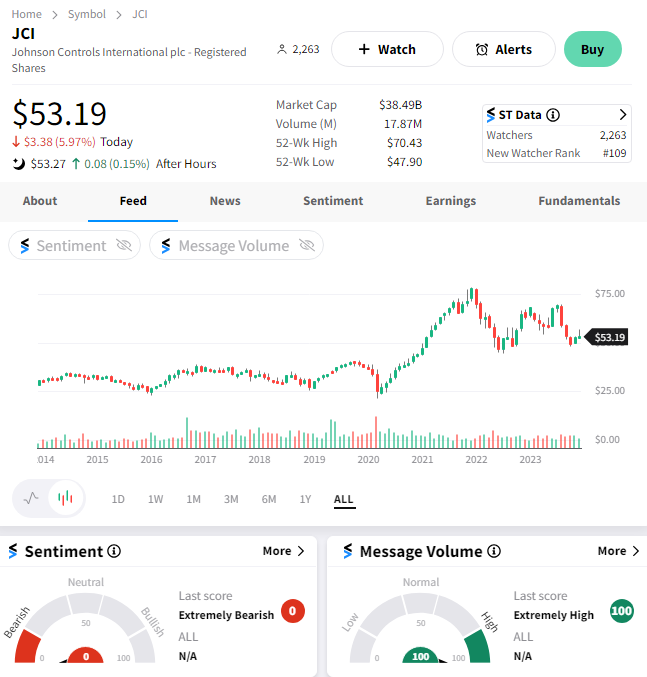

The multinational industrial conglomerate Johnson Controls International was back on investors’ radars as its stock price remained out of control. 🫨

The maker of building heating systems reported a 3% YoY increase in sales to $6.9 billion. Fourth-quarter adjusted earnings per share of $1.05 was up 6% YoY. As for orders, they rose 9% YoY organically, and its record backlog of $12.1 billion was also up 9% YoY. 📊

CEO George Oliver said the company continues to post strong sales growth and margin expansion and is entering its new fiscal year with a record backlog. Strength in both its install and service businesses throughout this year shows the company’s value proposition, even in a challenging macroeconomic environment.

With that said, the company’s adjusted earnings guidance for fiscal 2024 missed estimates. It now expects $3.65 to $3.80 per share vs. the $3.92 consensus view. Organic sales growth of mid-single-digits is also likely, either inline or a slight downtick from current levels. 🔻

Overall, investors remain concerned that weakness in its Asia-Pacific region will continue due to China’s slow economic turnaround. Should its other markets continue to slow, that would weigh further on overall results. Hence, management used an optimistic but cautious tone.

$JCI shares fell 6% on the day and are at the lower end of a three-year trading range. 📉

Company News

Epic Wins A “Victory Royale” Against Google

It’s been three years since Fornite-maker Epic Games sued Apple and Google for allegedly running illegal app store monopolies. And despite losing a similar battle against Apple, the game-maker has secured a win against Google. 🏆

The jury in Epic v. Google delivered its unanimous decision after just a few hours of deliberation. They found a few key things:

- Google has monopoly power in the Android app distribution markets and in-app billing service markets, and Google did anticompetitive things in those markets.

- Google has an illegal tie between its Google Play app store and Google Play Billing payment services.

- Google’s distribution agreement, Project Hug (which deals with game developers), and deals with OEMs are all anticompetitive.

Most importantly, it found that Epic was injured by the behaviors above.

Epic Games said in a company blog, “Today’s verdict is a win for all app developers and consumers around the world. It proves that Google’s app store practices are illegal and they abuse their monopoly to extract exorbitant fees, stifle competition, and reduce innovation.”

Google plans to challenge the verdict, saying that the trial made it clear that it competes fiercely with Apple’s App Store and app stores on Android devices and gaming consoles. 👎

However, it’s important to note that this victory is not quite sealed yet. Judge James Donato will decide the appropriate remedies, given that Epic never sued for monetary damages. Instead, it wants the court to tell Google that every app developer has total freedom to introduce its own app stores and billing systems on Android. 🧑⚖️

The judge has already said he will not decide what percentage fee Google should charge for its products, among other things. As a result, we’ll have to wait and see what happens when both parties meet the judge in January to hash out a remedy.

Google shares were down marginally on the news. But the broader implications of this trial are likely to be a major deal for Google, Apple, and other tech giants, as this battle represents just one part of a much larger conflict in the tech space. ⚔️

Bullets

Bullets From The Day:

🏨 Choice Hotels goes hostile in Wyndham takeover bid. The company has failed repeatedly to reach a deal with the rival hotel chain, with its last bid coming in at $49.50 in cash and 0.324 shares of Choice common stock. That offer gave Wyndham shareholders the option to choose between cash, shares, or a combination of the two. In order to increase the pressure, Choice accumulated about 1.5 million shares worth more than $110 million and plans to nominate a slate of directors at Wyndham’s 2024 annual shareholders meeting. AP News has more.

❌ Sanofi scraps $750 million drug deal due to FTC’s antitrust suit. The French pharmaceutical company is no longer pursuing its $750 million drug licensing deal with California-based Maze Therapeutics, just hours after the Federal Trade Commission (FTC) sued to block the agreement. The global licensing deal was for a Phase 1 drug candidate focused on a rare genetic condition called Pompe disease. It included $150 million up front and $600 million in earnouts. More from Axios.

🤖 Snapchat+ upgrades its value proposition with AI-generated images. The social media platform is releasing a few new AI-powered features for its premium subscribers. Most notable is that users can now create and send AI-generated images based on a text prompt, also gaining access to a new AI extend tool allowing them to use the app’s Dream selfie feature with friends. While Snapchat has not shared which specific model is powering this feature, it says it’s secured several deals with partners to use their foundational models. TechCrunch has more.

💸 Renault sells 5% of its Nissan stake at a 1.5 billion euro loss. This is the French carmaker’s first stage of a planned reduction of its holdings, which will bring its stake in the Japanese auto group Nissan down from 43% to 15%. The two automakers agreed in July to restructure their alliance, aiming to have cross-shareholdings of 15% as part of their new path forward. However, the recent decline in market value means that Renault’s 17.5 billion euro valuation of Nissan shares on its books will have to be adjusted for losses as it sells shares at a lower market price. More from Reuters.

🏬 Philadelphia-based mall owner files for second bankruptcy in three years. Penn REIT’s 2020 bankruptcy deal was supposed to provide a bridge to better times ahead, but then the Federal Reserve (and open market) started raising interest rates. Pennsylvania Real Estate Investment Trust (PREIT) filed for Chapter 11 bankruptcy again, effectively making it a Chapter 22, which is industry slang for a repeat filer. It tried to raise cash by selling assets, but just one of the 50 potential buyers it approached showed interest in the mall sector assets. Its initial bankruptcy was set to give it more time to stage a post-covid turnaround, but it never materialized. Axios has more.

Links

Links That Don’t Suck:

🛍️ The art and science of hyper-personalized shopping

👍 Pfizer gets OK for $43-billion Seagen deal after donating cancer drug rights

🛬 Delta passengers stranded at remote military base after flight diverted to Canada

🔋 Panasonic Energy strikes silicon anode supply deal with Sila for lithium-ion batteries

💳 Police warn holiday shoppers about card draining: What to know about the gift card scam

📝 Sports Illustrated publisher fires CEO in latest round of exec terminations following AI scandal