After running higher ahead of big tech earnings, the major indexes pulled back as several economic bellwethers shared a cautious business outlook. Let’s see else what you missed. 👀

Today’s issue covers UPS failing to deliver again, traders selling the big-tech earnings news, and a look at Nvidia’s increasingly steep ascent. 📰

Here’s today’s heat map:

6 of 11 sectors closed green. Financials (+1.26%) led, & real estate (-0.93%) lagged. 💚

Home prices fell by 0.2% MoM in November after posting nine straight months of gains, with the most significant declines coming in Seattle and San Francisco. Prices were still up 5.1% YoY, with Miami, Tampa, Atlanta, Charlotte, New York, and Cleveland seeing prices hit all-time highs. 🏘️

The U.S. initial public offering (IPO) market remains mixed. Renault canceled its plans to bring electric-car unit Ampere public due to market conditions. Meanwhile, Swiss cement maker Holcim plans to test its luck, spinning off its North American operations in a $30 billion U.S. IPO. 💰

Layoffs continue in the payments space. PayPal cut 9% of its workforce after the company’s “innovation event” failed to impress, and Jack Dorsey’s Block laid off 1,000 workers. 💳

Short sellers are once again targeting the “for-profit” college sector, with Fahmi Quadir’s report sending Adtalem Global Education shares down 18% on the day. Activist investors are also battling over Gildan Activewear, with one group attempting to bring back its fired CEO. 🎯

Tesla shares fell after a Delaware judge agreed to void Elon Musk’s $56 billion compensation package from the company. The ruling agreed that the Board of Directors inappropriately set Musk’s pay package, so the parties must agree on the next steps and submit them to the judge for approval. 🧑⚖️

Other symbols active on the streams: $SOFI (-8.30%), $LC (-6.63%), $GM (+7.80%), $SLB (-7.24%), $SANM (+28.20%), $POWL (+15.74%), $MSCI (+9.31%), $PEPG (+50.76%), & $VXRT (+11.21%). 🔥

Here are the closing prices:

| S&P 500 | 4,925 | -0.06% |

| Nasdaq | 15,510 | -0.76% |

| Russell 2000 | 1,996 | -0.76% |

| Dow Jones | 38,467 | +0.35% |

Earnings

UPS Fails To Deliver (Again)

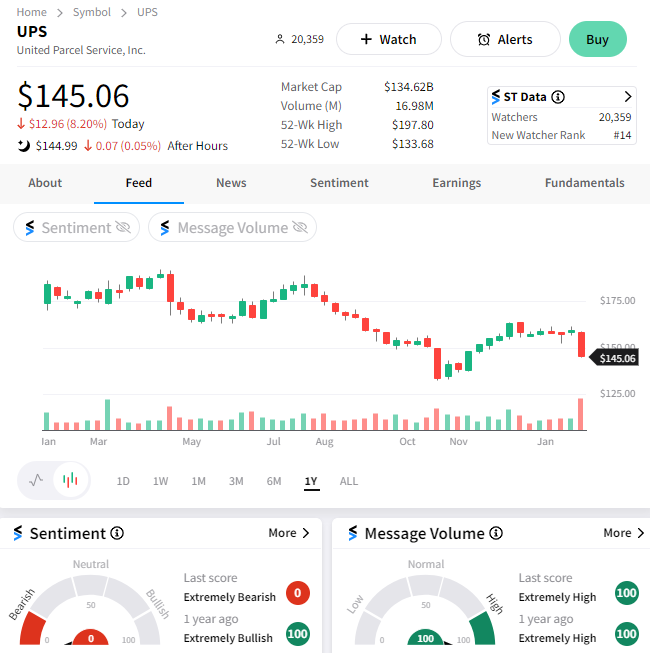

United Parcel Service returned to the spotlight today, but not for a positive reason. The transportation stock slumped once again after failing to deliver on earnings. ☹️

The shipping giant earned $2.47 per share on $24.90 billion in revenues during the fourth quarter. Those were mixed versus estimates of $2.44 and $25.40 billion, but its operating profit also missed.

While its recent labor negotiations with the Teamsters union are partially to blame, the core trend of declining shipping volumes remains. Volumes in the U.S. fell 7.40% YoY and 8.30% internationally. Management had been sustaining margins by raising prices but had to slow further increases as customers pushed back. 📦

Since the demand side of the equation remains weak, the company is again turning to cost-cutting. It plans to reduce its workforce by 12,000 people in 2024 to help boost short-term results and buy time for incremental price increases to help restore margins. It’s anticipating a half-point rise in operating profit margins each year for the next three years.

Unfortunately, that recovery will occur much more slowly than Wall Street had hoped. Full-year 2024 guidance for operating margins, profit, and sales was well below consensus estimates. 👎

As a result, $UPS shares fell another 8% on the day. They’re sitting roughly 40% below all-time highs while the broader market indexes hit new highs daily. With the path forward unclear, the Stocktwits community is maintaining an “extremely bearish” view of the stock. 🐻

Sponsored

Falcon’s Winter Sale: Elevate Your Trading Computer and Save $100

Step into the new trading season with Falcon Trading Systems’ Winter Sale! We’re offering an exclusive $100 discount on our high-performance trading computers, designed specifically for traders like you.

As your trusted tech partner, Falcon provides more than just a product. We provide 20 years of expertise, lifetime support, and a 5-year warranty. We’re committed to your success, providing you with the tools you need to excel in the trading market.

Experience unmatched speed, powerful processors, and the ability to manage multiple monitors simultaneously – all at an unbeatable price. Don’t miss your chance to invest in your future with Falcon and save big this winter. The clock is ticking, so secure your discount today with code WINTER2024 and unlock limitless trading possibilities!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

Traders Sell Big-Tech Earnings

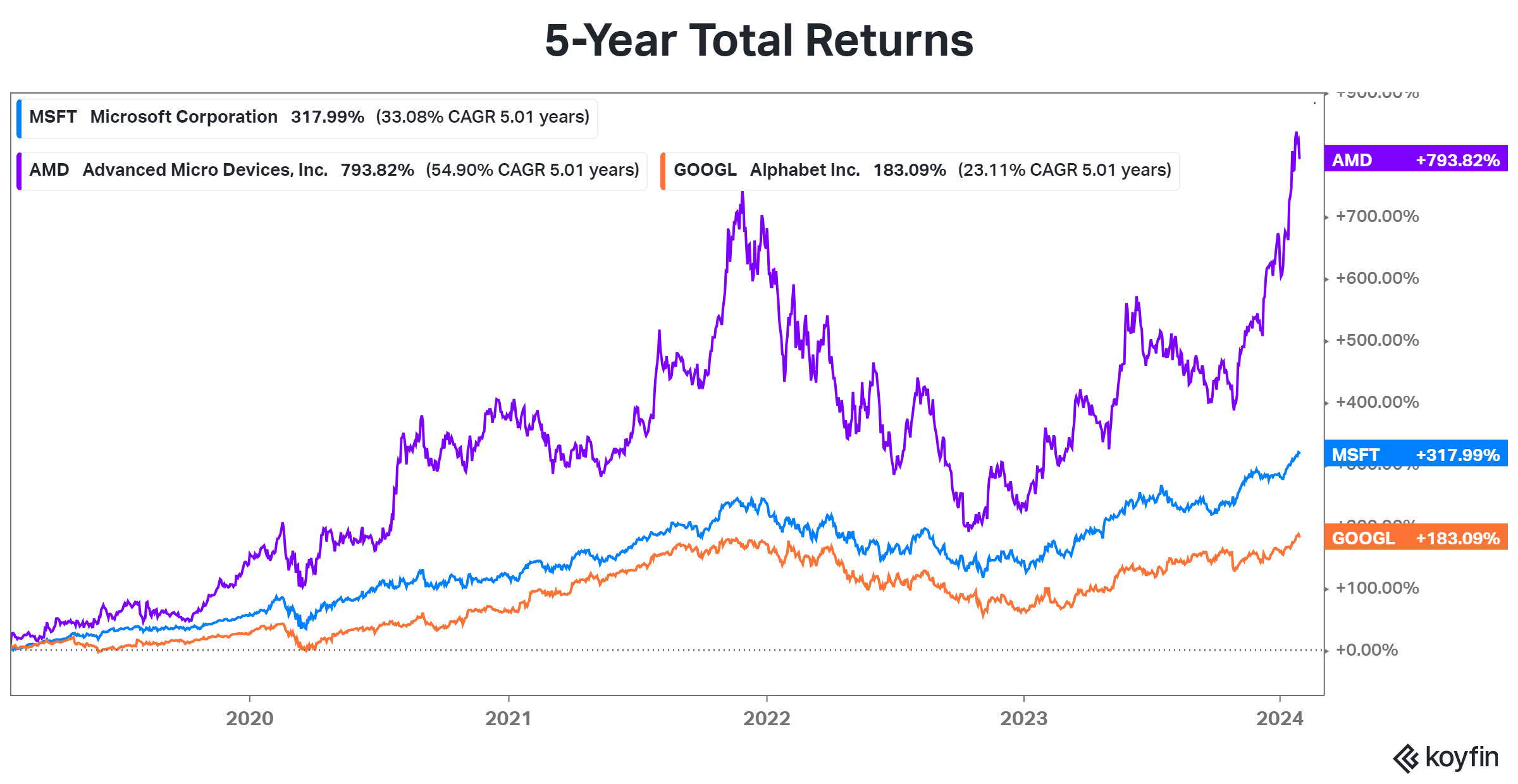

The “Magnificent Seven” stocks and other tech sector leaders have rallied significantly over the last three months. But with earnings season upon us, some are not living up to expectations.

Investors are selling Microsoft, Alphabet, and AMD shares after their reports, so let’s recap. 👇

First, we’ll start with $3 trillion Microsoft. The company’s earnings per share of $2.93 and revenues of $62.02 billion topped expectations of $2.78 and $61.12 billion. 💪

Revenues rose 17.6% YoY, with its Intelligent Cloud segment revenues increasing 20% YoY and beating the consensus view of $25.29 billion. Azure and other cloud services revenue rose 30%, up from the previous quarter’s 29%, beating Wall Street’s expectation for a slight QoQ decline. Its Productivity and Business Processes unit and Personal Computing segments also exceeded expectations, growing 13% and 19%, respectively. ⛅

Given the intense focus on cloud and artificial intelligence (AI) these days, investors were happy to see that the segment is firing on all cylinders. $MSFT shares are down marginally after the bell.

Unfortunately for Alphabet, delivering its fastest quarter of revenue growth since early 2022 was not enough to satisfy investors. Sales jumped 13% YoY, with Google Cloud revenue of $9.19 billion vs. the $8.94 billion expected. 📊

However, softer-than-expected ad revenue is weighing on the stock. YouTube ad revenue essentially matched expectations, but traffic acquisition costs were about $200 million shy of traffic acquisition costs. Last quarter, the concern was Google’s cloud business, and now it’s the core advertising segment. So, investors are frustrated it couldn’t deliver an “all-around” solid quarter.

Like other tech giants, Alphabet is cutting costs and restructuring its efforts around core products and initiatives. The company recently faced backlash from employees claiming leadership lacks a clear vision. $GOOGL shares are down about 6% after the bell. 😡

Lastly, chipmaker Advanced Micro Devices is falling despite solid data center segment revenue. It reported fourth-quarter adjusted earnings per share of $0.77, matching estimates. Revenue came in slightly ahead at $6.20 billion vs. $6.13 billion.

Fourth-quarter revenues were up 10% YoY, but full-year numbers were down 4%. Full-year net income also fell 35% on slipping margins, but data center revenues remained a bright spot, rising 38% YoY in the fourth quarter and 7% for the full year. 🔺

However, the company is struggling after forecasting first-quarter revenue of $5.10 to $5.70 billion, below the consensus estimate of $5.73 billion. $AMD shares are down 6% after hours.

With all these stocks selling off from all-time highs, we’ll have to see how quickly investors step in to “buy the dip.” With many missing the discounted prices of 2022, some may be tempted to jump back in despite the mixed earnings results. 🤷

Stocktwits Spotlight:

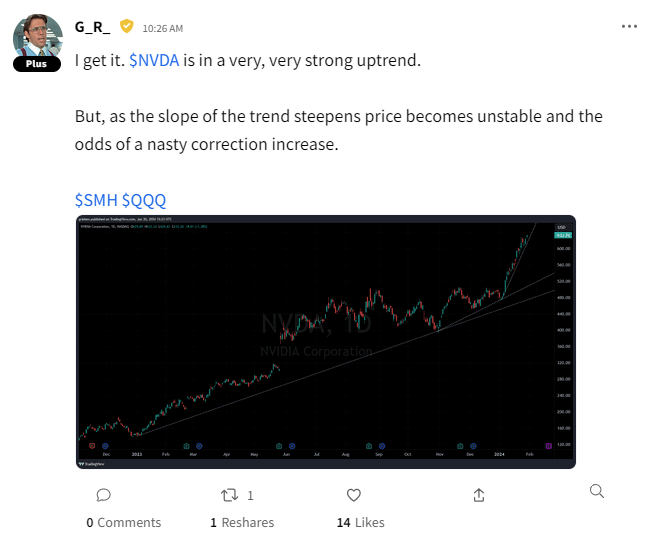

With today’s big tech earnings failing to impress, some investors are becoming concerned about the steep ascents in stocks like Nvidia. After all, a rapidly rising stock price amid already high expectations could set shareholders up for disappointment. 📈

Stocktwits user G_R_ pointed out the precarious angle Nvidia’s trend has taken. He warned that despite the stock being in a very strong uptrend, a sharply increasing price slope creates instability and increases the odds of a “nasty” correction. ⚠️

Although the chipmaker doesn’t report results until February 21st after the bell, bad news from its competitors could spark some weakness in its shares- weakness that it might not easily absorb given how swiftly prices have ascended recently.

It’s also interesting to note that the 3x Semiconductor Bear ETF $SOXS was trending on Stocktwits today, suggesting some traders are looking for weakness in the sector.

As always, time will tell. If you want to remain updated on this chart and see more like it, follow Bill_Lumbergh on Stocktwits! 👀

Bullets

Bullets From The Day:

🤑 World’s largest sovereign wealth fund posts a record 2023 profit. Strong returns on its technology stock investments helped propel Norway’s fund to a $213 billion profit last year, following a record loss of about $164 billion in the year prior. Its equity investments returned 21.3%, fixed income investments were 6.1%, and unlisted real estate fell 12.4%. CNBC has more.

✂️ TechCrunch sunsets subscription product amid layoffs. The Yahoo-owned technology publisher laid off eight staff members and is shutting down its subscription product, TC+, after five years. The move is part of a larger restructuring that looks to refocus its coverage around the investors, founders, and startups of Silicon Valley. Meanwhile, Yahoo spent the last year undergoing cost-cutting measures as it scales back its advertising technology footprint. More from AdWeek.

🏢 IBM gives managers an option: get back to the office or leave. The company is the latest tech giant to reduce its headcount by reducing remote work. It’s asking all of its U.S. managers to report to an office or client location at least three days a week. Employees who cannot live within 50 miles of those locations or obtain a remote position must leave the company. Business Insider has more.

🏗️ Chinese property giant Evergrande ordered to liquidate. A Hong Kong court’s order to liquidate China Evergrande, the world’s most heavily indebted real estate developer, is just a tentative step toward resolving a broader debt crisis. The company currently owes $340 billion to its creditors, but experts say it’s unclear if the order will be enforced in mainland China, where 90% of its assets are based. More from AP News.

🏦 NY AG sues Citibank over recent hacks and scammer activity. New York Attorney General Letitia James filed a lawsuit against the bank, alleging it failed to do enough to protect and reimburse victims of fraud. The suit argues New York customers lost millions of dollars to scammers and hackers because of Citi’s weak security and anti-fraud measures. CNN Business has more.

Links

Links That Don’t Suck:

😍 Introducing Stocktwits Edge: Unique social data, extended market lists, and an ad-free experience.

🏬 Walmart announces 3-for-1 stock split as shares hover below all-time high

✈️ Ryanair tells Boeing it would buy any MAX 10 orders dropped by U.S. airlines

🧠 Elon Musk says his Neuralink startup has implanted a chip in its first human brain

💊 Experimental pain drug may offer alternative to opioids for acute pain, study suggests

🫒 Starbucks’ olive-oil Oleato drinks, dubbed ‘a legit laxative,’ are now launching nationwide