The great thing about leap years is there’s one more trading day in February, and the bulls certainly took advantage of it by starting the month off on a solid note. Let’s see what you missed. 👀

Today’s issue covers Meta maturing as Amazon embraces AI, Ferrari racing while Peloton plummets, and an under-the-radar solar technology stock soaring. 📰

Here’s today’s heat map:

10 of 11 sectors closed green. Consumer staples (+2.04%) led, & energy (-0.01%) lagged. 💚

Brazil, Chile, and Colombia cut interest rates again as the Latin American countries’ central banks look to drive growth despite inflation risks. Meanwhile, developed markets like the Bank of England left policy unchanged and said future decisions are “under review.” ⏯️

Jobless claims rose to a nearly 3-month high, with January marking the second-highest layoff total and lowest planned hiring level since 2009. That trend continued today as Deutsche Bank planned another 3,500 job cuts, and Okta let 7% of its staff go. Labor costs continue to cool, with productivity growth rising more than anticipated during the fourth quarter. 💼

U.S. regional bank stocks remained under pressure following yesterday’s New York Community Bancorp scare. However, American banks aren’t the only ones worried about property loan losses. Japan’s Aozora Bank flagged its first annual net loss in fifteen years following massive loan-loss provisions for U.S. commercial property. ⚠️

Activist investors continue to target beaten-down stocks that haven’t participated in the strong rally of the last 15 months. Elliott Management has taken a 13% stake in e-commerce firm Etsy, sending shares up over 9%. And railroad stocks are back in vogue after Norfolk Southern rose 7% on news that an investor group led by Ancora Holdings took a significant stake to gain board control. 💰

Other symbols active on the streams: $SMCI (+10.18%), $WOLF (-13.61%), $TEAM (-5.67%), $DECK (+8.05%), $BOOT (+10.31%), $SKX (-6.74%), $ZIM (-11.60%), $MSOS (+7.25%), & $LINK.X (+8.90%). 🔥

Here are the closing prices:

| S&P 500 | 4,906 | +1.25% |

| Nasdaq | 15,362 | +1.30% |

| Russell 2000 | 1,974 | +1.39% |

| Dow Jones | 38,520 | +0.97% |

Earnings

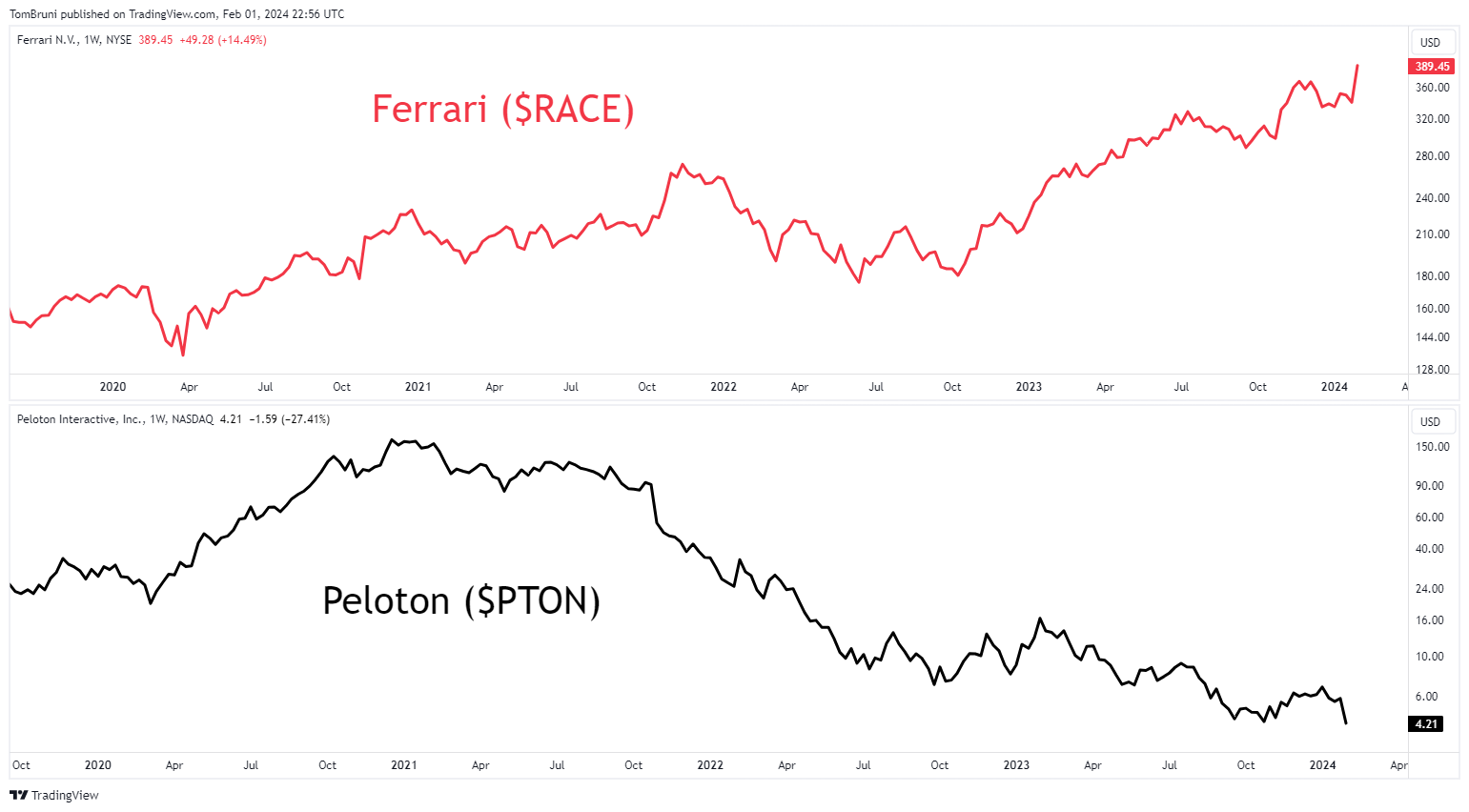

Ferrari Races & Peloton Plummets

Today, we’re looking at two companies in the vehicle space: one that goes very fast and another that doesn’t move at all. In terms of stock prices, one is making all-time highs, the other all-time lows. 👀

Starting with luxury sports car manufacturer Ferrari, the automaker closed out 2023 with a record year of profits. Full-year revenues jumped 17%, with net profits of $1.36 billion. However, these records are expected to be short-lived…with management anticipating business momentum to continue in 2024. Additionally, shares were supercharged by reports that Formula 1 star Lewis Hamilton could make a surprising move from Mercedes to Ferrari in 2025. 🏎️

Meanwhile, stationary bike manufacturer and fitness company Peloton plummeted again following its results and outlook. The company’s loss per share of $0.54 was $0.01 larger than expected, while revenues of $743.6 million narrowly topped estimates. Once again, its guidance came up short, forecasting a third-quarter adjusted EBITDA loss 10-15x larger than analysts anticipated. 🚲

After two years of executing Barry McCarthy’s turnaround plan, its results have failed to deliver. It now expects sales growth by the end of June, but many investors aren’t waiting around to find out.

$RACE shares soared to fresh all-time highs, while $PTON shares dipped to new lows. Despite coming into today in extremely bearish territory, the Stocktwits community has surprisingly turned extremely bullish on Peloton after today’s news.

We’ll have to see if that optimism pays off. As the fitness saying goes — no pain, no gain, right? 🤕

Sponsored

FibroBiologics Direct Listing Available on NASDAQ

Did you know that the stem cell revolution began with fibroblasts? FibroBiologics is fibroblasts. FibroBiologics is harnessing the power of fibroblasts to develop a pipeline of treatments and potential cures for chronic diseases using fibroblast cells and fibroblast-derived materials.

Fibroblasts are known for their ability to be easily sourced, cultured, and differentiated, but also possess stem-cell-like immune-modulating and anti-inflammatory properties.

FibroBiologics strives to leverage these advantages into effective treatments for conditions as diverse as multiple sclerosis, degenerative disc disease, wound healing, thymic involution, and cancer.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

Meta Matures And Amazon Embraces AI

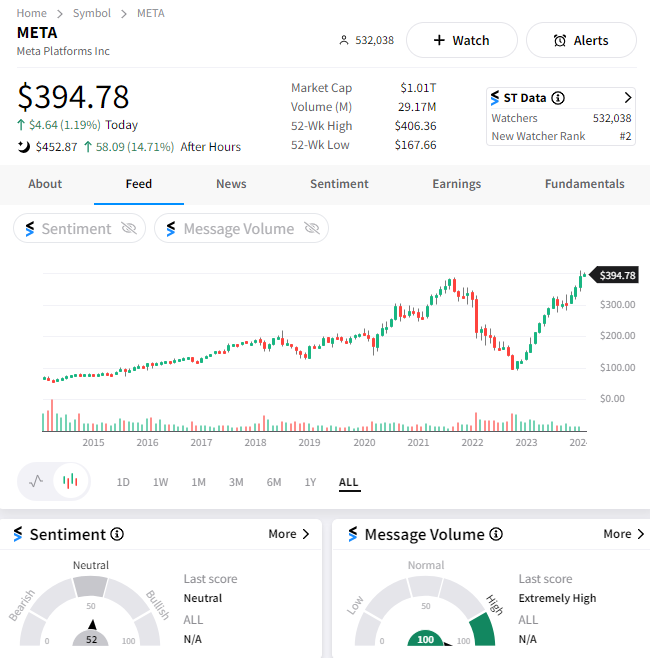

Meta’s Mark Zuckerberg has finally grown up, issuing the company’s first-ever quarterly dividend while announcing record results. 🤩

The company’s revenues jumped 25% YoY in the fourth quarter, while expenses fell 8%. That propelled earnings well above expectations, with revenues also beating as its core advertising business continues to rebound. Daily active users (DAUs), monthly active users (MAUs), and average revenue per user (ARPU) all beat expectations as well.

With its cost-cutting efforts mostly done and its operating margin more than doubling from a year ago, the company is flush with cash. And while it’s still investing heavily in longer-term bets like Reality Labs, it’s also looking to appease a wider investor base. As a result, it announced a $0.50 per share quarterly dividend and a whopping $50 billion share buyback program. 🤑

The company’s first-quarter sales guidance and full-year expense estimates also topped estimates, delivering an overall solid quarter. With it topping a $1 trillion market cap and padding its shareholders’ pockets with excess cash, investors say the company has finally “matured.” 👴

While some see that as a positive, others suggest that it’s a sign that it has few other places left to invest its cash in driving growth, which is the same type of argument being made about Apple, Google, and other mega-cap tech stocks.

Ultimately, we’ll have to wait and see. But for now, the market is loving it, with $META shares rising 15% to an all-time high. Interestingly enough, the Stocktwits community is talking a lot about the stock, but sentiment is sitting in neutral territory. We’ll be watching closely to see how that develops as the market digests this news. 👀

Meanwhile, Amazon reported better-than-expected results, with revenue jumping 14% YoY. Advertising was again a bright spot, topping estimates by $500 million, while Amazon Web Services (AWS) met expectations at $24.2 billion.

While CEO Andy Jassy says that generative artificial intelligence (AI) services remain a “relatively small” business, the company believes they could drive “tens of billions” in revenue within the next several years. As a result, it’s looking to integrate AI across all its business lines. One that investors are excited about is a generative AI shopping assistant, Rufus, which could help drive more sales in its core business over time. 🤖

Apple was the one exception today, falling about 3% after reporting results. Although its revenue grew for the first time in a year, a 13% decline in Chia sales has investors worried about one of the company’s key growth markets. Other than services and iPad revenues, most other metrics topped estimates. 🍎

Stocktwits Presents “Trends With Friends”

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends discuss:

- Markets: Sector rotation, JC’s favorite stock, and Chinese ETFs 🤩

- Health: The pivotal role of sleep and the importance of limiting unforced errors 🛌

- WTF Moment: How Howard’s friend lost his finger to an alligator 🤯

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

Stocktwits Spotlight:

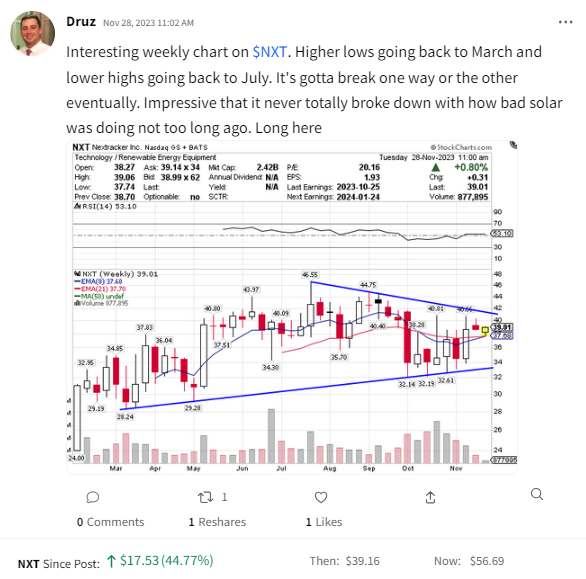

In general, the solar industry and clean energy have been tough places for investors these last three years. However, there are always outliers that manage to buck the trend and shine bright. 🌞

Nextracker is one of those companies. The manufacturer of systems that direct solar panels toward the sun soared today after increasing its full-year revenue and adjusted earnings forecast. Management said that as the world transitions to renewable energy, the company is well positioned as the global leader in trackers, with much more innovation to come…

With under 500 followers on Stocktwits and very few analysts covering the stock, we want to shout out Stocktwits user Druz for a solid call on the stock. He pointed out the strong chart setup in late November and got long on the breakout. Prices have since jumped more than 44% while the solar sector ETF (and others) sit stagnant near 52-week lows. 📈

But as most experienced market participants know, simply identifying a great idea doesn’t guarantee you’ll make money. We love the transparency on his stream, where he talked through the reasons why he didn’t hold the stock into earnings and how he might adjust to future situations.

Honesty and transparency in the trading game are hard to come by. If you like his style and want to hear more from Craig, follow him on Stocktwits! 👀

Bullets

Bullets From The Day:

🛢️ Shell reports lower profits after energy prices cool. After a record 2022, oil and gas giants like Shell are reporting lower annual profits due to lower energy prices. Management also said lower volumes being traded and lower margins for refining caused annual profits to fall from nearly $40 billion in 2022 to $28 billion in 2023. However, January was the first month since September that energy prices closed higher, and analysts expect 2024 to remain unpredictable given the election year in the U.S. and geopolitical turmoil in the Middle East. BBC News has more.

🤠 Elon Musk wants to incorporate Tesla in Texas. After a Delaware court ruling struck down the billionaire’s record Tesla pay package, Musk is seeking shareholder approval to incorporate the company in Texas. While Delaware is famously one of the world’s most welcome places for companies to incorporate for legal and tax purposes, Musk does not want Tesla to be one of the 70% of Fortune 500 companies that call it home. The situation adds more uncertainty to a business already struggling with many headwinds in its core business, so we’ll have to see how the stock handles the news. More from CNN Business.

🔐 Disney’s streaming service joins Netflix in cracking down on password sharing. The media giant has updated the language of its three streaming platforms to limit password sharing outside of a user’s account. The changes will be effective for all new subscribers and roll out to existing subscribers beginning on March 14th. In an increasingly competitive market where incremental price changes are the norm, one of the key ways streaming platforms are padding growth is by forcing their existing user base to pay for their own accounts. The crackdown did not hurt Netflix, but we’ll have to see if Disney has the same pull with consumers. NBC News has more.

🪫 Volvo is the latest carmaker to pull back its EV efforts. Swedish automaker Volvo saw shares soar after saying it would top funding Polestar Automotive Holding and was handling responsibility for the struggling luxury car brand over to China’s Geely Holding. Like other electric vehicle (EV) startups, the company has struggled to make headway since Tesla started its price war last year. Polestar’s shares are down over 80% since going public via SPAC, showcasing that traditional automakers’ transition to the EV space is far more challenging than anticipated. Reuters has more.

👨💼 Swiss bank CEO resigns during shift away from the private debt business. Julius Baer is setting more than a half-billion Swiss francs over its exposure to bankrupt Austrian asset manager Signa. Its CEO will leave, with the board saying that management “has not been a good steward of our firm” but that troubles were with a “single credit event” and that the rest of the bank is performing well. Its exit from the private debt business will bring net credit losses to about $702 million and pave the way for a brighter future. AP News has more.

Links

Links That Don’t Suck:

🧑🏻💻 Falcon Trading Systems’ Winter Sale 🚀❄️💻 — Upgrade & Save on a High-Performance Trading Computer*

🤖 GenAI can help small companies level the playing field

🥳 Wings, shrimp and booze: Super Bowl party hosts budget carefully this year

⚠️ Rights group warns major carmakers over risk of forced labor in China supply chains

☢️ New-wave reactor technology could kick-start a nuclear renaissance — the US is banking on it

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.