Meta’s Mark Zuckerberg has finally grown up, issuing the company’s first-ever quarterly dividend while announcing record results. 🤩

The company’s revenues jumped 25% YoY in the fourth quarter, while expenses fell 8%. That propelled earnings well above expectations, with revenues also beating as its core advertising business continues to rebound. Daily active users (DAUs), monthly active users (MAUs), and average revenue per user (ARPU) all beat expectations as well.

With its cost-cutting efforts mostly done and its operating margin more than doubling from a year ago, the company is flush with cash. And while it’s still investing heavily in longer-term bets like Reality Labs, it’s also looking to appease a wider investor base. As a result, it announced a $0.50 per share quarterly dividend and a whopping $50 billion share buyback program. 🤑

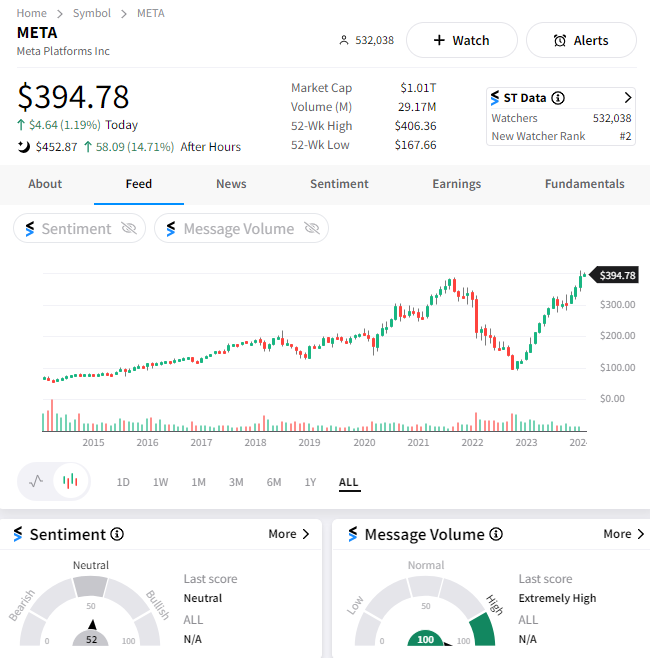

The company’s first-quarter sales guidance and full-year expense estimates also topped estimates, delivering an overall solid quarter. With it topping a $1 trillion market cap and padding its shareholders’ pockets with excess cash, investors say the company has finally “matured.” 👴

While some see that as a positive, others suggest that it’s a sign that it has few other places left to invest its cash in driving growth, which is the same type of argument being made about Apple, Google, and other mega-cap tech stocks.

Ultimately, we’ll have to wait and see. But for now, the market is loving it, with $META shares rising 15% to an all-time high. Interestingly enough, the Stocktwits community is talking a lot about the stock, but sentiment is sitting in neutral territory. We’ll be watching closely to see how that develops as the market digests this news. 👀

Meanwhile, Amazon reported better-than-expected results, with revenue jumping 14% YoY. Advertising was again a bright spot, topping estimates by $500 million, while Amazon Web Services (AWS) met expectations at $24.2 billion.

While CEO Andy Jassy says that generative artificial intelligence (AI) services remain a “relatively small” business, the company believes they could drive “tens of billions” in revenue within the next several years. As a result, it’s looking to integrate AI across all its business lines. One that investors are excited about is a generative AI shopping assistant, Rufus, which could help drive more sales in its core business over time. 🤖

Apple was the one exception today, falling about 3% after reporting results. Although its revenue grew for the first time in a year, a 13% decline in Chia sales has investors worried about one of the company’s key growth markets. Other than services and iPad revenues, most other metrics topped estimates. 🍎