Crypto traders and investors rejoice; it was the best weekly close for cryptos in sixteen weeks! Will it last? The Total Market Cap is back up to $936 billion, a 10% gain. And the Altcoin Market Cap is back at $520 billion, or 8% higher.

But – there’s always a but – it’s Friday, and the weekend is coming. Weekends are notoriously hideous and volatile for crypto. And given that volume is still near historic lows (despite being higher than the past few months), volatility risk remains elevated.

Today’s focus is on Ethereum ($ETH.X) and Cardano ($ADA.X). Ethereum’s exchange outflows have spiked, giving bulls some hope. We’ll also look at Cardano’s activity and the successful Vasil update on the test net.

As you navigate the turbulent waters of the crypto news stream, you get peppered with new updates and allegations regarding Celsius’ debacle. It’s like boating on the Missouri river – you can’t get anywhere without getting smacked in the face by a bajillion flying carp everywhere you go.

Expect to see some heavy updates to the continuing bloodbath with Celsius ($CEL.X) and Three Arrows Capital nightmare in next week’s Litepapers.

Here’s how crypto looked at the end of the regular trading day:

| Cardano (ADA) |

$0.468

|

-2.67% |

| Binance Coin (BNB) |

$242.01

|

0.21% |

| Bitcoin (BTC) | $21,778.41 | 0.48% |

| Dogecoin (DOGE) |

$0.071

|

-0.71% |

| Ethereum (ETH) |

$1,237.62

|

0.09% |

| Polkadot (DOT) | $7.11 | -2.60% |

| Solana (SOL) |

$38.98

|

1.30% |

| XRP (XRP) |

$0.343

|

0.26% |

| Altcoin Market Cap |

$522 billion

|

-0.23% |

| Total Market Cap |

$937 billion

|

0.17% |

Think of crypto outflows like Santa packing his sleigh to drop presents at your house. The more gifts thrown out of the workshop and into his sleigh, the happier you should be because it means more goodies for you.

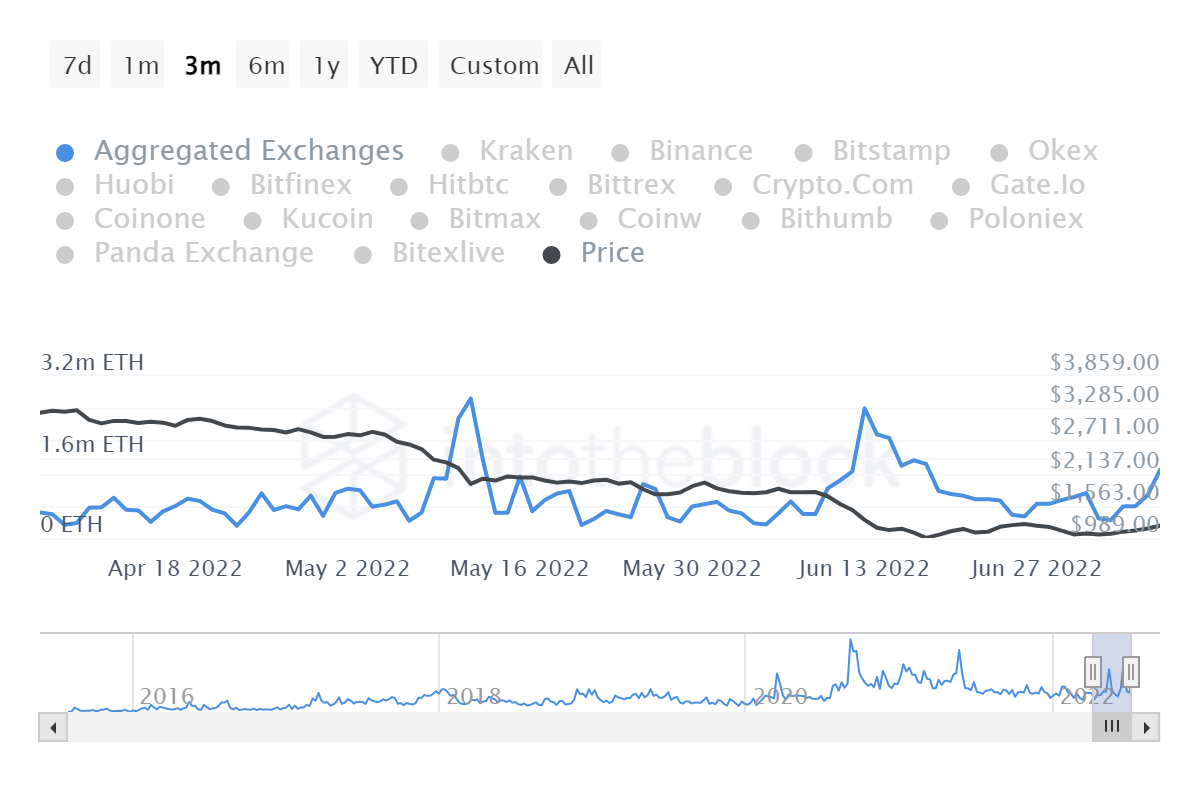

The image above shows Ethereum’s ($ETH.X) aggregated outflow volume from eighteen of the largest (by confirmed volume) crypto exchanges. Since July 3rd, there has been a massive spike in Ethereum leaving those exchanges.

In the last 24 hours, there has been a 55.5% spike in outflows. Over the previous seven days, that number is 66%, and it’s a whopping 86% for the past thirty days.

Large blocks between $100k and $250k of Ethereum have moved, indicating a high probability that those outflows are from the exchange’s OTC (over-the-counter) trading desks – which is most often institutional volume. This movement is interpreted as bullish because there’s less supply on the exchange, showing that ‘big money’ is hodling.

But it could also just be large chunks of Ethereum being moved from the same exchange’s wallet to another of its wallets – it is hard to tell. But the odds that all those outflows are just a shifting of intra-exchange wallets is low. No way to quantify that opinion, but that’s why it’s an opinion. 🚀

Crypto

Cardano Continues To Expand

The most important and anticipated update of Cardano’s ($ADA.X) network hit that blockchain’s testnet this week – with resounding success. The Vasil hard-fork increases the entire network’s scalability, efficacy, and efficiency. But, of course, the area that will most benefit from the upgrade is dapps.

Addressing concerns about the delay of Vasil, during one of his AMAs on YouTube, Cardano founder Charles Hoskinson cited the collapse of Terra’s Luna ($LUNA.X) as a reason to “… measure three times and cut once given the nature of things.”

Cardano has historically erred on the side of caution and takes more time as opposed to rushing goals to meet fanboy demand. Hoskinson last night confirmed that smart contracts wouldn’t need to be rewritten.

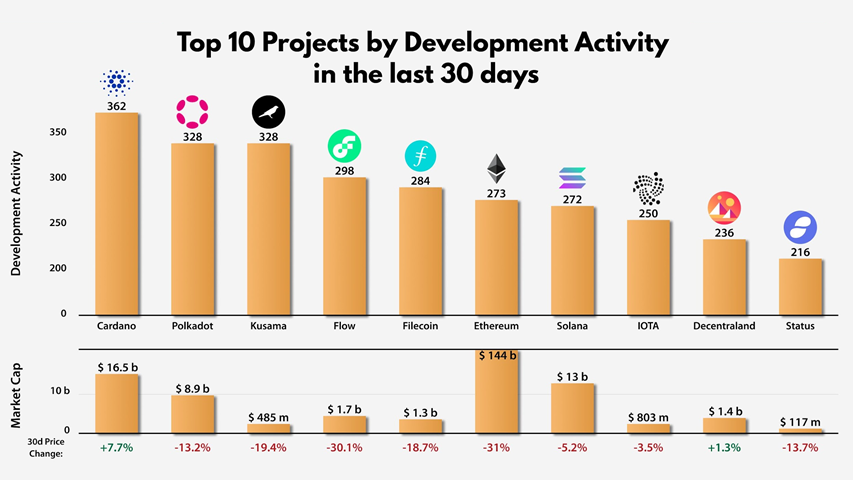

Activity on Cardano’s network continues to grow. In 2021, it was the most developed blockchain on Github. And despite the bearish price action across the cryptocurrency market, Sanbase reported that in June 2022, Cardano had the most development activity.

Despite all the haters, Cardano is one of the few altcoins released in late 2017 that has so far weathered two bear markets and has only seen activity and hodlership increase. Of course, it helps that the voice and face of your cryptocurrency doesn’t act like Willy Wonka. I mean the Johnny Depp Willy Wonka, not the Gene Wilder Willy Wonka. To be clear, Charles Hoskinson is the Gene Wilder Willy Wonka.

Understandably, this is very bullish, but there is no pamp for ADA yet – nor is there a damp. We’ll keep a close on how the market reacts to this news over the weekend and into next week. 🤞

Bullets

Bullets From The Day:

💵 FTX is putting its foot in the derivatives market door and wants to offer leverage to the individual investor instead of necessitating the use of a broker. The CME ($CME), naturally, opposes the proposal. A decision from the CFTC is expected in late 2022. Read the full story from thecoinrepublic.

🎁 Tron ($TRON.X) founder Justin Sun is ready to toss in a mere $5 billion to help crypto firms facing solvency and bankruptcy issues due to the current crypto bear market. Sun said he is interested in helping both centralized and decentralized financial platforms. More at The Block.

⛏ Bitcoin mining giant Marathon Digital bucks the trend of other miners selling their BTC or shutting down. According to the company, they have not sold any BTC since 2020 and continue to ramp up their mining. See how well their cash flow and balance are doing from bitcoinist.

🌋 Mt. Gox creditors are close to getting things finalized and repaid. Years in the working, a resolution for victims of one of the biggest hacks in cryptocurrency history has those people happy – but will it result in another sell-off for the crypto market? See what experts have to say in Finbold.