While the stonk market may be done for 2022, crypto has one more day left after today.

Today’s Litepaper will look at some of the major records the crypto market made in 2022 and the ten Stocktwits crypto indices and how they performed, from best to worst, in 2022.

The daily top ten best performers are in the green. And because it’s 2022 still and weird is normal, the Total Market Cap and Altcoin Market Cap are still slightly in the red.

$SOL.X is trying to go out with a bang, up almost +20% today, easily the best performer.

Here’s how the rest market looked at the end of the trading day:

| Solana (SOL) |

$9.88

|

19.38% |

| Litecoin (LTC) | $68.13 | 2.66% |

| TRON (TRX) | $0.054 | 1.92% |

| Polkadot (DOT) | $4.33 | 1.47% |

| XRP (XRP) |

$0.34

|

1.20% |

| Cardano (ADA) | $0.245 | 1.18% |

| Avalanche (AVAX) | $10.87 | 1.02% |

| Uniswap (UNI) | $5.07 | 0.70% |

| Monero (XMR) | $146.04 | 0.65% |

| Cosmos (ATOM) | $9.33 | 0.40% |

| Altcoin Market Cap |

$436 Billion

|

-0.32% |

| Total Market Cap | $755 Billion | -0.42% |

2022 was arguably the worst year for cryptocurrencies ever. Fundamentally, no year in cryptocurrency history was more catastrophic than 2022.

From a price action perspective, many bearish records were broken and made. However, 2022 still wasn’t as bad as 2018.

Major Price Drops

🪓 December 2022 is on track to be the lowest monthly close for 2022 and the lowest close since December 2020.

🔉 December 2022 is also the lowest traded volume month for cryptocurrencies since May 2019.

🥉 June was the worst-performing month for 2022 (-33.06%), the worst since November 2018 (-37.29%), and the third worst-performing month in crypto’s history.

🥈 2022 was the second worst-performing year in cryptocurrency history, -65.50%. Only 2018 (-78.12%) was worse.

🥇 Unless something dramatic changes between today (December 30, 2022) and tomorrow, 2022 will be the first year in cryptocurrency history that the yearly close is below the prior year’s open.

1️⃣ For Bitcoin, 2022 is the first year in its history that its yearly close is below the prior year’s open.

🏎️ The fall from April 2022’s open to June 2022’s close was the fastest and most violent sustained collapse in crypto’s history, -57.72%.

Major Cycles Broken

🤸♂️ The longest stretch of consecutive weekly losses in cryptocurrency history occurred in 2022. From the first week of April 2022 to the week of Jun 13, 2022, the crypto market crashed for eleven straight weeks.

4️⃣ Bitcoin is currently in a record four consecutive quarters of losses.

☀️ Prior bear markets have lasted between 430 and 445 days. As of December 30, 2022, the current crypto market is on day 417.

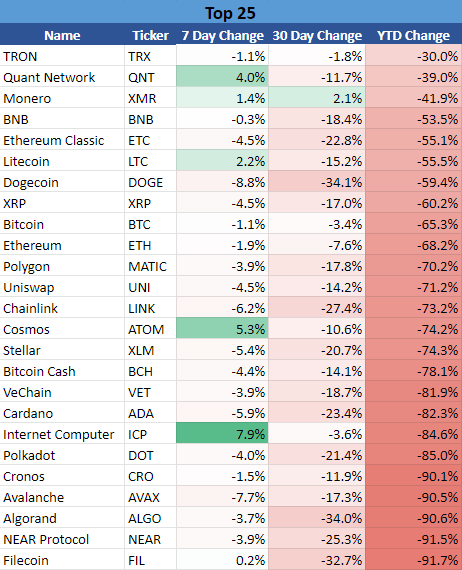

Top 25 Cryptocurrencies

2022 Top 25 Cryptocurrency List

The market is in a bad spot when the best performer out of the bunch, $TRX.X, only got there because it never really moved – and it’s still down -30%.

2022 Performance: -65.65%

If we considered the Top 25 as its own index, it would be the third-best performer for 2022.

*The universe used to construct the Top 25 list consists of all cryptocurrencies with at least $1 billion market caps, excluding stablecoins.

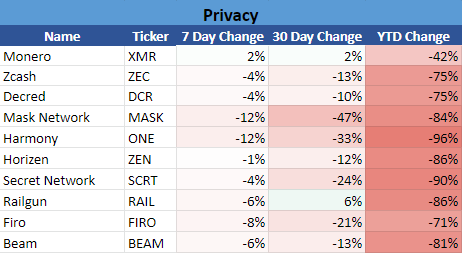

Privacy Coins/Tokens

#1 – Privacy Coins/Tokens Index

Privacy coins/tokens are cryptocurrencies that either focus on creating complete anonymity with transactions or offer anonymity as an option when performing transactions.

We construct this index by limiting the assets in this space to a minimum market cap of $10 million.

2022 Performance: -55.37%

The Privacy Coin Index was the best performer for 2022. And while -55.37% may not sound great, compared to the rest of the crypto market, it’s pretty damn good.

A lot of this index’s success is owed to Monero ($XMR.X); it’s been one of the best performers of 2022, and out of the Top 25 list, it’s ranked #3.

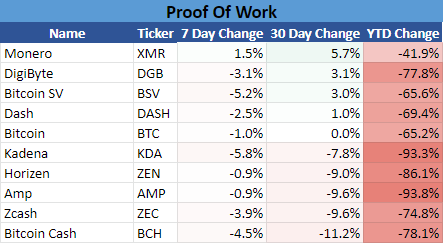

Proof Of Work

#2 – The Proof-Of-Work Index

The Proof-Of-Work Index is a collection of cryptocurrencies that, you guessed it, are blockchains that use Proof-Of-Work as their primary consensus mechanism. Bitcoin is the most well-known and biggest Proof-Of-Work cryptocurrency.

We construct this index by limiting the assets in this space to a minimum market cap of $100 million.

2022 Performance: -64.84%

Echoing back to the Privacy Coin Index, Monero is the best performer of the Proof-Of-Work Index. Note that another Privacy Coin, $DASH.X is in the top 5 of the Proof-Of-Work Index.

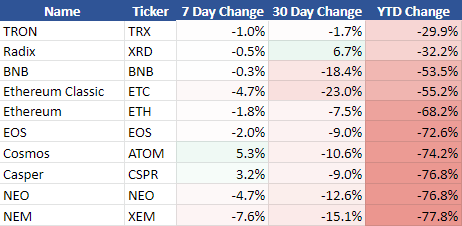

Smart Contracts

#3 The Smart Contracts Index

The Smart Contracts Index includes cryptocurrencies whose blockchains allow for smart contracts. Ethereum and Cardano would be examples of cryptocurrencies that fall into this index.

We construct this index by limiting the assets in this space to a minimum market cap of $250 million.

2022 Performance: -67.29%

$TRX.X is the best-performing major market cap cryptocurrency for 2022, so it’s no surprise it’s at the top of this index.

$ETC.X outperforming $ETH.X is likely a big surprise, especially given $COIN dropped support for ETC in 2022.

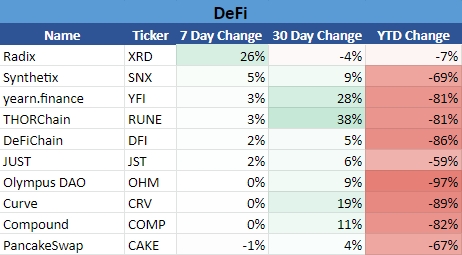

DeFi

#4 The Decentralized Finance Index (DeFi)

The DeFi Index (Decentralized Exchange) comprises the cryptocurrencies and tokens that make up the DeFi space. Cryptocurrencies such as Curve Finance, yearn.finance, and Clover are examples of assets that make up this index.

It’s not uncommon to see cryptos that fall into the DEX category in the DeFi too.

We construct this index by limiting the assets in this space to a minimum market cap of $200 million.

2022 Performance: -75.51%

Radix ($XRD.X) has outperformed for the latter part of 2022. Likewise, $YFI.X has been pamping a little more during the last half of 2022, giving this index a decent bump higher.

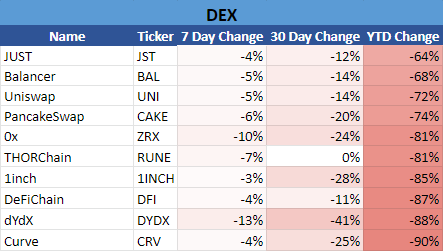

DEX

#5 – The Decentralized Exchange Index (DEX)

The DEX Index (Decentralized Exchange) comprises the cryptocurrencies and tokens that make up the DEX space.

We construct this index by limiting the assets in this space to a minimum market cap of $100 million.

2022 Performance: -75.99%

While the DeFi and DEX indices have always been heavily correlated, since the latter part of Q2, when Terra’s collapse began, they’ve been like an unhealthy co-dependent relationship, rarely within more than an arm’s reach away from one another.

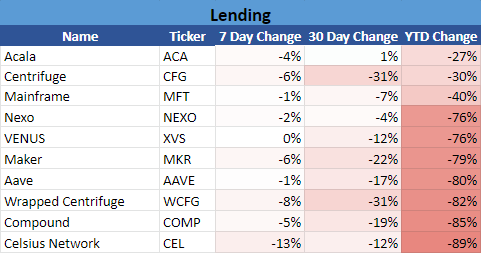

Lending

#6 – The Lending Index

The Lending Index comprises cryptocurrencies and platforms where users can offer their cryptocurrency for liquidity or loans for a return.

We construct this index by limiting the assets in this space to a minimum market cap of $50 million.

2022 Performance: -76.65%

After BlockFi’s massive fine earlier in 2022, the crypto space saw the withdrawal of many platforms that offered lending rewards. Surprisingly, however, its performance is in the middle of the pack.

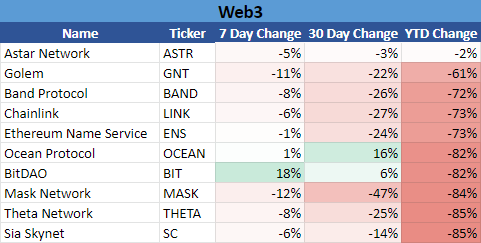

Web3

#7 – The Web 3 Index

The Web3 Index comprises cryptocurrencies focusing on the next generation of the internet: blockchain, publicly distributed ledgers, transparency, openness, decentralization, and tokenonomics.

$LINK.X and $GNT.X are examples of assets in this category.

We construct this index by limiting the assets in this space to a minimum market cap of $50 million.

2022 Performance: -81.53%

Web3 has lost momentum in the crypto and TradFi spaces in 2022. However, a good chunk of this index’s loss is related to regulatory scrutiny and uncertainty. Many assets in this index are heavily focused on privacy and have suffered as a result.

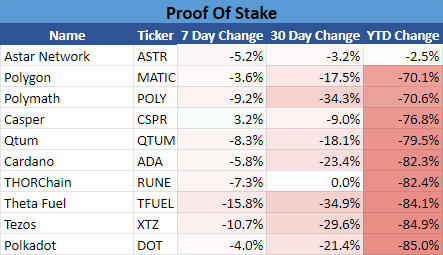

Proof-Of-Stake

#8 – The Proof-Of-Stake Index

The Proof-of-Stake Index includes any cryptocurrency that has a Proof-of-Stake consensus mechanism.

We construct this index by limiting the assets in this space to a minimum market cap of $100 million.

2022 Performance: -83.40%

The Proof-Of-Stake Index’s performance for 2022 suffered for the same reasons as Lending, DeFi, and DEX: regulatory crackdown on any crypto that offers interest has freaked out a lot of the assets in this index.

However, the industry has been more proactive in stressing the difference between staking and interest. Lending platforms offer interest where staking is a reward for maintaining/securing/processing transactions/etc the blockchain.

There’s been a noticeable change in the nomenclature as well – instead of exchanges and cryptocurrencies showing APY for staking, some have switched to ARY (Annual Rewards per Year) – or a similar derivative of that style.

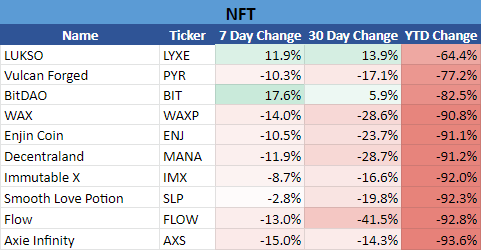

NFTs

#9 – The NFT Index

The NFT Index is made up of cryptocurrencies that offer non-fungible tokens.

We construct this index by limiting the assets in this space to a minimum market cap of $50 million.

2022 Performance: -90.63%

We probably don’t have to explain a lot of why this dumpster fire of an index is where it’s at. Stoned-looking monkey’s with joints hanging lazily from their lips are worth millions of dollars? The NFT space collapsed as dramatically as it had risen.

However, the use case of NFTs outside of digital art continues to grow and isn’t going away anytime soon.

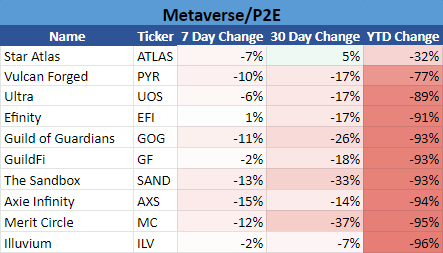

Metaverse

#10 – The Metaverse Index

The Metaverse Index is a collection of cryptocurrencies that focuses on virtual worlds and environments, including the Play 2 Earn and gaming class of cryptocurrencies.

We construct this index by limiting the assets in this space to a minimum market cap of $10 million.

2022 Performance: -91.95%

And here it is: the biggest pile of poo for 2022, the biggest dumpster fire of them all, the monument to monumental failures: the Metaverse Index.

This index would have been in the top three at one point in 2021 and even early 2022 – but not anymore. Consumers are still not sold on the idea of a Ready Player One world, and the play-to-earn category is filled with its own problems.

It may be a while before this index and sector of crypto mature.

Bullets

Bullets From The Day:

💰 A ‘common’ tax-loss harvesting loophole in cryptocurrency trading has made it another year without the IRS saying much about it. The loophole in question is related to what the IRS calls the ‘wash rule’. The wash rule is meant to prevent an investor/trader from selling a particular asset at a loss, then buying back within 30 days. Stocks are assets that the wash rule applies. Still, according to attorney Benjamin Goldburd of Goldburd McCone, “Cryptocurrency is not considered a security for IRS purposes, for the time being, it’s considered an asset, and thus the heavy aspects of tax law don’t apply to it, including the wash sale rule.” Forkast has more.

😲 Cardano was 2022’s most active blockchain by development activity, according to the on-chain analytics firm, Santiment. Cardano was also 2021’s most active blockchain. Cardano ($ADA.X), like the rest of the cryptocurrency market, is down by a big chunk, -81.35%, to be exact.Santiment’s blog has more.

🤯 Mamma Mia! Italy’s Parliament just approved a 25% capital gains tax on crypto as part of a broader budget bill passed on Thursday. However, if assets are declared as of January 1, the tax is reduced to 14%. The tax only involves gains above 2,000 euros. On a positive note, however, the Italian budget classifies cryptocurrencies as assets. It defines them as “..a digital representation of value or rights, which can be transferred and stored electronically, using the technology of distributed ledger or similar technology.” More from The Block.

Links

Links That Don’t Suck:

😀 FTX Japan to allow customers to withdraw funds starting in February

👽 South Korea’s unannounced rocket launch causes UFO scare

⛰️ BlackRock among bankrupt miner Core Scientific’s creditors

🏧 Did Sam Bankman-Fried secretly cash out $1.5M?

🎮 Kotaku’s Top 10 Games Of 2022

🚨 Logan Paul’s NFT ‘game’ as a big crypto scam

⤵️ Dogecoin plummets 13% amid rumors of Ethereum-like merge

⚱️ Northern California statue of meat-packing magnate beheaded

🦄 Crypto Unicorns founder: P2E gaming is in a long ‘maturation phase’

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: