A little lower today, but clear signs of indecision by the bulls and bears. 🟥

In today’s Litepaper, we’re exploring how the European Union is sprinting ahead of the United States in the race for crypto regulation and counting down the days until Litecoin’s highly anticipated next halving event.

And make sure you’re up to speed with a Crypto 101 crash course on why halving events are such a big deal.

Don’t let the green in the table below fool you; the market has been ping-ponging green to red all day, so let’s see what tomorrow brings.

Here’s how the market looked at the end of the trading day:

| Litecoin (LTC) |

$87.65

|

2.86% |

| Avalanche (AVAX) | $17.01 | 2.28% |

| Chainlink (LINK) | $7.11 | 1.57% |

| Internet Computer (ICP) |

$5.39

|

1.48% |

| Polkadot (DOT) |

$5.91

|

1.47% |

| Cosmos (ATOM) | $10.86 | 1.09% |

| Solana (SOL) | $21.36 | 0.83% |

| Monero (XMR) | $157.86 | 0.71% |

| Bitcoin Cash (BCH) | $119.91 | 0.69% |

| BNB (BNB) |

$331.36

|

0.47% |

| Altcoin Market Cap |

$601 Billion

|

0.09% |

| Total Market Cap | $1.121 Trillion | 0.02% |

Let the countdown begin: the ETA for $LTC‘s next halving event is 100 days away.

Not sure what a halving event is? Check out our Crypto 101 article on it here.

Few things in the crypto space generate more anticipation than having events. And Litecoin’s is just around the corner.

Wait, 100 days is a long time away, you say? Well, the first 114 days of 2023 have gone by pretty damn fast.

How has Litecoin performed before and after its previous halving periods? Let’s see:

Not a whole heck of a lot to take away from this, unlike what happens with $BTC when there is a halving event.

Litecoin’s next halving event occurs eight months before Bitcoin’s, which happens in May 2024 – but that could change depending on mining activity.

Again, if you want to know more about what a halving event is, check out our Crypto 101 article here.

The European Union is light years ahead of the U.S. regarding crypto legislation.

The recent approval of the E.U. Commission’s proposed MiCA (Markets in Cryptoassets) legislation by the European Parliament signals a turning point in the global crypto landscape, with the E.U. setting the stage for a well-regulated crypto environment and the much-anticipated digital Euro.

MICA Legislation: A Resounding Approval

- E.U. Parliament’s Decision: Last week, the European Parliament approved the E.U. Commission’s proposed MICA (Markets in Crypto-Assets) legislation with a resounding majority. This legislation aims to introduce uniform regulatory standards for the crypto industry across E.U. countries.

- Next Steps: The legislation, which has been under discussion since 2021, will be sent to the European Council for final approval in the coming months.

Key Regulations and Impacts

- Client and Investor Protection: The proposed law will introduce wide-reaching safeguards and regulations to protect clients and investors. Crypto exchanges will be required to hold clients’ funds and maintain adequate capital buffers, and they won’t be able to invest or gamble with clients’ funds. In addition, Stablecoin issuers must prove a 1:1 backing with cash.

- AML and KYC Regulations: The legislation will implement comprehensive anti-money-laundering (AML) and know-your-customer (KYC) regulations, with particular emphasis on transfers totaling €1,000 and above from self-hosted addresses (because no-one will figure out how to obfuscate transactions or send multiple transfers for €999…).

- Implementation Timeline: The regulations will take at least two years to be implemented in each E.U. member state, with the €1,000 rule coming into effect by 2025.

Digital Euro: Laying the Groundwork

- E.U. Commission’s Consultation Process: Following the European Council’s green light for new legislation to launch the digital Euro, the E.U. Commission initiated a consultation process with relevant stakeholders, ending on June 16.

- Stakeholders Expected to Provide Feedback: Payment industry specialists and providers, merchant and retail payments providers, payments regulators, and finance intelligence units are among the stakeholders expected to provide feedback.

- ECB’s Stance: The European Central Bank (ECB) has long favored a digital Euro and has urged European legislators to collaborate on the legislation before its launch. The ECB believes that launching the digital Euro will help Europe move closer to a widespread roll-out of digital payments.

E.U. vs. U.S.: A Comparison

- E.U.’s Progress: The E.U. is confidently strutting down the cryptocurrency catwalk, poised to adopt the first-ever wide-reaching regulatory framework for the crypto industry while potentially being one of the first major international institutions to debut its own digital currency.

- U.S.’s Ongoing Efforts: Meanwhile, the U.S. finds itself awkwardly stumbling around the dance floor, still trying to figure out the right moves for its crypto legislation, as it hosts never-ending congressional hearings that seem to last longer than a Hollywood awards ceremony.

Let’s talk about a pivotal event in the world of digital currencies: the halving! In this Crypto 101 article, we’ll unravel the mystery of halving and how it impacts cryptocurrencies like $BTC. Let’s dive in! 🏊

The Basics: What is a Halving Event? 🤔

- A halving event is when the mining reward for a cryptocurrency (usually Bitcoin) is cut in half.

- Occurs approximately every four years (or after every 210,000 blocks are mined).

- Ensures a controlled supply and protects against inflation.

- A major milestone in the life of cryptocurrencies.

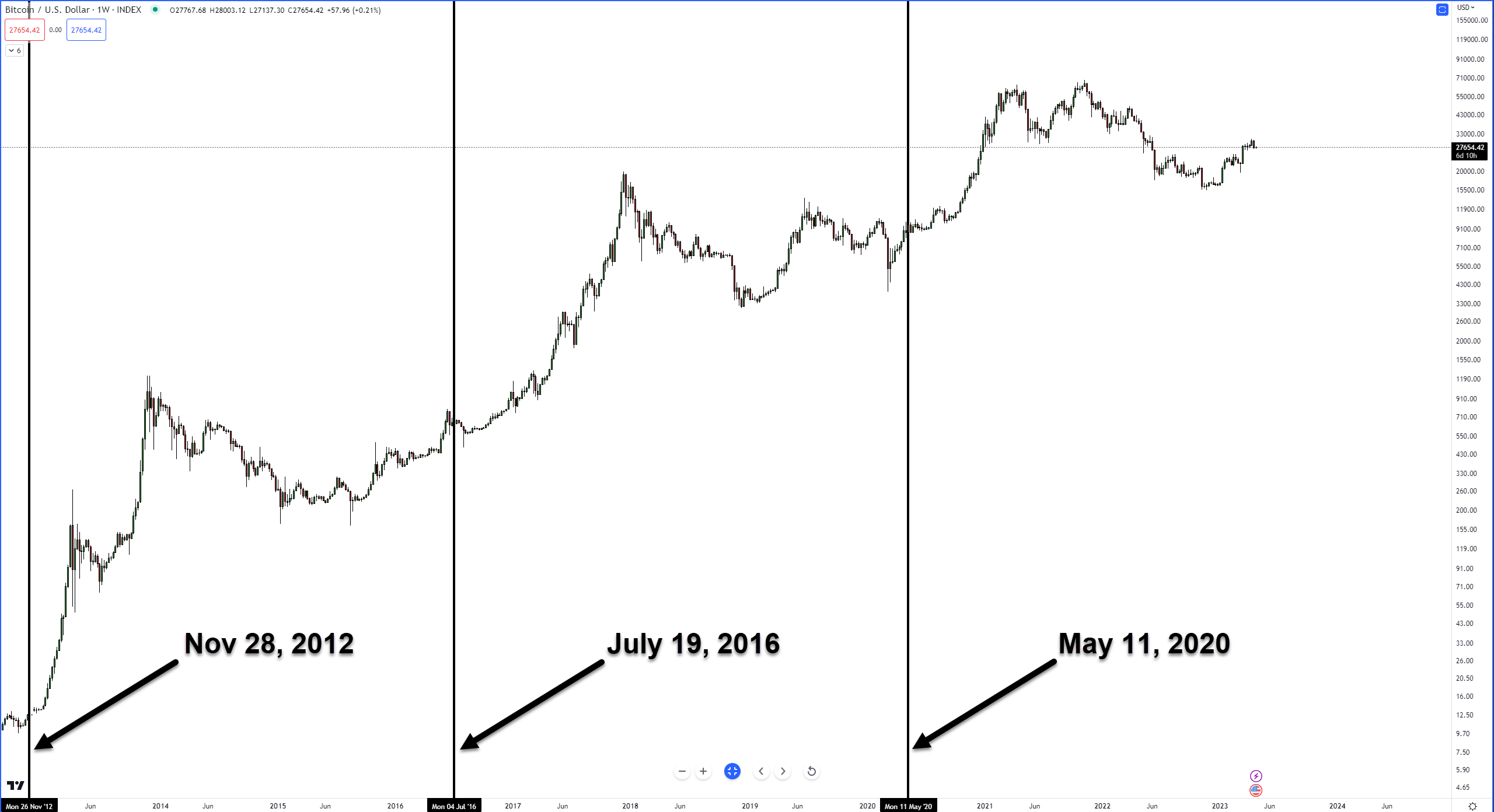

Bitcoin’s Halving History: A Trip Down Memory Lane 📜

- First Halving (November 28, 2012): Bitcoin mining reward dropped from 50 to 25 BTC.

- Second Halving (July 9, 2016): Reward slashed to 12.5 BTC.

- Third Halving (May 11, 2020): Reward further reduced to 6.25 BTC.

- Next Halving: Expected on May 14, 2024, reward to decrease to 3.125 BTC.

The Impact of Halving: Price, Mining, and More ⛏️

- Price Impact: Historically, halving events have been followed by price surges, but there are no guarantees.

- Mining Impact: Reduced rewards may lead to miners exiting the market, potentially affecting network security.

- Supply Impact: With fewer new coins entering circulation, halving events can impact supply and demand dynamics.

Why Should You Care? The Significance of Halving Events 🌟

- Market Sentiment: Halving events can influence investor confidence and shape market trends.

- Scarcity Factor: Reduced mining rewards can contribute to a perception of scarcity, potentially driving up value.

- Milestone: Each halving event marks a significant moment in the life of a cryptocurrency, drawing attention to its progress.

The Future: Life After Halving Events 🔖

- Bitcoin’s Cap: Once all 21 million bitcoins have been mined (estimated around 2140 A.D. – you read that right, another 117 years), there will be no more halving events.

- Alternatives: Other cryptocurrencies may implement alternative mechanisms to control supply and maintain value.

Bullets

Bullets From The Day:

📲 Sam Bankman-Fried’s lawyers are facing difficulties meeting the bail conditions set for their client. Part of the conditions of SBF’s bail includes monitoring the cell phones of Bankman-Fried’s parents. The condition requires the devices to take photos of the user every five minutes. The defense team has explored alternative solutions, but it is unclear what those solutions are. Bankman-Fried’s access to electronic devices, including his parents’ cell phones, was restricted after the judge warned that he could be trying to influence witnesses in the case.

🥺 So far in 2023, last week marked the worst week for cryptocurrencies. The crypto market experienced a dip last week, resulting in $650.9 million in long liquidations. $BTC price fell over 9%, trading below $28,000, while $ETH dropped around 13%. The falling crypto prices led to significant losses for futures traders holding long positions. Most of the liquidations occurred on Binance and OKX, totaling $234 million and $197 million, respectively. This decline has been attributed to a lack of liquidity and a large sell order on Binance.

🚨 Faruk Fatih Özer, the founder of Turkish crypto exchange Thodex, has been extradited to Turkey. He is accused of fraud and operating a criminal organization. We last talked about Thodex almost a whole year ago. Thodex, which turned out to be an exit scam, left 400,000 users without access to $2.6 billion worth of crypto funds. Özer was detained in Istanbul after evading capture for over a year in Albania. Thodex halted transactions in April 2021, and soon after, its executives deactivated their social media profiles, and customer support became inaccessible. Six people, including two of Özer’s siblings and four senior employees, were jailed in connection with the scandal, while 62 others were detained.

2️⃣ Two consortiums will compete for the assets of bankrupt crypto lender Celsius ($CEL.X) Network in an auction on April 25 in New York. Crypto exchanges Gemini and $COIN are among the companies participating in the bids. The Fahrenheit consortium, backed by Arrington Capital, Proof Group Capital Management, Steven Kokinos, and Ravi Kaza, is one of the bidders. The other group, Blockchain Recovery Investment Committee, is backed by Gemini, VanEck, Global X Digital, and Plutus Lending. Both consortiums will challenge NovaWulf Digital Management, the “stalking horse bidder,” whose proposal could allow customers to recover up to 70% of their funds.

Here is some of what’s inside today’s curated NFT news collection:

NFT launch breaks the internet, Mattel NFTs, Marvel Studios founder NFTs, and NFT traders turned memecoin traders.

Links

Links That Don’t Suck:

🌌 Cosmose AI valuation reaches $500 million after NEAR Protocol partnership

❄️ Memecoin PEPE falls 18% at start of trading week

🗑️ ‘Cash is trash,’ says Robert Kiyosaki; would buy more gold even if it crashes

🤼 Former Goldman Sachs executive predicts 1,000,000,000 users to flood crypto markets this cycle

🌋 Volatile week for Bitcoin and crypto ahead: save these dates