Unless something crazy happens, the crypto market is poised to conclude the most disastrous trading week of 2023. 🟥

Today’s Litepaper examines how DeFi’s daily volume has surpassed some significant centralized exchanges, credit scores are entering the DeFi space, and why Texas may be establishing a new cryptocurrency standard.

Additionally, today’s Technically Speaking article will take a look at some critical support levels analysts see as we move into the weekend.

The pullbacks and profit selling that occurred yesterday continue into today.

Here’s how the market looked at the end of the trading day:

| BNB (BNB) |

$324.97

|

2.98% |

| Monero (XMR) | $153.25 | 1.13% |

| Litecoin (LTC) | $88.30 | 1.10% |

| Bitcoin Cash (BCH) |

$122.58

|

-0.61% |

| Stellar (XLM) |

$0.095

|

-0.52% |

| TRON (TRX) | $0.066 | -0.50% |

| Solana (SOL) | $21.69 | -0.07% |

| Ethereum Classic (ETC) | $19.71 | -0.51% |

| Bitcoin (BTC) | $27,777 | -1.09% |

| Polygon (MATIC) |

$1.03

|

-1.33% |

| Altcoin Market Cap |

$596 Billion

|

-2.09% |

| Total Market Cap | $1.133 Trillion | -2.02% |

Bitcoin

We’ve looked at $BTC‘s chart ad nauseum lately, especially in the weekend Litepaper.

First things first: for regular readers of the Litepaper, the drop this week shouldn’t be a major surprise; it’s something we’ve looked at now for a couple of weeks.

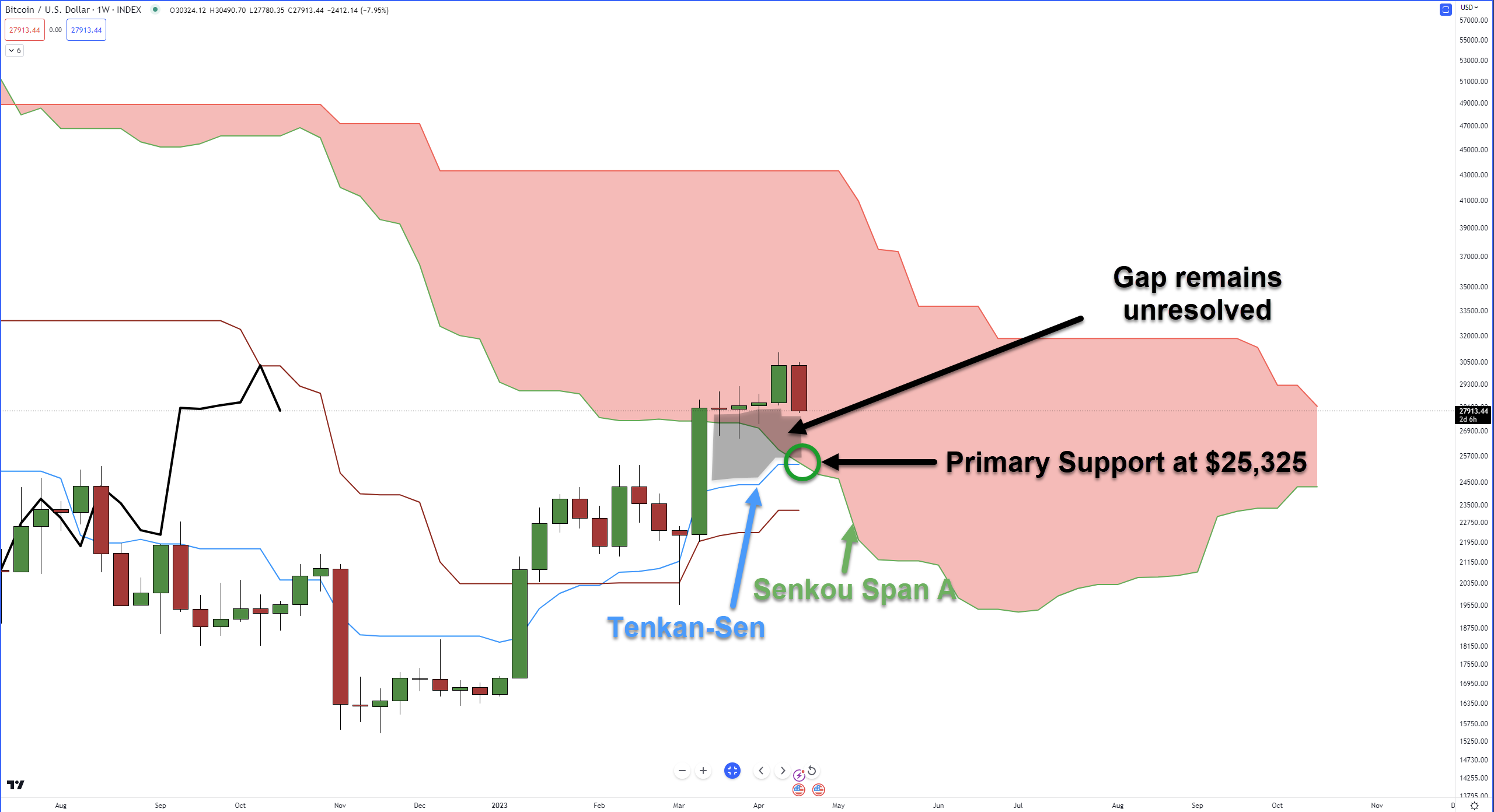

If we go all the way back to the March 31 Litepaper, we discussed Bitcoin sitting inside the Cloud on the weekly chart and how it’s pretty much the suck.

The forecast was for partly cloudy skies with a 100% chance of pain. What we’re experiencing is the exact kind of price action behavior we’d expect to see when Bitcoin’s stuck in the Cloud.

Also, the gap between the bodies of the candlesticks and the Tenkan-Sen has yet to be resolved, but it looks like equilibrium may be established soon.

Primary support sits where the Tenkan-Sen and Senkou Span A both exist: $25,325.

Ethereum

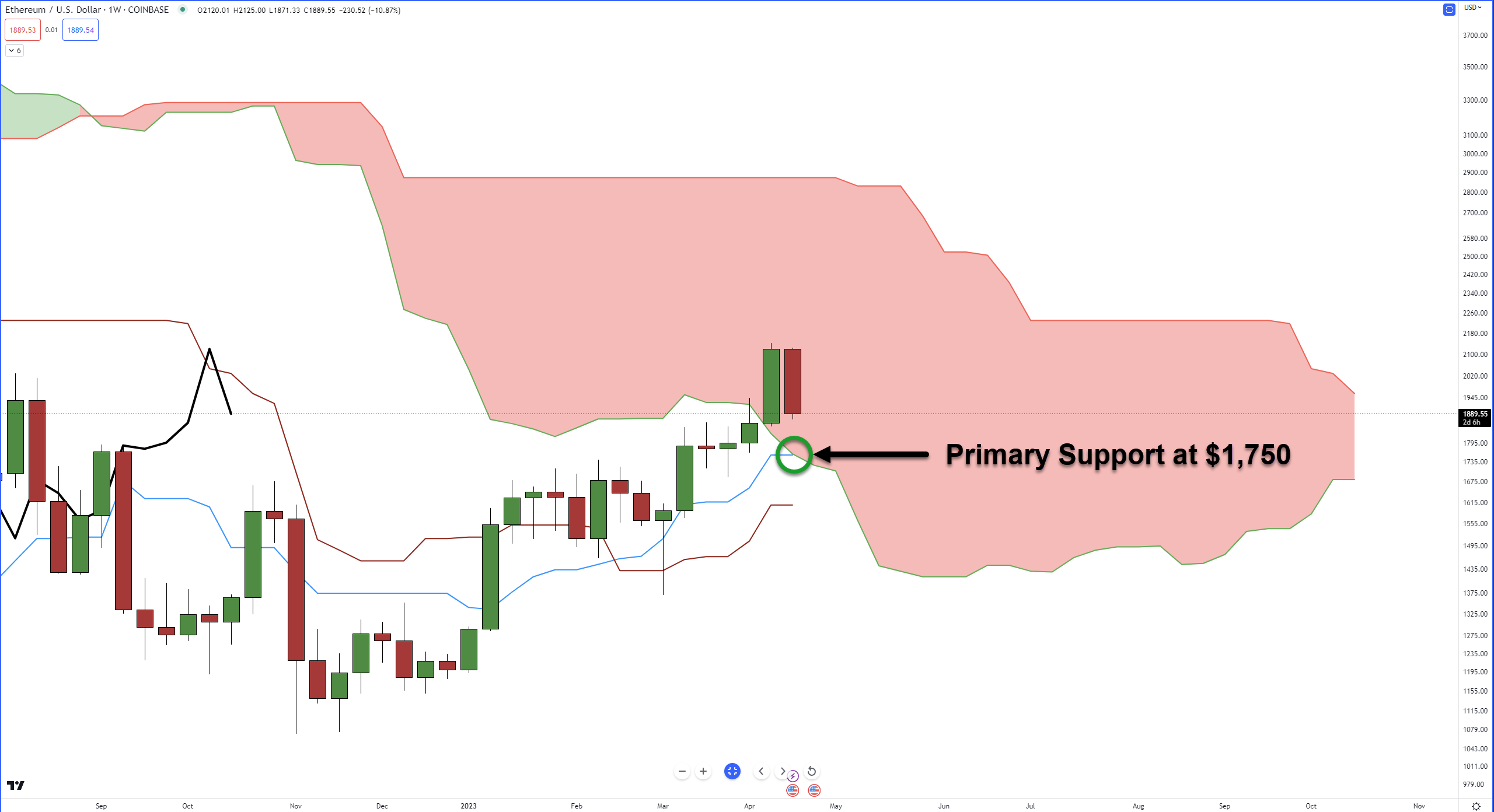

Don’t need to spend a ton of time here on $ETH because it’s pretty much just like Bitcoin’s chart.

From an Ichimoku perspective, the support zone for ETH is the same as BTCs: The Tenkan-Sen and Kijun-Sen, or $1,750.

Cosmos

The first chart for $ATOM we’ll look at is from the April 3 Technically Speaking article:

The way I described ATOM’s chart was: It’s just one ugly mess. How does it look now?

Even worse:

The primary support levels for ATOM are the bottom of the bearish pennant and the Volume Point Of Control (VPOC) in the $10.70 to $10.80 value area.

Stellar

Crazy fact about Stellar: Out of all the major market cap cryptocurrencies, $XLM has spent the longest time trading since its last all-time high.

When was XLM‘s last ATH? January 2018.

The primary near-term resistance for XLM at its VPOC at $0.11 has clearly been a tough nut to crack for bulls, giving sellers a nice opportunity to push prices through the thin volume node between 0.093 to 0.104.

The Kijun-Sen and Tenkan-Sen at $0.094 are currently being tested and represent the final major support zone on the weekly chart for Stellar.

The CCData Exchange Benchmark Report for April 2023 has some interesting highlights for CEXs (Centralized Exchange) and DEXs (Decentralized Exchanges).

You can read the full 61-page deck here, but we’ve also summarized some main points.

CCData Exchange Benchmark Report: Key Highlights

Centralized Exchange Highlights:

- Transparency increased with 20% implementing Proof of Reserves or alternative

- Security standards improve with 30% possessing ISO 27001, SOC2 certificate, or similar

- Market quality data availability grows, but data quality declines

- Bitstamp holds the only AA rating, followed by Coinbase with a grade A

- Exchange KYC practices improving with only 15% deemed to have inadequate practices

Decentralized Exchange Highlights:

- Uniswap received the highest score and is the only DEX eligible for an A rating

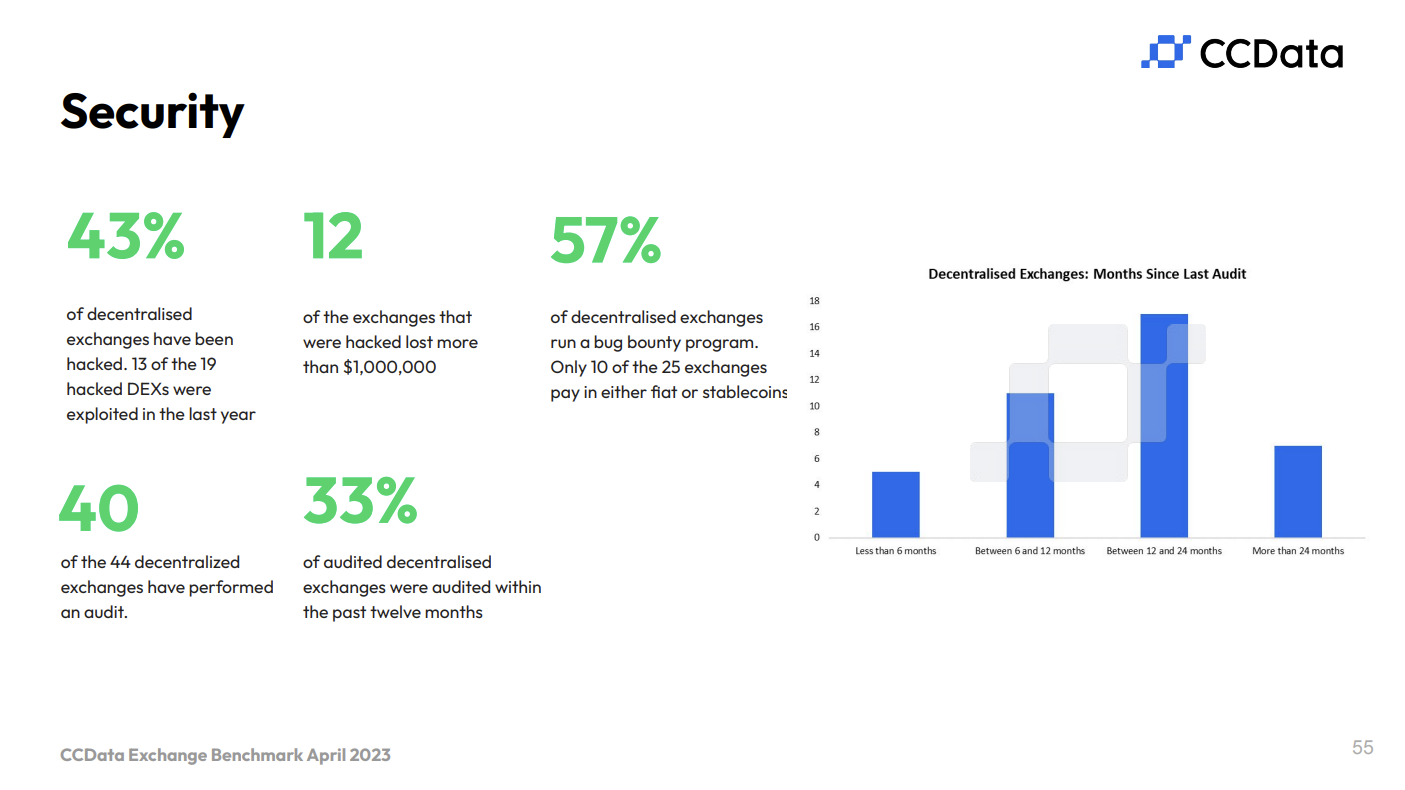

- Security vulnerabilities remain prevalent with 43.2% of DEXs covered hacked previously

- Governance participation is declining, and only 4 DEXs experienced an increase in voter turnout

- Total Value Locked (TVL) dropped to $16.9 billion, down from $21.7 billion in October 2022

Market Quality and Liquidity:

- Top-Tier volume from exchanges scoring BB and above with 23 rated Top-Tier in DEXs

- ADV (Average Daily Volume) on leading DEXs, Uniswap and Curve, surpassed volumes on some top centralized exchanges

- In March 2023, 71% of total volumes were from Top-Tier exchanges based on updated grading, compared to 92% in October 2022

And to close out this summary, look at page 55’s info on the percentage of DEXs that have been hacked.:

Can’t wait to see how things go for DEXs in CCData’s next report.

Everything’s bigger in Texas, and it seems that includes cryptocurrency regulations. A new bill is making its way through the Lone Star State’s legislature, aimed squarely at digital asset service providers. 👁️

Bill 88(R) HB 1666, dubbed the “Digital Asset Service Providers” bill, aims to tighten the reins on these companies. Let’s break down the key points of this proposed legislation.

- Separating Funds: Commingling Prohibition

The bill prohibits digital asset service providers from commingling customer funds with their own, including operating capital, proprietary accounts, digital assets, fiat currency, or other non-customer property. The goal is to ensure customer funds are kept separate and secure, protecting them from potential misuse.

- Who’s Affected? Defining the Scope

Bill 88(R) HB 1666 applies to digital asset service providers operating in Texas that hold a money transmission license and serve more than 500 digital asset customers in the state or have at least $10 million in customer funds. Banks and entities exempted by the Finance Commission of Texas or the Texas Department of Banking are not subject to this bill. 🏦

- Administration: The Texas Department of Banking Steps In

The Texas Department of Banking is tasked with administering the regulations laid out in the bill, ensuring compliance among affected digital asset service providers.

- The Road to Becoming Law: Navigating the Legislative Process

While the bill has been introduced and the House Committee Report version has been presented, it still has a long way to go before becoming law. It must pass both houses of the Texas legislature and be signed by the governor before it takes effect.

TL;DR – Texas is looking to tighten its grip on digital asset service providers. By prohibiting the commingling of funds and ensuring customer assets are safeguarded, Texas aims to bolster consumer protection. As the bill progresses through the legislative process, crypto firms operating in the Lone Star State will be watching closely. 🕵️♂️

TransUnion ($TRU), one of the big three credit agencies in the U.S., has announced that it’ll be bringing credit scores to decentralized finance (DeFi) lenders starting next week. Let’s dive into the details. 🏊

Credit Scoring Meets Blockchain

Bullets

Bullets From The Day:

🏈 Tom Brady, retired (at least for now) NFL star quarterback, still likes crypto. Despite facing an ongoing lawsuit over his promotion of the now-defunct FTX exchange, he shared his continued enthusiasm for the digital asset realm at the eMerge Americas 2023 tech conference in Miami. The former NFL player’s NFT platform, Autograph, had previously raised $170 million in a Series B funding round, with ex-FTX CEO Sam Bankman-Fried once reported as a board member. At the conference, Brady participated in a Q&A session with questions curated by AI chatbot ChatGPT, revealing his love for beach life and water sports, as well as his favorite football film, “Wildcats.” As for the possibility of playing for the Miami Dolphins, Brady kept his cards close to his chest, expressing admiration for his friends on the team.

👩⚖️ Because nothing says contempt of court like Tweeting an FU to the justice system from a beach, em i rite? Ben Armstrong, known as “BitBoy Crypto,” mocked a federal judge’s authority by tweeting pictures of himself on a beach during a court appearance related to a harassment case. Judge Melissa Damian warned Armstrong’s attorney of a potential arrest warrant if he fails to appear by April 24. The lawsuit involves multiple crypto influencers allegedly promoting fraud without disclosing compensation.

🪙 $USDT issuer Tether is showing the Federal Reserve that they don’t have a monopoly on making the money printing machine go brrrrrrrrr. Tether is minting an additional one-billion USDT stablecoins on the $ETH network, as part of inventory replenishment. With a market cap of $81 billion, USDT is the ponziest dominant stablecoin in the crypto space. Analysts often examine USDT supply to predict market trends, as increases could indicate fresh cash entering the system and higher demand for cryptocurrencies like Bitcoin and Ethereum.

😲 Crypto fans, rejoice (unless, like me, you’re from the US)! Telegram just added a shiny new feature for P2P $BTC trading, making digital currency transactions a breeze. Users of the @wallet web interface can now buy, sell, and swap Bitcoin directly via Telegram’s platform. The updated “Exchange” even allows for instant swaps between Bitcoin, Tether (USDT), and Telegram Open Network (TON).

🪀 Come on Barbie, let’s go party. $MAT is launching a Rarible-powered peer-to-peer marketplace on April 27th for NFT trading, alongside the fifth series of its popular Hot Wheels NFT Garage. Mattel’s platform, designed for mainstream consumers, lets you buy without crypto. The toy giant’s NFT collections include Cryptoys and Boss Beauties x Barbie, with more on the horizon.

Here is some of what’s inside today’s curated NFT news collection:

NFT launch breaks the internet, Mattel NFTs, Marvel Studios founder NFTs, and NFT traders turned memecoin traders.

Links

Links That Don’t Suck:

😱 AI has most Americans scared about privacy, job losses

🏎️ F1 legend Michael Schumacher’s family threatens lawsuit over faked AI interview

😆 From billionaire to Montenegro jail: The rapid rise and fall of Terra chief Do Kwon

🐶 Meme season blamed for jump in Ethereum (ETH) gas fees

🎰 TikTok is turning into gaming’s discovery engine

🐄 Retail Horror: Cow wanders into hardware store in Israel, spills paint