Red across the board today – but nothing drastic. Yet. 🟥

Risk-on assets such as stonks and cryptocurrencies are still processing the FOMC minutes.

We’ll delve into the FOMC minutes and also cover two stories related to staking on Cardano and Ethereum.

Also, there are allegations that Binance has engaged in fund mingling similar to SBF and FTX.

Here’s how the market looked at the end of the trading day:

| Cosmos (ATOM) | $10.37 | -1.09% |

| Polygon (MATIC) | $0.872 | -1.38% |

| Monero (XMR) | $149.73 | -1.43% |

| TRON (TRX) |

$0.076

|

-1.45% |

| XRP (XRP) |

$0.453

|

-1.84% |

| Cardano (ADA) | $0.364 | -1.87% |

| Uniswap (UNI) | $4.94 | -1.96% |

| Stellar (XLM) | $0.086 | -2.03% |

| BNB (BNB) | $305.74 | -2.26% |

| Polkadot (DOT) |

$5.24

|

-2.27% |

| Altcoin Market Cap |

$558 Billion

|

-2.60% |

| Total Market Cap | $1.069 Trillion | -2.95% |

Crypto

Crypto 101: What Is Staking?

1. Introduction to Staking

Staking, in essence, is the act of committing your crypto assets (your stake) to support a blockchain’s transaction validation or security, earning rewards in return. Nonetheless, these rewards are often viewed as a type of interest generation by certain jurisdictions, potentially triggering regulatory scrutiny.

Cardano’s staking ecosystem has achieved a significant milestone as the total value of ADA tokens staked on the network surpasses 430 million. 🤩

This accomplishment reflects the growing confidence in $ADA‘s proof-of-stake (PoS) consensus process, where ADA holders actively contribute to network security and earn rewards.

Additionally, as more tokens are staked, less ADA is available for trading, potentially driving up the market value of ADA. Investors who participate in staking not only contribute to the network but also stand to benefit from potential price growth. 📈

As ADA holders continue to stake their tokens, Cardano’s network becomes more robust, offering a promising future for the platform and its stakeholders.

Case in point:

Yesterday was a record breaking day for both Minswap DEX and Cardano ! 🤠

✅ Minswap had ATH Daily Volume at 30.30mn $ADA/12.54mn $USD

✅ Cardano became the top 9th chain in terms of DEX Volume

✅ Minswap had 87.24% of Volume among all Cardano DEXs

✅ Minswap in the top 17th… pic.twitter.com/xSlZcBAVxz— Minswap Labs (@MinswapDEX) May 23, 2023

Minswap, the largest DEX on Cardano, became the 9th largest DEX by traded volume on Monday and the 17th for the past 30 days.

Oh, and here’s a random anecdote: when trades are executed on Minswap’s platform, a cat-purring sound plays. 😺

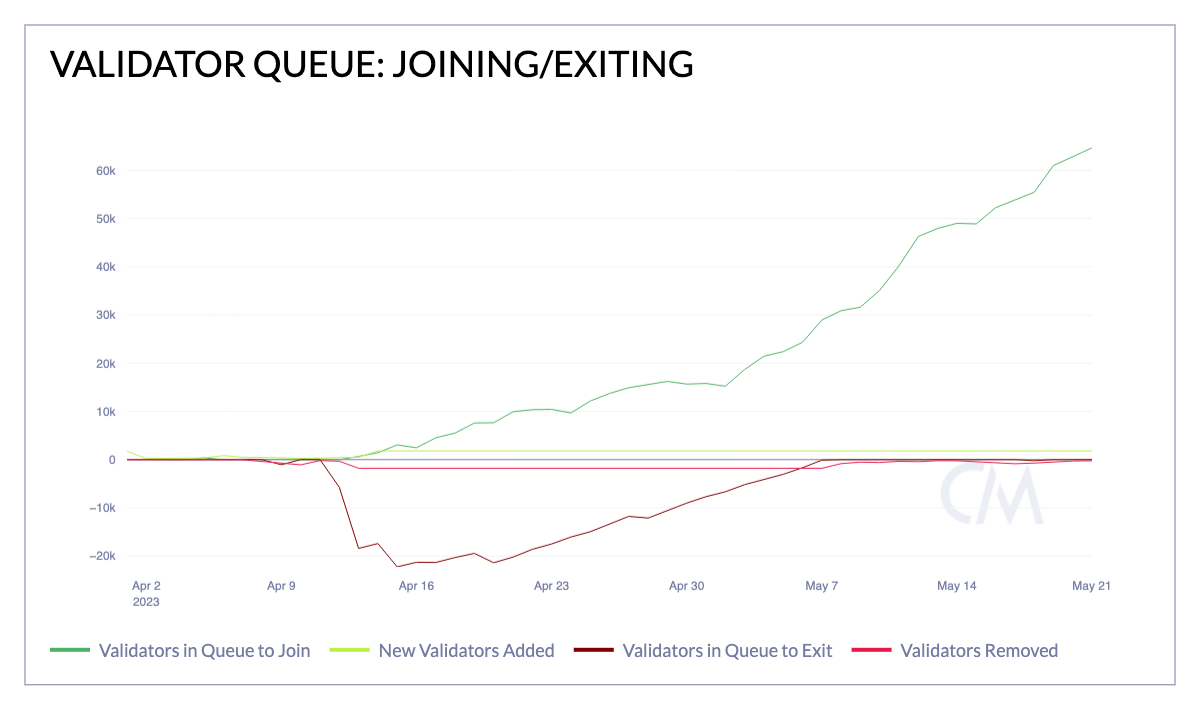

Ethereum is experiencing record levels of staking following Ethereum’s transition to Proof-of-Stake (PoS) and the recent “Shapella” network upgrade. 🚀

The last update facilitated withdrawals of staked $ETH and rewards, leading to a surge in demand for new validators. Despite initial fears of a withdrawal rush impacting the ETH price, the increasing queue of validators eager to join the network suggests that demand for Ethereum staking is holding steady.

The active validator count is at a record high of nearly 584,000.

Adding to the excitement is the growing demand for Liquid Staking Tokens (LSTs) in the DeFi space. These tokens represent staked assets, offering liquidity to the PoS model and enabling staked assets to participate in DeFi applications while contributing to network security. 💥

Binance, the world’s largest crypto exchange, is facing another big allegation – an allegation that Sam Bankman-Freid and FTX are also accused of: commingling customer and corporate funds in accounts at Silvergate Bank during 2020 and 2021. 😱

Reuters reports that Binance’s corporate funds were funneled into an account where users were purchasing $BUSD, Binance’s stablecoin. The commingling allegedly occurred in an account belonging to Merit Peak, a Cayman Islands-based entity controlled by Binance’s CEO, Changpeng Zhao (CZ).

Merit Peak was previously implicated in unusual transfers amounting to over $400 million from Binance US’s Silvergate account, which were later passed on to another entity controlled by CZ, Key Vision Development.

Binance has admitted to past instances of commingling with customer funds in different wallets, referring to these incidents as “historical operations oversights” which sounds like the financial equivalent of “special military operation.” 🤦♂️

It’s noteworthy that Binance’s claims of segregating client assets from Binance-owned assets may not reflect the actual structure on the blockchain. Instead, these are internal accounting entries within the Binance system.

This raises legitimate questions about the quality of their reporting, especially in light of previous issues such as the inadequate backing of BUSD.

Binance already has an ongoing lawsuit from the Commodities and Future Trading Commission (CFTC), which accuses Binance of allowing US individuals to trade on its platform and even against its users. 👨⚖️

If you wanted some clarity on what the Fed might be doing in the near future, today’s FOMC notes were not it.

Here’s a quick breakdown of the notes, which can be found here:

- The level of certainty regarding the need for further rate hikes was less clear, with participants generally agreeing on the uncertainty.

- Many participants emphasized the importance of retaining the flexibility to adapt.

- Several participants expressed that if the economy evolved as anticipated, additional rate hikes might not be necessary.

- Some participants indicated that there would likely be a need for further rate hikes.

- Some stressed the importance of not signaling potential rate cuts later this year or ruling out the possibility of further hikes.

- Participants reached a consensus that inflation remained unacceptably high and was declining slower than anticipated.

- Staff projections maintain a forecast of a forthcoming recession, followed by a gradual recovery.

- Discussions also covered challenges in the banking industry and the importance of raising the national debt ceiling in a timely manner.

- Economic indicators point to a resilient economy with few signs of contraction, although concerns about a potential slowdown persist.

Bullets

Bullets From The Day:

😂 Do ‘Con’ Kwon is having a really, really bad day. It seems like the higher-ups in the Montenegrin legal system have decided to throw a wrench in the wheel of his bail. The high court in Podgorica, Montenegro’s capital, has decided to yank back the earlier verdict where Kwon was about to taste freedom on bail. According to Bloomberg’s source from inside the courtroom, court rep Marija Rakovic, Kwon will be stuck behind bars. Former CFO Chong-joon is also stuck behind bars.

🔐 Ledger is holding off on their Ledger Recover. Ledger’s CEO, Pascal Gauthier, has announced the postponement of the company’s controversial recovery feature until the open-sourcing of the company’s code is complete. The announcement comes as a response to the extensive criticism from the crypto community following the original disclosure of the feature, which allows users to secure backups of seed phrases through custodians. Gauthier acknowledged the poor communication around the feature’s release and apologized to the community. He assured that Ledger’s security remains intact and emphasized the feature will be optional, requiring a Know-Your-Customer (KYC) check for those opting in.

🏀 You just got served. Basketball legend Shaquille O’Neal has reportedly been served amid a class-action lawsuit targeting FTX and its celebrity endorsers, according to the law firm handling the case. Shaq was hit with the papers during a live broadcast of the Miami Heat vs. Boston Celtics game – ironically held at the formerly-named FTX Arena, which now dons the Kaseya Arena label following the exchange’s downfall. It’s the second alleged serving for Shaq, the first instance involving tossed papers and a public road. The lawsuit centers around claims that Shaq’s “FTX: I Am All In” campaign swayed consumers towards using the now-defunct FTX.

🖐️ More $BTC leaving exchanges than entering. On-chain analytics firm, Glassnode, has highlighted a deviation in the current Bitcoin cycle, showing that more Bitcoin has left exchanges than in previous cycles. Unlike previous halving cycles, which saw a net growth of Bitcoin balances on exchanges, the current cycle has shown a net withdrawal of around 680,000 BTC. Notably, exchange balances peaked at 3.2 million BTC just before the 2020 COVID crisis and have since fallen to 2.3 million BTC, a 28% decrease. This marks a break from the past, suggesting a change in investor interaction with exchanges.

Here is some of what’s inside today’s curated NFT news collection:

Brave Browser NFTs for gating video calls, NFT platform to pay over multiple networks, more BTC ordinal news, and why ticketing will be a huge use case for NFTs.

Links

Links That Don’t Suck:

😖 Coinbase defiant in SEC lawsuit, demands court intervention

🤯 Legendary trader Peter Brandt issues warning as Bitcoin (BTC) forms key pattern

☠️ Oh, great, a ‘green’ coffin: it’s a mushroom coffin

👣 Exploring the potential of generative AI in games

🎉 Synthetix adds 7 new perpetual futures markets

💰 TradFi hedge fund Hunting Hill starts crypto arm

🏧 Multichain token price drops 20% as claimed bridge upgrade delays transactions