A little green all over, but nothing dramatic as the market continues to congest, congest, and congest. 🪗

Today’s Litepaper begins with a Technically Speaking article, covering the ongoing consolidation while highlighting certain altcoins that show early signs of a breakout (or, at least, attempting a breakout).

A look at the growth of tokenized bonds, Marathon ($MARA) supporting Bitcoin devs, and a Bitcoin skyscraper are also on deck today.

And Happy Bitcoin Pizza Day! 🍕

Here’s how the market looked at the end of the trading day:

| TRON (TRX) | $0.079 | 5.41% |

| Shiba Inu (SHIB) | $0.00000884 | 3.42% |

| Avalanche (AVAX) | $14.70 | 2.73% |

| Cardano (ADA) |

$0.368

|

2.11% |

| Internet Computer (ICP) |

$5.13

|

1.82% |

| Chainlink (LINK) | $6.52 | 1.45% |

| Monero (XMR) | $152.24 | 1.27% |

| Ethereum Classic (ETC) | $18.21 | 1.23% |

| Dogecoin (DOGE) | $0.073 | 0.98% |

| Polygon (MATIC) |

$0.868

|

0.76% |

| Altcoin Market Cap |

$567 Billion

|

0.49% |

| Total Market Cap | $1.088 Trillion | 0.56% |

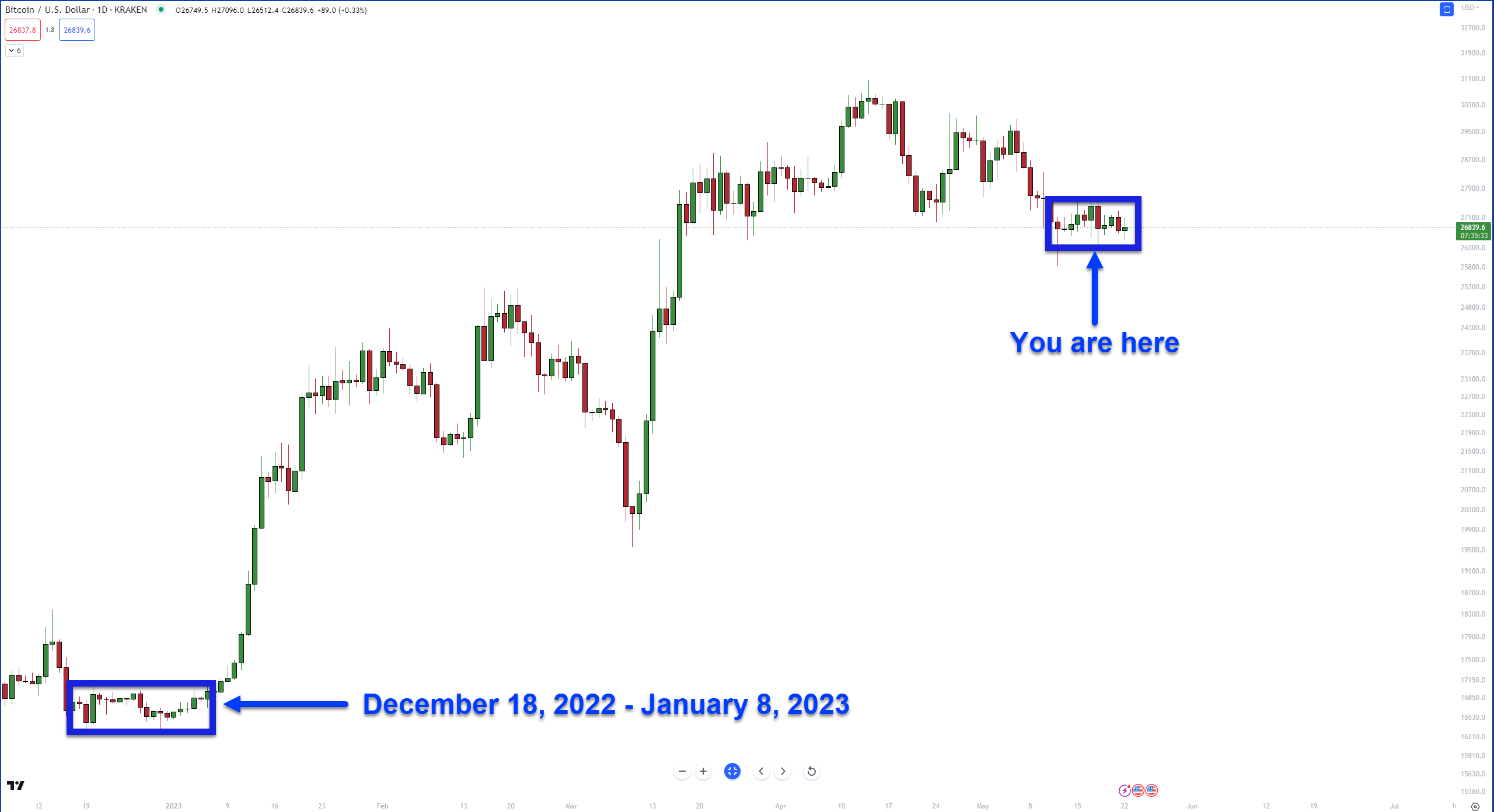

$BTC, and the broader market is more congested than a herd of penguins at a revolving door convention. 🐧

The last time this market was stuck in a congested environment like we are experiencing today was the last half of December 2022 to the first week-ish of January 2023.

Oof. Not fun. Look at $ETH‘s chart below. Get rid of the wicks, and this is what this shite show of a trading range looks like:

Ya, that’s a less than $30 range over the past ten trading days. Blegh. 🤢

Is there anything showing bullish signs of breaking out? There are a few:

The last chart we’re looking at is the Total Crypto Market Cap chart. It’s in a Falling Wedge pattern. 🧀

One of the common characteristics that analysts associate with the Falling Wedge, especially if the two trend lines visibly converge, is this:

Volume drops the closer price gets to the apex.

Additionally, a noticeable drop in overall volume can be a precursor to a bigger move, with a sudden spike in volume being the ‘final’ warning sign that something big is about to happen.

Has the maket had a sudden drop in volume? So far, it looks fairly controlled in its decline – but that’s up for interpretation.

We’ll watch for anything major and update as price action continues to develop. ⏱️

Surge in Tokenized Public Securities

Tokenized versions of public securities are making headlines, crossing a whopping $200M in market cap this week, as per Dune Analytics. 🪙

With regulatory turbulence stirring up the US crypto space, investors are flocking to tokenized versions of the country’s debt. The market is led by OUSG, a tokenized avatar of Blackrock’s ($BLK) short-term US Treasury Bond ETF ($SHV), which accounts for more than 60% of the market share.

Rising US interest rates and declining DeFi stablecoin yields have piqued interest in tokenized treasuries, hinting at a product-market fit for traditional assets on the blockchain.

Growing Interest and Advantages of Tokenized Securities

Ondo’s founder and CEO, Nathan Allman, reveals that interest is primarily inbound from crypto startups and high-net-worth individuals. 🤑

The allure of Ondo’s products lies in their ease of converting stablecoins into assets that yield accruing treasuries, available 24/7. Matrixdock’s SBTB, another token representing short-term treasury bills, is the second-highest tokenized security with a $72M market cap.

As the business world has begun to appreciate blockchain technology, tokenizing traditional securities has finally seen significant uptake.

Regulatory Hurdles and Future Prospects

However, this success invites regulatory hurdles. Ondo’s assets under management exceeding $150M would necessitate registering with the SEC as a registered investment advisor. 😒

Consequently, Ondo would need to disclose details such as client types, fees, and ownership structure. Interestingly, while fixed-income offerings are gaining traction, equities are lagging. Even Swarm, which launched compliant and tokenized versions of Tesla and Apple stock, has issued a modest $25,000 combined of swAAPL and swTESLA.

Looking ahead, Allman is enthusiastic about a proposal to enable fUSDC, representing yield-bearing $USDC lent to institutions through Flux, as collateral on the leading lending protocol Aave.

Crypto

Marathon Supports The Devs

Marathon Digital Holdings ($MARA) has committed to matching donations of up to $500,000 for the non-profit Bitcoin research and development organization Brink. ⛏️

During the Bitcoin 2023 conference in Miami Beach, Marathon will provide a two-for-one match, followed by a one-for-one match for additional donations until December 31. These funds will support grants and programs to compensate Bitcoin Core developers, who are vital in maintaining and improving the decentralized blockchain.

CEO Fred Thiel emphasized the importance of paying developers and acknowledged their reliance on grants from organizations like Brink. The collaboration between Marathon and Brink seeks to ensure the proper funding of Bitcoin Core development and maintenance, with Marathon encouraging industry partners to contribute to this cause. 👏

Dubai’s developer Salvatore Leggiero is trailblazing a novel approach to real estate, announcing his vision of the world’s inaugural Bitcoin Tower, set for a grand unveiling at the upcoming COP28 meeting. 🤯

Breaking away from the conventional, this unique venture is to manifest as a Bitcoin-themed hotel chain, blurring the lines between cutting-edge technology and hospitality. Committed to sustainability, the project harnesses blockchain and artificial intelligence, all while ensuring zero CO2 emissions.

An added twist in the tale, the hotel chain leaps into the NFT realm, rewarding its customers with distinctive utilities. For example, guests can stake cryptocurrencies and earn an APY, enabling a potentially profitable offset against their rental payments.

The 40-story Bitcoin Tower, far more than a skyscraper, is an homage to Bitcoin and its enigmatic creator, Satoshi Nakamoto. Embodying a real estate revolution, it marries digital and physical assets in an unprecedented fashion.

The invitation to contribute is open to creatives worldwide, heralding a stride into the future. ⏩

Bullets

Bullets From The Day:

🍕 Happy Bitcoin Pizza Day! 13 years ago. Damn, that seems like a long time – 13 years ago Laszlo Hanyecz, from Florida, bought 2 Papa John’s pizzas for 10,000 $BTC. That’s a little over a quarter of a billion dollars. Today we get to share the pain Mr. Hanyecz must feel every day.

💻 Overload alert on the blockchain horizon – Ethereum’s mastermind, Vitalik Buterin, voiced his concern about blockchain consensus overloads. As the strain on blockchain infrastructure grows, Vitalik’s pointed to the pressing need for a revamp. However, it begs the question: how long before a major overhaul becomes inevitable?

🦊 MetaMask in the clear? The popular crypto wallet MetaMask denies the allegations of playing taxman with your crypto transactions. ConsenSys, the force behind MetaMask, asserts that there’s no tax-collecting mischief happening. However, a screenshot on crypto social media highlighted a part of MetaMasks’s Terms and Conditions that says MetaMask has the right to withhold taxes when required.

👼 Robert F. Kennedy Jr. has announced his campaign will accept Bitcoin donations, signaling his endorsement of the cryptocurrency sector. During his address at the Bitcoin 2023 conference, Kennedy Jr. lauded Bitcoin for its representation of “democracy” and “freedom,” highlighting its durability and flexibility. Furthermore, he criticized Joe Biden’s proposed 30% tax on crypto mining, calling it a “bad idea” and asserting that nurturing the crypto industry could stimulate significant growth.

🌪️ Turbulence at Tornado Cash – in a dramatic turn of events, an attacker at the $ETH mixer submitted a proposal to revert governance control. After taking control, the attacker sold off close to 475k TORN (more than $2 million). He sold them on-chain and then re-deposited on Tornado. The drama is still unfolding. As a result, $TORN, the platform’s native token, took a sharp 40% dip.

Here is some of what’s inside today’s curated NFT news collection:

Space Pepes, Gary Vee on NFT, big floor price declines, 3AC’s NFTs sale with Sotheby’s, and BitBoy NFT sued.

Links

Links That Don’t Suck:

💸 Terra Founder Do Kwon having his bail conditions appealed in Montenegrin court

🥴 DCG misses $600M payment to Genesis as Gemini seeks resolution

🍦 World’s most expensive ice cream costs $6,696 per serving

🛩️ The E-Sports world is starting to teeter

🛑 Crypto exchange Hotbit shuts down 9 months after criminal probe