If you’re not caught up on what’s going on, here’s a quick summary:

The SEC alleges that Binance did some bad stuff. But that wasn’t all; included in the filing is the claim that certain cryptocurrencies are securities.

If the SEC was a country at war with the Republic Of Crypto, General Gary ‘Guns Out’ Gensler decided to forgo a single targeted missile attack on Binance’s infrastructure.

Instead, the SEC called up Rear Admiral Hold My Beer and ordered the U.S.S. Let’s Fuck Some Shit Up and launched every nuke in its arsenal to wipe out the Republic of Crypto. 💣

And that means today’s Litepaper is formatted a little differently.

The first article highlights the main points of the SEC’s allegations against Binance – something we’re still updating.

The second part of the Litepaper looks at the cryptocurrencies the SEC called out as securities and summarizes why they believe they’re securities. 🕵️♂️

Crypto

SEC VS. Binance

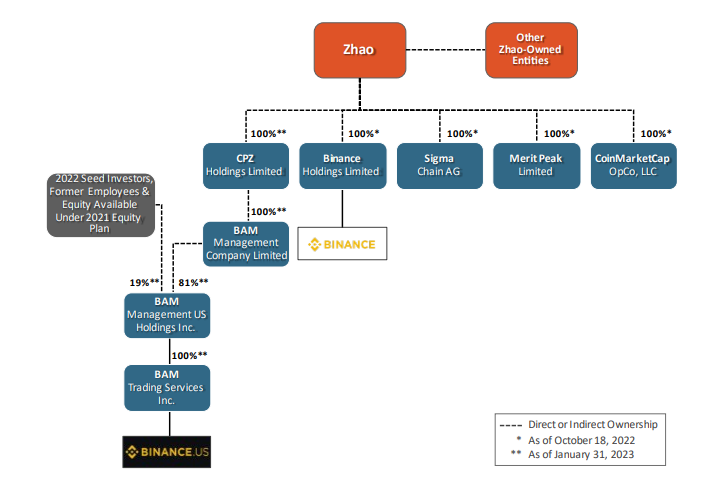

Before we dive in, let’s first get a look at the ‘Who Owns Who’ in this mess:

Here’s the summary of the allegations, which you can also read from the SEC here.

- Defendants have disregarded federal securities laws and enriched themselves at the expense of investors.

- Binance and BAM Trading have unlawfully solicited US investors through unregistered trading platforms.

- In addition, they have engaged in unregistered offers and sales of crypto asset securities and other investment schemes.

- BAM Trading and BAM Management have misrepresented surveillance and control over manipulative trading on the Binance.US Platform.

- Defendants have evaded registration and regulatory oversight designed to protect investors and markets.

- They have commingled and diverted investors’ assets without proper oversight.

- Defendants failed to implement adequate trade surveillance and manipulative trading controls on the Binance.US Platform.

- Sigma Chain engaged in wash trading to artificially inflate trading volumes on the platform.

- Binance and BAM Trading have violated securities laws by conducting unregistered offers and sales, evading registration, and operating with conflicts of interest.

- Their actions have violated the Securities Act of 1933 and the Securities Exchange Act of 1934.

- They have dodged disclosure and other requirements meant to protect capital markets and investors.

And here are a few of the damning facts as alleged by the SEC; as we review this hog of a filing, more will be added.

- Text or e-mail from Binance COO replying to an employee about blocking US customers showed they encourage US users to use a VPN to circumvent blocked access.

- Binance’s COO in 2018 admitted to a Binance compliance officer: “We are operating as a fking unlicensed securities exchange in the USA bro.”

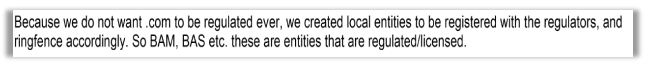

-

From the SEC filing – click to enlarge. - There were strong efforts by Binance.US to wrest control and get more independence from CZ and Binance Corporate; the CEO even called it Project 1776, but that CEO was then fired.

Crypto

Cardano And COTI

Cardano

The SEC claims that Cardano ($ADA) is a security, based on several reasons, as detailed in their filing:

Algorand (ALGO)

The SEC asserts that Algorand ($ALGO) should be considered a security based on the following reasons, as stated in their filing:

The Sandbox

The SEC contends that The Sandbox’s native token, $SAND, qualifies as a security for the following reasons, as explained in their filing:

Crypto

Cosmos And Filecoin

Cosmos (ATOM)

The SEC believes that Cosmos’s native token, $ATOM, qualifies as a security for the following reasons, as outlined in their filing: