Fundamentally, August was great for Bitcoin.

From a technical analysis perspective, August was like falling into a State Fair’s porta-potty, finally pulling yourself halfway out of that soup of horribleness, losing your grip, and then slipping back into the pit of stank a second time. 💩

In today’s Litepaper, we’ll look at the post-mortem of Bitcoin in August.

Also on deck: China’s courts surprise stance on crypto and Robinhood’s expansion into DeFi.

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $26,854 | -0.96% |

| Ethereum (ETH) | $1,621 | -1.51% |

| Total Market Cap | $1.017 Trillion | -0.98% |

| Altcoin Market Cap | $516 Billion | -0.98% |

| Chainlink (LINK) – Biggest Winner |

$5.90

|

0.68% |

| XRP (XRP) – Biggest Loser | $0.495 | -3.70% |

Crypto

August Sucked

From a fundamental analysis perspective, August was great, probably the best of the year, with $XRP, Grayscale, $UNI, and the broader DeFi and DEX platforms getting huge wins in courts against the SEC and/or government.

Not so from a technical analysis view. For $BTC, August included the worst week for Bitcoin since FTX’s collapse in November 2022, and August was also the worst-performing month since November 2022. 💩

Bitcoin’s Monthly Chart

The chart above shows only one Ichimoku Kinko Hyo system component: the Kijun-Sen.

The longest run of consecutive monthly closes below the monthly Kijun-Sen is 16 months, which Bitcoin has matched again.

And unless something dramatic happens in September where Bitcoin closes above $41,500 – a new record of 17 will be established. 😱

Bitcoin’s Weekly Chart

From a weekly chart perspective, Bitcoin is still in the same conditions it has been in for the past 25 weeks: stuck inside the Ichimoku Cloud.

But for the past three weeks, bears have been really testing near-term support against the Kijun-Sen. If that fails, the remaining support level is the bottom of the Cloud (Senkou Span A). 🫣

Crypto

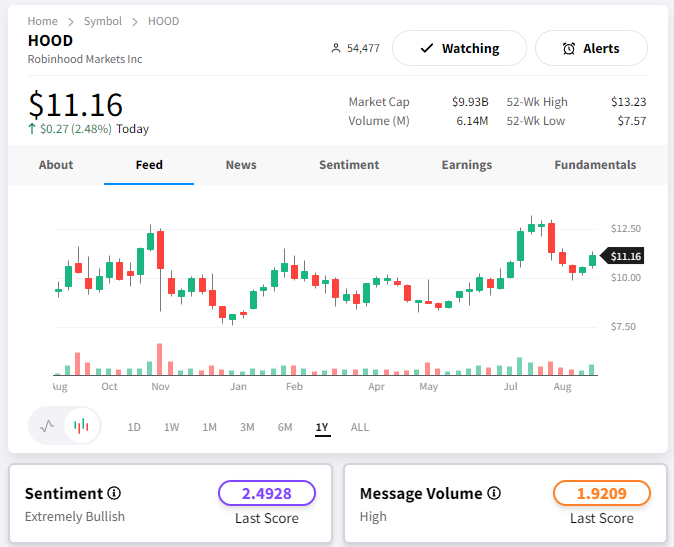

Web3 And DeFi In The $HOOD

Robinhood is making an attempt to make DeFi more accessible to the masses.

They’re also introducing in-app swaps on the Ethereum network for 200+ tokens. The best part? Users can swap without holding $ETH. Network fees? Deducted from the tokens you already hold. Easy-peasy. 🚀

$HOOD Wallet is now a multi-chain, self-custody, Web3 wallet that supports a range of networks like Arbitrum ($ARB), $BTC, Ethereum, $DOGE, Optimism ($OP), and $MATIC. And yes, users have full control over their crypto, holding their private keys.

Robinhood emphasizes security. Users must set up Face/Touch ID or a custom PIN for app access. And that secret recovery phrase (or seed phrase)? It’s crucial for wallet access, and Robinhood never sees it. So, keep it safe and never share! 📚

Currently, Robinhood Wallet is available for all iOS users. Android users have to wait #sadface until later this year.

Despite Beijing’s 2021 crypto ban, Chinese courts have been singing a different tune. A recent report from the People’s Court concluded that they’re still legal property under the current framework and deserve legal protection. 📜

This isn’t the first time Chinese courts have shown a softer side to crypto; back in September 2022, legal experts argued that crypto holders still had rights, and by May 2022, a Shanghai court declared Bitcoin as virtual property.

The report suggests a unified approach to strike a balance between personal property rights and broader societal interests. While the national policy might be chilly towards digital assets, the courts seem to be warming up, offering a glimmer of hope to crypto enthusiasts in the country.

What does the Chinese Communist Party have to say about this? No idea. Just another example of why China’s relationship with crypto has been… complicated. 🎢

Bullets

Bullets From The Day:

📉 Robinhood strikes a deal with the U.S. Marshal Service, shelling out $605.7 million to repurchase stocks once owned by FTX’s Sam Bankman-Fried. The U.S. government had previously seized these shares, and now Robinhood’s making its move to reclaim them.

🎥CryptoKing, a Brazilian crypto streamer, learns a hard lesson in privacy. During a live tutorial, he accidentally flashes his private keys’ QR code. Viewers pounce, swiping around $60,000 from his digital wallet. A stark reminder: always guard those keys.

🚗 Colorado’s DMV goes crypto-friendly, but there’s a twist: payments are through PayPal only. While PayPal’s not traditionally known for crypto payments, this move might signal a broader acceptance. But remember, there’s a service fee for those opting for the crypto route.

💼 UK’s crypto tax dilemma: Inaccessible yet taxable. The UK government faces criticism over its approach to taxing crypto. Bereaved families could be slapped with hefty tax bills on inherited crypto they can’t even access. With around $30.2 million lost daily due to inaccessible crypto, the UK’s tax system seems ill-equipped for the digital age.

🔍 SEC’s ETF Delay Game: BlackRock’s Odd One Out? The U.S. SEC’s playing the waiting game with Bitcoin spot ETF applications, but there’s a curious twist. While all applications faced a delay, BlackRock’s took a detour. Bloomberg’s James Seyffart noticed BlackRock’s delay letter wasn’t with the rest on the SEC’s site. It’s there, just not where you’d expect. A simple oversight or something more?

Links

Links That Don’t Suck:

🧌 ‘Troll Post Of The Day:’ Dogecoin lover Elon Musk reacts to post mocking cypto as ‘F***ing Lame’

📱 The first smartphones on Ethereum’s blockchain were all sold in 24 hours

✈️ Lufthansa takes to digital skies, launching NFT loyalty rewards with Uptrip on Polygon

🪙 Tether’s stablecoin USDT ‘has a peg stability problem’, claims analyst

😒 Meta isn’t enforcing its own political ads policy, while the 2024 US election looms