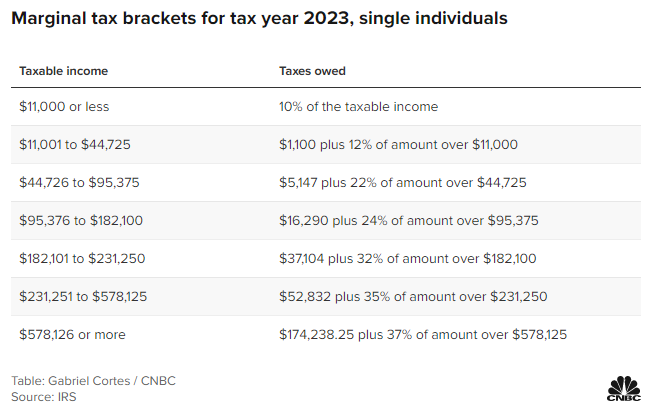

As inflation sits near 40-year highs, the government has to adjust limits for specific services and policies like social security. So today, the IRS announced higher federal income tax brackets and standard deductions for the coming year.

The adjustments mean people will see more money in their paychecks, as less of their income will be subject to higher marginal tax rates. In addition, an increase in the standard deduction also means fewer dollars will be subject to tax.

While this is positive, the negative with these adjustments is that they are related to inflation. So while you’ll be paying fewer taxes, you’ll likely have to spend that money elsewhere just to maintain your standard of living.

The IRS is also raising contribution limits for tax-deferred retirement plans by a record 9.8%, or $2,000, due to inflation. That means Americans can contribute up to $22,500 into 401(k), 403(b), and most 457 plans. On top of that, individual retirement account (IRA) limits have risen to $6,500 from $6,000. 🔺

Finally, the limit on flexible spending accounts (FSA) is set to increase from $2,850 to $3,050.

The government hopes these adjustments will help people cope with record-high inflation better. It’s not much, but we’ll take what we can get in this environment. 🤷

And if you’ve got nothing better to do this weekend, you can read all of the changes on the IRS’s website. 📝