Cannabis stocks had another rough year in 2024, failing to make any meaningful progress or participate in the broader stock market’s rally. But, like all beaten-down industries, they occasionally pop back in the news like they did today. 📰

In late August, the industry’s biggest names and ETFs began rallying after a top official at the Department of Health and Human Services (HHS) wrote to Drug Enforcement Agency (DEA) Administrator Anne Milgram. In it, the official called for marijuana to be reclassified as a Schedule III drug under the Controlled Substances Act.

That would fall short of federally legalizing the drug but would mark a critical shift away from its current Schedule I substance status alongside heroin, LSD, ecstasy, and other high-risk drugs. 🥦

Well, to start the new year, the Drug Enforcement Agency (DEA) told House lawmakers that the agency is “now conducting its review” of marijuana as a Schedule 1 drug. It also noted that it has the “final authority” to schedule, reschedule, or reschedule a drug under the Controlled Substances Act, regardless of the HHS’s evaluation and recommendation.

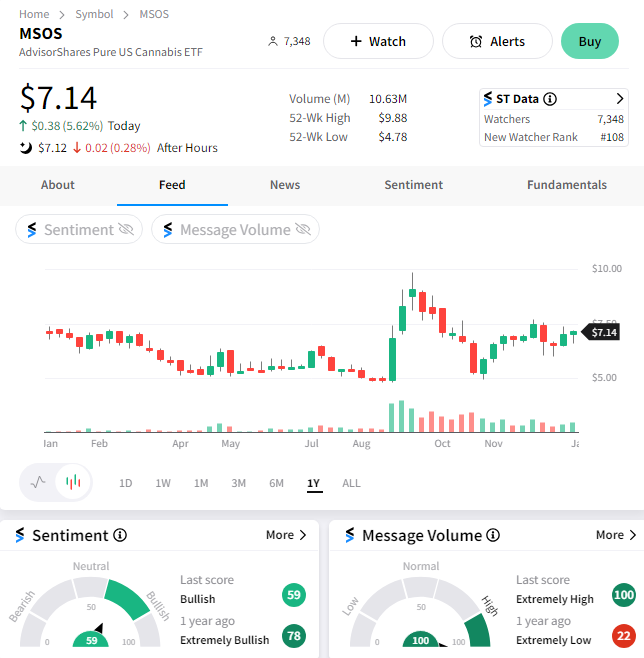

While not a groundbreaking comment or event, it was enough to renew interest in the highly shorted sector. Popular ETFs like $MSOS rose several percent throughout the day and continue to trade above the levels they were at before the initial news last August. The Stocktwits community is a bit hesitant to jump in so far, with the sentiment meter leaning slightly toward bullish. 🧐

We’ll have to wait and see whether this “news” takes the industry anywhere or if it’s another moment of false hope. For now, traders have the sector on their radars and are looking to potentially capitalize on another news-driven short squeeze. 👀