We last talked about the U.S.’s largest initial public offerings (IPOs) a month ago, when their results failed to inspire confidence among investors. However, we wanted to bring them back this week because at least one of them is perking up. 👀

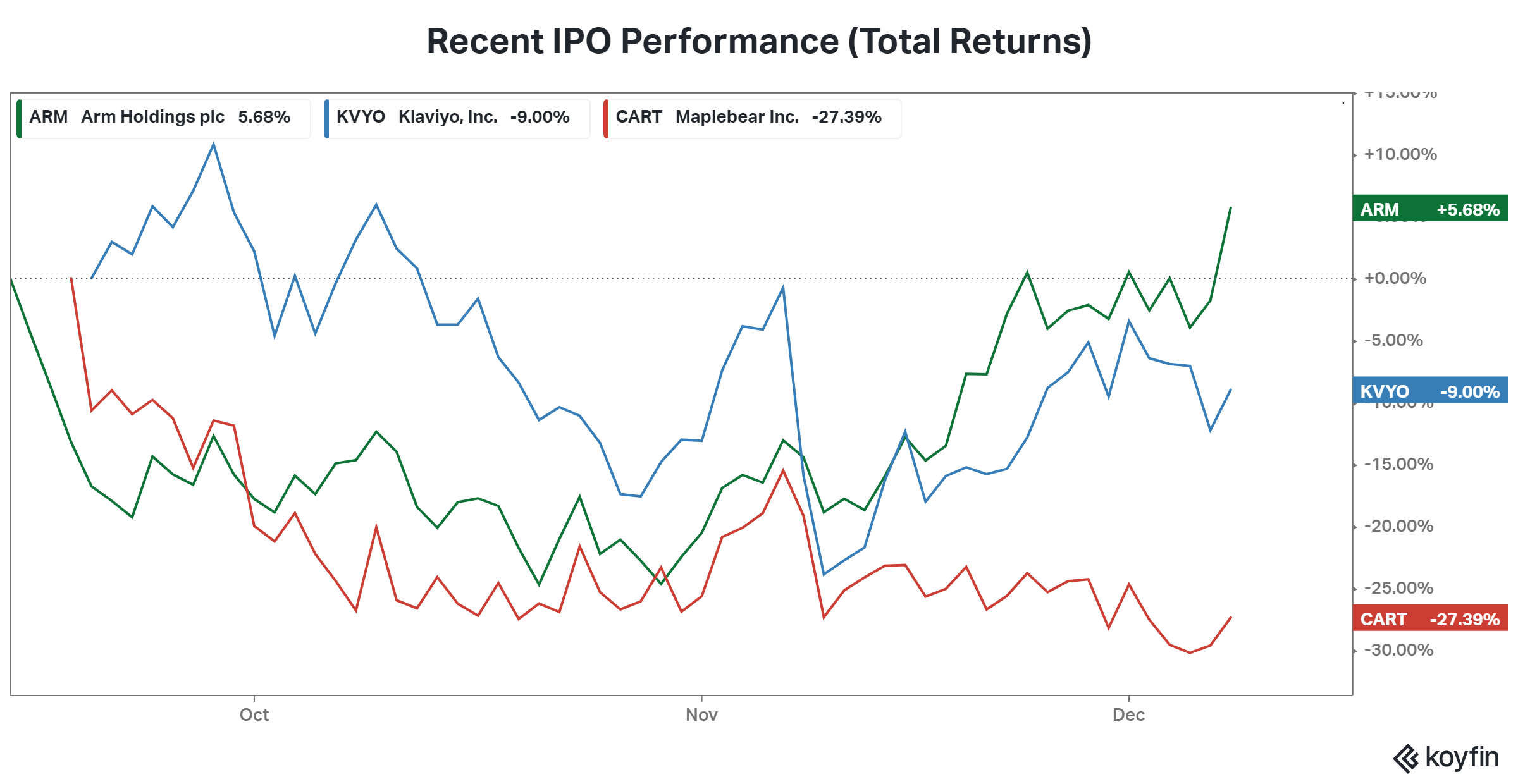

The chart below shows Arm Holdings closing at its highest level since coming public, now firmly in positive territory. Klaviyo, which started off hot, is between its highs and lows. But Instacart remains on a downward path, making fresh lows this week before rebounding marginally. 📊

This reiterates that investors remain very selective when it comes to new offerings in the market. We’ll have to wait and see how Reddit, Shein, and other high-profile startups fare as they prepare to go public early next year. 💰