Three of the “hottest” IPOs of recent history just released their first earnings results as public companies. Let’s see how they did. 👇

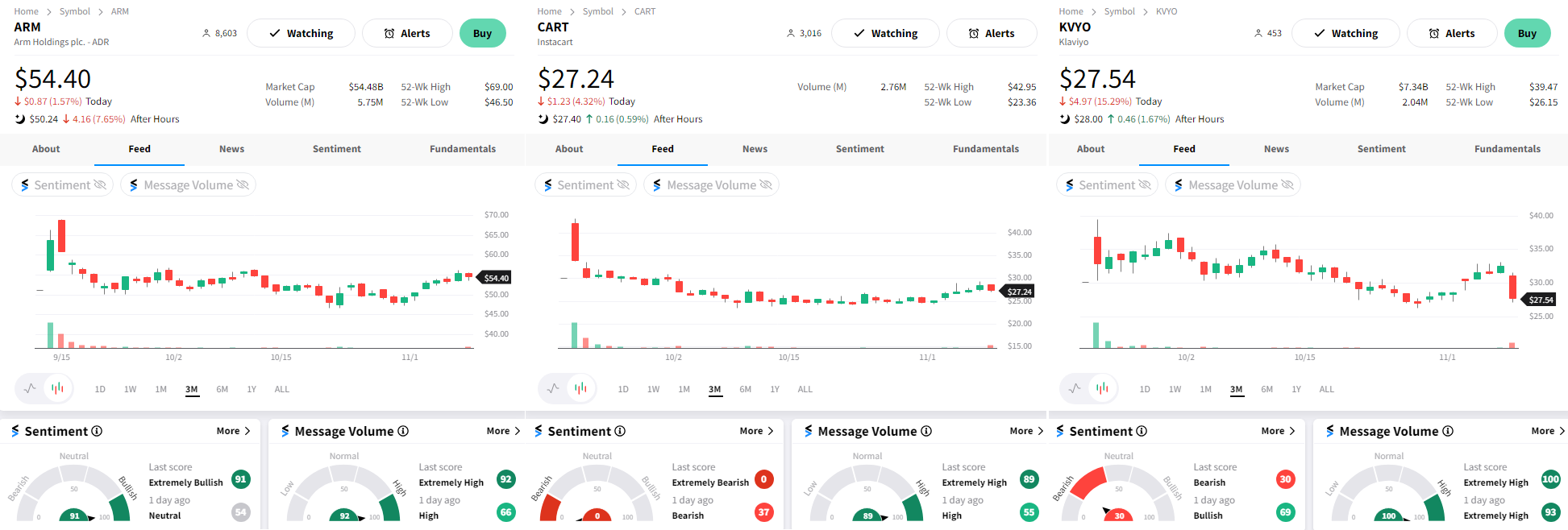

First up is semiconductor equipment maker Arm Holdings. Its adjusted earnings per share of $0.36 on revenues of $806 million topped expectations of $0.26 and $740 million. However, its guidance for the current quarter came in below estimates, at $720 to $800 million vs. $776 million expected. 🔻

Next, grocery delivery company Instacart posted better-than-expected results. Third-quarter revenues of $764 million were up 14% YoY and topped the $737 million expected. Gross transaction value narrowly beat the consensus view at $7.49 billion vs. $7.46 billion expected. Transaction revenues rose 12%, with orders increasing 4% and an average order value of $113. 🛒

Advertising and other revenue ticked up 19% YoY to $222 million. Additionally, its loss of $2 billion was slightly below the $2.2 billion expected, while adjusted EBITDA came in $43 million above expectations. Despite seemingly good headline numbers, the stock still fell 4% as investors take a cautious approach toward this business model in an uncertain economy. 🔺

Lastly, marketing automation company Klaviyo reported revenues of $175.8 million vs. the $167.2 million expected. Its revenue guidance for the current quarter of $195 to $197 million was also slightly above the consensus view of $194.7 million. However, its third-quarter loss of $1.24 per share widened from $0.10 last year and was below expectations. 📊

Overall, it was a pretty “meh” start for most of these companies. Despite receiving strong opening valuations and initial day pops, their shares have treaded water since IPOing as investors await a clear catalyst to propel them higher. So far, it doesn’t appear their first earnings reports will supply that boost. 🤷