Well, it was another wild month for the markets in October. Seasonally, it tends to be a rough period for the stock market, so it certainly lived up to that by crushing investors’ hopes for an “Uptober.” Let’s see how the various asset classes did. 👇

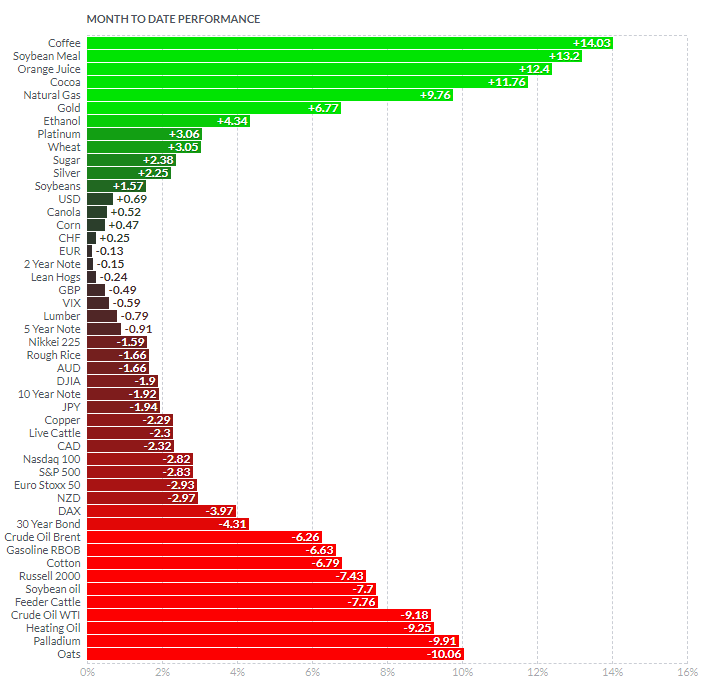

First, we’ll start with the Finviz futures chart summarizing the major asset classes. As we can see, October was a good month for several commodities but pretty rough for the rest of the market. Bonds continued their decline, while the average stock continued to struggle.

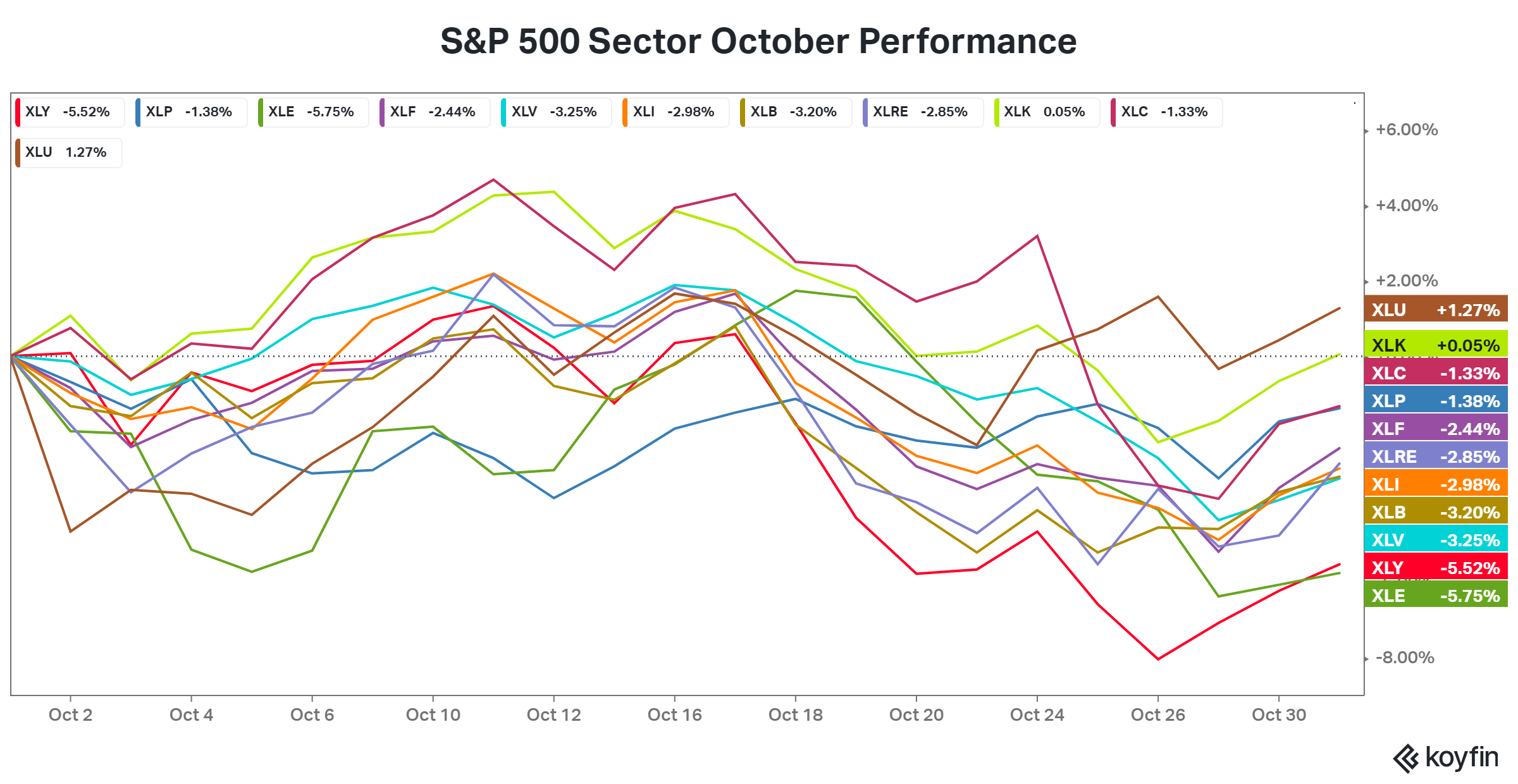

Until last week, the “magnificent seven” mega-cap technology stocks had been holding up the Nasdaq 100 and S&P 500, but earnings finally gave bears an edge there too. 🐻

Meanwhile, consumer discretionary and energy led the sector declines while utilities and technology managed to eke out a small gain. Interest rates and earnings continue to drive sector performance right now, which has been leaning more defensive as global recession fears reverberated again. 📊

The only market to experience a significant “Uptober” was crypto, which saw its total market cap increase by a whopping 19%. That brought it firmly back above the $1 trillion mark as optimism grows that a spot Bitcoin ETF will be approved sometime soon. ₿

Overall, it was a messy month of October. With two months left in the year, there are a lot of money managers that need to catch their benchmarks. Combine that with the many macroeconomic and geopolitical concerns facing the world, and we’ve got a recipe for continued volatility. 😬