We don’t want to say CNBC caused the top in Super Micro Computer Inc., but they definitely pushed sentiment over the edge. 🤪

Mania’s are hard to time, but most market participants agree that today was “a” top in the stock. What we all fail to agree on is whether it was “the” permanent top. Let’s see how it played out. 👇

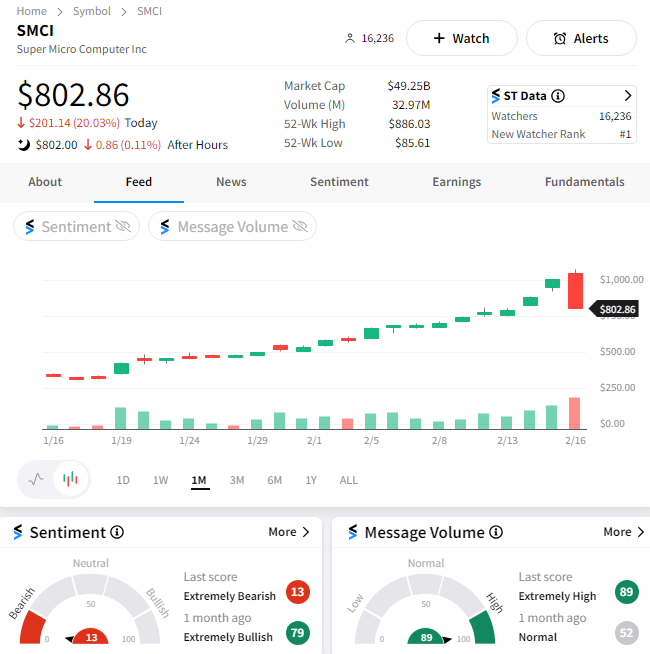

SMCI shares rose to nearly $1,100 in pre-market trading but sold off at the open and throughout the day. The stock traded in a $300 price range and closed down 20% from yesterday’s highs, erasing two full days of gains in the process.

Clearly, the short-term momentum has shifted. So, with traders moving to the sidelines, at what price do investors become interested in buying the dip? We’ll have to wait and see in the days ahead, but many expect the chip volatility to continue since Nvidia earnings are on deck next Wednesday. 😬

With semiconductors cooling off, technical analysts are keeping an eye on this trendline in the Nasdaq 100 ETF. This “line in the sand” has supported the market throughout 2024 and as far back as November, so traders are watching it closely to see if that continues.

Bulls argue that as long as prices are above this trendline, they’re buying the dip because the trend remains intact. On the other hand, bears say that the more times a level of support is tested, the more likely it is to break. ⚔️

As of today’s close, we’re right at this trendline, so the pressure is on bulls to reassert their dominance and scare the bears off again. This inflection point will set the tone for the tech-heavy index in the short term as we head into another important earnings week.

We’ll see what happens on Tuesday when the U.S. markets reopen. Until then, if you want more content on AI and a potential market top, check out the Trends With Friends podcast below! 🍿