Advertisement|Remove ads.

US Election 2024: Schwab, Robinhood, Interactive Brokers’ Stocks Surge As Trump Win Sparks Retail Optimism

Shares of brokerage firms such as Charles Schwab ($SCHW), Robinhood ($HOOD), and Interactive Brokers ($IBKR) soared Wednesday morning following President Donald Trump’s 2024 election win.

Investors anticipate a shift towards less regulation and a more favorable environment for businesses.

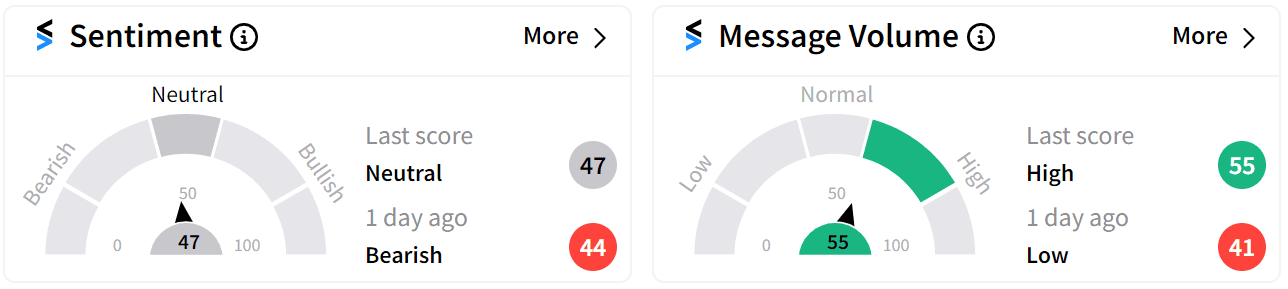

Charles Schwab ($SCHW)

Shares of Charles Schwab surged nearly 7% during mid-day trading on Wednesday while retail sentiment around the stock improved to ‘neutral’ (47/100) from ‘bearish’ a day ago.

Charles Schwab analyst Kevin Gordon told CNBC TV that the market set-up looks “healthy” going into the election before the final results for the US Election 2024 were in.

Last week, the brokerage announced plans to add stocks in the S&P 500 ($SPY) and Nasdaq-100 ($NDX), as well as hundreds of exchange-traded funds (ETFs), to the securities available for trading 24 hours a day, five days a week.

Currently, it offers only a few dozen ETFs for round-the-clock trading.

Shares of Charles Schwab have gained 10% so far in 2024.

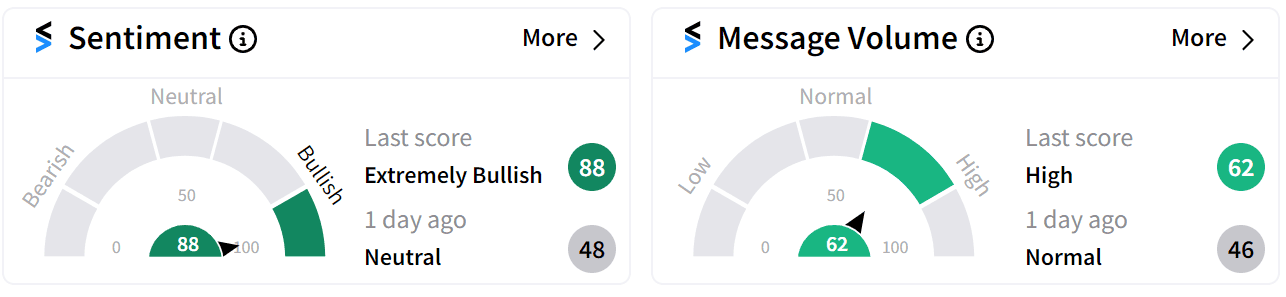

Robinhood ($HOOD)

Robinhood shares saw a near 20% jump on Wednesday with retail sentiment rocketing into ‘extremely bullish’ (58/100) territory and message volume rising to ‘high’ (62/100).

Wednesday’s surge in share price pushed Robinhood’s stock to a three-year high of $29.87.

This jump came on the heels of a similar surge last week, triggered by the company’s introduction of prediction market trading ahead of the 2024 U.S. elections.

Robinhood’s stock has more than doubled in value so far this year with gains of 142%.

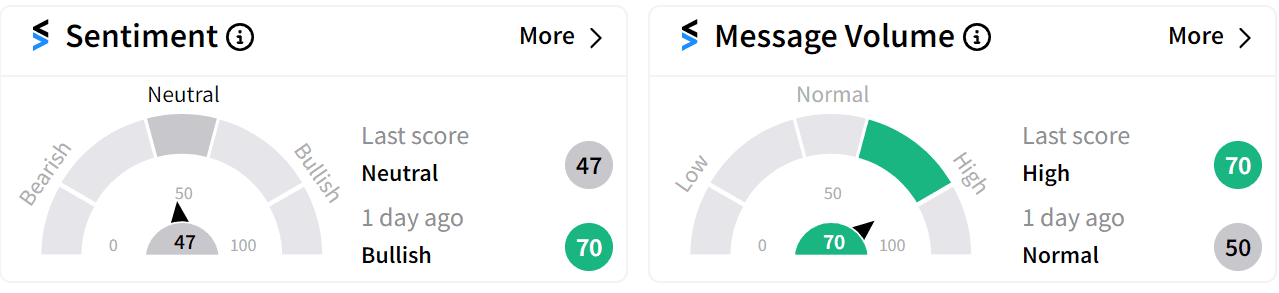

Interactive Brokers ($IBKR)

Interactive Brokers hit an all-time high of $172.20 after soaring over 11% on Wednesday.

However, retail sentiment around the stock has dipped to ‘neutral’ (47/100) from ‘bullish’ a day ago.

The company reported strong daily average revenue trades (DART) numbers before markets opened on Tuesday, which rose 46% compared to October 2023 and 7.2% from the previous month.

Interactive Broker’s stock has also doubled in value with gains of 104% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190030422_jpg_015a76718e.webp)