Advertisement|Remove ads.

Robinhood Stock Hits 3-Year High On Election Trading Launch, But Retail's Far From Excited

Robinhood’s ($HOOD) stock climbed nearly 4% on Monday, reaching a three-year high of $28.23 during mid-day trading, following the platform’s rollout of election trading.

The digital brokerage will now allow trading on U.S. presidential election event contracts, something that platforms like Kalshi and Polymarket already offer, as it seeks to capitalize on growing retail demand for betting products.

Starting Monday, eligible U.S. users can trade contracts for candidates including Kamala Harris and Donald Trump, expanding options traditionally available for equities and other securities.

“We believe event contracts give people a tool to engage in real-time decision-making, unlocking a new asset class that democratizes access to events as they unfold,” said Robinhood in a statement.

Barclays has maintained its ‘Equal Weight’ rating on the stock with a price target of $23. While the initial revenue boost from these contracts is expected to be modest, Barclays sees this as part of Robinhood's broader product roadmap.

It estimates Robinhood's election contract volumes may reach only a portion of the $2.5 billion traded on U.S. election bets on PolyMarket.

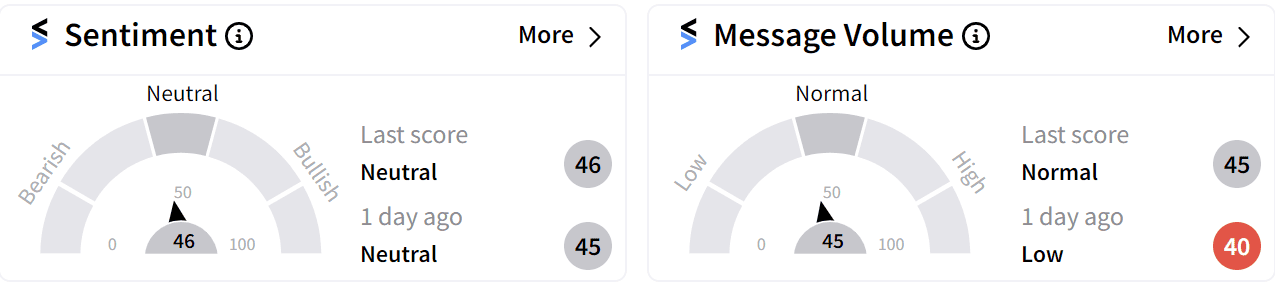

Retail sentiment on Stocktwits remains neutral (48/100), with low message volume (44/100), indicating that investors are divided about Robinhood’s latest rollout ahead of quarterly results on Wednesday.

Robinhood's decision to enter prediction markets comes after Kalshi won a key ruling against the Commodity Futures Trading Commission (CFTC), which was seeking to stop the election outcome trading.

This venture into election markets marks Robinhood's first foray into prediction markets, where users can buy and sell contracts tied to specific outcomes, such as election results, economic indicators, or policy announcements.

Robinhood’s stock value has quadrupled over the last 12 months while gaining 127% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

Read more: MicroStrategy’s Bitcoin Holdings Drive Historic High: Retail Unfazed

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)