Advertisement|Remove ads.

Diwali 2025 Muhurat Pick: Tata Power’s Green Push Makes It A Top Trade, SEBI Analyst Sees Over 50% Upside

Tata Power has emerged as a Diwali Muhurat pick for 2025, with SEBI-registered analyst Deepak Pal bullish on the company’s aggressive renewable expansion and strong technical structure.

The company intends to scale renewable capacity from 5 GW to over 20 GW by 2030 through organic projects and acquisitions, with management guiding investment up to $9 billion for this expansion. This is a transformational growth driver, according to Pal.

Its kitty of solar EPC projects, focus on renewable projects and other distribution assets, offers steady cash, ensuring future revenue visibility.

Tata Power: What are technical charts showing?

Deepak Pal highlighted that the long-term (monthly) trend has been bullish since the stock’s consolidation breakout periods, with higher highs and higher lows on the monthly timeframe indicating a structural uptrend.

He identified a primary accumulation/support band at ₹300–₹360, with secondary support near ₹250–₹280. Near-term resistance is seen around ₹450–₹500, with a 12-month target at ₹550 and ₹600+ in a bullish scenario.

Diwali trading call

Pal advised traders to accumulate Tata Power shares on dips toward the support band in tranches and add more on a confirmed breakout above ₹450–₹475 with volume.

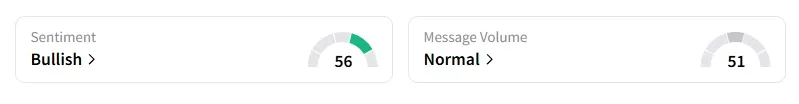

What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment turned ‘bullish’ a day ago

Tata Power shares are flat year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_COMCAST_NBC_Universal_OG_jpg_6c6153d748.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2196132829_jpg_48db169d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_OG_jpg_e819c9d392.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_digital_logo_resized_4885381f60.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_logo_headquarters_original_jpg_d9fbb245f9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)