Advertisement|Remove ads.

Arthur Hayes Wallet Activity Puts Limitless Token Back On Breakout Radar

- Arthur Hayes’ locked wallet received about $179,000 worth of LIT, according to on-chain data.

- The Moving Average Convergence Divergence shows a bullish breakout as buy-side pressure for the token increased.

- The financial score for Limitless remained in weaker territory.

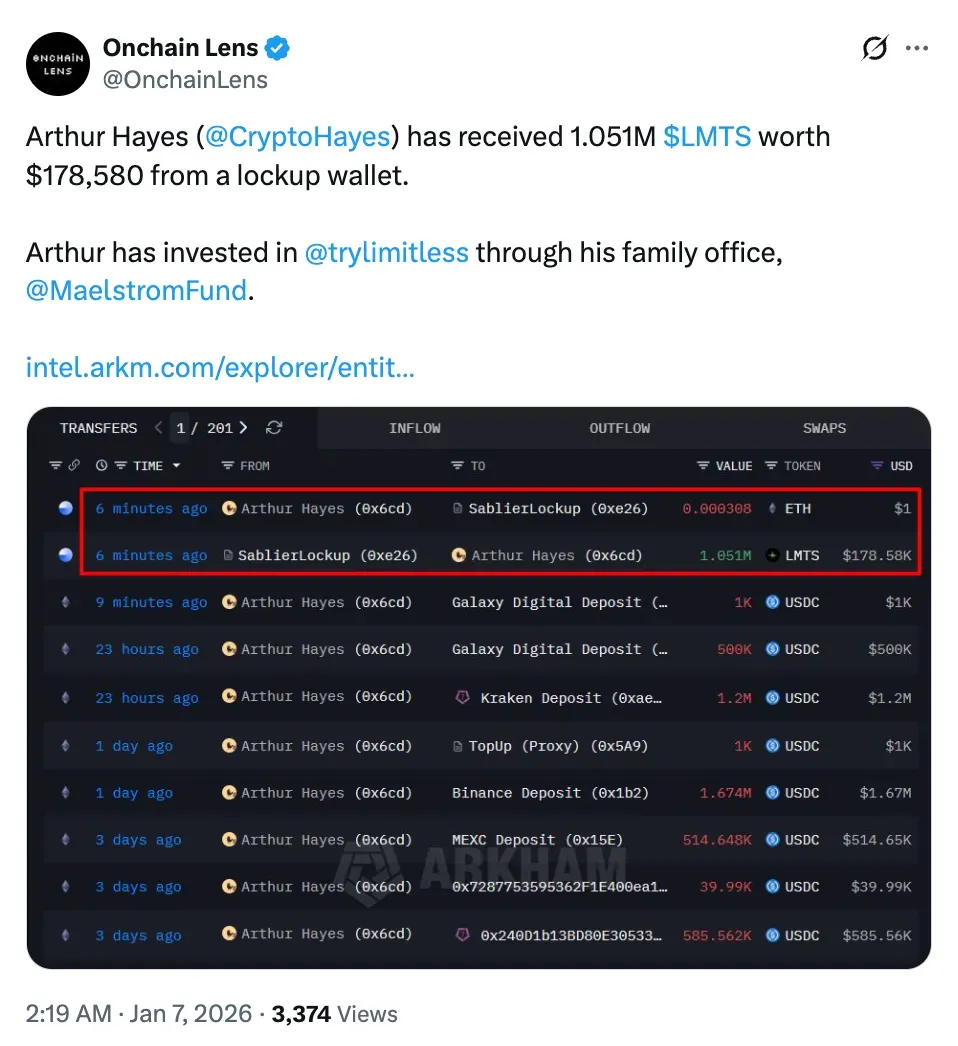

Limitless (LMTS) drew attention on Tuesday after Arthur Hayes received nearly $178,600. Soon after, Limitless signaled a bullish breakout.

Onchain Lens reported on Tuesday that BitMEX co-founder Arthur Hayes received 1,051,000 LMTS tokens, valued at approximately $178,600, from a Limitless project-linked wallet. According to the analytics firm, Hayes previously invested in the project through his family office, Maelstrom. The transfer came from a lockup wallet and does not necessarily indicate an imminent sale.

Tracking Technicals

On a technical level, the histogram has been moving lower and towards the center line, indicating diminishing selling momentum. At the same time, the MACD line has started curling upward towards the signal line, which would lead to a bullish crossover if positive price action continues. At this point, the signal indicates a possible momentum shift rather than a final confirmation of the breakout. The buy-and-sell volume from Coinalyze also shows increasing buy-side pressure for the token.

Limitless (LMTS) was trading at $0.16, down 2.39% in the last 24 hours. On Stocktwits, retail sentiment around Limitless was in ‘neutral’ territory, as chatter remained ‘extremely low’ over the past day.

Risk and Fundamental Overlay

A second, risk-based analysis offers a more conservative view. According to the audit report, the token is at a total “Stay Cautious” ratio of 5.5. Although the security number is at 79, which is relatively positive, and moderate scores can be seen in fundamentals at 62, social markers at 66, and on-chain metrics at 53, its financial score remains notably weak at 17.

Read also: Bitcoin, Gold Start 2026 Higher, But Analysts Say The Rally Is ‘A Simple Coincidence’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)