Advertisement|Remove ads.

The Billion Dollar Outflow: Bitcoin ETFs Suffer Heaviest Withdrawals Since Debut As Crypto Market Buckles

Bitcoin’s (BTC) price remained under pressure, trading below $90,000 during early U.S. market hours on Wednesday, struggling to recover from a three-month low following the rout that rippled through the broader cryptocurrency market.

The leading digital asset slipped to the $86,000 mark on Tuesday, triggering a wave of investor withdrawals from U.S.-listed spot Bitcoin exchange-traded funds (ETFs) at the fastest pace seen this year.

According to data from Farside Investors, net outflows from spot Bitcoin ETFs reached $937.78 million on Tuesday, marking the largest single-day redemption since the funds debuted in January 2024.

That figure has since risen to $1.01 billion, according to SoSoValue’s live tracker.

Fidelity’s FBTC saw the heaviest withdrawals, with investors pulling $344.65 million, followed by $164.37 million in redemptions from BlackRock’s IBIT. Other funds reported outflows of less than $100 million each.

The exodus eclipsed the previous record set on Dec. 19, when net outflows from spot Bitcoin ETFs hit nearly $670 million after Bitcoin fell below $97,000.

In a post on X, Arthur Hayes, the co-founder of BitMEX, warned that this pattern could push Bitcoin’s price as low as $70,000.

According to him, when hedge funds exit the market in large numbers, it often leads to a chain reaction with additional selling by other investors, further exacerbating the price drop.

Hayes also pointed to changes in Trump’s tariff policy as a key factor contributing to the selling pressure on Bitcoin.

Meanwhile, according to CoinDesk, the retreat from spot Bitcoin ETFs could be a result of the decline in the premium of CME-listed Bitcoin futures, which has eroded the appeal of the “cash-and-carry” arbitrage strategy.

This strategy, favored by institutional investors, involves buying spot Bitcoin ETFs while shorting CME futures to capture the premium – locking in risk-free returns.

However, the yield on this trade has deteriorated sharply, offering little advantage over traditional fixed-income assets.

According to data from Velo, cited by CoinDesk, the annualized one-month basis (premium) in CME Bitcoin futures fell to 4% on Tuesday, its lowest level in nearly two years.

That’s a steep drop from nearly 15% in December, significantly reducing arbitrage opportunities.

Meanwhile, the U.S. 10-year Treasury yield stood at 4.32% at the time of writing, making fixed-income investments an increasingly attractive alternative to crypto-based arbitrage.

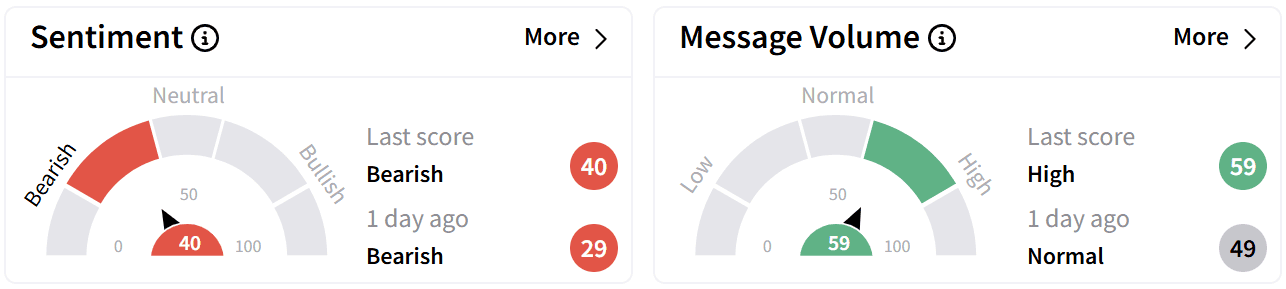

On Stocktwits, retail sentiment around Bitcoin improved but remained in the ‘bearish’ territory, even as chatter increased to ‘high’ levels.

One user noted that Bitcoin's price is in line with global liquidity trends, suggesting that the apex coin has likely found a temporary low and may be set for a longer upward move.

Another user stated that Tuesday’s crash was most likely the last opportunity for traders to buy Bitcoin at $80,000 levels.

Bitcoin’s price has fallen nearly 10% over the past month but still holds onto gains of 73.4% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)