Advertisement|Remove ads.

Vitalik Buterin Warns Of Three Structural Flaws Holding Back Decentralized Stablecoins

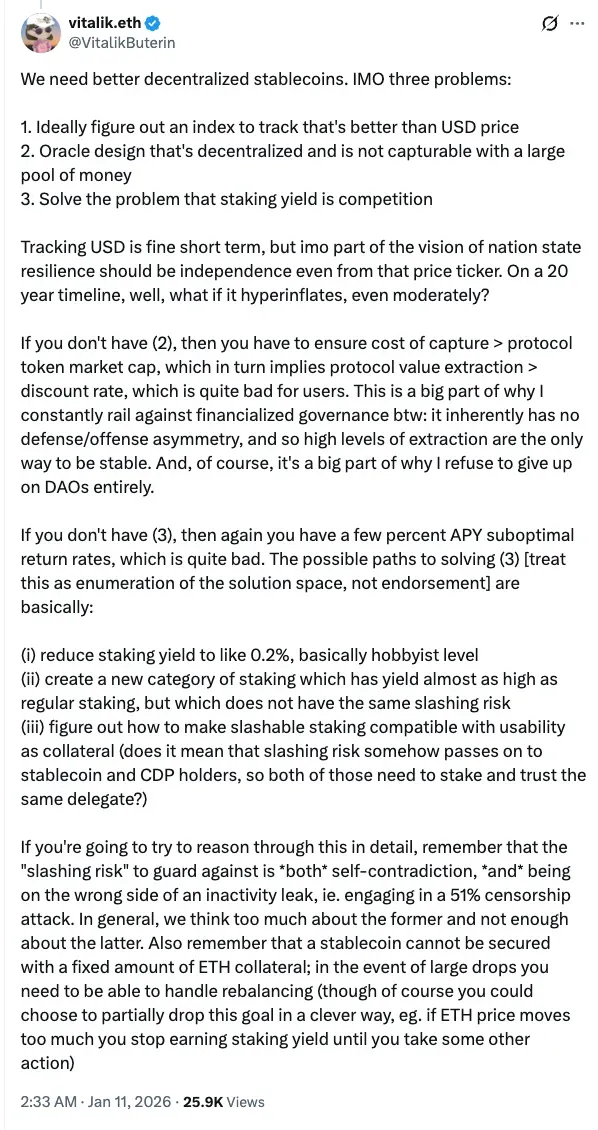

- Decentralized stablecoins have inherent design issues, said Ethereum co-founder Vitalik Buterin on Sunday.

- He cautioned that oracle design and financialized governance systems are pushing protocols towards high-value extraction to stay secure, describing this as “bad” for users.

- The comments come ahead of Thursday's crucial markup by the Senate Banking Committee of the U.S. crypto market structure bill.

Decentralized stablecoins’ fundamental design flaw means they present a longer-term risk and face structural weaknesses, according to Ethereum (ETH) co-founder Vitalik Buterin.

Buterin wrote on X that the industry requires a more fundamental architectural innovation, not just incremental patches. Buterin said that the industry is still too reliant on tracking the U.S. dollar and lacks much in the way of resiliency to long-term macro risks. “Tracking USD is fine in the short term, but part of the vision of nation-state resilience should be independence even from that price ticker,” he wrote, noting that across a multi-decade horizon, dollar debasement could emerge as a material vulnerability.

Ethereum (ETH) was trading at $3,102.81, up 0.29% in the last 24 hours. On Stocktwits, retail sentiment around Ethereum remained in ‘neutral’ territory, with chatter levels in ‘normal’ over the past day.

Buterin Warns of Oracle Capture, Governance Risks, And Weak Yields

He also mentioned oracle design as a critical risk, stating that decentralized systems must be resistant to capital-based capture. Without that, protocols are incentivized to achieve higher value extractions in order to protect themselves, something he described as “quite bad for users.” Buterin was dismissive of financialised governance systems, arguing they lack defensive asymmetry and inefficiently require high economic penalties in order for them to be trustworthy.

On yield, he described trade-offs encountered by staking-based stablecoins, arguing that without structural changes, users are stuck on “a few percent APY suboptimal return rates.” He also stressed that the cutting of risk and inactivity penalties is an undervalued consideration when designing stablecoins, especially when involved funds are supposed to remain usable even in cases of sharp market drawdowns.

The remarks also come as U.S. lawmakers are getting ready to mark up the highly anticipated crypto market structure bill later this week. The legislation will be reviewed by the Senate Banking Committee on Thursday, and if it passes, we should hopefully see shored-up regulatory frameworks that could jump-start institutional involvement across the stablecoins and wider digital asset infrastructure.

Read also: ‘No Faith In Any Given Trade’: Peter Brandt Pushes Back On Tom Lee’s $200k Bitcoin Target

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)