Advertisement|Remove ads.

Bitcoin Drops Below $108,000: Fed Rate Jitters Prompt Traders To Gauge Risks Closely

- Among other tokens, BNB was down 4.4%, Solana was down 5.8% and Dogecoin was down close to 8%.

- According to a CoinDesk report, market maker FlowDesk said that its clients have mostly paused adding new risk after last week’s Federal Reserve meeting.

- Spot BTC ETFs logged over $600 million in outflows last week.

Bitcoin and other major cryptocurrencies fell in early trading on Monday after a tepid show in October, as investor concerns grew around the lack of near-term positive drivers.

The apex cryptocurrency fell 2.6% to $107,486.52 at the time of writing, according to CoinMarketCap data, while Ethereum fell 4.5% to $3,724.37 and XRP slipped nearly 4% to $2.42. Among other tokens, BNB was down 4.4%, Solana was down 5.8% and Dogecoin was down close to 8%.

What Did Federal Reserve Chair Jerome Powell Say Last Week?

The Federal Reserve lowered benchmark interest rates by 25 basis points on Wednesday. However, digital assets and equities declined after Federal Reserve Chair Jerome Powell dampened expectations of another rate cut this year.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it,” Powell said, before adding that there was “a growing chorus now of feeling like maybe this is where we should at least wait a cycle” before the next move.

The lack of near-term drivers has caused significant outflows from the apex cryptocurrency spot ETFs. Spot BTC ETFs logged over $600 million in outflows last week.

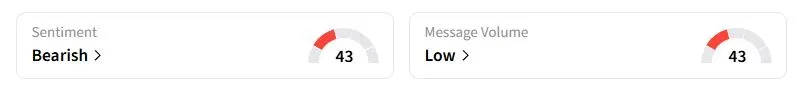

Retail sentiment on Stocktwits about Bitcoin was in the ‘bearish’ territory at the time of writing.

According to a CoinDesk report, trading platform FlowDesk said that its clients have largely paused adding new risk after last week’s Federal Reserve meeting, with flows dominated by short-term trading strategies and portfolio rebalancing.

One retail trader warned that the weakness could drag Bitcoin prices below $100,000 soon.

FlowDesk reportedly said cheap risk reversals could appeal if spot markets stabilize, with volatility likely to drift lower into year-end.

Also See: Trump To Skip US Supreme Court Hearings On Tariffs: ‘I Wanted To Go So Badly’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)