Advertisement|Remove ads.

Bitcoin Hits 4-Week Highs While XRP, Ethereum Gain Ahead Of Fed Rate Decision

Major cryptocurrencies advanced in the early hours of Wednesday, ahead of the U.S. Federal Reserve’s crucial decision on benchmark interest rates later in the day.

Bitcoin advanced 1% to $117,170 and touched a four-week high at the time of writing. Ethereum was up 0.7% to $4,514.02, while XRP gained 1.3% to $3.02. Among other tokens, Solana gained 0.3% and BNB was up 2.7%.

According to SoSoValue data, Bitcoin ETFs saw inflows of $292 million on Tuesday, while spot Ethereum ETFs logged outflows of $61.7 million, as some investors remained cautious after a recent rally.

Analyst Benjamin Cowen wrote that Ethereum would fall to its 21W EMA within the next 4-6 weeks, regardless of what happens to Bitcoin, and then it could rally to new all-time highs.

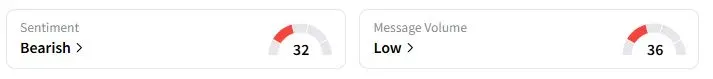

Retail sentiment on Stocktwits about Ethereum was in the ‘bearish’ territory at the time of writing.

An overwhelming majority of traders anticipate the U.S. Federal Reserve to cut benchmark interest rates by 25 basis points after the end of the Federal Open Market Committee meeting. The bets have been emboldened by weak labor market data, which has raised concerns about the health of the U.S. economy.

Investors are awaiting Fed Chair Jerome Powell’s commentary, which could signal whether the U.S. central bank plans to deliver further cuts. “I think that the volatility on the markets has just begun. Bitcoin is attacking the resistance here, the crucial breakout is above $118K,” analyst Michael Van De Poppe noted.

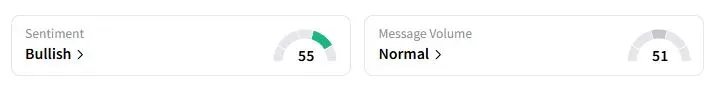

Retail sentiment on Stocktwits about the iShares Bitcoin ETF (IBIT) was in the ‘bullish’ territory at the time of writing.

Among other tokens, BNB, the native token of Binance, advanced after reports suggested that Binance is close to reaching a settlement that will lift U.S. Department of Justice supervision.

Also See: Will JPMorgan Be The Next $1 Trillion Stock? Jim Cramer Says Bank Has 'Something Special'

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_OG_jpg_d3e6e5843b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)