Advertisement|Remove ads.

Bitcoin, Major Cryptos Edge Lower Ahead Of Fed Decision — Bitwise Solana ETF Makes Blockbuster Debut

- The largest digital currency slipped 0.7% to $113,042.30 at the time of writing, while Ethereum fell 1.4% to $4,028.41, and the BNB token fell 1.5% to $1,110.62.

- “End of day Fed jitters. Nothing more, nothing less. It’s basically noise if you are a long-term oriented investor.” — Mike Alfred, crypto investor.

- Bitwise Solana Staking ETF saw trading volume of $55.4 million, the highest among the three crypto ETFs that debuted on Tuesday.

Bitcoin and most of the cryptocurrencies slipped in early trading on Wednesday ahead of the U.S. Federal Reserve’s key decision on benchmark interest rates.

The largest digital currency slipped 0.7% to $113,042.30 at the time of writing, while Ethereum fell 1.4% to $4,028.41, and the BNB token fell 1.5% to $1,110.62. Among other tokens, Solana was down 1.9%, Dogecoin was down 2.4% and Cardano fell 2.1%.

XRP was up 0.1% at $2.62 after a report by the crypto market intelligence platform Messari showed that seven U.S. spot XRP ETF applications are pending with the Securities and Exchange Commission, with decisions expected between Oct. 18 and Nov. 14.

Fed Rate Cut Already Priced In

The Federal Open Market Committee (FOMC) is widely expected to announce a 25-basis-point reduction in benchmark interest rates on Wednesday following softer-than-expected September inflation data. According to CME Group’s FedWatch tool, traders saw a 91% probability of a similar rate cut at the December FOMC meeting as well. However, the number was lower than the 94.4% odds the traders saw a day earlier, indicating that some investors are cautious.

“End of day Fed jitters. Nothing more, nothing less. It’s basically noise if you are a long-term oriented investor,” prominent crypto investor Mike Alfred said on X. “Just because it’s nearly certain that we get the cut, it doesn’t stop folks from de-risking and hedging in to the meeting.”

Investors will carefully examine every word from Fed Chair Jerome Powell following the rate decision. The decision-making of Fed policymakers could also be hampered by the ongoing federal government shutdown, which has delayed the release of key economic data.

What Is Retail Thinking?

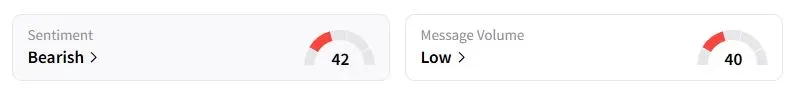

Retail sentiment on Stocktwits about Bitcoin was in the ‘bearish’ territory at the time of writing.

“Interest rate cut and trade deal one day after another. Bitcoin dreams do come true!” one trader said, alluding to the much speculated trade agreement between the U.S. and China on the sidelines of the Asia Pacific Economic Cooperation summit in South Korea.

Strong Debut For Bitwise Solana Staking ETF

Among the three altcoin ETFs that debuted on Tuesday, the Bitwise Solana Staking ETF recorded the highest trading volume, at $55.4 million. As per Bitwise, it is now the largest Solana ETF, with $217 million in assets under management.

As per Bloomberg ETF analyst Eric Balchunas, the Bitwise Solana ETF’s first-day trading volume was also the highest for any ETF this year, even higher than the REX Osprey XRP ETF. The other two ETFs, the Canary Capital HBAR ETF and the Canary Capital Litecoin Fund, saw trading volumes of $8 million and $1 million, respectively, according to Balchunas.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)