Advertisement|Remove ads.

Bitcoin’s Sell-Off May Be Coming From Its Own Collateral, Says Institutional Lender Two Prime

- Alex Blume said on Schwab Network that retail borrowers using Bitcoin-backed loans were margin-called and forced to sell as Bitcoin slid toward $60,000.

- Blume said institutional borrowers were largely able to meet margin calls, while a retail layer of Bitcoin-backed loans “often do get liquidated,” triggering cascading selling.

- On-chain data showed about $388 million in Coinbase-linked loans were liquidatable at a 30% Bitcoin drawdown, rising to more than $800 million at a 50% move.

Retail investors using Bitcoin-backed loans were margin-called and forced to sell during Bitcoin’s recent slide toward $60,000, Two Prime CEO Alex Blume said on a Schwab Network segment on Saturday.

According to Blume, the selloff was driven by a wave of liquidations tied to leveraged positions and crypto-backed lending. “What we saw is just momentum, liquidations, and a total blowout in the price of Bitcoin,” he said, adding that funding rates turned sharply negative as long positions were wiped out.

Blume explained the pressure intensified in Bitcoin-backed lending markets as prices fell. He added that while institutional borrowers were generally able to meet margin calls, retail borrowers were more vulnerable. “There’s another retail layer to these loans that often do get liquidated,” Blume said, describing a “cascading set of loan liquidations” that require lenders to sell additional Bitcoin to “meet the margin calls.”

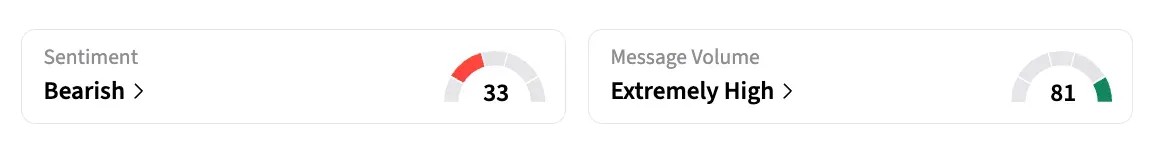

Bitcoin (BTC) was trading at $70,552.34, up 4% over 24 hours. On Stockwits, the retail sentiment around BTC remained in the ‘bearish’ territory, as the chatter around it remained in ‘extremely high’ levels over the past day.

Coinbase-Backed Loans Under Liquidation Risk

On-chain data tracking Coinbase (COIN) crypto-backed loan positions showed a large pool of loans at risk of liquidation as Bitcoin prices declined on Saturday. According to Dune Analytics, the Coinbase on-chain loan built on Morpho, Bitcoin collateral was priced at $67,284 on Thursday, based on Oracle data.

The dashboard showed roughly $388 million in Coinbase-linked loans would be liquidatable if Bitcoin declined by 30% from current levels. Across all Morpho users, total loans liquidatable at a 30% drawdown rose to about $515 million.

Liquidation exposure increased under deeper stress scenarios. At a 50% decline in collateral value, total liquidatable loans across Morpho climbed to roughly $812 million, according to the dashboard.

User-level data showed that about 4,807 Coinbase crypto-backed loan users were flagged as liquidatable under a 30%drawdown scenario, while 8,692 users across all Morpho participants faced liquidation at the same level. The data showed that at a 50%drawdown, more than 14,500 users were flagged as liquidatable.

Read also: Coinbase Stock Pushes Higher Even As Lawsuit Aims To Block Its Prediction Markets

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)