Advertisement|Remove ads.

Bitcoin Slips; XRP, Ether Gain As Investors Await Inflation Data

Bitcoin edged lower toward the $111,000 mark on Tuesday, while XRP and Ether gained, as investors braced themselves for crucial U.S. inflation data.

The apex cryptocurrency slipped 0.3% to $111,470 at the time of writing, while Ethereum gained 0.1% to $4,316.92 and XRP rose 0.1% to $2.96, according to Coingecko data.

Digital assets took a slight hit after the Bureau of Labor Statistics revised down the estimates of nonfarm payroll job additions by 911,000. While the data itself does not reflect the current labor market situation, it shows that the labor market was already weakening before Trump took office. While adjustments to jobs data are common, this was the largest revision on record, going as far back as 2002.

However, the tepid data also boosted hopes of a rate cut by the Federal Reserve. According to the CME Group's FedWatch tool, 91.6% of traders have priced in a 25-basis-point cut, while some are even projecting a larger 50-basis-point cut.

“Gold is up 40% year-to-date on expectations of looser policy. Bitcoin could follow if the Fed cuts unleash liquidity,” BTC Markets analyst Rachael Lucas said.

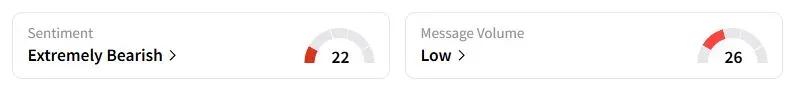

Among Bitcoin ETFs, iShares Bitcoin ETF (IBIT) saw inflows of $169.3 million, while Fidelity and Ark Investment’s Bitcoin ETFs posted net outflows. Retail sentiment on Stocktwits iShares Bitcoin ETF was in the ‘extremely bearish’ territory at the time of writing.

OKX Partner and crypto investor Ted Pillows stated that Ethereum's price action is also looking weak due to macroeconomic “uncertainty and weak ETF demand,” before adding that a “sweep of lower liquidity” could occur before a reversal.

According to Stocktwits data, traders were also ‘extremely bearish’ about the second-largest cryptocurrency.

Investor attention now shifts to Thursday's inflation report, which could influence the U.S. Fed's rate decision. According to a survey of economists by Dow Jones Newswires and The Wall Street Journal, the consumer price index rose 2.9% over 12 months through August, up from 2.7% in July.

Among other tokens, MYX Finance gained 31% on the back of the listing of the Trump family-backed World Liberty Financial’s token on the MYX platform, and increased bets of a technological upgrade. However, several analysts warned about a potential plunge after the drastic gains.

Also See: Why Did Military Drone Maker AeroVironment’s Stock Rise In Extended Trading?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)