Advertisement|Remove ads.

Donald Trump’s Comments At Crypto Summit Leave Retail Divided – Bitcoin Slumps While AVAX, DOGE, SOL Lead Losses

Bitcoin crashed more than 10% over the weekend as the highly anticipated White House Crypto Summit failed to deliver market-moving announcements amid the ongoing global tariff wars.

The apex cryptocurrency was trading just under $82,000 during U.S. pre-market hours on Monday, losing 3.3% over the past 24 hours, according to CoinGecko data.

The summit did not include any bold announcements for the crypto market. Instead, it resulted in a framework for stablecoin legislation by August and a promise of lighter regulation, but these outcomes did not stimulate the market as anticipated.

President Donald Trump also accused the Biden administration of selling billions of dollars worth of Bitcoin and said his administration would not follow the same playbook.

“From this day on, America will follow the rule that every Bitcoin investor knows very well – never sell your Bitcoin… I don’t know if it’s right or not. Who the hell knows, right?” he stated.

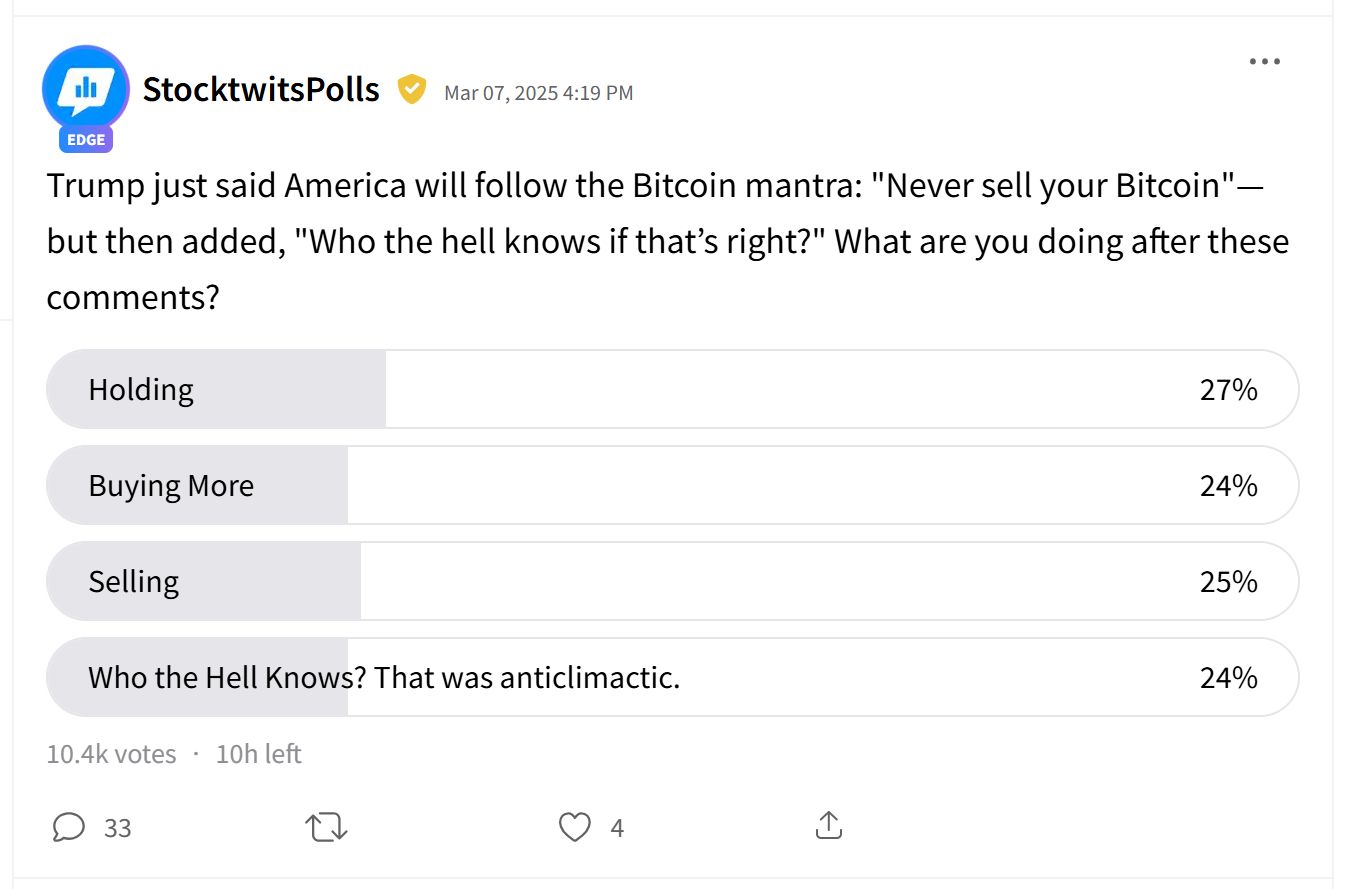

An ongoing Stocktwits poll with over 10,000 responses revealed a split in retail sentiment over President Donald Trump’s remarks at the summit. Opinions were divided on whether they were bullish, bearish, or simply ‘anti-climactic.’

One user argued that Trump should be given the benefit of the doubt, noting that he likely doesn’t yet grasp the distinction between Bitcoin and other cryptocurrencies.

Another speculated that his comments might have been a subtle way of issuing a disclaimer against investment advice.

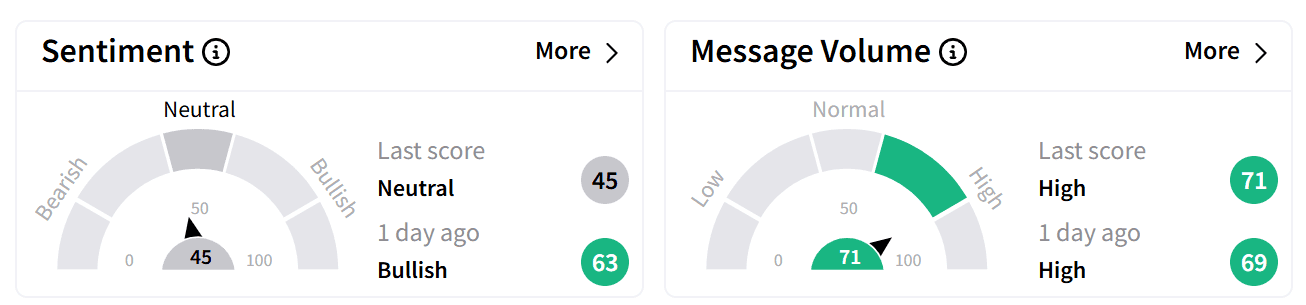

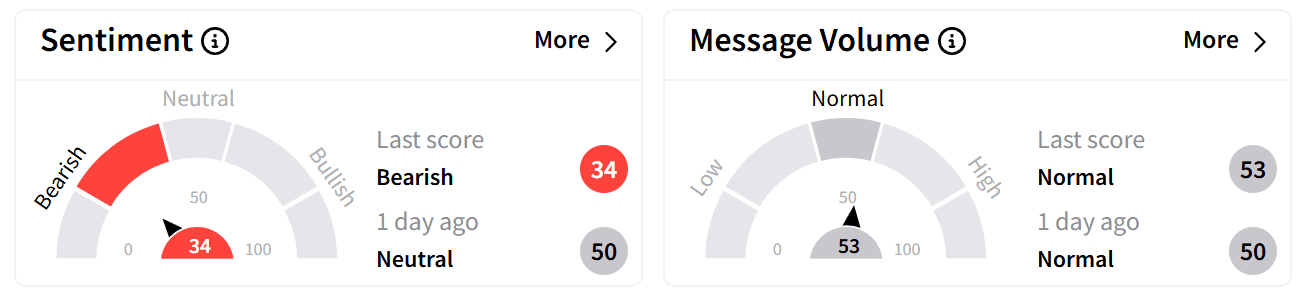

Stocktwits data reflected the uncertainty, with overall retail sentiment around Bitcoin slipping to ‘neutral’ from ‘bullish’ a day earlier. Message volume increased marginally but remained at ‘high’ levels.

The cryptocurrency market’s losses were magnified as global markets took a hit amid an ongoing tariff war sparked by Trump and other world leaders. A widely tracked dollar index (DYX), a measure of the U.S. dollar's strength, is at its lowest since November 2024 at around 103.

Overall, the cryptocurrency market capitalization dropped to $2.8 trillion, down 5.4% for the day.

Among major currencies, Avalanche (AVAX), Solana (SOL), and Dogecoin (DOGE) experienced the biggest losses in the past 24 hours, down over 6%.

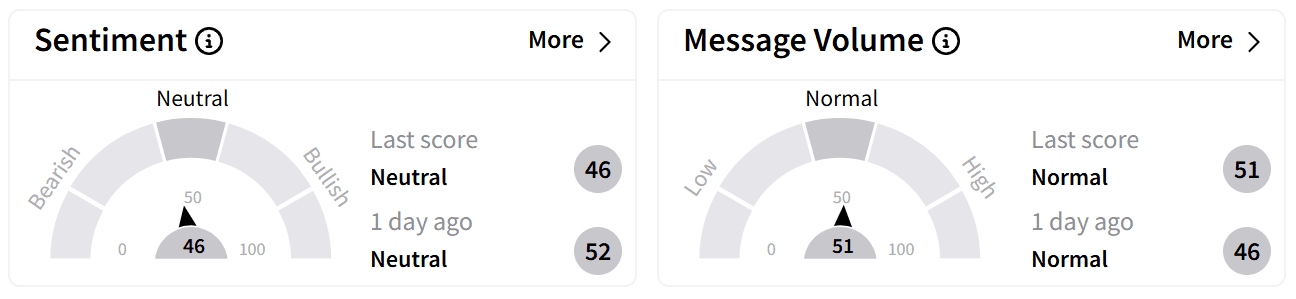

Retail sentiment on Stocktwits around Avalanche’s token saw a marginal dip but remained in the ‘neutral’ zone.

AVAX’s price dropped around 10% over the weekend, with the cryptocurrency’s value falling 57% over the past year.

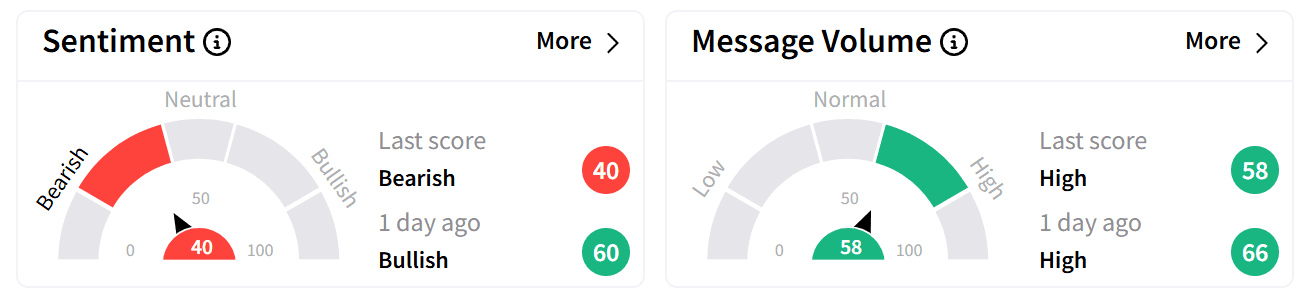

Retail sentiment around Solana’s token flipped to ‘bearish’ from ‘bullish’ a day ago, accompanied by ‘high’ levels of chatter.

SOL’s price also slid over 10% during the weekend, bringing its total losses over the past year to 13%.

Meanwhile, sentiment around Dogecoin slid to ‘bearish’ from ‘neutral’ territory a day ago.

Dogecoin’s price took the biggest hit, over 15%, over the weekend, however, its gains have been flat over the past year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)