Advertisement|Remove ads.

JPMorgan Doubts Trump’s Bitcoin Strategic Reserve Strategy, As Others Propose Cheesy Solution – Retail's Divided

Bitcoin’s has dipped 3% to under $88,000 on Friday afternoon despite President Donald Trump’s executive order to establish a Bitcoin Strategic Reserve.

The apex cryptocurrency climbed back to $90,000 from an intraday low of $84,900 but failed to sustain those gains during U.S. market hours.

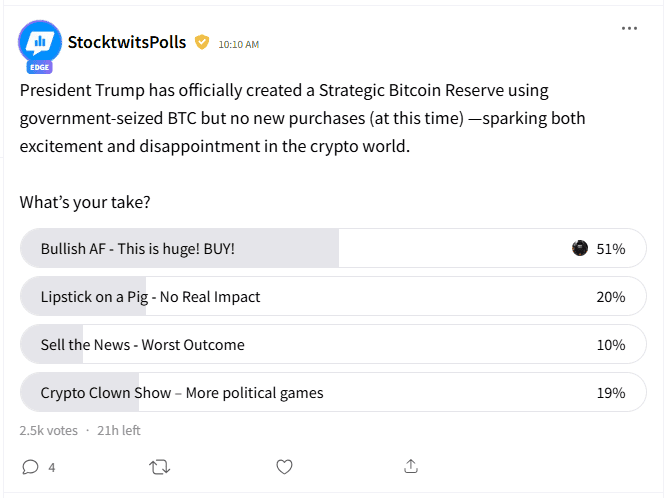

A Stocktwits poll reflected the divided sentiment among retail traders. Of those surveyed, only 52% viewed the move as overwhelmingly bullish, while others took a more cautious stance.

One-fifth dismissed it as having no real impact. Another 10% took a more pessimistic stance, calling it a “sell the news” event, while 18% categorized it as political maneuvering.

Meanwhile, JPMorgan expects the cryptocurrency market to remain under pressure as traders weigh skepticism over whether Congress will approve a U.S. strategic crypto reserve.

In a note cited by CoinDesk, analysts said the absence of a clear roadmap and political resistance could limit any near-term optimism.

Arkham Intelligence data shows that the U.S. government currently holds about 198,109 Bitcoin (BTC), 122 million Tether (USDT), and 56,035 Ethereum (ETH), among other tokens.

"Not only is there skepticism about Congressional approval for such a strategic crypto reserve, but also the feasibility of including smaller tokens outside bitcoin (BTC) and ether (ETH) given their high risk and volatility," JPMorgan wrote.

The brokerage added that central banks worldwide have been cautious about including the world's largest cryptocurrency in their reserves due to risk and volatility concerns.

However, some retail traders believe that the U.S. legitimizing Bitcoin may lead to a domino effect in global regulation.

Others also pointed to the Texas Senate passing a bill to form a Bitcoin Reserve on Thursday as a positive catalyst for mainstream adoption.

Standard Chartered also noted that formalizing a U.S. Strategic Bitcoin Reserve could spur other sovereign nations to follow suit.

As for how the U.S. could fund its Bitcoin reserve, Standard Chartered’s Geoff Kendrick suggested one potential approach – selling a portion of the country’s gold reserves.

“In theory, the U.S. could sell gold and buy Bitcoin as a budget-neutral strategy,” Kendrick wrote in an email to The Block, noting that the government holds roughly $760 billion worth of gold.

The Bitcoin Policy Institute (BPI) weighed in with a more unconventional proposal. In a post on X (formerly Twitter), the group suggested bolstering U.S. Bitcoin reserves by selling off the country’s Strategic Cheese Reserve.

Mathew Sigel, head of research at VanEck, echoed this sentiment, questioning the necessity of maintaining a cheese stockpile while advocating for a shift toward Bitcoin as a reserve asset.

Bitcoin's price is currently trading 18% below its all-time high of nearly $109,000 reached in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)