Advertisement|Remove ads.

Bitcoin Versus Tokenized Gold: Changpeng ‘CZ’ Zhao And Peter Schiff Agree To Debate In Dubai

- Changpeng Zhao accepted Peter Schiff’s debate challenge, inviting him to Binance Blockchain Week in Dubai.

- The debate follows a clash over Schiff’s plans to launch tokenized gold.

- CZ criticized tokenized gold for lacking true on-chain ownership.

Binance co-founder and former CEO Changpeng ‘CZ’ Zhao on Friday accepted Peter Schiff’s challenge for a debate, inviting the gold bull to the upcoming Binance Blockchain Week in Dubai, scheduled for December.

“I might lose the debate, and more publicity for your new tokenization company,” CZ said in a post on X.

Bitcoin Versus Tokenized Gold Sparks Online Clash

The debate stems from a heated exchange earlier this week over Schiff’s plans to launch a tokenized gold product. CZ criticized the concept, arguing that tokenizing gold does not constitute true on-chain ownership.

“Tokenizing gold is NOT ‘on chain’ gold,” CZ wrote. “It’s tokenizing that you trust some third party will give you gold at some later date, even after their management changes, maybe decades later, during a war, etc. It’s a ‘trust me bro’ token. This is the reason no ‘gold coins’ have really taken off.”

Schiff responded by emphasizing the value of tangible ownership. “Most people prefer owning something to owning nothing,” he wrote, defending traditional gold ownership.

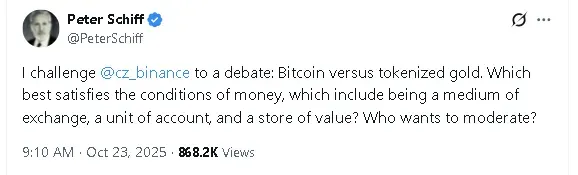

Following this exchange, Schiff had challenged CZ to debate Bitcoin versus tokenized gold. CZ acknowledged the offer in a follow-up post, stating, “I am in the mood for it. As much as you voice against Bitcoin, you are always professional and non-personal. I appreciate that. Can have a debate about it.”

Schiff confirmed his agreement, noting that several people had already offered to moderate the discussion. “Absolutely. Several people have already reached out to me, offering to moderate. Do you have a preference?” he wrote on X.

Actual Gold Vs Tokenized Gold

The recent surge in gold prices has fueled interest in tokenized gold, though experts remain divided on whether it represents “real gold” or another speculative asset class. Schiff’s planned tokenized gold product comes amid three consecutive years of rising gold prices, which hit an all-time high of $4,380 in October before retreating to around $4,100.

Despite the debate, Bitwise Investments sees promise in tokenizing real-world assets. Its Q3 market report noted that tokenized assets are gaining traction as “cousins” of stablecoins, offering global liquidity and around-the-clock trading.

RWA sector data further illustrates the rapid growth of tokenized gold. Charts show Tether Gold (XAUT) and PAX Gold (PAXG) leading the category, with market caps surpassing $1.5 billion and $1.3 billion, respectively, in Q3.

Read also: BTC Price Climbs As Investors Await CPI, Trade Talks Between Trump And Xi

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bigtechs_jpg_63ac524cdb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231155247_jpg_4c42250aff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bill_Holdings_jpg_f481f21546.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)