Advertisement|Remove ads.

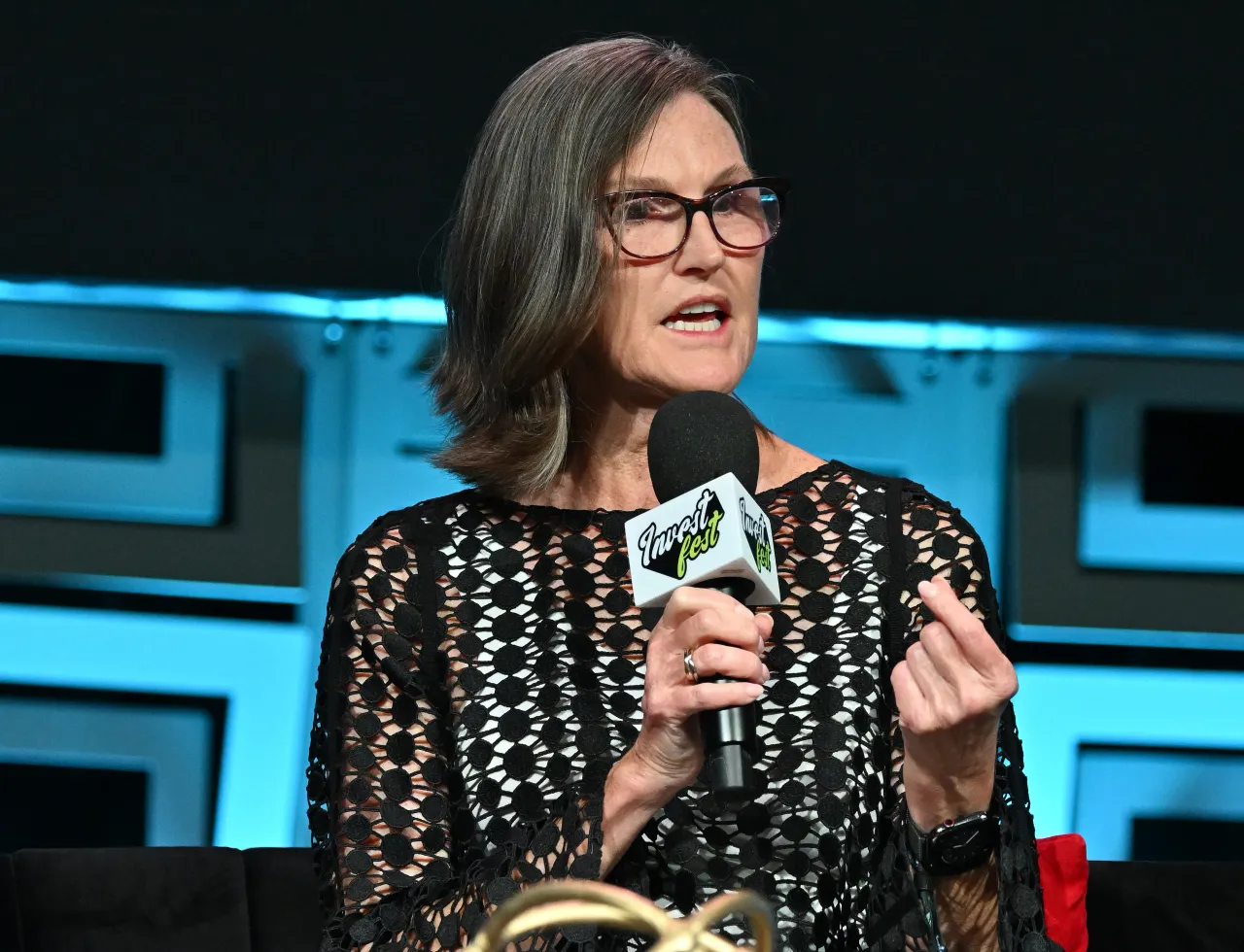

Cathie Wood Says Gold Is Winning Now, But Bitcoin Is ‘Playing The Long Game’

- Gold rose about 65% in 2025, while Bitcoin fell roughly 6%, according to Wood.

- Wood said Bitcoin’s recent price weakness does not undermine its long-term investment thesis.

- She noted gold typically rallies sharply during periods of rising inflation fears, though this cycle may also reflect global wealth growing faster than gold supply.

Ark Invest CEO Cathie Wood sees the current decoupling between gold and Bitcoin (BTC) not as a competition, but as a difference in market roles and timing.

In a note to investors, she noted that gold significantly outperformed Bitcoin in 2025, rising 65% while Bitcoin’s price fell around 6%. She added that since the end of the U.S. equity bear market in late 2022, gold prices have surged 166%.

Bitcoin Versus Gold

Wood said Bitcoin’s recent price weakness does not undermine its long-term thesis. She said that, usually, gold rallies this hard when inflation fears are mounting. However, this time around, it’s possible that global wealth has grown faster than gold supply, pushing demand beyond what miners can easily produce.

Unlike gold, Bitcoin can’t increase supply when prices rise. Its inflation rate is built into the code and gets smaller over time. That scarcity, plus its low correlation with stocks, bonds, and even gold itself, makes Bitcoin a powerful tool for diversification over the long run, Wood noted. Despite short-term weakness, Bitcoin has still risen roughly 360% since late 2022.

Wood noted that while gold may be benefiting from near-term demand dynamics, Bitcoin is “playing the long game”. Since 2020, Bitcoin has shown very low correlation with stocks, bonds, gold, and commodities. This makes it a potential diversifier in institutional portfolios.

Different Roles In Portfolios

Wood suggested that gold’s recent price action likely reflects its use as a hedge amid geopolitical uncertainty and tariff hearings around the corner. According to her, Bitcoin is instead gaining interest as a long-term store of value and a return enhancer.

Bitcoin’s price fell 1.4% in the last 24 hours to trade at around $95,300 on Friday morning. Retail sentiment on Stocktwits around the apex cryptocurrency remained in ‘bullish’ territory, but chatter dipped to ‘normal’ from ‘high’ levels over the past day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)